Illusions and Patterns: A Study on Perception and Reality

This presentation delves into the intricate relationship between illusions and patterns, exploring how they shape our understanding of the world. Join Celestine, Walter, and Jun Yue as they uncover the fascinating dynamics of perception and reality, challenging conventional viewpoints and offering fresh insights into the nature of illusions and patterns.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Illusions of Patterns and Patterns of Illusion GROUP 1 Celestine Walter Jun Yue (Presenter)

OUTLINE Illusions human perception Causes Effects Randomness in the financial market Hot-hand fallacy Bill Miller Clash between human need to feel in control and ability to recognise randomness

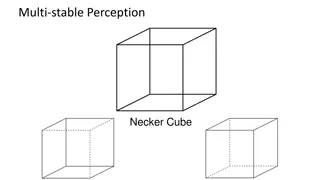

WHAT YOU SEE MAY NOT BE WHAT IT ACTUALLY IS Human perception can be understood as illusion, because it is a result of our imagination Insufficient or ambiguous data Imagination engaged, take shortcuts to fill gaps Weak conclusions drawn, judgements formed based on weak evidence Scientists: observations are good enough for making a conclusion Statistical analysis used to judge whether a collection of Everyday people: Heavy reliance on gut instinct

IT IS OUR INSTINCT TO SEARCH FOR AND SEEK EXPLANATIONSINPATTERNS We tend to make up patterns in long sequences, or among a collection of sequences of events Performance of stocks in financial markets is random, i.e. largely based on luck. Past market successes are not a reliable gauge for future success Hot-hand fallacy: False notion that a random streak is due to talent P(success|success) P(success|failure) Higher average success/failure rate, higher tendency to exhibit longer, more frequent streaks of success/failure

BILL MILLER TRUE TALENT? His funds in every fifteen-year streak out-performed the portfolio of equity securities that constitute the Standard & Poor s 500 Because of his achievements, he is acclaimed as the Greatest Money Manager of the 1990s, Fund Manger of the Decade, and one of the top thirty most influential people in investing for 5 years Randomness, not talent, is more likely to be an explanation to Miller s ability to maintain a fifteen-year streak in stocks Miller s win is compared with his weighted average of the stock prices, and not with the S&P s average. Has his own calendar year, so the streaks he achieved was unnatural, and favoured towards him by chance

FIGURES SUGGESTED FOR THE ODDS OF MATCHING MILLER SPERFORMANCEPURELYBYCHANCE Suggested estimates for the probability of a fund beating the market for twelve-consecutive years: 1 in 4096, 1 in 477000, 1 in 2.2 billion Actual chance: 3 out of 4 Chances of a particular person out-performing the market for a specific twelve- consecutive year period by chance are the three estimates Actual probability for someone in some twelve-consecutive year period will be 3 out of 4 The number of people involved in the second calculation is higher. Anyone in this larger group can too achieve a streak, hence greater probability

FUNDAMENTAL CLASH BETWEEN HUMAN NEED ANDABILITYTORECOGNISERANDOMNESS Events are random, we are not in control. We are in control, events are not random. Humans are more occupied with the outcomes and our ability to influence them. Exercise awareness of illusion of control can help to overcome them Confirmation bias: Tendency to prove our ideas right instead of seeking reasons to prove them wrong As a result of confirmation bias, we selectively focus on evidence that tends to confirm our hypothesis, or intentionally misinterpret ambiguous evidence in favour of our ideas

TAKE HOME MESSAGES Question our own perceptions and theories Spend the same amount of time looking for evidence to prove we are right and to prove we are wrong Understand how randomness operates allows us to draw conclusions depending on circumstances wisely