Healthcare Coverage Insights and Challenges over the Decades

Explore the evolution of healthcare coverage in the U.S. through data on uninsured populations, Medicaid enrollment, impact of ACA on different ethnic groups, and Medicaid's role in improving access to care. Discover how underinsurance affects health outcomes and financial stability.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Uninsured All Year 100 Medicare/Medicaid 80 Millions 60 40 20 0 1940 1950 1960 1970 1980 1990 2000 2010 2020 Data after 2013 are projected Social Security Bul, HIAA, CPS, and CBO estimate

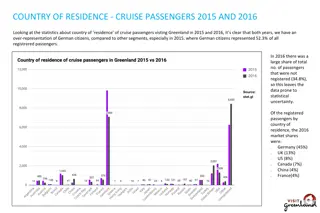

The ACA Cut Uninsurance Among Hispanics, Blacks, and Whites by ~1/3 50% 40% 42.8% 40.1% Percent of adults 18-64 uninsured 30% 31.8% 25.9% 25.5% 20% 17.2% 16.0% 14.8% 10% 10.5% 0% 2012 2013 2014 Hispanic Black White Health Affairs 2015;34:1774

Medicaid: Poor Access, But Better Than Nothing

Medicaid Enrollment 70 60 Millions 50 40 30 20 10 0 1987 1992 1997 2002 2007 2012 Bureau of the Census Data for 2015 based on CBO estimate

Medicaid Improved Access and Hypertension Control for the Poor 6 5 5.0 Odds ratio for Medicaid vs uninsured 4 3 2 1.8 1.7 1 0 Had a doctor visit Aware of hypertension Hypertension controlled Christopher, Wilper, Himmelstein, Woolhandler, McCormick AJPH 2015 Odds ratios are adjusted for sex, age, race/ethnicity, presence of chronic conditions, disability

Many Specialists Wont See Kids With Medicaid 100% 100% 100% 98% 96% Appointments for Children 91% 89% 89% % of Clinics Scheduling 80% 60% 57% 51% 46% 40% 45% 37% 34% 29% 20% 20% 17% 0% All Ortho Private Insurance Psych Asthma Neuro Endoc ENT Derm Public Insurance Bisgaier J, Rhodes KV. N Engl J Med 2011;364:2324-2333

Medicaid Managed Care Enrollment Soaring 60 50 52.2 Millions of enrollees 45.5 43.9 40 40.6 38.3 35.2 30 32.4 20 10 0 2008 2009 2010 2011 2012 2013 2014 Sanofi Managed Care Digest, 2015 Note: Medicaid payments for managed care firms = $123.637 billion in 2013; profits = $2.4 billion No evidence of cost savings; some evidence of worse quality

Underinsurance Impedes Access, Worsens Health, Bankrupts Families

Average Deductibles Rising $1,200 $1,077 $1,000 $989 Average deductible for covered workers, single coverage $883 $800 $802 $747 $600 $646 $533 $400 $433 $343 $303 $200 $- 2006 2008 2010 2012 2014 Kaiser/HRET Survey of Employer-Sponsored Benefits, 2015

Many Families Cant Afford Out-of-Pocket Costs 100% 89% Percent of non- poor families with liquid assets less than category 80% 81% 60% 63% 49% 40% 20% 0% Deductible $2500/5000 All Families OOP Limit $6000/12000 Uninsured Families Kaiser Foundation, Consumer Assets and Cost Sharing, Based on Fed Survey, Feb 2015 31% of non-poor say they could not borrow $3,000 from relatives or friends in an emergency

High Deductibles Cut All Kinds of Care 150,000 Employees Lost Cadillac Coverage No Evidence that Patients Shifted to Higher Value Care Percent utilization reduction -8.0% -11.5% -15.0% -19.0% -20.5% -22.0% -27.0% Preentive Office Visit Mental Health ED Inpatient Drugs Imaging Brot-Goldberg et al, 6/2015 http://eml.berkeley.edu/~bhandel/wp/BCHK.pdf Findings closely resemble those of Rand Health Insurance Experiment Study found no evidence that patients shopped for lower prices

Privately Insured Skip Care Because of Cost Especially among those with high deductible plans 29% Percent with problems due to health costs 24% 23% 23% 18% 15% 15% 14% 13% 10% Visit When Sick Preventive Care High Deductible Test or Treatment Medication Usual Physician* Other Private Insurance *Went to Urgent Care Center rather than usual PCP Source: AP/NORC Survey, Oct. 2014

Uninsured and Under-Insured Delay Seeking Care for Heart Attacks 1.6 1.4 1.38 Odds ratio for delayed care* 1.2 1.21 1.0 1.00 0.8 0.6 0.4 0.2 0.0 Insured Under-insured Uninsured Source: JAMA April 15, 2010. 303:1392 *Adjusted for age, sex, race, clin. charact., hlth status, social/psych fx, urban/rural. Under-insured=had coverage but patient concerned about cost

Higher Medication Co-Pays = Worse Pediatric Asthma Outcomes 50 40 41.7 40.3 30 Low Copay High Copay 24 20 17 10 0 % of Days Used Meds Asthma Admits/1000 Children age 5-18 Source: JAMA 2012;307:1284

Higher Copayments = Kids Without Care 40% Percentage with no physician visits in year 30% 32% 20% 21% 18% 15% 10% 10% 5% 0% Free Care 25% Copay 95% Copay (Like HSA) Age 0-4 Age 5-13 Source: Rand Experiment. Pediatrics 1985;75:942

Most of the Medically Bankrupt Had Coverage Insurance at Illness Onset VA / Military 2% Private Insurance 60% Medicare 10% Medicaid 5% Uninsured 22% Source: Himmelstein et al. Am J Med: August, 2009

2005-2014 Medical Bill and Debt Problems: Back to Where We Were Pre-Recession 50% 40% Percent of adults 19-64 reporting medical bill/debt problems 41% 40% 35% 34% 30% 30% 29% 26% 24% 20% 23% 23% 22% 21% 18% 16% 15% 10% 13% 0% Problem paying Collection agency call 2005 Paying over time 2012 Any med bill / debt prob 2014 2010 Commonwealth Fund Biennial Health Insurance Surveys 2005, 2010, 2012, 2014

Planning for Retirement? Don t Forget Health Care Costs Medicare covers only 51% of health care services . For a 65 year old couple retiring this year, the cost of health care in retirement will be $240,000. New York Times. Wealth Matters

Rising Economic Inequality

Change in Real Family Income 1979 - 2014 100% 80% 77.9% 60% 54.4% 40% 20% 25.9% 12.4% 3.0% 0% -11.7% -20% Bottom 20% Second 20% Middle 20% Fourth 20% Top 20% Top 5% Woolhandler/Himmelstein Analysis of data from the Bureau of the Census

Growing Gap in Life Expectancy by Income Dramatic gains for the wealthy; losses for lower income 45 41.9 40 Remaining life expectancy at age 50 35 36.2 33.4 33.1 32.4 32.4 32.3 30 31.4 29.7 28.3 25 20 Turned 50 in 1980 Turned 50 in 2010 Poorest Q2 Q3 Q4 Richest Growing Gap in Life Expectancy by Income National Academy of Sciences, 2015

Child Poverty Rates Denmark 2.7% Finland 2.9% Germany 7.4% Sweden 8.3% UK 10.4% France 11.4% Australia 12.9% USA 20.9% Mexico 22.7% 0% 5% 10% 15% 20% 25% OECD 2015

Incarceration Rates Japan 51 Germany 79 France 98 Italy 106 Canada 118 China 121 UK 148 Iran 284 Russia 475 USA 716 0 100 200 Prisoners per 100,000 population 300 400 500 600 700 800 Walmsley World Prison Population List, 10th Ed.

Persistent Racial Inequalities

Black Americans Die Younger 80 81.6 79.1 Life expectancy at birth 75.5 70 60 50 White Hispanic* Black CDC, 2015 Final Mortality Data for 2013 *Hispanics can be of any race, and Blacks and Whites include some Hispanics

Median Family Income $80,000 Median income (2014 $s) $60,000 Whites $40,000 $20,000 Blacks $0 2014 1947 1957 1967 1977 1987 1997 2007 Inflation adjusted, 2014 $s Bureau of the Census

Minority College Graduates Incomes Have Fallen 18.0% 15% Change in median family income of college graduates, 1992-2013 (inflation adjusted) 5% -5% -10.0% -12.1% -15% Non-Hispanic Whites Blacks Hispanics Emmons WR. Federal Reserve. St. Louis August 2015

Driving While Black More Likely to be Searched; Less Likely to be Found with Contraband 6 5.2 5 5 Black Rate / White Rate (1.0 = Equally Likely) 4 2.9 2.8 2.7 2.7 2.6 3 2.2 2.1 2 1.5 1 1 0.9 0.8 0.8 0.8 0.7 0.7 0.7 0.7 0.6 0 Car Searched Contraband Found* NY Times 10/25/2015 * Contraband found among those searched

Causes of Black/White Disparity In Life Expectancy Cancer 21% Heart Disease 30% Stroke 9% Homicide 11% All Other 22% HIV 7% Source: MMWR 2001;50:780

Black Enrollment in U.S. Medical Schools 20% AAMC Goal Percent Blacks in 1st Year Medical School Class 15% 10% 5% 0% 1976 1981 1986 1991 1996 2001 2006 2011 RWJ Fdn. 1987; AAMC; JAMA Annual Medical Education Special Issue

Blacks in VA: No Health Disadvantage 1.2 1.0 0.99 Odds ratio for Black vs White Vets (<1 indicates lower rate for Blacks) 0.8 0.78 0.6 0.63 0.4 0.2 0.0 Total Mortality Rate New CAD Event Stroke Kovesdy et al. Circulation 9/18/2015 Longitudinal study of 3,072,966 Vets cared for at VAs

Immigrants Keep Medicare Afloat $10.1 Billion Net contribution to Medicare Trust Fund, 2009 $3.7 Billion -$30.9 Billion US Born Foreign Born Citizens Non-Citizens *Adjusted for ethnicity, poverty, age, insurance status, patient/parent-reported health status Source: Mohanty et al. Am J Public Health 2005;95:1431

Rationing Amidst a Surplus of Care

22.5% of 111,707 Defibrillator Implants Were Not Evidence-Based 25% Sometimes Lethal 20% In hospital death rate for non- evidence based ICD implant 0.6% Cost of ICD implant ~$25,000 15% 22.5% 10% 14.0% 5% 8.3% 0.7% 2.7% 0% Any CHF MI NYHA Class IV CHF CABG <90 Days Inappropriate Use <90 Days <40 Days Note: In-hospital death rate for non-evidence-based ICD implantation was 0.6%. Cost of ICD implant ~$25,000 Source: JAMA 2011;305:43

Many Elective PCIs Are Inappropriate Appropriate 33.9% Uncertain 41.3% Inappropriate 22.0% JAMA IM 2014;174:1630 Based on 1,225,562 patients in PCI Cath Registry

Administrative Overhead Rising

Growth of Physicians and Administrators 3500% 3000% Growth since 1970 2500% 2000% 1500% 1000% 500% 0% 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015 Managers Physicians Bureau of Labor Statistics; NCHS; Himmelstein/Woolhandler analysis of CPS Managers shown as moving average of current year and two previous years

Investor-Owned Care: Inflated Costs, Inferior Quality

Health Industry Profits, 2014 Pharmaceuticals $67.3 billion Insurers $14.0 billion Equipment/Supplies $7.4 billion Pharmacy $6.8 billion Lab/Benefits Mgrs $3.6 billion Providers $3.3 billion Distributors/Wholesalers $3.2 billion Fortune 500, 2015

For Profit Hospitals = Lower Quality Highest Quality Lowest Quality 79% Hospitals 89% Hospitals 12% 21% For-Profit Non-Profit / Government Source: Health Affairs 2011;30:1904. Quality rating based on Medicare s Hospital Compare data

For-Profit Hospitals Cost 19% More Lower payments at PFP Hospitals Higher payments at PFP Hospitals PFP/PNFP Payments Ratio (95% CI) Relative payments for care at private for-profit (PFP) and private not-for-profit (PNFP) hospitals Source: CMAJ Devereaux et al. 170 (12): 1817.

For-Profit Hospitals Administrative Costs Are Higher 30% 27.2% 25% Percentage spent on administration 25.0% 20% 15% 10% 5% 0% For-Profit Hospitals Non-Profit Hospitals Himmelstein and Woolhandler Analysis of 2011 Medicare hospital cost reports

For Profit Home Care: Lower Quality 90% 87.4% 86.0% 80% 78.7% 77.2% 73.5% 70% 71.6% 60% 60.1% 56.9% 50% Overall Quality Process of Care For-Profit Functional Improvement Non-Profit Avoiding Hosp. Admit Cabin, Siman, Himmelstein & Woolhandler. Health Affairs 8/2014

For Profit Home Care: Higher Cost $5,000 $4,827 $4,000 $4,075 Annual Cost per Patient $3,000 $2,000 $1,000 $1,279 $261 $724 $681 $0 Total Administration Profit Excluding Profit For-Profit Non-Profit Cabin, Siman, Himmelstein & Woolhandler. Health Affairs 8/2014

Hospice Care Goes For-Profit 70% 60% 61% Percent of hospices under for- profit ownership 59% 57% 56% 50% 54% 53% 52% 40% 36% 30% 33% 31% 30% 20% 10% 9% 6% 0% 1993 1994 2000 2001 2002 2003 2007 2008 2009 2010 2011 2012 2013 Source: MEDPAC annual report, 2014 Profit rate: for-profits = 12.4%; non-profits = 3.2%

US Prescription Drug Spending $400 $350 Prescription drug spending, Billions of dollars 343 328 $300 305 $250 271 263 262 256 255 243 236 224 $200 205 192 176 $150 158 139 $100 121 105 85 75 $50 67 61 55 51 48 45 40 $0 1990 1995 2000 2005 2010 2015 Source: CMS, Office of the Actuary Note: 2014-2016 estimated

Drug Company Profits 25% 23% 22% 20% 20% Return on Revenue (%) 19% 19% 19% 19% 19% 17% 17% 15% 16% 16% 16% 16% 16% 15% 14% 14% 10% 7% 5% 6% 6% 6% 6% 6% 5% 5% 5% 5% 5% 5% 5% 4% 1% 3% 3% 0% 1995 2000 2005 Fortune 500 Median 2010 Drug Companies Fortune 500 rankings for 1995-2015 Total drug company profits, 2010 = $44.6 billion