Home Loans in Arizona: Why Working with a Mortgage Broker in Utah Could Be Your

Buying a home is exciting, but it may also seem stressful, especially when you are looking for the right home loans in Arizona. Many buyers focus only on local creditors or banks in Arizona, thinking that this is the only option.nvisit us - //asso

Uploaded on Sep 01, 2025 | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Buying a home is exciting, but it may also seem stressful, especially when you are looking for the right home loans in Arizona. Many buyers focus only on local creditors or banks in Arizona, thinking that this is the only option. But here is something you may not know: working with a reliable mortgage broker in Utah sometimes can help you find a better loan, save money, and facilitate the process. At Associated Mortgage, we help many people guarantee the best housing loans, even when they are buying properties outside Utah. In this blog, we'll explain why choosing a mortgage broker in Utah can be your smartest move when buying in Arizona and how we guide you with each step on the way.

Arizona has become the most popular places to buy a house quickly, and it's no surprise that many people are moving there. First, Arizona is famous for its warm and sunny weather, which lasts for most of the year. If you could experience outside activities together with walking, golfing, or simply enjoyable inside the sun, it looks like a perfect region to stay in Arizona. Another huge motive is a robust process marketplace in cities which includes Phoenix, Tucson, and Scottsdale. Many companies are commencing offices there, which means that greater process opportunities for people of different origins and industries. This economic growth looks like a smart investment to buy a home.

Arizona is also known for its attractive natural beauty. From the wide desert landscapes and the colorful valley to the beautiful mountain views, there is always something beautiful. You prefer to explore nature or just want to enjoy beautiful views from your previous verandah, delivering Arizona. One of the biggest benefits is that home prices in Arizona are often less than in expensive states like California or Colorado. This means that you can often buy a large building or stay in a good neighborhood for the same amount. But while providing many wonderful reasons for buying an Arizona home, getting the right home loan in Arizona may feel confusing. There are many loan types, rates, and conditions for choosing, and that is where working with an experienced mortgage broker in Utah can make everything easier and less stressful.

You may be wondering why not just use a local Arizona Creditor or Bank when buying the next home. It is a fair question-but working with us at the Associated Mortgage, a reliable mortgage broker in Utah, can provide you with extra benefits that only local lenders may not offer. When you work with us, you are not limited to what just a few Arizona banks can provide. Instead, you get access to a much wider network of lenders, which often means better interest rates, special promotions, or lower fees that can save you thousands of dollars during the life of the loan.

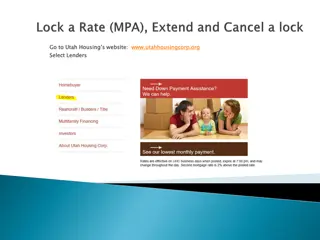

1. More loan options As we work in the states, we usually see special loan products or promotions that local brokers may not know. This can mean better interest rates or lower rates. It offers more options, so you are not limited to just a few local banks. 2. Help buyers outside the state If you currently live in Utah and want to buy in Arizona, we know how to deal with the paperwork and extra schedules. We even help with remote closures. This facilitates the purchase of a home in Arizona without traveling for each step. 3. Personal and friendly service Unlike large banks, we offer direct access to a mortgage specialist who cares about your situation. You are not just another file for us. We hear carefully and ensure that you always feel supported.

4. Focus on your goals We asked about your plans. For example, if you can move in a few years, a shorter adjustable-rate loan can save money. If you plan to remain in the long run, a fixed-rate loan can make more sense. Our goal is to find a loan that fits your life, not just your numbers. 5. Faster Communication We respond quickly to calls, texts, and emails so that your questions are answered quickly. This means fewer delays and less stress while you wait for updates. 6. Help with special programs We follow Arizona's specific programs for starters, veterans, and rural homes, and we help to apply if they qualify. These programs can help lower their costs or make it easier to buy a home.

7. Solutions for exclusive situations Are you autonomous? Changing jobs? Buying an investment property? We know how to present your application so that creditors see you as a strong borrower. We believe that everyone deserves a fair chance of owning a home, even if their situation is not "standard". 8. Support even after closing We do not disappear when you receive the keys. We are here if you want to refinance, buy another house, or just have questions. You will always have someone to turn to to get reliable mortgage advice in the future.

When it comes to housing loans in Arizona, there is no unique solution, and this is a good thing! At the Associated Mortgage, we help you explore different types of loans so you can find what fits your budget, credit history, and home goals. For regular-earnings consumers and robust credit score, conventional loans may be a smart choice, normally imparting lower interest rates. If you're a customer for the primary time or have a decrease credit rating, FHA loans can assist with decrease bills and flexible requirements.

VA loans are specially designed for veterans, active military members, and some military families; Often, these loans do not even need an advance. If you are thinking of buying in rural areas, USDA loans can be a great option by offering low or even no down payment for eligible properties. And for those looking for houses with higher prices that exceed standard loan limits, Jumbo loans can make your purchase possible. No matter what kind of loan you are interested in, we explain everything in clear and simple language. Our goal is to help you feel confident in your choice, so you don't get a loan, but the right loan for your future.

Arizona is really a fantastic place to call home, with its endless sun, a strong labor market, and fantastic nature in the desert. Do you dream of a family home in Phoenix, a cozy condominium in Tucson, or a holiday home near Sedona? Finding the right place to stay is just part of the journey. The second part, which often seems overwhelming, is choosing the right mortgage loan to get it done. That's where we got in. When you work with a mortgage broker in Utah, as the Associated Mortgage loan officer, you are not limited to just local creditors. Instead, you get access to a wide range of mortgages in Arizona, along with specialized guidelines adapted to your single situation. We take the time to understand your financial goals, explain each option, and help you choose a loan that fits your budget and plans.