IACC Legislative Review Highlights 2020 Session in Idaho

Explore key details from the 2020 IACC Legislative Review in Idaho, featuring updates on the Coronavirus Relief Fund allocations, house and senate bills, and initiated legislation affecting the state. Learn about impactful bills like House Bill 349 and House Bill 429, and the passage of House Bill 463 authorizing various court fees. Stay informed on important legislative changes and their implications for Idaho's legal framework.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

2020 IACC Legislative Review GoToWebinar Thursday, May 14, 2020

THANK YOU TO OUR CORPORATE PARTNERS:

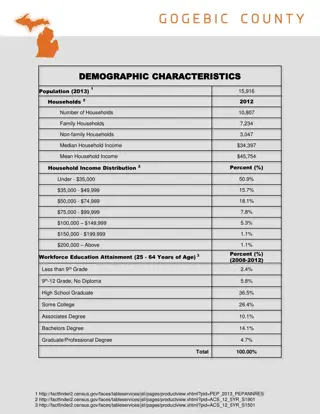

Initial Allocation Idaho CRF $1.25B Small Business Grants: $300M Tribes $633K Counties $44.2M Cities $42.4M SPTD $7.1M State Agencies $57.7M Unallocated $798M

Eligible Expenses US Treasury Guidance FAQs

House Bill 349 Would have removed the department as required from Section 32-403(2), Idaho Code, to rid statute of ambiguity regarding what additional proof of residency information county clerks may have been required to collect. ACLU had concerns with change being unconstitutional based on federal case law. No fiscal impact. Pulled by Governor s Office.

House Bill 429 Would have established a pilot program in which the Public Defense Commission would have administered public defender services in the Second Judicial District. No fiscal impact. Failed on House Floor 27-33-10

House Bill 463 Authorizes juvenile pretrial supervision program and collection of pretrial supervision fees. Authorizes collection of miscellaneous court fees (electronic monitoring, drug and alcohol testing, etc.). Allows for the collection of adult pretrial supervision fees for withheld judgements. There is no fiscal impact as counties are already collecting all associated fees. Law Effective: 07/01/2020

House Bill 583 Protects public employees that experience adverse action as a result of reporting waste and violations of a law, rule or regulation. Caps non-economic damages ($370,000 plus inflation). May result in positive fiscal impact because prior to this legislation, the Supreme Court held that no cap on damages for whistleblower claims existed. Law Effective: 07/01/2020

Senate Bill 1268 Requires all write in candidates to pay a filing fee at the time of filing unless they submit a petition in lieu of fees. Establishes that the write-in deadlines for all candidates is the eighth Friday prior to the election. Authorizes the Secretary of State s office to design ballots without a write in line. There is no fiscal impact. Law Effective: 07/01/2020

Senate Bill 1269 Requires all ballots be sealed and secured for 20 days after an election or until a requested recount has been completed. There is no fiscal impact. Law Effective: 03/08/2020

Senate Bill 1306 Removes the requirement for city elections to be held if all seats have either only one qualified candidate or one write-in candidate. There is a possibility of savings. Law Effective: 07/01/2020

Senate Bill 1339 Adds a clerk to the magistrate commission in each judicial district. Clerk on magistrate commission to be appointed by the ADJ. Allows for a temporary vacancy if an applicant is applying for a magistrate position in the clerk member s county or for the removal of any magistrate judge in the judicial district. There is no fiscal impact. Law Effective: 07/01/2020

State General Funds Legislature appropriated Medicaid expansion funding for state fiscal year 2021 (July 1, 2020 - June 30, 2021). No county contribution.

House Bill 600 Sponsor: Rep. Britt Raybould Counties would have funded 30% of Medicaid expansion from revenue sharing. Would have repealed county medically indigent program and suspended CAT program. IAC Position: Opposed Held in House Health and Welfare Committee.

House Bill 642 Sponsor: Rep. Fred Wood Counties would have forgone 17% of annual revenue sharing. No individual eligible for Medicaid or insurance would have qualified for county medically indigent program or CAT program. IAC Position: Opposed Passed House Health and Welfare Committee but was not taken up for vote by full House.

What to Expect in 2021 Medicaid expansion enrollment may increase in 2020 dues to COVID-19 public health crisis, increasing overall cost to state. Legislators will likely make another attempt to divert county revenue sharing to partially fund Medicaid expansion.

House Bill 354 Sponsor: Representative Steve Harris Requires counties and other taxing districts to reserve current year forgone property taxes for future use. Fiscal Impact: No immediate fiscal impact; however, failure to reserve current year forgone will result in loss of future budget/levy capacity. Law effective 07/01/2020

House Bill 562 Sponsor: Idaho Realtors Removes April deadline to apply for homeowners exemption. Applications may be made at any time during the year. Fiscal Impact: Exemptions granted after budgets/levies are set will result in loss of tax revenue. IAC Position: Opposed Law Effective: 01/01/2021

House Bill 409 Sponsor: Rep. Mike Moyle Would have established a 4% cap on property tax budget increases for up to three years. Failed Senate 11-24

Senate Bill 1277aaH Amendment Sponsor: Rep. Mike Moyle, Rep. Robert Anderst, Sen. Jim Rice Would have raised homeowners exemption to $112,000 and required local government to reduce budgets to prevent tax shift. Senate failed to concur in House amendments.

Senate Bill 1416 Sponsor: Sen. Steve Vick Would have raised the homeowners exemption to $120,000. Was not brought up for vote in Senate.

Senate Bill 1417 Sponsors: Sen. Kelly Anthon, Sen. Dave Lent, Sen. Grant Burgoyne Would have expanded eligibility for the property tax reduction program (PTR/circuit breaker) Passed Senate 31-1-3, House refused to hear the bill.

Property Tax Interim Committee Property tax interim committee to be appointed by Legislative Council on June 5, 2020. Committee will include 5 house members and 5 senators. Likely will include a nonvoting county member. Committee will evaluate Idaho s property tax system and make recommendations to full legislature in 2021. Committee likely will be extended for 2021 interim.

House Bill 319 Sponsor: State Appellate Public Defender s Office Amends Section 19-870, Idaho Code to give the SAPD the authority to represent indigent defendants in misdemeanor and juvenile appeals from the district court to the Idaho Court of Appeals and the Idaho Supreme Court. There could be a slight savings at the county level. IAC Position: Support Law Effective: 07/01/2020

House Bill 614 Sponsor: Representative Palmer Creates a new Distracted Driving law establishing that no person shall operate a motor vehicle while using mobile electronic devices. There are a few exceptions. No fiscal impact on counties. IAC Position: Neutral Law Effective: 07/01/2020

Senate Bill 1233 Sponsors: Sen. Patti Anne Lodge, Rep. Fred Wood & Rep. Steve Harris Revises provisions within the existing Sunshine Law by expanding those who may file a campaign finance report. Ensures that the candidate or political committee always has access to file a timely report should their respective treasurer be unavailable. No fiscal impact on counties. IAC Position: Neutral Law Retroactive to 01/01/2020

Senate Bill 1280 Sponsor: Phil McGrane, Ada County Clerk This bill is a follow-up to recent campaign finance reforms that took effect January 1, 2020 regarding the exemption of local government candidates from filing campaign finance reports unless and until the candidate receives contributions or expends funds in the amount of $500 or more. S1280 extends this exemption to include judicial candidates. IAC Position: Neutral No fiscal impact on counties. Law Retroactive to 03/09/2020