Impact of ALSM Draft Regulations 2015 on Capital Requirements

This content discusses the ALSM Draft Regulations 2015 and their impact on capital requirements in the insurance industry. It covers key areas such as asset valuation, liability valuation, consultative processes for amendments, changes in asset valuation practices, and the treatment of different forms of capital in determining solvency margins. The content emphasizes the need for insurers to comply with the regulations for financial reporting and capital adequacy.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

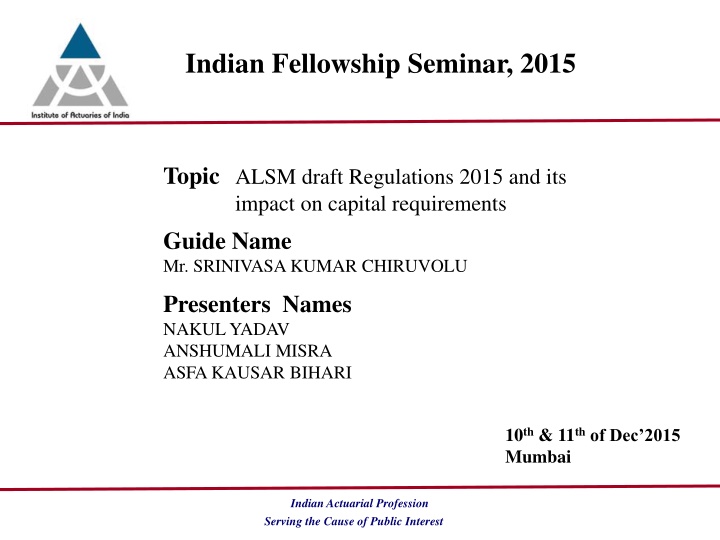

Indian Fellowship Seminar, 2015 Topic ALSM draft Regulations 2015 and its impact on capital requirements Guide Name Mr. SRINIVASA KUMAR CHIRUVOLU Presenters Names NAKUL YADAV ANSHUMALI MISRA ASFA KAUSAR BIHARI 10th & 11thof Dec 2015 Mumbai Indian Actuarial Profession Serving the Cause of Public Interest

Review of ALSM Regulations Key Areas under ALSM Regulations ALSM Regulations Determination of Solvency Margin Asset Valuation Liability Valuation www.actuariesindia.org 2

Consultative Process of ammedment Background reports and consultations Committee Report on ALSM with proposed changes Comments from the Industry on the proposals Working Committee constituted by IRDAI Comments on ALSM 2015 Regulation - Exposure Draft Revised ALSM 2015 Regulations Exposure Draft on ALSM Regulations Future course of action till implementation Focus of discussion www.actuariesindia.org 3

Asset valuation changes Sr. No. 1 Changes to the asset valuation ALSM 2015, exposure draft The specific requirement of depreciation of computer hardware and software has been excluded. Intangible assets and receivable of unrealizable nature to be taken as inadmissible assets. Service Tax Unutilized Credit disallowed Impact on Capital Requirement May change based on current practice. Should not materially impact solvency margin. No impact. Already incorporated in Preparation of financial statements and Section 64VB in the Insurance Act Reduced ASM for companies who are currently utilizing the credit. The asset is not realizable and hence disallowed No impact on solvency 2 3 4 All other assets of an insurer have to be valued in accordance with the IRDAI (Preparation of Financial Statements and Auditor s Report of Insurance Companies) Regulations, 2015 www.actuariesindia.org 4

Asset valuation changes Other forms of capital Preference Share Capital Subordinated Debt Amortization of the instruments for solvency Impact on ASM Value net of hair cut Years to Maturity > 5 years 4-5 years 3 4 years 2 3 years 1 2 years < 1 year Included in capital 100% 80% 60% 40% 20% 0% www.actuariesindia.org 5

Asset valuation Unchanged principles Sr. No. 1 Key assets and their valuation principle Debt securities including government bonds shall be Held to maturity Debt securities valued at amortized book value 2 3 Equity securities to be valued at fair value on the balance sheet 4 Real Estate at historical cost subject to revaluation at least once in three years Unlisted and other than actively traded equity securities and derivative instruments to be measured at historical cost 5 No material changes proposed in asset valuation based on the exposure draft for Preparation of Financial statements 2015 www.actuariesindia.org 6

Liability valuation method changes Explicit allowance for Cost of Guarantee in addition to Cost of Options Impact on Mathematical Reserves Expected to increase Mathematical Reserves where companies are not holding this reserve Extent of increase depends on the nature and materiality of Guarantees in the portfolio and how much is allowed for today In case companies are not accounting for it completely Increase in RSM Reduction in ASM It is expected that companies will be holding Cost of Guarantee as per GN22 Impact on Capital Additional Comments www.actuariesindia.org 7

Liability valuation method changes Use of Higher of (Special Surrender Value, Guaranteed Surrender Value) for the purpose of section 13,49, 64V and 64VA of the Act Impact on Mathematical Reserves Expected to increase as special surrender value is expected to be higher than guaranteed surrender value The impact is expected to be insignificant for most companies are already valuing using this approach Impact on Capital If SSV is not accounted for it will lead to Increase in RSM Reduction in ASM Additional Comments Change already incorporated as floor of Surrender Value Payable on GPV in ARA Circular 2011 www.actuariesindia.org 8

Liability valuation method changes Use of GPV except: Explicit approach for one year renewable group term Higher of Gross Premium Valuation Reserve and Unexpired Premium Reserve for Riders Explanation One year renewable term Allow for unexpired risk, premium deficiency and incurred but not reported claims Applies to riders attached to group The rule for ensuring the higher of (GPV, Other approach as per AA) not applicable Impact on Mathematical Reserves companies Impact on Capital Depends on the approach used earlier and may impact RSM & ASM Similar methodologies may be followed today Not expected to be material for majority of www.actuariesindia.org 9

Liability valuation method changes For ULIPs additionally account for :- Non-negative residual additions, if any Zeroisation of negative cash-flows Explanation Requirement necessitated by new ULIP RIY requirement Impact on Mathematical Reserves Expected to increase reserve if it is not allowed for appropriately today, and Can be material depending on the product structure and mix of business Impact on Capital In the above scenario Increase in RSM Reduction in ASM www.actuariesindia.org 10

Liability valuation method changes Variable Linked & Non-Linked Business (Par and Non-Par) Policy account reserves and general fund reserves Explanation Same approach as that for ULIP With policy account equivalent to unit liabilities General fund reserves shall be determined using discounted cash flow method Including the requirement of non-negative addition The product structure may have some form of guarantees For Par VIP allowance for future regular and terminal bonuses and for taxes Impact on Mathematical Reserves Otherwise structurally same as specified in product regulation Impact on Capital Will impact RSM & ASM Depends on the changes required, specifically with respect to inclusion of the guarantees Depending on the changes www.actuariesindia.org 11

Liability valuation assumption changes Use of actual expense experience Explanation Provided that appropriate additional provisions shall be made if the actual experience has not been considered for the valuation. Impact on Mathematical Reserves Depends on the extent of actual expenses not recognized currently Expected to increase Can be material for companies with high renewal expense overrun In case actual expense experience is not used Increase in RSM reduction in ASM Impact on Capital www.actuariesindia.org 12

Liability valuation assumption changes Use of lapse rate Explanation Should be based on prudent assumption Based on past experience of the product or similar products Shall have regard to the expected future experience Should allow companies to reduce prudence in reserve If currently using perfect persistency and that it is more onerous Otherwise the impact is dependent on the product structure and nature of current assumption Depends on the actual scenario for company Change in RSM & ASM Will change Capital Requirement & Solvency Ratio The APS 7 prescribes the approach to the level of prudence Impact on Mathematical Reserves Impact on Capital Additional Comments www.actuariesindia.org 13

Liability valuation other changes Business Outside India Explanation Comparison of liability norms with that followed in India If the norms (method and assumptions) lead to lower liability then set additional reserves Will increase Mathematical Reserves depending on Extent of foreign operations Difference in norms Depends on the actual scenario for company Change in RSM & ASM Impact on Mathematical Reserves Impact on Capital Additional Comments Can lead to significant justification depending on Nature of products offered Difference in market conditions economic and non- economic www.actuariesindia.org 14

Liability valuation other changes Statement Added In case reinsurance cash-flows have been allowed in reserves, the valuation basis and methods shall be as per this schedule. Statement Removed Statements pertaining to resilience test reserve or mismatch reserves www.actuariesindia.org 15

Changes to solvency requirement Category of change Changes in exposure draft Minimum solvency requirement Higher of:- 100 % of RSM, Or INR 50 crore (i.e. 50% of minimum capital as per Section 6 of the insurance Act) Introduced Control Level of solvency margin 150 % of RSM Control Level of solvency margin Business outside India Same as that for business written within India Solvency Factors as proposed in the ARA 2015 Regulations exposure draft More clarity added for the Health riders Might impact the capital requirement

Controls around solvency monitoring Regulatory & Company Intervention Greater than 150% No action required from the regulator Action as per Sub-section (3) of Section 64VA of the Act Early stage intervention by IRDAI If it is due to unfavourable claim experience, sharp increase in volume of new business, then IRDA may direct modifications The Company shall submit a remedial plan within 6 months. Considered default if no action taken by the insurer Solvency Ratio Less than 150% but greater than Minimum requirement Action as per Sub-section (2) of Section 64VA of the Act Company deemed as insolvent and may wound up by court on an application by IRDA Less Than 50 crore or 100% of RSM

Thank you!! www.actuariesindia.org 18