Heads of Income and Income Tax Computation

Learn about the classification of income under different heads for income tax purposes, the importance of computation rules for each head, and the implications of deductions and exemptions in tax calculations. Explore why it is essential to categorize income and follow specific rules for taxation under each head to determine the total taxable income accurately.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

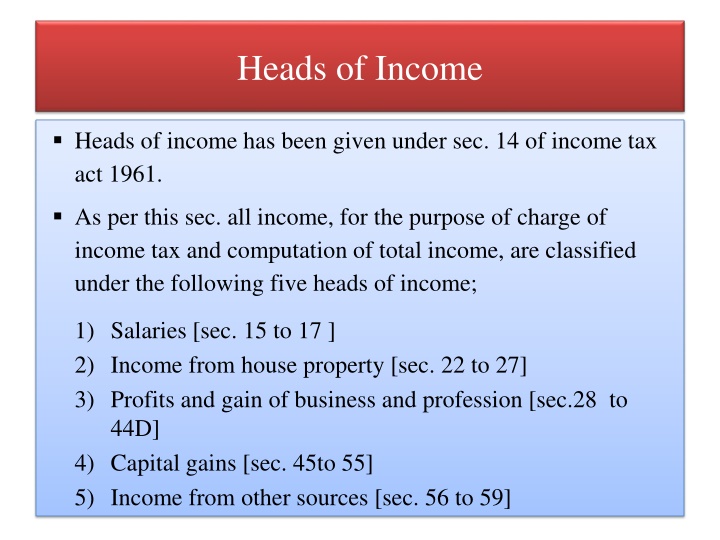

Heads of Income Heads of income has been given under sec. 14 of income tax act 1961. As per this sec. all income, for the purpose of charge of income tax and computation of total income, are classified under the following five heads of income; 1) Salaries [sec. 15 to 17 ] 2) Income from house property [sec. 22 to 27] 3) Profits and gain of business and profession [sec.28 to 44D] 4) Capital gains [sec. 45to 55] 5) Income from other sources [sec. 56 to 59]

Why is this classification to be done? Although there is only one tax applies on the income calculated under various heads of income, but there are different rules of computation on income under the each head and income has to be computed under that head after applying such rules only. General rules ; Income under each head has to be determined in the manner given by the appropriate manner section mentioned against each head. If there is any income which cannot be brought to tax by computation under the above heads, it would not be include in the total income as define in sec. 2[45] for the purpose of chargeability.

Continue The computation of income under each heads of income will have to be made independently and separately. There are specific rules of deduction and allowance under each head. No deduction or adjustment on account of any expenditure can be made except as provided by the act. [Tuticorin Alkali Chemical and Fertilizers Ltd. vs. CIT] Whether an income falls under one head or another has to be decided according to common notion of practical men for the act does not provide any guidance in the matter. [ Nalinikank Ambalal mody v. Narayan Row, 1966]

Continue It does not matter any way how the asessee has chosen to show a particular income in the return submitted by him. However the income is to taxed under the appropriate head of income. It is imperative on the part of department to charge the income under the specific head. [Bihar State Co-operative Bank Ltd. v. CIT]

No deduction for expenditure incurred in the respect of exempt income against taxable income [14A] To nullify the decision of the supreme court in case of Rajasthan State Warehousing Corporation v CIT, 2000, Sec. 14A has been inserted to provide that for the purpose of computing the total income, no deduction shall be allowed in the respect of any expenditure by the assesee in the relation to income . which expenditure does not form part o total income under the this act.