IL&FS Group Recovery Process Snapshot 2021

"Detailed overview of Infrastructure Leasing & Financial Services Limited's recovery process since 2018, outlining debts, challenges faced, estimated recovery amounts, and timelines for resolution. The new board aims for an overall recovery of around Rs. 61,000 Cr, with significant progress made through resolution and liquidation methods. Explore the complex structure, entity breakdown, and recovery milestones in this comprehensive report."

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Infrastructure Leasing & Financial Services Limited July 2021

Complex structure with debt exceeding Rs. 99,000 Cr in 347 entities Since taking over IL&FS Group on Oct 4, 2018, the New Board faced significant challenges - Complex corporate structure with 347 entities - 172 domestic, 175 foreign Rs. 99,000+ Cr debt with very high leverage (debt to equity of 17:1 as of Mar 18) Multiple business verticals, 4 layered structure, presence across 11 countries Significant intra-group exposure with risks not commensurate to revenue streams Multiple and diverse stakeholders Government Cos, State Govts, Indian/ Foreign private players IL&FS (CIC) Waste Mgmt. (IEISL) Maritime & Ports (IMICL) Real Estate (HCPL) Transport- ation (ITNL) Total: 347 Education (IETS) EPC (IECCL) Others Foreign: 175 5 entities 1 entity 14 entities 1 entity 203 entities 9 entities 9 entities Domestic: 172 Financial Services (IFIN & IIML) Energy (IEDCL) Project Devpt. Advisory Technology (TTL) Urban Infra. Water 35 entities 30 entities 17 entities 8 entities 8 entities 6 entities 1

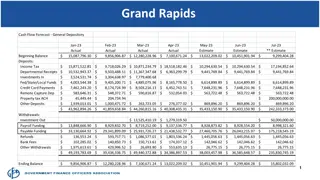

Estimated recovery under the resolution process New Board expects overall recovery of around Rs 61,000 Cr (61%) Recovery estimate includes recovery spanning both, resolution and liquidation Rs. 43,600 Cr. (44%) of total estimated recovery addressed as of 31 May 2021 Recovery from IBC cases has been 39 % through resolution and 3.5 % through liquidation(1) (1)Source: IBBI Mar 21 Quarterly Newsletter 2

A Break up of Rs. 43,600+ Cr as on 31 May 2021** Particulars Total (Rs. Cr) 99,355 Total External Debt O/s (8 Oct 18) A 29,030 Recovery basis resolution & cash Debt recovered from resolution 1 9,150 Available Cash Balance ** 15,284 2 Debt discharged (FB/NFB) 4,596 3 14,643 Net estimated recovery - applications filed with courts B Estimated recovery based on cash balances and NCLT/NCLAT filings 44% A B 43,673 ** Includes proceeds totalling Rs. 1,925 Cr. towards interim termination payment from Haryana Shehari Vikas Pradhikaran (HSVP) towards the IL&FS Gurgaon Metro project, under a Supreme Court Order. Proceeds received in June 2021 3

Snapshot of overall estimated recovery timelines # of Entities addressed Estimated Recovery (Rs. Cr) S No. Timeline Remarks Recovery basis debt resolved and cash balances - Rs. 29,000 Cr As on 31May 21* 211 43,600 1 Net estimated recovery based on court filings - Rs. 14,640 Cr Entity monetization Rs. 4,360 Cr Jun 21 Sep 21 23 7,700 2 InvIT Rs. 3,340 Cr Entity monetization Rs. 2,050 Cr InvIT Rs. 2,350 Cr Termination Rs. 1,200 Cr Real estate Rs. 1,100 Cr Oct 21 Mar 22 18 6,700 3 Incremental recovery value of Rs. 3,000 Cr in 89 entities 95** 3,000 Beyond Mar 22 4 ITPCL group (6 entities) - final resolution through sale. Value considered in 1 above Overall 347 61,000 * Includes proceeds from HSVP, received in June 2021 ** Includes ITPCL and 5 associates 4

89% estimated recovery at operating entities; 37% at IFIN, 28% at ILFS All amount in Rs. Cr Total External Debt as on Oct 18 Estimated recovery for External lenders Estimated recovery % for External Debt Entities Operating entities (SPVs/JVs etc.) 47,882 42,600 89% IEDCL, ITUAL, IMICL and IIPL 3,569 1,700 47% 12,747 5,200 ITNL 41% 16,032 6,000 IFIN 37% 19,125 5,500 ILFS 28% 99,355 61,000 Total 61% Recovery estimates above for Hold Cos is an outcome of revised distribution framework which has enabled higher upstreaming to Hold cos as compared to section 53 waterfall of IBC 5

Challenges being faced Impact of COVID - 19 Timelines for approvals from NCLT & NCLAT Non receipt of annuities amounting to Rs. 700+ Cr Complex transactions involving PSUs and state government as joint venture partners Non-receipt of NOCs from JV partners Non-receipt of approval from government authorities like NHAI Appeals filed by 20+ creditors with the Supreme Court against Resolution Framework Coercive creditor actions in contravention of court orders: Debits without authorization Refusal for meeting even going concern payments Refusal to create fixed deposits/interest-bearing instruments Pre-existing litigations and arbitrations in various entities by lenders, contractors and authorities 6

Way forward Significant portion (Rs. 50,000 Cr) of estimated recovery to be addressed by Sep 21 95% (Rs. 58,000 Cr) of estimated recovery by Mar 22 High number of residual entities with low recovery potential would still remain beyond Mar 22 Key considerations for resolution of residual companies Limited buyer universe Long drawn process for closure Time and costs to keep the IL&FS Group as a going concern for completing the resolution 7