Humber Coast and Vale Health and Care Partnership Estates Strategy Update

The Humber Coast and Vale Health and Care Partnership is focused on enhancing partnership working through collaborative work programs covering clinical priority areas such as cancer and mental health while developing sustainable models of acute service provision. Their Long Term Plan reflects agreed aims, objectives, and approaches for improved care provision and capital investment plans.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Humber Coast and Vale Health and Care Partnership Summer 2019 STP/ICS Estates Strategy Checkpoint Date: 15 July 2019 Version 3.1 NHS England and NHS Improvement

Disclaimer The options set out in this document are for discussion purposes. The involved NHS bodies understand and will comply with their statutory obligations when seeking to make decisions over estate owned strategies which impact on the provision of care to patients and the public. The options set out do not represent a mandate from NHS Improvement/NHS England or commitment to any particular course of action on the part of the organisations involved. In respect of any request for disclosure under the Freedom of Information Act 2000 ( FoIA ): This is a confidential document for discussion purposes and any application for disclosure under the FoIA should be considered in accordance with your disclosure obligations under the Act, including against potential exemptions such as those contained in s.22 (Information intended for future publication), s.36 (Prejudice to effective conduct of public affairs) and s.43 (Commercial Interests). Prior to any disclosure under the FoIA the party which has received the request is invited to discuss the potential impact of releasing such information with NHS Improvement/NHS England and any other relevant parties. 2 | 2 | STP Estates Strategy Check-point - Summer 2019

Contents 1. Addressing NHSI/E feedback on HCV s July 2018 Estates Strategy 2. Governance Update 3. Clinical Service Strategies and Capital Plans 4. Primary Care Estates Strategies and Capital Plans 5. Disposal Plans for Surplus Land and Buildings 6. Delivering Estates Efficiencies 7. Delivery of STP Wave 1 - 4 projects 8. Appendices: 1. Utilisation of Technology 2. Delivering Estate Efficiencies Calculation Methodology 3. Delivering NHS Staff Accommodation Through Estates Rationalisation 4. Summary of Proposed and Potential HCV Capital Developments 3 | 3 | STP Estates Strategy Check-point - Summer 2019

1. Addressing NHSI/E Feedback on HCVs July 2018 Estates Strategy (1) NHSE/I Feedback July 2018 The feedback was .. Summer 2019 STP Update - The STP did Continue development of Local Strategic Estates Groups and locality plans to enhance partnership working Local Strategic Estates Groups, with health care and Local Authority representation, have now been established in North Lincolnshire, North East Lincolnshire, Hull and East Yorkshire. A fifth group had been established to cover the York/Scarborough area. However, arrangements are currently being made to develop separate groups for the City of York and North Yorkshire (including Scarborough) areas. We have therefore now achieved Local Strategic Estates Group coverage for the whole of the Humber Coast and Vale area. The Partnership has developed a comprehensive set of collaborative work programmes that are operating effectively at place, sub-system and Partnership level. This collaborative work covers the national clinical priority areas (including cancer and mental health) and integrated out of hospital care. In addition, strategic reviews are being undertaken to develop and implement sustainable models of acute service provision across the Humber Coast and Vale area. The Partnership is currently developing its Long Term Plan which reflects the aims, objectives and approaches that have been agreed through our collaborative clinical work programmes. Our capital investment plans and priorities have been reviewed and refined to support delivery of these clinical service strategies. A summary of the Partnership's updated capital investment plans is set out in section 6. The Partnership's top priority Wave 4 bid (Transformation of Urgent and Emergency Care Services including Diagnostics) was supported. Capital funding of 88.5m has been allocated to support delivery of this programme. A second Wave 4 bid relating to the upgrade of infrastructure on the Partnership's 5 main acute hospiutal sites was not supported. The Partnership has reviewed and refined its capital investment plans and priorities to support delivery of agreed clinical service strategies, whilst addressing estates pressures and constraints. A summary of the Partnership's updated capital investment plans is set out in section 6. Disposal and housing number proposals have been reviewed and anomalies have been addressed. Revised figures are set out in section 6. Provide evidence that emerging clinical strategies and estates priorities are underpinned by detailed plans Develop contingency plan in the event that Wave 4 capital bids cannot be funded Clarify and correct differences in disposal and housing numbers 4 | 4 | STP Estates Strategy Check-point - Summer 2019

1. Addressing NHSI/E Feedback on HCVs July 2018 Estates Strategy (2) NHSE/I Feedback July 2018 The feedback was .. Summer 2019 STP Update - The STP did The disposal pipeline should be supported by an action plan to ensure all potential sites are included and progressed HCV's action plan involves 3 active components; 1. Interrogation of all STP partners at Estates Director level to review progress on currently scheduled sites; 2. Meetings with all STP partner estates teams on the more complex sites/sites with greater development potential to accelerate disposals and identify new opportunities; 3. Incorporation of above data and monthly reporting via the Surplus Land Data Tracker for review by the NHS Property Board. The Strategic Estates Advisor who leads this work is a general practice Chartered Surveyor with 30 years private sector house building and major mixed-use development experience. The Partnership has developed a full schedule of planned and proposed capital investments for the strategic planning period. This covers all service sectors and all localities across the Humber Coast and Vale area. The schedule has been reviewed by the Local Strategic Estates Groups and by the Partnership's Strategic Estates Board. Through this process priority investments and potential sources of funding have been identified. There are two schemes with a capital value in excess of 100m that will need to be discussed with regional and national teams at an early stage. A robust project pipeline should be put in place to ensure that the Partnership is in a strong position to apply for funding in future rounds 5 | 5 | STP Estates Strategy Check-point - Summer 2019

1. Addressing NHSI/E Feedback on HCVs July 2018 Estates Strategy (3) NHSE/I Feedback July 2018 The feedback was .. Summer 2019 STP Update - The STP did Differences in values of disposals between the July version of the Estates Strategy and the DHSC Pipeline and the Naylor fair share shortfall of ca 30m should be reviewed The explanation for the variance with the Naylor target was contained at A.11, slide 34 of the HCV STP Estates Strategy and Capital Investment Plan July 2018, and is therefore not repeated here. The explanation notwithstanding, very good progress has been achieved since the above plan; namely; 1. Over 32% by value of scheduled disposals have been completed. (this rises to over 48% if the current NHSPS contract for the sale of the Bootham Park Hospital site becomes unconditional; 2. A further 1.28m of potential disposal receipts have been identified; 3. The site at Castle Hill, Cottingham which is the sole variance contained in the 2018 Plan explanation, is now the subject of consideration in the Local Development Framework Plan process for the release of a further 400 housing units. This reflects the proactive approach referred to in the 2018 variance explanation. The potential receipt for this has yet to be estimated and will be in addition to the 1.28m stated above; 4. The total number of potential housing plots has increased by 247 units since the 2018 Plan to 1,454 units; 6 | 6 | STP Estates Strategy Check-point - Summer 2019

1. Addressing NHSI/E Feedback on HCVs July 2018 Estates Strategy (4) NHSE/I Feedback July 2018 The feedback was .. Summer 2019 STP Update - The STP did 5. The rationalisation achieved through surplus land disposal has created 220 new homes for staff at land adjoining Grimsby Hospital, and the success of this scheme is supporting the masterplanning for a further 180 homes for staff at land adjoining Scunthorpe Hospital. These H4S units totalling 400 are in addition to the 1,454 units noted under point 4 above; 6. It is conservatively estimated that the backlog maintenance that is being eliminated from the estate is over 8.2m and work continues to identify the full profile of potential costs that are being saved through the disposal and redevelopment programme. NB. An entry in the 2018 Plan disposal data identified as 2 sensitive sites 2 organisations with land area, estimated disposal value and number of housing units of 2.53ha, 3.68m and 78 units respectively was supplied by the Department of Health. Enquiries could not yield the source for this information, and no STP partners could identify this data. These figures have therefore been removed from the 2018 Plan totals for the purpose of assessing year on year progress. 7 | 7 | STP Estates Strategy Check-point - Summer 2019

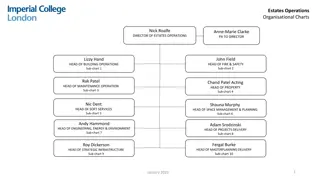

2. Governance Update The Partnership has continued to develop its strategic estates governance arrangements. The arrangements are based on the model that has been successfully developed in Greater Manchester. A Strategic Estates and Capital Investment is operating at Partnership level. This is underpinned by Strategic Estates Groups that are operating at local level. The local Strategic Estates Groups are multi-organisational and involve representation from healthcare, Local Authorities and other stakeholders. Terms of reference have been reviewed and agreed for all of the groups in the estates governance structure. Mike Proctor, Chief Executive of York Teaching Hospitals Foundation Trust, is the Senior Responsible Officer for Partnership s Estates programme and is the Chair of the Strategic Estates and Capital Investment Board. Further support to the Estates programme is provided by Chris O Neill (Partnership Director) and Nigel Goodall (Strategic Estates Advisor). Arrangements are currently being made to provide additional dedicated support to the programme. A separate Steering Group has been established to oversee the planning and delivery of the Partnership s Wave 4 programme. This programme involves a range of capital development projects on 4 acute hospital sites with a total capital value of 88.5m. An organogram showing current the Partnership s current estates governance arrangements is set out on the following slide. 8 | 8 | STP Estates Strategy Check-point - Summer 2019

2. HCV Estates Governance Structure HCV Partnership Executive Group Wave 4 Programme Steering Group HCV Strategic Estates and Capital Investment Board North Lincolnshire Strategic Estates Group North East Lincolnshire Strategic Estates Group York & Scarborough Strategic Estates Group East Yorkshire Strategic Estates Group Hull Strategic Estates Group Partnership Organisations Providers , Clinical Commissioning Groups, Local Authorities 9 | 9 | STP Estates Strategy Check-point - Summer 2019

3. Clinical Service Strategies and Capital Plans Articulate within the below table how current and future capital plans enable clinical service strategies and workstreams and align to national priorities. Include reference to capital received through other sources such as Digital, Mental Health, Ambulance, Diagnostics, UEC etc. Ref Key STP Clinical Service Strategies linked to national priorities Capital plans (STP Wave 1-4), other current projects and future plans Place Based Care The Partnership s aims in relation to place based care can be summarised as follows: 1 A number of developments are being planned that will provide accommodation that facilitates the implementation of agreed models of place based care across the Humber Coast and Vale area. These schemes will support provision of integrated, multi-organisational provision of primary, community and social care services at neighbourhood level. Key schemes include: Improving the health and wellbeing of local populations by: o addressing the wider determinants of health o promoting prevention initiatives o providing better support for people to manage their own health and health conditions Burnholme Health and Wellbeing Campus (York) value ca 5.4m Integrating health and care service provision o based on closer collaboration between GPs, community health service providers, mental health providers, acute hospitals and social care providers Brigg Primary and Community Care Hub value ca 1.5m Bridlington integrated primary, community and acute care facilities value subject to finalisation of preferred development option Integrating health and social care commissioning o based on CCG collaborations and collaborations between Local Authorities and CCGs West Hull Primary Care Hub - value ca 4.0m Children s Integrated Care Hub (Hull) value ca 6.0m 10 | 10 | STP Estates Strategy Check-point - Summer 2019

3. Clinical Service Strategies and Capital Plans Articulate within the below table how current and future capital plans enable clinical service strategies and workstreams and align to national priorities. Include reference to capital received through other sources such as Digital, Mental Health, Ambulance, Diagnostics, UEC etc. Ref Key STP Clinical Service Strategies linked to national priorities Capital plans (STP Wave 1-4), other current projects and future plans Primary Care The Partnership has recently developed a Primary Care Strategy that sets out the following aims and objectives: 2 The Partnership has developed a programme of planned investment in Primary Care facilities linked to the agreed strategic objectives. Key schemes are summarised in section 4 below. Developing Primary Care Networks to deliver tangible benefits for their patient population Developing out of hospital services through integration with community, secondary and social care Developing and supporting the Primary Care workforce to deliver place based person-centred care Developing the Digital and Technological platform to provide patients choice in how and when they access services Supporting development of the Primary Care Estate infrastructure to meet the emerging service models of the future 11 | 11 | STP Estates Strategy Check-point - Summer 2019

3. Clinical Service Strategies and Capital Plans Articulate within the below table how current and future capital plans enable clinical service strategies and workstreams and align to national priorities. Include reference to capital received through other sources such as Digital, Mental Health, Ambulance, Diagnostics, UEC etc. Ref Key STP Clinical Service Strategies linked to national priorities Capital plans (STP Wave 1-4), other current projects and future plans Urgent and Emergency Care The Partnership has agreed the following strategic priorities in relation to urgent and emergency care: 3 The Partnership has developed a comprehensive schedule of planned and potential capital developments covering all service sectors and all localities across the HCV area. This schedule is being used to inform discussions regarding capital developments at organisational, locality and Partnership level. These discussions are wide ranging, looking at overall strategic objectives, development options, partnership opportunities, innovative financing models, priorities, planning and development timescales etc. Delivery of 24/7 integrated urgent care that is accessible via NHS 111 or online Ensuring all hospitals with a major A&E provide: o Same Day Emergency Care at least 12 hours a day, 7 days a week o Provide an acute frailty service for at least 70 hours a week, working towards achieving assessment within 30 minutes of arrival o Aiming to record 100% of patient activity in A&E, Urgent Treatment Centres and Same Day Emergency Care via the Emergency Care Data Set by March 2020 o Test and begin implementing the new emergency and urgent care standards arising from the clinical standards review by October 2019 o Reduce Delayed Transfers of Care across our Partnership working with our Local Authorities and community service providers Reducing Stranded and Super Stranded patients Improving performance against standards / constitutional targets through our three A&E/Urgent Care Delivery Boards Developing High Intensity Users plans Some of the planned and potential developments map directly to the Partnership s strategic objectives in clinical priority areas. Key schemes have therefore been listed in the sheets in this section of the return that relate to place based care, primary care, mental health and cancer. The majority of the Partnership s planned and potential developments in the acute sector will support achievement of strategic objectives across a range of clinical priority areas, including urgent and emergency care, planned care and cancer. Key acute sector schemes have therefore been grouped and are set out in the following section. 12 | 12 | STP Estates Strategy Check-point - Summer 2019

3. Clinical Service Strategies and Capital Plans Articulate within the below table how current and future capital plans enable clinical service strategies and workstreams and align to national priorities. Include reference to capital received through other sources such as Digital, Mental Health, Ambulance, Diagnostics, UEC etc. Ref Key STP Clinical Service Strategies linked to national priorities Capital plans (STP Wave 1-4), other current projects and future plans Planned Care The Partnership s agreed strategic objectives are as follows: Key Acute Sector Developments 4 Preparatory planning work is currently being completed on schemes that are being supported through emergency capital and Wave 4 capital funding. Transformation of Outpatient Services Reduction in face to face consultations and use of digital technology Musculoskeletal Services Further implementation of the national back pain pathway and development of First Contact Practitioner roles Medicines Optimisation Focus on self-care and over the counter medicines, work with care homes, Transfer of Care and Medicines (TCAM), and antimicrobial resistance RightCare Projects Cardiology (including CVD prevention), Respiratory and Gastroenterology with a specific focus on Endoscopy Clinical Thresholds Implementation of evidence based intervention Ophthalmology Focus on pathways and delivery models through an Operational Delivery Network approach Diabetes Ongoing delivery of the Diabetes Prevention Programme Performance Eliminating 52 week waiters and reducing waiting list size Additional MRI and CT capacity at Northern Lincolnshire and Goole Hospitals ( 8.1m) Transformation of urgent and emergency care including diagnostics at Grimsby, Scunthorpe, Hull and Scarborough hospitals ( 88.5m) Significant capital investment is required over the coming years for the refurbishment and reprovision of clinical accommodation on the acute hospital sites across the HCV area. Estates surveys undertaken by the Partnership s 3 acute Trusts show significant and increasing challenges in relation to physical condition and functional suitability. The physical condition challenges relate to both building fabric and services infrastructure. Some of the functional suitability challenges are very severe including continued use of Nightingale style wards and inadequate provision of sanitary facilities and single rooms. 13 | 13 | STP Estates Strategy Check-point - Summer 2019

3. Clinical Service Strategies and Capital Plans Articulate within the below table how current and future capital plans enable clinical service strategies and workstreams and align to national priorities. Include reference to capital received through other sources such as Digital, Mental Health, Ambulance, Diagnostics, UEC etc. Ref Key STP Clinical Service Strategies linked to national priorities Capital plans (STP Wave 1-4), other current projects and future plans Key Acute Sector Developments (contd) 4 The scale of the required refurbishment and reprovision of clinical accommodation in the acute sector is such that it cannot be managed through provider block capital allocations. It is therefore essential that a structured programme of supplementary capital investment be put in place to reduce service safety, quality and business continuity risks, to facilitate service transformation and to support efficient delivery of agreed models of acute hospital care. The Partnership s clinical service strategy anticipates additional investment in primary, community and mental health care with a view to improving clinical outcomes and minimising growth in demand in the acute sector. On this basis the Partnership is not proposing significant investment in additional acute sector capacity over the next few years. However, demand for diagnostic services is expected to continue to increase. Provision therefore needs to be made for capital investment in additional diagnostic service capacity. 14 | 14 | STP Estates Strategy Check-point - Summer 2019

3. Clinical Service Strategies and Capital Plans Articulate within the below table how current and future capital plans enable clinical service strategies and workstreams and align to national priorities. Include reference to capital received through other sources such as Digital, Mental Health, Ambulance, Diagnostics, UEC etc. Ref Key STP Clinical Service Strategies linked to national priorities Capital plans (STP Wave 1-4), other current projects and future plans Key Acute Sector Developments (contd) 4 The proposed programme of investment in core acute sector facilities (value ca 250m) covers the following key areas: Provision of additional CT and MRI facilities Refurbishment and reprovision of inpatient wards Upgrade of operating theatres and associated engineering services Modernisation of supporting service infrastructure (IT networks, energy centres, decontamination units, catering, laundry etc) Essential Backlog Maintenance works In addition to the proposed programme of investment summarised above, large scale investment is required to facilitate the reprovision of core clinical accommodation on two acute hospital sites. A large scale investment (ca 140m) is required at Scunthorpe General Hospital to enable the reprovision of clinical accommodation from the Coronation Block which needs to be fully vacated as quickly as possible due to major water infrastructure and fire risks. 15 | 15 | STP Estates Strategy Check-point - Summer 2019

3. Clinical Service Strategies and Capital Plans Articulate within the below table how current and future capital plans enable clinical service strategies and workstreams and align to national priorities. Include reference to capital received through other sources such as Digital, Mental Health, Ambulance, Diagnostics, UEC etc. Ref Key STP Clinical Service Strategies linked to national priorities Capital plans (STP Wave 1-4), other current projects and future plans Key Acute Sector Developments (contd) 4 A further large scale investment (ca 160m) is required at Hull Royal Infirmary to enable the reprovision of 20 inpatient wards that are currently accommodated on the 10 upper floors of the 13 storey tower block. These wards do not comply with current standards in relation to control of infection, privacy and dignity and the efficient provision of high quality care. The age and layout of the tower block precludes refurbishment or reconfiguration of the ward accommodation in situ. Reprovision is therefore proposed as part of a wider re-development plan that will optimise efficient future use of the site. 16 | 16 | STP Estates Strategy Check-point - Summer 2019

3. Clinical Service Strategies and Capital Plans Articulate within the below table how current and future capital plans enable clinical service strategies and workstreams and align to national priorities. Include reference to capital received through other sources such as Digital, Mental Health, Ambulance, Diagnostics, UEC etc. Ref Key STP Clinical Service Strategies linked to national priorities Capital plans (STP Wave 1-4), other current projects and future plans Cancer The Partnership has agreed the following strategic priorities in relation to cancer: 5 Through its Cancer Alliance, the Partnership has been awarded capital funding to support service transformation projects in Radiology and Pathology. Lifestyle choices to minimise the risk of cancer o Cancer Champions, Lung Health Checks, FIT rollout Standardised Treatment Pathways o 62 day performance, new model of lung services, rapid diagnostic pathway for colorectal, rapid pathway for UGI Equity of access to high quality services o Shared radiology reporting, digitisation of pathology, future networked model for diagnostic services Services designed to reduce inequalities in health outcomes o Risk stratification for breast, consistent recovery package, patient engagement The Radiology project (capital value ca 1.5m) involves the procurement of an image storage and communication system that is being deployed across the 3 acute Trusts in the HCV area. This system will support networked provision of Radiology services, including shared reporting arrangements, and will facilitate more timely and more efficient multi-disciplinary management of patients across the area The Pathology project (capital value ca 0.6m) involves the deployment of new digital slide scanners in the Pathology departments in York and Hull. The scheme will facilitate collaborative working and more efficient provision of Pathology services. Training is currently underway with a view to digital reporting starting in December. 17 | 17 | STP Estates Strategy Check-point - Summer 2019

3. Clinical Service Strategies and Capital Plans Articulate within the below table how current and future capital plans enable clinical service strategies and workstreams and align to national priorities. Include reference to capital received through other sources such as Digital, Mental Health, Ambulance, Diagnostics, UEC etc. Ref Key STP Clinical Service Strategies linked to national priorities Capital plans (STP Wave 1-4), other current projects and future plans Mental Health The Partnership has agreed the following strategic priorities in relation to mental health: 6 Two major new build schemes are nearing completion in the HCV area. Eliminating out of area placements for patients by 2020/21 Continuing to develop and improve Crisis Care and Liaison Services Developing Community Mental Health Teams to support people with severe mental illness Development of specialist perinatal mental health services Developing and improving a post diagnostic pathway for dementia Delivering improvements in suicide prevention interventions Increasing community forensic teams provision through development of New Models of Care and Forensic Outreach Liaison Services Developing new models of care for children and young people Collaborating on the development and improvement of autism, attention deficit hyperactivity disorder (ADHD) and eating disorder services The Foss Park Hospital scheme will provide improved services and facilities for mental health patients from the York area. The scheme will also enable the vacation and disposal of a number of buildings that are currently in the ownership of NHS Property Services. The scheme (value ca 21.8m) is being managed by Tees, Esk and Wear Valleys FT Humber Teaching FT was allocated Wave 3 capital funding ( 8.2m) to support the development of a 13 bedded CAMHS Tier 4 facility in Hull. The new unit will open in Autumn 2019 and will provide services to patients from across the HCV area. Further capital developments are being planned, linked to achievement of the Partnership s agreed objectives in relation to mental health. Key schemes include: A new 8 bed Mother and Baby Unit enabling improved provision of perinatal mental health support Development of the Humber FT healthcare campus to support transformation of adult and older people s mental health services 18 | 18 | STP Estates Strategy Check-point - Summer 2019

4. Primary Care Estates Strategies and Capital Plans Describe the number of Primary Care Networks and their progress in developing Primary Care Estates Strategies (PCES) in the table below Stages of Primary Care Estates Strategy development /ICS STAGE 2 STAGE 3 STAGE 1 Define future plan for Primary Care Estate strategies Where do we want to be? Determining methodology to enable future plan implementation. How are we going to get there? Ascertaining baseline position where are we now ? Total number of Primary Care Networks at an STP/ICS level. (Insert number below) (Insert Number of PCN Estates Strategies at this stage of development below) (Insert Number of PCN Estates Strategies at this stage of development below) (Insert Number of PCN Estates Strategies at this stage of development below) 29 20 6 3 (incl PCNs in Hull, E Yorks, Scarborough and NE Lincs) (incl PCNs in Vale of York) (incl PCNs in N Lincs) STP/ICS The 3 PCNs in North Lincolnshire have developed an Estates Strategy through the locality estates review that has recently been undertaken by the CCG. Vale of York CCG is refreshing its Estates Strategy. This process is due for completion in 2019. Primary care infrastructure is being assessed at locality level (including the complexities of central York) and is being mapped to the 6 PCNs to inform the development of the strategy. Hull and East Riding CCGs (covering 12 PCNs) have recently refreshed their Estates Strategies, based around previous locality or Practice groupings. Consideration will be given over the next 12 months to refreshing them again to reflect the PCNs. Scarborough and Ryedale CCG s Estates Strategy was last updated in 2017. The CCG is now planning a refresh of the strategy to reflect local developments. The CCG is aiming to undertake this work within the year and will directly involve the PCNs. North East Lincolnshire CCG is currently reviewing its approach to the refresh of its Estates Strategy following the establishment of the PCNs. commentary on plan for future development 19 | 19 | STP Estates Strategy Check-point - Summer 2019

4. Primary Care Estates Strategies and Capital Plans Articulate the current and planned primary care capital pipeline in below table. Each column to include scheme name and value STP/ICS Primary Care Capital Schemes Summary (Actual/Estimated Value of Schemes) Scheme Completion/Operational Date (Enter combined actual/estimated 000k value per year of schemes from table on previous slide) 2019/20 2020/21 2021-2024 Primary Care Developments STP comments (if required) Ref Approved and/or Build In Progress Name and Value ( 000k) Planning Stage (subject to Approvals) Name and value ( 000k) Approved and/or Build In Progress Name and value ( 000k) Planning Stage (subject to Approvals) Name and Value ( 000k) Planning Stage (subject to Approvals) Name and value ( 000k) Approved and/or Build In Progress Name and Value ( 000k) Old Fire Station ( 475) Eastfield ( 500) Pickering ( 360) Brough ( 1,300) Holme on Spalding Moor ( 1,000) Montague ( 765) Hallgate ( 785) Riverside Broughton ( 710) Riverside Brigg ( 1,500) Beech Tree ( 615) GP Premises Improvements 250k - 500k 1 Cambridge Avenue ( 940) Sherburn ( 430) Millfield ( 1,200) GP Premises Developments (Major Improvements/New Development) 500K> 2 20 | 20 | Totals STP Estates Strategy Check-point - Summer 2019 0 0 0 0 0 0

4. Primary Care Estates Strategies and Capital Plans Articulate the current and planned primary care capital pipeline in below table. Each column to include scheme name and value STP/ICS Primary Care Capital Schemes Summary (Actual/Estimated Value of Schemes) Scheme Completion/Operational Date (Enter combined actual/estimated 000k value per year of schemes from table on previous slide) 2019/20 2020/21 2021-2024 Primary Care Developments STP comments (if required) Ref Approved and/or Build In Progress Name and Value ( 000k) Planning Stage (subject to Approvals) Name and value ( 000k) Burnholme ( 5,600) Approved and/or Build In Progress Name and value ( 000k) Planning Stage (subject to Approvals) Name and Value ( 000k) Planning Stage (subject to Approvals) Name and value ( 000k) Approved and/or Build In Progress Name and Value ( 000k) Local Health Hubs (may include LA/other third-party components) 3 Area Health Hubs (may include LA/other third-party components) 4 Totals 0 0 0 0 0 0 21 | 21 | STP Estates Strategy Check-point - Summer 2019

5. STP/ICS Summary from 2018 Estate Strategy 22 | 22 | STP Estates Strategy Check-point - Summer 2019

5. STP/ICS Summary from 2018 Estate Strategy 23 | 23 | STP Estates Strategy Check-point - Summer 2019

5. STP/ICS Summary of 2019 Disposals Pipeline 24 | 24 | STP Estates Strategy Check-point - Summer 2019

5. STP/ICS Summary of 2019 Disposals Pipeline TBC TBC TBC 25 | 25 | STP Estates Strategy Check-point - Summer 2019

5. STP/ICS Summary of 2019 Disposals Pipeline 26 | 26 | STP Estates Strategy Check-point - Summer 2019

5. STP/ICS Summary of 2019 Disposals Pipeline See above See above See above See above 27 | 27 | STP Estates Strategy Check-point - Summer 2019

5. STP/ICS Summary of 2019 Disposals Pipeline TBC 28 | 28 | STP Estates Strategy Check-point - Summer 2019

5. STP/ICS Summary of 2019 Disposals Pipeline 29 | 29 | STP Estates Strategy Check-point - Summer 2019

5. STP/ICS Summary of 2019 Disposals Pipeline TBC 30 | 30 | STP Estates Strategy Check-point - Summer 2019

5. STP/ICS Summary of 2019 Disposals Pipeline 31 | 31 | STP Estates Strategy Check-point - Summer 2019

5. STP/ICS Summary of 2019 Disposals Pipeline TBC TBC 32 | 32 | STP Estates Strategy Check-point - Summer 2019

5. STP/ICS Summary of 2019 Disposals Pipeline TBC TBC 33 | 33 | STP Estates Strategy Check-point - Summer 2019

5. STP/ICS Summary of 2019 Disposals Pipeline TBC 34 | 34 | STP Estates Strategy Check-point - Summer 2019

5. STP Summary Disposals comparator Number of sites Land Area (Ha) Estimate disposal value ( 000) Estimate Housing units 2018 Estate Strategy 49 48.50 49270 1207 2019 Estate Strategy 46 60.83 46869 1454 Variance -3 12.43 -2401 169 Variance (adjusted for footnote)* -1 14.96 1279 247 *2018 figure includes x2 sensitive sites that had a total of 78 Housing Units, a land area of 2.53 Ha and an Estimated disposal value of 3.68m STP Disposals Commentary Please explain the variances show in the table above Summary of sites sold or no longer applicable 11 sites were sold in the last year and 1 site was no longer declared surplus as there was a refined healthcare use. Summary of sites added 1 new site was added at Castle Hill, Cottingham for 400 house via the Local Development Framework Plan process. 35 | 35 | STP Estates Strategy Check-point - Summer 2019

5. STP Summary Disposals comparator 36 | 36 | Presentation title

5. STP Summary Disposals comparator 37 | 37 | Presentation title

6. Delivering Estate Efficiencies Table to be completed at an STP level (aggregation of all available Trust data subject to ERIC returns) Indicator 2018 2019 Progress against targets Forecast target position for 2020/2021 (17/18 prices) Estate Running Costs ( /m2) 281.75 /m2 263.43 /m2 - 18.32 /m2 247.62 /m2 172.94m pa 146.38m pa. - 26.56m pa 137.59m pa. Carter ( 244) Median 257.42 /m2 Median 256.77 /m2 Median - 0.65 /m2 Non-Clinical Space (%) 198,177m2 174,434 m2 -23,743 m2 (Carter target 35%) 32% 31% - 1.3% 29% Unoccupied Floor Space (%) 45,009m2 20,678m2 -24,331 m2 7.3% 3.7% - 3.6% 2.92% (Carter target 2.5%) Total Backlog maintenance ( ) 108m 127m + 18.9m NA Critical Infrastructure Risk (CIR) Backlog Maintenance ( ) 49m 64.97m + 16.2m 38.98m (CIR = High + Significant BLM) Details on the ERIC data fields used in the calculations are set out in Appendix 2 38 | 38 | STP Estates Strategy Check-point - Summer 2019

6. Delivering Estate Efficiencies The checkpoint values included in this submission vary compared to the HCV 2018 Estate Strategy for the following reasons: In the 2018 data we included the available Community Estate Data however in order to ensure a like for like comparison generated by the data from ERIC returns. we have now excluded the Community Estate Data. This now allows for direct comparison with the same field value to measure against the Carter running cost KPI per m2. In the 2018 data we excluded the Soft FM cost fields, e.g. laundry, porterage. To be consistent with the Model Hospital and the Carter KPI metric per m2 we have now included all these costs. The appendix to this document identifies the field s uses. In the checkpoint Progress to Date column we identify the variance of the 2017/18 ERIC returns in comparison to the 2016/17 ERIC returns to demonstrate progress. The values in brackets represent the 2016/17 ERIC return numbers. Details on the ERIC data fields used in the calculations are set out in Appendix 2 . 39 | 39 | STP Estates Strategy Check-point - Summer 2019

6. Delivering Estate Efficiencies (continued) Area of focus STP commentary The Partnership is developing its Long Term Plan and is refreshing its financial strategy as part of this process. Increasing efficiency is a key component of the financial strategy. In relation to estates, long term targets for rationalisation, improved utilisation and reduced running costs were included in the Partnership s Estates Strategy that was developed in 2018. These targets are being reviewed and revised using best practice guidance and benchmark data (eg Model Hospital metrics). The targeted reductions in revenue expenditure on estates will facilitate planned additional investment in key service areas (including out of hospital care and mental health) in accordance with the Partnership s clinical service strategies. STP s to describe how planned estates efficiencies will support reinvestment in frontline services and enable clinical service efficiencies. New CHP plants have been installed at 6 hospital sites across the HCV area. These investments are delivering both recurrent revenue savings and reductions in CO2 emissions that are enabling host Trusts to meet environmental targets. STP s to describe how capital investment will lead to recurrent / non-recurrent operational efficiencies (revenue cost savings). The CHP plant at Grimsby Hospital was installed as part of a 15 year Engineering Construction and Procurement contract with Centrica that has facilitated replacement of all internal and external lighting and installation of solar PV at Grimsby and Goole Hospitals. Hull University Teaching Hospital has developed a Trust wide Energy Scheme, in collaboration with Hull City Council, that includes replacement of boilers, installation of 2 new CHP plants, new lighting and improvements to chiller plant and BMS controls. This scheme will generate revenue savings of around 1.7m per year on a capital investment of 13.8m. The scheme is at FBC stage, fully designed and can progress immediately, subject to approval from NHSE/I. 40 | 40 | STP Estates Strategy Check-point - Summer 2019

6. Delivering Estate Efficiencies (continued) Area of focus STP commentary As stated above, significant investment has been made into services infrastructure on hospital sites across the HCV area to deliver improvements in energy efficiency and financial sustainability. Further investments of this type have been planned and will go ahead, subject to business case and capital financing limit approval being secured from NHSE/I. STP s to articulate how energy efficiency and environmental sustainability initiatives have been considered and are contributing to clinical and financial sustainability. Sustainable Development Management Plans have been drawn up at organisational level. These are currently being reviewed through the Local Strategic Estates Groups with a view to identifying opportunities for collaboration and further improvement. Provide examples where available Different models of financing and management are being used to facilitate implementation of plans and achievement of energy efficiency and environmental sustainability targets. These include establishment of subsidiary FM companies, collaborations with Local Authorities and partnerships with specialist commercial organisations, as referenced above. 41 | 41 | STP Estates Strategy Check-point - Summer 2019

7. STP Capital Projects Current Summary (June 2019) Basic Scheme Information Financials Total STP Capital Funding ( ,000) FBC Latest Expected Return Date Scheme Ref No. Date Lead Organisation Title of Scheme Scheme Description Completed New build 11 bed CAMHS inpatient unit, including 9 general beds and 2 PICU beds, to meet the needs of young people in the Humber Coast and Vale area STP6.1d Humber Teaching Foundation Trust CAMHS Tier 4 8,200 2018 Reconfiguration of facilities at 4 acute hospital sites (including accommodation, diagnostics equipment and enabling engineering infrastructure) to support transformation of urgent and emergency care service, enabling safer and more effective management of the acutely ill patient. Transformation of Urgent and Emergency Care Facilities Including Diagnostics Humber Coast and Vale Health and Care Partnership STP6.w4.1 September 2020 88,516 42 | 42 | STP Estates Strategy Check-point - Summer 2019

Appendices 43 | 43 | STP Estates Strategy Check-point - Summer 2019

Appendix 1 Estate Strategy Refresh Using Web and Database Technology The HCV Partnership has adopted an approach to the development of its Estates Strategy reports that seeks to maximise accuracy, consistency and resource efficiency. The agreed approach also creates the potential to monitor ongoing estate performance, at organisational level and across the Partnership, between strategy check points and strategy refreshes. The approach is based on 3 main elements: Developing a central data repository and continually maintaining and updating the data. Processes for collecting and refreshing data have been streamlined and digitally enabled to allow a greater focus on the quality and quantity of data. All reports and outputs are now being driven from the same consistent database; Automating the template report outputs, by drawing directly from the data to the calculations to the final table outputs. As a consequence, any changes to the base data automatically feed through into updated outputs; Generating management report dashboards to support the Partnership, enabling progress to be continually tracked at organisational, local and Partnership level. This has been achieved using web and database technology. The web technology automates the calculations and template outputs and is connected to the database technology that manages the data. To date the web app has been created to produce the Checkpoint tables, with initial work having been undertaken on the development of the management dashboards. The next phase is to complete the dashboards and to enable editing of the data within the app by users, including automating the ERIC return imports directly from the NHS digital website. Therefore, when future update checkpoints are required the data and templates will be up to date, ready for the inclusion of additional explanatory narrative and submission. The web application was developed for HCV by their partner, Shared Agenda. A version is also being used by the neighbouring STP/ICS of South Yorkshire Bassetlaw. HCV and Shared Agenda would be very happy to explore the further roll out and deployment of this very useful app across other STP and ICS areas. 44 | 44 | STP Estates Strategy Check-point - Summer 2019

Appendix 2 - Delivering Estate Efficiencies Calculation Methodology 2018 Estate Strategy Methodology The data used for the 2018 Estate Strategy was from a data collection from direct requests made to the Trusts, CCG's and direct collection of community estate data. For the Trust Estates the direct estate running costs were provided, but excluded laundry, porterage, food and other non direct estate costs that are included in the full Eric Site returns data. For the community estate we used the estate cost data from NHSE for reimbursement and the LIFT Estate running costs. The community estate data was missing lots of values, example the reimbursement cost data of a property were available, but not the floor area of the buildings. 2019 Checkpoint Methodology The running cost data is now directly comparable to the Carter running cost metric. The Carter metric relates only to hospital running costs not Community. We therefore dismissed the Community Estate data to provide a consistent data set for comparators where the data source was from purely ERIC Trust data returns. Now having access to the copies of the published 2016/17 and 2017/18 ERIC data sets. We requested the 2018/2019 ERIC return data from the Trusts, but they confirmed that the data is not validated ready for submission. Having realised the inconsistency of the dataset to the hospital model comparator metric in the 2018 Estate Strategy, we now rebuilt the baseline for the 2018 Estate Strategy using the 2016/2017 ERIC returns. Using the same full site costs from the ERIC data fields that are used for the Hospital model and full site costs: Estates and facilities finance costs ( ) Estates and property maintenance ( ) Grounds and gardens maintenance ( ) Electro Bio Medical Equipment maintenance cost ( ) Other Hard FM (Estates) costs ( ) Other Soft FM (Hotel Services) costs ( ) Energy costs (all energy supplies) ( ) Water cost ( ) Sewerage cost ( ) Landfill disposal cost ( ) Incineration disposal cost ( ) Waste recycling cost ( ) Other recovery cost ( ) Car parking services cost ( ) Cleaning service cost ( ) Inpatient food service cost ( ) Laundry and linen service cost ( ) Portering service cost ( ) 45 | 45 | STP Estates Strategy Check-point - Summer 2019

Appendix 2 - Delivering Estate Efficiencies Calculation Methodology The new realigned 2018 baseline position is show in column 2018 Baseline, generated from the 2016/17 ERIC return. The 2019 position was then produced from the 2017/18 ERIC return data using the same cost fields as above. calculated the relative Forecast target position for 2020/2021 (17/18 prices). Using the original 5 year target objectives for the STP in the 2018 Strategy i.e. 10% reductions and Zero Critical Infrastructure Risk Backlog , we then Finally the progress against target show the variance between the 2018 and 2019 positions. Conclusion The new methodology aligns to the hospital model KPI, ERIC full site cost and Carter running and cost metrics. Allowing the future ERIC data (when published) to be used to report progress in a consistent accurate way. Therefore providing a consistency between data reported in: STP Estate Strategies STP Estate Checkpoints Hospital Model Data ERIC return total site cost 46 | 46 | STP Estates Strategy Check-point - Summer 2019

Appendix 3 16.4m, completed Nov 18 & operational Jan 19 Business case built upon strong performance & recruitment gain Complete review & transformation of team, processes, policy & agreements Design & build of new web based booking, & management system 124 Apartments & 96 en-suite rooms Full I&E including utilities 15 Year payback, including recruitment gain May 2019 Average occupancy 89% 19/20 Income over-performing by c 20k pcm BMA, HYMS & Residents all reporting positive impact 47 | 47 | STP Estates Strategy Check-point - Summer 2019

Appendix 3 The new accommodation exceeded my expectations. It made my time in Grimsby very comfortable and made all the difference to a placement experience. I slept very well there- which I wasn t expecting to! The regular cleaning service meant there was one less thing to think about and providing cooking equipment saved me packing a car-full. Thank you! Essi Heaton, Year 3 Medical Student: The accommodation and service is the ideal environment to wind down and relax in after gruelling NHS shifts, This last year for me has been a home away from home Dr Tajinder Khera , Speciality Registrar Having stayed at the previous on-site accommodation, I can attest to the very positive impact that The Roost has made to me and my colleague s living standard. I no longer get woken up by other colleagues coming home from work late at night as the sound insulation in each room is excellent. Having proper furniture in the flat helps with my studying too! I am confident that The Roost will help to entice more healthcare staff to join Diana Princess of Wales Hospital in the future. Dr Yeow Wha Loh FY1 48 | 48 | STP Estates Strategy Check-point - Summer 2019

Appendix 4 Proposed and Potential Capital Investments (Number of schemes) Mental Health Primary & Community Locality Acute Total N and NE Lincolnshire 8 16 5 29 Hull and East Yorkshire 9 27 10 46 York and Scarborough 4 24 10 38 Total 21 67 25 113 49 | 49 | STP Estates Strategy Check-point - Summer 2019

Appendix 4 Proposed and Potential Capital Investments (Value of schemes) Mental Health Primary & Community Locality Acute Total N and NE Lincolnshire 1.63m 184.18m 2.72m 188.53m Hull and East Yorkshire 79.00m 276.40m 12.62m 368.02m York and Scarborough 31.10m 187.00m 8.01m 226.11m Total 111.73m 647.58m 23.35m 782.66m 50 | 50 | STP Estates Strategy Check-point - Summer 2019