Global Financial Crisis: The Great Moderation to Great Recession

The lecture delves into the transition from the Great Moderation to the Great Recession, exploring empirical data, the US and European experiences, and the unanticipated crisis. It discusses the impact on inflation, unemployment, and the shift in macroeconomic policies that led to the economic downturn.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Behavioural Finance Lecture 12 Part 1 The Global Financial Crisis Empirical Data & Modelling

Biggest crisis since the Great Depression.. For almost every country Australia (you re standing in it) the exception Reasons why discussed later First: the US (and European) experience Crisis not anticipated by neoclassical economists Saw Great Moderation as key macroeconomic issue: Explaining the linked phenomena of: Falling inflation; Less extreme cycles in employment Attributed it to better macroeconomic policy:

The Great Moderation As it turned out, the low-inflation era of the past two decades has seen not only significant improvements in economic growth and productivity but also a marked reduction in economic volatility, both in the United States and abroad, a phenomenon that has been dubbed "the Great Moderation." Recessions have become less frequent and milder, and quarter-to-quarter volatility in output and employment has declined significantly as well. The sources of the Great Moderation remain somewhat controversial, but as I have argued elsewhere, there is evidence for the view that improved control of inflation has contributed in important measure to this welcome change in the economy. (Bernanke 2004)

The Great Moderation Statistics till 2008 supported Great Moderation US Inflation and Unemployment since 1970 16 Inflation Unemployment U-6 Measure 14 12 10 Percent 8 6 4 2 0 2 70 72 74 76 78 80 82 84 86 88 90 92 94 96 98 100 102 104 106 108 110 Year Neoclassical models extrapolated this trend forward:

Did (neoclassical) economists see this coming? the current economic situation is in many ways better than what we have experienced in years Our central forecast remains indeed quite benign: a soft landing in the United States, a strong and sustained recovery in Europe, a solid trajectory in Japan and buoyant activity in China and India. In line with recent trends, sustained growth in OECD economies would be underpinned by strong job creation and falling unemployment. (p. 9) OECD Chief Economist Jean-Philippe Cotis in OECD Economic Outlook June 2007 Then all hell broke loose

Great Moderation to Great Recession Unemployment soared and inflation plunged into deflation US Inflation and Unemployment since 1970 16 US Inflation and Unemployment since 1970 16 Inflation Unemployment U-6 Measure 14 14 12 12 10 10 Percent Percent 8 8 6 6 4 4 Inflation Unemployment U-6 Measure 2 2 0 0 2 2 70 72 74 76 78 80 82 84 86 88 90 92 94 96 98 100 102 104 106 108 110 70 72 74 76 78 80 82 84 86 88 90 92 94 96 98 100 102 104 106 108 110 Year Year Apparent cause: worst financial crisis since 1929

The Scale: Biggest Bubbles in History 2000 asset market bubbles biggest in history Then they began to burst USA Real Asset Price Indices 300 Lagged 10 Year Price-Earnings Ratio Real House Price Index 275 250 225 200 1890 = 100 175 150 125 100 75 50 25 0 1900 1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 2010 2020 Source: Robert Shiller (http://www.econ.yale.edu/~shiller/data.htm)

A Black Swan event? Neoclassical economists prefer to regard crisis as unpredictable I do not know anyone who predicted this course of events. This should give us cause to reflect on how hard a job it is to make genuinely useful forecasts. What we have seen is truly a tail outcome the kind of outcome that the routine forecasting process never predicts. But it has occurred, it has implications, and so we must reflect on it. (Glenn Stevens, Interesting Times , 2008; see my comment on this speech here) In fact at least 12 economists predicted and warned of the crisis

A Black Swan event? Analyst Country Capacity Forecast plunging housing investment will likely push the economy into recession. (2006) Co-director, Center for Economic and Policy Research Dean Baker US The small slowdown in the rate at which US household debt levels are rising resulting form the house price decline, will immediately lead to a growth recession before 2010 (2006). " [will] start to rise significantly and does not come down again." (2007) The next property market tipping point is due at end of 2007 or early 2008 only way prices can be brought back to affordable levels is a slump or recession (2005). Debt deflation will shrink the " economy, drive down real wages, and push our debt- ridden economy into Japan-style stagnation or worse. (2006) The US will enter a recession within years (2006). " stock markets are likely to begin in 2008 to experience a " Deflation Bear Market" (2007) Long before we manage to reverse the current rise in debt, the economy will be in a recession. On current data, we may already be in one. (2006) We are seeing large bubbles and if they bust, there is no backup. The outlook is very bad (2005)" The bursting of this housing bubble will have a severe impact on the world economy and may even result in a recession" (2006). The new housing bubble together with the bond and stock bubbles will invariably implode in the foreseeable future, plunging the U.S. Economy into a protracted, deep recession (2001). "recession and bear market in asset prices are inevitable for the U.S. economy All remaining questions pertain solely to speed, depth and duration of the economy' downturn." (2006) Real home prices are likely to fall at least 30% over the next 3 years; "itself this house price slump is enough to trigger a US recession." (2006) The United States economy is like the Titanic ...I see a real financial crisis coming for the United States. (2006). " will be an economic collapse" (2007). There is significant risk of a very bad period, with rising default and foreclosures, serious trouble in financial markets, and a possible recession sooner than most of us expected. (2006) Distinguished Scholar, Levy Economics Institute of Bard College Wynne Godley US Fred Harrison UK Economic commentator Michael Hudson US Professor, University of Missouri Eric Janszen US Investor and iTulip commentator Associate Professor, University of Western Sydney Stephen Keen Australia Jakob Br chner Madsen & Jens Kjaer S rensen Professor & graduate student, Copenhagen University Denmark private consultant and investment newsletter writer Kurt Richeb cher US Nouriel Roubini US Professor, New York University Stock broker, investment adviser and commentator Peter Schiff US Robert Shiller US Professor, Yale University Bezemer, Dirk J, No One Saw This Coming": Understanding Financial Crisis Through Accounting Models, Groningen University, 16 June 2009

A Black Swan event? Common factors in 12 economists identified by Bezemer: a concern with financial assets as distinct from real- sector assets, with the credit flows that finance both forms of wealth, with the debt growth accompanying growth in financial wealth, and with the accounting relation between the financial and real economy. (p. 8) Key causal factor as with Great Depression blowout in private debt levels

A Black Swan event? Debt levels higher than Great Depression: Private debt to GDP ratios 300 USA Australia 275 250 Years (percent of GDP) 225 200 175 175 150 125 100 75 65 50 25 0 1870188018901900191019201930194019501960197019801990200020102020 Flow of Funds Table L1+Census Data; RBA Table D02

A Black Swan event? Mainstream economists ignored Debt/GDP Focused instead on inflation, unemployment & interest rates Saw economy as well balanced now Complemented good monetary policy for outcome ( Taylor Rule ) Blamed previous major crisis (Great Depression) on bad monetary policy :

A Black Swan event? "Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve. I would like to say to Milton and Anna: Regarding the Great Depression. You're right, we did it. We're very sorry. But thanks to you, we won't do it again. Ben Bernanke 2002: Remarks by Governor Ben S. Bernanke, At the Conference to Honor Milton Friedman, University of Chicago, Chicago, Illinois, November 8, 2002 On Milton Friedman's Ninetieth Birthday) Bernanke on failings of 1930s Fed:

What caused the Great Great Depression? Blames Depression on Fed policy our analysis provides the clearest indictment of the Federal Reserve and U.S. monetary policy. Between mid-1928 and the financial crises that began in the spring of 1931, the Fed not only refused to monetize the substantial gold inflows to the United States but actually managed to convert positive reserve inflows into negative growth in the M1 money stock. Thus Fed policy was actively destabilizing in the pre- 1931 period. (Bernanke 2000, p. 111; emphasis added) Note he criticises The Fed on the basis of what happened to M1

What caused the Great Depression? M1 did collapse... (Friedman & Bernanke s estimates of periods of Fed tightening included in graph) Annual Change in M1 1927-1936 20 M1 (Friedman) M1 (Bernanke) FS-1 Tighten FS-2 Tighten FS-3 Loosen FS-4 Tighten 15 10 Percent p.a. 5 0 0 5 10 15 1927 1928 1929 1930 1931 1932 1933 1934 1935 1936

What caused the Great Depression? Strong correlation between change in M1 & unemployment M1 growth falls, unemployment rises Change in M1 and Unemployment 20 0 0 15 4 Correlation = -0.404 10 8 Percent of workforce Percent p.a. 5 12 0 0 16 M1 (Friedman) FS-1 Tighten FS-2 Tighten FS-3 Loosen FS-4 Tighten Unemployment (RHS) 5 20 10 24 15 1927 1928 1929 1930 1931 1932 1933 1934 1935 1936 Year But M1 includes cheque accounts Money created by private banks M0/Money Base only part under direct Fed control

What caused the Great Depression? M0 Unemployment correlation very different result M0 fell only during 1930; rose from 31-36 But M0 growth rises, and so does unemployment? Change in M0 and Unemployment 25 0 0 M0 FS-1 Tighten FS-2 Tighten FS-3 Loosen FS-4 Tighten Unemployment 20 4 15 8 Percent of workforce 10 12 Percent p.a. 5 16 0 0 20 5 24 Correlation = 0.18 10 28 15 1927 1928 1929 1930 1931 1932 1933 1934 1935 1936 Year Small correlation with the wrong sign But correlation, not causation...

What caused the Great Depression? Implies 1930s Fed did try to boost money supply But fall in private credit more than outweighed increase in fiat money Bernanke s criticism of Fed assumes money multiplier deposits create loans relation between M0/Money Base and broader credit Bernanke also ignored Fisher s debt-deflation theory & Minsky s Financial Instability Hypothesis Firstly, Bernanke on Fisher: Fisher envisioned a dynamic process in which falling asset and commodity prices created pressure on nominal debtors, forcing them into distress sales of assets, which in turn led to further price declines and financial difficulties.

What caused the Great Depression? His diagnosis led him to urge President Roosevelt to subordinate exchange-rate considerations to the need for reflation, advice that (ultimately) FDR followed. Fisher s idea was less influential in academic circles, though, because of the counterargument that debt- deflation represented no more than a redistribution from one group (debtors) to another (creditors). Absent implausibly large differences in marginal spending propensities among the groups, it was suggested, pure redistributions should have no significant macroeconomic effects. (Bernanke 2000, Essays on the Great Depression, p. 24; emphasis added) Compare to Fisher himself (lecture 11, slides 13-20):

What caused the Great Depression? Bernanke ignores Key role of disequilibrium in Fisher Theoretically there must be over-or under- production, over-or under-consumption, , and over or under everything else. It is as absurd to assume that, for any long period of time, the variables in the economic organization, or any part of them, will stay put, in perfect equilibrium, as to assume that the Atlantic Ocean can ever be without a wave. Bernanke instead considers equilibrium transfer from debtors to creditors Starting point of excessive debt

What caused the Great Depression? Fisher: The two dominant factors which cause depressions are over-indebtedness to start with and deflation following soon after Bernanke Fisher envisioned a dynamic process in which falling asset and commodity prices Even sloppier treatment of Minsky: Hyman Minsky (1977) and Charles Kindleberger (1978) have argued for the inherent instability of the financial system but in doing so have had to depart from the assumption of rational economic behaviour

What caused the Great Depression? A footnote adds I do not deny the possible importance of irrationality in economic life; however it seems that the best research strategy is to push the rationality postulate as far as it will go. (Bernanke 2000, p. 43; emphases added) Remember rationality from 1st 3 lectures? Rationality in microeconomics: ability to have complete preference set computationally impossible Rationality as assumed in macroeconomics even worse: Neoclassicals assume Meta-rationality Ability to know how the entire economy behaves E.g., original rational expectations paper in economics

What caused the Great Depression? Rational expectations introduced into macro by Robert Lucas (1976): Econometric Testing of the Natural Rate Hypothesis , The Econometrics of Price Determination Conference, Board of Governors of the Federal Reserve System, October 30-31, 1970 Washington Rejected Friedman s adaptive expectations because it implied that monetary policy could have real effects: It promises unlimited real output gains from a well- chosen inflationary policy. Even a once-and-for-all price increase, will induce increased output over the (infinity of) transition periods. (53) To prove that monetary policy is ineffective, you need to assume that people can accurately predict future inflation:

What caused the Great Depression? the hypothesis of adaptive expectations was rejected on the grounds that, under some policy: E{Pt-P*} [gap between expected and actual inflation] is non-zero. If the impossibility of a non-zero value for Expression 6 is taken as an essential feature of the natural rate theory, one is led simply to adding the assumption that Expression 6 is zero as an additional axiom or to assume that expectations are rational in the sense of Muth (Lucas, p. 54) i.e., rational expectations is equivalent to assuming that people can predict the future! This is meta-rationality : not merely rational but capable of successful prophecy

What caused the Great Depression? No wonder neoclassicals didn t see crisis coming Assumed world consists of people capable of foreseeing future Crises would never occur in such a world Have to abandon equilibrium-obsessed, prophetic agents model of neoclassicals to understand Great Depression Begins with reversing money-creation model Not Deposits create loans but Loans create deposits Deleveraging drove broad money supply down Reduced cash flow in economy caused collapse Key role of debt in aggregate demand...

Debt in aggregate demand Key point from Schumpeter, Minsky, Marx: In growing economy, part of demand is debt financed: If income is to grow, the financial markets must generate an aggregate demand that, aside from brief intervals, is ever rising. For real aggregate demand to be increasing, it is necessary that current spending plans, summed over all sectors, be greater than current received income and that some market technique exist by which aggregate spending in excess of aggregate anticipated income can be financed. It follows that over a period during which economic growth takes place, at least some sectors finance a part of their spending by emitting debt or selling assets. (Minsky 1982, p. 6; emphasis added)

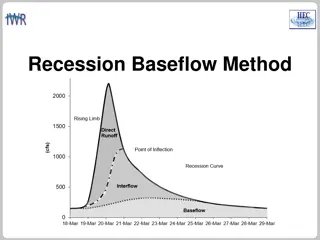

Debt in aggregate demand Aggregate demand for both commodities & assets therefore equals GDP (measured using income or production method) Plus the change in debt During normal growth, rising debt adds to demand But needn t rise faster than GDP During Ponzi period, rising debt adds to demand Rises faster than GDP Fuels rising asset prices as well Applying this to Great Depression AND Roaring Twenties before it

Debt in aggregate demand Debt and GDP 1920-1940 US Private Debt and GDP 1920-1940 180000 Debt GDP 170000 160000 150000 140000 130000 $ million 120000 110000 100000 90000 80000 70000 60000 50000 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 Year

Debt in aggregate demand Aggregate Demand 1920-1940 US Aggregate Demand GDP 1920-1940 120000 110000 100000 90000 $ million 80000 70000 60000 GDP alone GDP+Change in Debt 50000 40000 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 Year

Are We It Yet? Aggregate demand & unemployment 1920-1940 Far stronger correlation than for M1 & unemployment And applies in boom (Roaring 20s) as well as bust Correlation of change in private debt and unemployment 8 0 0 2 7 Percent unemployed (inverted) 6 4 5 6 4 8 Percent change p.a. 3 10 2 12 1 14 0 16 1 18 2 20 3 22 4 24 5 26 6 28 Change in Debt (lagged one year) Unemployment 7 30 8 32 9 34 10 20 22 24 26 28 30 32 34 36 38 40 Year

Debt in aggregate demand Effect even stronger for current period US Private Debt and GDP 1990-2010 5 107 Debt GDP 4.5 107 4 107 3.5 107 $ million 3 107 2.5 107 2 107 1.5 107 1 107 5 106 10 9 8 7 6 5 4 3 2 1 0 1 2 3 4 5 6 7 8 9 10 11 Years since 2000

Debt in aggregate demand Aggregate Demand 1990-2010 US Aggregate Demand GDP 1990-2010 2 107 GDP alone GDP+Change in Debt 1.8 107 1.6 107 1.4 107 $ million 1.2 107 1 107 8 106 6 106 4 106 10 9 8 7 6 5 4 3 2 1 0 1 2 3 4 5 6 7 8 9 10 11 Years since 2000

Debt in aggregate demand Aggregate demand & unemployment 1990-2010 Correlation of change in private debt and unemployment 15 0 0 13.25 Percent unemployed (inverted) 11.5 1 9.75 8 2 6.25 Percent change p.a. 4.5 3 2.75 1 4 0.75 2.5 5 4.25 6 6 7.75 9.5 7 11.25 13 8 Change in Debt Unemployment 14.75 16.5 9 18.25 20 10 7.9 5.8 3.7 1.6 0.5 2.6 4.7 6.8 8.9 11 Years since 2000 Both boom and bust driven by changing debt levels

Debt in aggregate demand Expansion of debt initially causes a boom Demand much higher than with constant debt/GDP But contraction of debt during slump reduces demand Deleveraging When debt/GDP ratio low, debt contribution to demand less significant When ratio high, debt contribution can be most important determinant of economic activity E.g., compare USA 1955-1975 with USA 1920-1940 and 1990-2010

Debt in aggregate demand Correlation of change in debt to unemployment -0.315 Correlation of change in private debt and unemployment 20 0 0 0.5 Private only Unemployment 19 18 1 17 1.5 16 2 Percent unemployed (inverted) 15 2.5 14 3 Percent change p.a. 13 3.5 12 4 11 4.5 10 5 9 5.5 8 6 7 6.5 6 7 5 7.5 4 8 3 8.5 2 9 1 9.5 0 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 Year Much larger correlations 1920-40 (-.938) & 90-10 (-.957)

Debt in aggregate demand Reasons for different correlations Size of debt relative to GDP: Debt Ratios 1955-75 & 1990-Now 300 Ratio Mean Ratio Mean 200 Percent of GDP 100 0 40 60 80 100 120 Year

Debt in aggregate demand Contribution of change in debt to aggregate demand Annual change in US Private Debt to GDP 30 Dec2008 Debt + 25 GDP Debt 20 15 Percent of GDP 10 5 0 0 0 5 10 15 20 25 55 60 65 70 75 80 85 90 95 100 105 110 115 Notice the plunge? Only happened once before: The Great Depression Years since 1900

Debt in aggregate demand A bigger plunge US Private Debt contribution to Aggregate Demand 25 20 Percent of Aggregate Demand 15 10 5 0 0 5 10 15 20 25 25 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 Years since 1900 But what time period is relevant?

Debt in aggregate demand Compare from time of Peak Debt in both cases Measure debt-driven downturn in aggregate demand From point where debt-driven boost reached peak 1920-1940 peak was mid-1927 Lagged one year to mid-1928 since data year- end annual back then 1990-Now peak was December 2007 Only 4 episodes of falling private debt Two during Great Depression One during end of WWII And now

Debt in aggregate demand (Dip in 50s due to glitch in combining time series) US Private Debt contribution to Aggregate Demand 30 Mid27 Dec08 24.5 Percent of Aggregate Demand 19 13.5 8 2.5 0 3 8.5 14 19.5 25 25 20 25 30 35 40 45 50 55 60 65 70 75 80 85 90 95 100 105 110 115 Years since 1900

Debt in aggregate demand Comparing Now to Then from similar starting point Mid-1928 Then similar to December 2008 Now Debt boosted demand by 7% then, 22% Now Now (mid-2010) similar to late 1930 Then Deleveraging reduced demand by 15% then, 20% now So deleveraging worse Now than Then Sole positive scale of government intervention Government fiscal stimulus adding about 12% to aggregate demand Now versus 3% Then

How does Now compare to Then in the USA? Debt + Debt-financed proportion of aggregate demand: GDP Debt Debt-financed demand percent of aggregate demand 25 20 15 10 Current crisis less severe than Great Depression because (a) still early days (b) far greater government stimulus 5 Percent 0 0 5 Great Depression including Government Great Recession including Government 10 15 20 25 0 1 2 3 4 5 6 7 8 9 10 11 12 13 Years since peak rate of growth of debt (mid-1928 & Dec. 2007 resp.)

Change in aggregate demand If AD = GDP + Debt Then AD = GDP + Debt Change in employment correlated to Debt acceleration: US Credit Impulse & Change in Unemployment 20 40 Credit Impulse Unemployment 15 30 10 20 5 10 Percent (inverted) Percent of GDP 0 0 0 5 10 10 20 15 30 20 40 25 50 30 60 35 70 40 80 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 Year

Why did Australia do so well? Government policy especially First Home Vendors Boost turned around private debt: no deleveraging Private Debt contribution to Aggregate Demand 25 20 Percent of Aggregate Demand 15 10 5 0 0 5 10 15 USA Australia 20 25 55 60 65 70 75 80 85 90 95 100 105 110 115 Years since 1900

Why did Australia do so well? First Home Owners Grant used as macro policy tool: Encourage mortgage lending to counter unemployment Change in Real House Prices and the FHOS FHOS2 in 88 after Stock Market Crash (Hawke) 40 12 FHOS1 in 80s recession (Hawke) Index 1983 1988 2000 2001 2008 Unemployment FHOS3 2000 temporary GST boost (Howard) 36 11 FHOS4 2001 recession fears (Howard) 32 10 28 9 Annual Price Change Percent FHOS5 2008 GFC fears (Rudd) Percent of Workforce 24 8 20 7 16 6 12 5 8 4 4 3 0 0 2 4 1 8 0 1976197819801982198419861988199019921994199619982000200220042006200820102012 Year

Why did Australia do so well? First Home Vendors Boost caused mortgage releveraging Mortgage debt to GDP Mortgage debt on track to fall to 78.6% of GDP by March 2010 Instead rose to 86.85% Equivalent to $100 billion debt-financed boost to economy 90 FHVB Actual Trend before FHVB 86.85 8.2% of GDP 85 Percent of GDP 80 78.635 75 70 5 5.5 6 6.5 7 7.5 8 8.5 9 9.5 10 10.5 11 Years since 2000

Why did Australia do so well? Only mortgage debt rose: business rapidly deleveraging Private debt percent of GDP 100 160 Mortgage All Household Business Total Private 95 155 90 150 85 145 80 140 By Sector All Debt 75 135 70 130 65 125 60 120 55 115 50 110 45 105 40 100 0 1 2 3 4 5 6 7 8 9 10 11 Years since 2000

Why did Australia do so well? Credit impulse stopped in its tracks for now Australian Credit Impulse & Unemployment 20 40 15 30 Percent of workforce (inverted) 10 20 5 10 Percent of GDP 0 0 0 5 10 10 20 15 30 20 40 25 50 Credit Impulse Unemployment 30 60 35 70 40 80 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 Year

Debt in aggregate demand Unemployment: current measure understates severity U6 far closer to 1930s definition than U3 measure Shadowstats (www.shadowstats.com) more accurate Unemployment Great Depression vs Today 30 25 Percent of workforce 20 15 From mid-1927 U-3 from Dec-2007 U-6 from Dec-2007 Shadowstats measure 10 5 0 0 1 2 3 4 5 6 7 8 9 10 11 12 Years since peak rate of growth of debt (mid-1928 & Dec. 2007 resp.)

Monetary policy Then vs Now As noted, Fed tried to stimulate in 1930s by boosting M0 Change in M0 and Inflation, Great Depression 8 30 7 28 Inflation Change in Base Money (RHS) 6 26 5 24 22 4 22 Annual change in M0 3 20 2 18 1 16 0 0 0 14 Inflation 1 12 2 10 3 8 4 6 5 4 6 2 0 7 0 8 2 9 4 10 6 11 8 12 10 30 30.5 31 31.5 32 32.5 33 33.5 34 34.5 35 Year