How to Help Someone with a Tax Problem: Recognizing, Referring, and Supporting

Understand how to identify when someone needs assistance with personal tax issues, prepare them for seeking help, and refer them to the appropriate support services. Help clients recognize tax problems, gather necessary paperwork, and refer them to experts for resolution. Enhance client outcomes by providing step-by-step guidance and referrals to address tax challenges effectively.

Uploaded on | 1 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

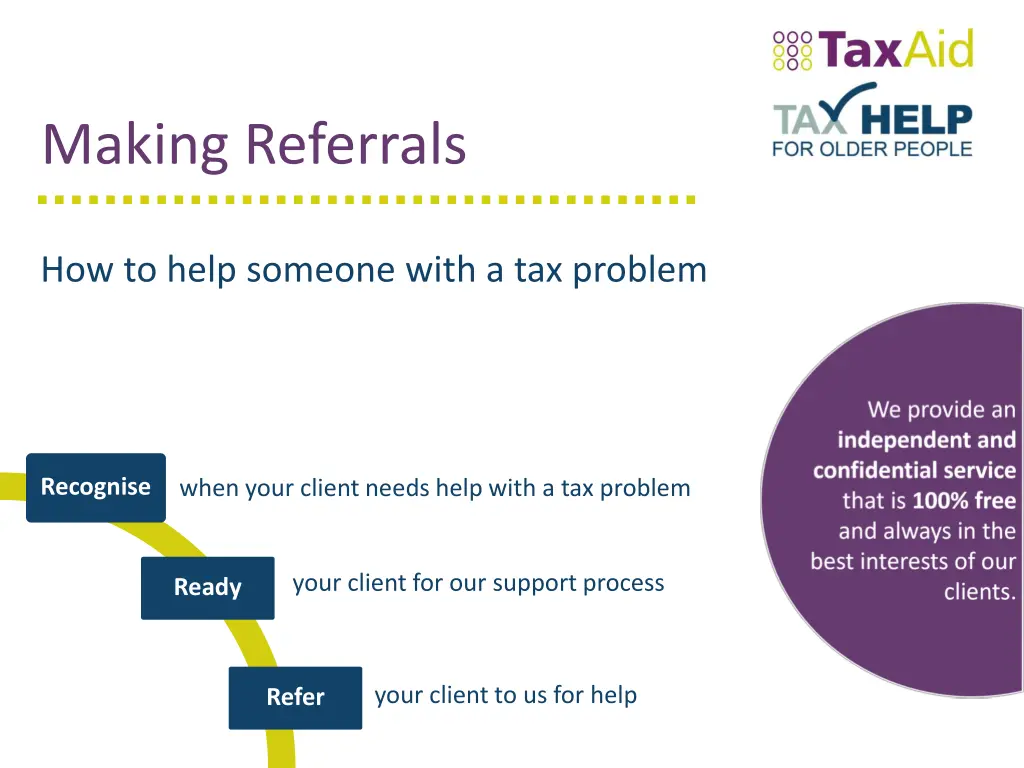

Making Referrals How to help someone with a tax problem Recognise when your client needs help with a tax problem your client for our support process Ready your client to us for help Refer

Recognise When someone is struggling with a personal tax problem, they may say: they need help understanding HMRC s paperwork, including Pay As You Earn issues, letters, bills, statements, and over- or under-payment of tax they have a tax debt, penalties and/or interest to pay they are having a dispute with HMRC over unpaid debts or penalties there has been an incorrect determination or estimate of tax made by HMRC on a previous return They need help completing tax forms, especially due to mental or physical disability they have multiple jobs, incorrect tax codes, or unexpected deductions from their pay they may be struggling with other debts including tax, and are regularly incurring fees and late payment penalties it is important to find out if a tax debt is part of the larger debt picture they are working in the gig economy or as a subcontractor, especially those working in construction or as a delivery driver they have difficult personal circumstances which might impact their ability to take care of their personal finances

Ready To achieve a positive outcome for your client, ask them to: Call from a quiet space with a good mobile signal and enough time (minimum 20 minutes) Prepare all correspondence from HMRC in order of date received Prepare income statements contracts of employment, payslips, benefits statements, P45, P60, and any other statements of earnings Prepare paperwork including business expenses for those who are self-employed Provide previous years tax returns or self-assessments Have their National Insurance Number ready

Refer Thousands of people every year encounter problems with their taxes. The best way to get your client help is to call our helpline on 0345 120 3779. Our trained advisers can take them through the advice process: 3 4 6 2 5 1 The tax adviser will provide further guidance to enable your client to better understand their taxes going forward Our tax adviser will work with your client to achieve the best possible resolution of their tax problem We will speak to your client about their tax problem and take details on their personal circumstances For those clients who fit within our remit, we will try to resolve your client s problem on the call through advice and information If the tax problem can be resolved by HMRC s Extra Support Team, we will make a referral For more complex tax problems, we will record your client s contact information and assign them to a qualified tax adviser Our goal is to provide your client with a service that is compassionate and confidential. Our qualified tax advisers have the experience and expertise to work with your client and HMRC to legally remit any tax debts and penalties where practicable.

Financial Eligibility: Individuals, including self-employed/sole traders. TaxAid and Tax Help for Older People will support people who are: Remit earning approximately 20,000 annually (before tax), or people on higher income with: o debt more than 25% of their annual income, or o other hardships or disadvantages such as (but not limited to) mental or physical health problems, disabilities, domestic violence, bereavement, or homelessness. TaxAid and Tax Help for Older People do not advise on eligibility for DWP benefits (including Tax Credits), council tax, Capital Gains Tax, Inheritance Tax, VAT, or Limited Companies. Our advisers do not provide tax planning advice, but we can provide guidance on making good tax decisions.