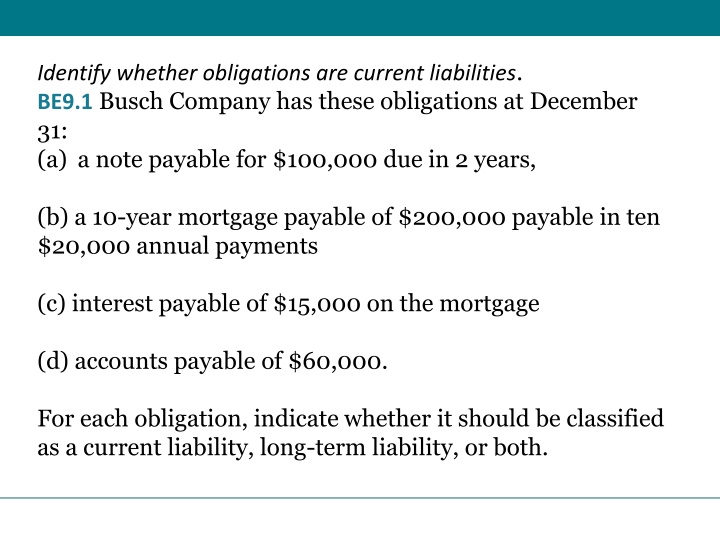

Identifying Current Liabilities - Busch Company Obligations

Busch Company's obligations at December 31 are analyzed to determine whether they should be classified as current liabilities, long-term liabilities, or both. The obligations include a note payable, mortgage payments, interest payable, and accounts payable.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Identify whether obligations are current liabilities. BE9.1 Busch Company has these obligations at December 31: (a) a note payable for $100,000 due in 2 years, (b) a 10-year mortgage payable of $200,000 payable in ten $20,000 annual payments (c) interest payable of $15,000 on the mortgage (d) accounts payable of $60,000. For each obligation, indicate whether it should be classified as a current liability, long-term liability, or both.

BE9.2 Hive Company borrows $90,000 on July 1 from the bank by signing a $90,000, 7%, 1-year note payable. Prepare a tabular summary to record (a)the proceeds of the note (b) accrued interest at December 31, assuming adjustments are made only at the end of the year.

BE9.3 Greenspan Supply does not segregate sales and sales taxes at the time of sale. The register total for March 16 is $10,388. All sales are subject to a 6% sales tax. Compute sales taxes payable and prepare a tabular summary to record sales taxes payable and sales.

BE9.8 Bridle Inc. issues $300,000, 10-year, 8% bonds at 98. Prepare a tabular summary to record the sale of these bonds on March 1, 2022.

BE9.9 Ravine Company issues $400,000, 20- year, 7% bonds at 101. Prepare a tabular summary to record the sale of these bonds on June 1, 2022.

BE9.10 Clooney Corporation issued 3,000 7%, 5- year, $1,000 bonds dated January 1, 2022, at face value. Interest is paid each January 1. Record the sale of these bonds on January 1, 2022. Adjust accounts on December 31, 2022, to record interest expense. Record interest paid on January 1, 2023.

BE9.14 On June 1, Forrest Inc. issues 3,000 shares of no-par common stock at a cash price of $7 per share. Prepare a tabular summary to record the issuance of the shares.

BE9.13 On May 10, Pilar Corporation issues 2,500 shares of $5 par value common stock for cash at $13 per share. Prepare a tabular summary to record the issuance of the stock.

BE9.15 Layes Inc. issues 8,000 shares of $100 par value preferred stock for cash at $106 per share. Prepare a tabular summary to record the issuance of the preferred stock.

E9.13 (LO 3), AP Sagan Co. had these transactions during the current period. Issued 80,000 shares of $1 par value common stock for cash of $300,000. Issued 3,000 shares of $100 par value preferred stock for cash at $106 per share. Purchased 2,000 shares of treasury stock for $9,000. June 12 July 11 Nov. 28

Basse Corporation has 7,000 shares of common stock outstanding. It declares a $1 per share cash dividend on November 1 to stockholders of record on December 1. The dividend is paid on December 31. Prepare a tabular summary to record the declaration and payment of the cash dividend. Assets Cash = Liabilities + Div. = Pay. +$7,000 $7,000 Stockholders' Equity Paid-in-Capital + Common + Stock 7,000 Retained Earnings - Exp. + - Rev. Div. $7,000 Nov. 1 Dec. 31