Impact of Bank Shocks on Firm-Level Outcomes and Risk-Taking

Explore the effects of bank supply shocks on firm performance and bank risk-taking behaviors, with insights on identification challenges and research findings from the 12th Young Economists Seminar in Dubrovnik. Discover how bank-loan supply shocks impact growth, investment, and risk mitigation in both crisis and non-crisis periods.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

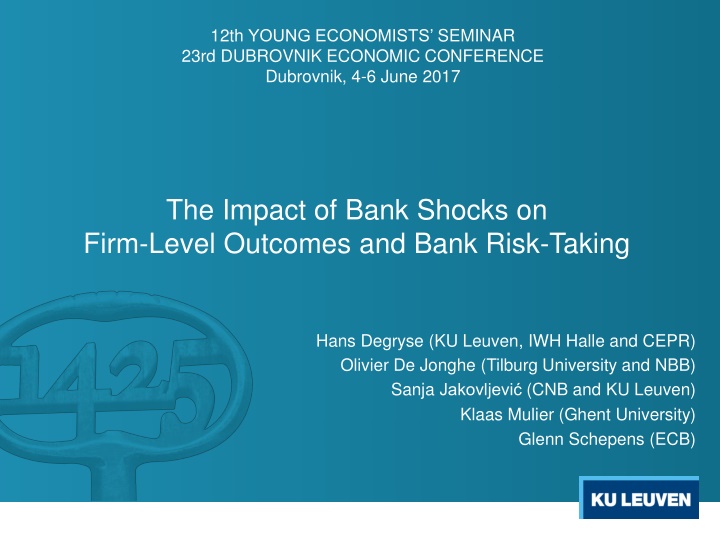

12th YOUNG ECONOMISTS SEMINAR 23rd DUBROVNIK ECONOMIC CONFERENCE Dubrovnik, 4-6 June 2017 The Impact of Bank Shocks on Firm-Level Outcomes and Bank Risk-Taking Hans Degryse (KU Leuven, IWH Halle and CEPR) Olivier De Jonghe (Tilburg University and NBB) Sanja Jakovljevi (CNB and KU Leuven) Klaas Mulier (Ghent University) Glenn Schepens (ECB)

Motivation Finance is an important driver of economic growth. E.g., King and Levine (1993), Guiso, Sapienza and Zingales (2004), Beck, Demirg -Kunt, Laeven and Levine (2008), Rajan and Zingales (1998). Banks are important providers of external finance to firms in general and SMEs in particular. Bank-loan supply shocks may hamper the availability of credit and impact the real economy. Main identification challenge: separating the firm-borrowing and the bank- lending channels. E.g., literature in the area of monetary policy; banking; corporate finance. 1/22

Motivation (2) Research questions and main findings 1. Can the identification of bank supply shocks be adjusted to include the many single-relationship firms? Does it matter? It can, and it does: the ranking of banks according to the magnitude of the shock varies, and the real impact of the recent financial crisis is better captured. 2. Are bank-loan supply shocks only relevant in crisis periods? The dispersion of bank supply shock estimates is also high in non-crisis periods. 3. Do bank-loan supply shocks impact firm performance and bank risk-taking? Negative bank supply shocks result in lower growth and investment of firms, and in risk-mitigating behavior by banks (and vice versa). 2/22

Identification of firm-borrowing and bank-lending channels Two methodological choices may limit the generality of conclusions on the impacts of bank shocks: 1. Identification based on exogenous shocks to loan supply o drops in asset prices and real estate exposures of banks (Gan, 2007) o nuclear tests and the collapse of the dollar deposit market (Khwaja and Mian, 2008) ???? ???? 1 ???? 1 ????= ??+ ? ??+ ??? Does not say much on the behaviour of credit supply over prolonged periods of time. 3/22

Identification of firm-borrowing and bank-lending channels (2) Two methodological choices may limit the generality of conclusions on the impacts of bank shocks: 2. Direct identification of loan supply shocks, on a sample of firms borrowing from multiple banks ???? ???? 1 ???? 1 ????= ???+ ???+ ???? Unusable in samples with plentiful single-bank firms. (Ongena and Smith, 2000; Degryse, Kim and Ongena, 2009) Single-bank and multiple-bank firms might not be similar. 4/22

Our methodology We address the methodological challenges by 1. Developing an indicator of bank-loan supply shocks which captures their cross-sectional variation, over an extended time period 2. Including firms borrowing from just one bank 3. Considering the weighting structure suggested by Amiti and Weinstein (2016) Adding-up constraints: a bank cannot lend more without at least one firm borrowing more and vice versa Amiti and Weinstein (2016) suggest to use weighted least squares 5/22

Our methodology (2) We provide an alternative demand control which encompasses the vast majority of firms. Firm-time fixed effects are replaced by industry-location-size-time fixed effects (2-digit NACE codes; 2-digit postal codes; deciles by total assets) ????= ???+ ???+ ???? ????= ?????+ ???+ ???? ?1?= ?2?= = ???,(1..?) ??? 6/22

Our data We use the following datasets of the NBB: o Monthly bank-firm information on authorized credit to firms incorporated in Belgium (reporting threshold: 25,000 EUR) o Annual accounts of Belgian firms o Monthly bank balance sheet information Time coverage: 2002m1 2012m3 Estimation sample: around 17 mil. bank-firm time observations 7/22

Our data (2) How relevant are firms borrowing from just one bank? Figure 1. The number of firm borrowing relationships and their share in total loan volume 8/22

Our data (3) Are single-bank and multiple-bank firms similar? Table 1. Characteristics of single-bank and multiple-bank firms Firm-bank-month observations T-stat (p-value) of difference in means Mean Firms Age (in years) Single-bank firms Multiple-bank firms 12.70 24.01 9,705,534 1,367,672 183,885 5,752 166.36 (0.000) Total assets (in mil. EUR) Single-bank firms Multiple-bank firms 1.74 29.44 9,705,534 1,367,672 183,885 5,752 10.98 (0.000) Number of employees, FTE Single-bank firms Multiple-bank firms 4.17 57.67 9,705,534 1,367,672 183,885 5,752 18.30 (0.000) Fixed assets/total assets Single-bank firms Multiple-bank firms 0.52 0.36 9,705,534 1,367,672 183,885 5,752 -132.69 (0.000) Loan size (in mil. EUR) Single-bank firms Multiple-bank firms 0.30 1.33 9,705,534 1,367,672 183,885 5,752 32.77 (0.000) Multiple-bank firms are on average older, larger, have lower investment ratios and borrow larger credit amounts. 9/22

Our data (4) What do we gain by considering the ILS grouping? Figure 2. The number of ILS borrowing relationships and their share in total loan volume 10/22

Our data (5) What do we gain by considering the ILS grouping? Figure 3. The average credit growth rate 11/22

Estimation and verification of bank-loan supply shocks: multiple-bank firm sample Within the multiple-bank firm sample, we estimate the following set of equations: ?+ ????, ????= ???+ ??? ? = ,?,??,???,???,???,???,? Demand controls: location, industry, age, current assets, risk (interest coverage ratio; debt; Altman Z), size. 12/22

Estimation and verification of bank-loan supply shocks: multiple-bank firm sample (2) We then compare the bank shocks from various demand specifications with the standard bank shocks: ??? ?= ? ??? ?+ ??+ ???, ? = ,?,??,???,???,???,???,? Table 2. Multiple-bank firm sample: comparison of credit demand controls ? ?? ? ?? ? ?? ? ?? ? ?? ? ?? ? ?? ? ?? ? ?? ? ?? ? ?? ? 1.001*** 0.998*** 1.009*** 1.048*** 1.023*** 0.993*** 1.039*** 1.046*** 1.022*** 1.066*** p-value coef.=1 0.983 0.951 0.671 0.068 0.210 0.680 0.083 0.085 0.124 0.135 Adjusted R 0.725 0.729 0.769 0.765 0.758 0.742 0.784 0.735 0.791 0.837 Spearman's r.c.c. 0.747 0.750 0.789 0.788 0.798 0.783 0.799 0.793 0.813 0.851 ILS provides the best fit; The model performs equally well during crisis periods. 13/22

Estimation and verification of bank-loan supply shocks: multiple-bank ILS sample As we extend the sample towards multiple-bank ILS groups, our bank shock estimates are departing from the standard bank shocks. Table 3. Multiple-bank firm setup vs. multiple-bank ILS setup 0.752*** 0.576*** p-value coef.=1 2.66e-10 1.34e-09 Adjusted R 0.787 0.632 Spearman's r.c.c. 0.778 0.669 The ranking of banks based on the size of the shocks depends on the sample used. We can meaningfully relate our bank shock estimates to: o Tightening of lending standards (Bank Lending Survey) o Growth in interbank liabilities 14/22

Variation of bank-loan supply shocks Fluctuation of bank shocks might be high also in non-crisis periods! Figure 4. Dispersion of estimated bank shocks (p75-p25) 15/22

How (in)efficient are Khwaja and Mian (2008) estimates in our sample? Not so much: suggestive of limited lending asymmetry. Figure 5. The actual and predicted bank credit growth rates using KM(2008) 16/22

Application of bank-loan supply shocks We analyse how bank-loan shocks relate to 1. Firm-level outcomes Growth (growth in total assets) Investment (growth in fixed assets) Employment (growth in number of FTE employees) (??, ?)+ ??+ ??+ ??? ????? 1 ??? 1 ???= ? 17/22

Firm-level outcomes Table 4. Bank credit supply estimates and firm-level outcomes Khwaja and Mian (2008) approach Amiti and Weinstein (2016) approach Growth Investment Employment Growth Investment Employment Multiple-bank ILS sample ILST shock 0.0327** (0.0128) 0.0367*** (0.0101) 0.0941** (0.0395) 0.122*** (0.0311) -0.0209 (0.0240) -0.0138 (0.0187) 0.0973*** (0.0132) 0.0456*** (0.00757) 0.179*** (0.0408) 0.0820*** (0.0234) 0.0429* (0.0245) 0.0357*** (0.0136) FT shock Multiple-bank firm sample ILST shock 0.0287 (0.0240) -0.00316 (0.0215) 0.0830 (0.0662) 0.00983 (0.0592) 0.0139 (0.0348) 0.0147 (0.0312) 0.105*** (0.0223) 0.0434** (0.0171) 0.137** (0.0614) 0.0420 (0.0473) 0.103*** (0.0320) 0.0775*** (0.0243) FT shock The weighting structure matters. In the multiple-bank ILS sample, both methodologies work well in identifying shocks to growth and investment, albeit of somewhat differing economic magnitudes. 18/22

Firm-level outcomes (2) Table 5. Bank credit supply estimates, firm growth and investment Khwaja and Mian (2008) approach Amiti and Weinstein (2016) approach Growth Investment Growth Investment ILST shock 0.0327** (0.0128) 0.0273** (0.0129) 0.112*** (0.0382) 0.0941** (0.0395) 0.0862** (0.0399) 0.165 (0.118) 0.0973*** (0.0132) 0.0788*** (0.0135) 0.263*** (0.0414) 0.179*** (0.0408) 0.147*** (0.0418) 0.459*** (0.128) ILST shock * Crisis FT shock 0.0367*** (0.0101) 0.0383*** (0.0103) -0.0233 (0.0295) 0.122*** (0.0311) 0.129*** (0.0318) -0.0932 (0.0910) 0.0456*** (0.00757) 0.0468*** (0.00783) -0.0143 (0.0235) 0.0820*** (0.0234) 0.0853*** (0.0242) -0.0395 (0.0725) FT shock * Crisis When the crisis effects are considered in the multiple-bank ILS sample, our methodology captures them better than the standard one. Same conclusion holds for smaller and more indebted firms. 19/22

Application of bank-loan supply shocks (2) We analyse how bank-loan shocks relate to 2. Bank risk-taking (at the extensive margin) Portfolio-weighted average of firm-level Altman Z score Loan share ??? ??? 1 ??? = ? ??? 1 (??, ?)+ ??+ ??+ ??? ??? (??, ?)+ ??+ ??+ ??? = ? ??? 1 ???/ ??? 1 ??? ??? 20/22

Bank risk-taking Table 6. Bank-loan supply estimates and bank risk-taking Khwaja and Mian (2008) approach Amiti and Weinstein (2016) approach 2002m1 - 2008m9 2008m10 - 2012m3 2002m1 - 2008m9 2008m10 - 2012m3 Full period Full period Entries Altman Z score -0.00140** (0.000614) -0.00109* (0.000659) -0.00394** (0.00155) -0.00323*** (0.000775) -0.00291*** (0.000797) -0.00340* (0.00186) Share 0.456*** (0.0571) 0.514*** (0.0662) 0.0903** (0.0414) 0.281*** (0.0370) 0.320*** (0.0420) 0.0137 (0.0317) Exits Altman Z score -0.00287*** (0.000855) -0.00298*** (0.000953) -0.00278** (0.00136) -0.00560*** (0.00128) -0.00622*** (0.00143) -0.000419 (0.00161) Share -0.308*** (0.0596) -0.133*** (0.0391) -1.656*** (0.535) -0.334*** (0.0574) -0.194*** (0.0490) -1.327*** (0.401) New firms in the portfolio more risky and are taken on faster; riskier firms also dropped from the portfolio, but more slowly: risk-taking behaviour by banks with more positive supply shocks. 21/22

Conclusion We develop a methodology to identify bank supply shocks in the presence of a multitude of single-borrowing firms. Firms borrowing from lenders with a more negative bank-loan supply shock have lower growth, investment and (to some extent) employment rates, and vice versa. Banks with more positive supply shocks take on more risk, and vice versa. 22/22

![GET [✔PDF✔] DOWNLOAD✔ The Ultimate Burger: Plus DIY Condiments, Sides, and](/thumb/68033/get-pdf-download-the-ultimate-burger-plus-diy-condiments-sides-and.jpg)