Impact of Economic Cycles on South African Property Market Trends

Explore the fluctuating trends in the South African property market through the lens of economic cycles, geopolitics, and demographic shifts. From real office and industrial rents to nominal house prices and capitalization rates, delve into the dynamics shaping the property landscape in South Africa.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

The property market in South Africa: the impact of economic cycles, geopolitics and demographic shifts Presentation delivered at the AVC on 1 April 2025 at Sandton Erwin Rode

Real office rents Johannesburg (19602024) Downswing phases of business cycle are hatched Office property cycle: Real Johannesburg office rentals 140 Nominal rentals deflated by BER BCI 120 100 Real rental indices (2000 = 100) 80 60 40 60 Source of data: Rode Publications & Media; BER 65 70 75 80 85 90 95 00 05 10 15 20

Real industrial rents Johannesburg (19752024) Downswing phases of business cycle are hatched Industrial property cycle: real Central Witwatersrand rentals 180 Nominal rentals deflated by BER BCI 160 140 Real rental indices (2000 = 100) 120 100 80 60 75 80 85 90 95 00 05 10 15 20 Source of data: Rode Publications & Media; BER

Nominal house prices vs the prime rate South Africa (1966 2024) Downswing phases of business cycle are hatched Change in national house prices vs The prime rate 24 20 Change in nominal house prices (%) 16 Prime rate (%) 12 40 Change in nominal house prices Prime rate 8 30 4 20 10 0 -10 70 75 80 85 90 95 00 05 10 15 20 Source of data: Absa; FNB

Real house prices South Africa (19662024) Downswing phases of business cycle are hatched Residential property cycle 160 150 Nominal house prices deflated by BER BCI 140 Real house price indices 130 (2000 = 100) 120 110 100 90 80 70 75 80 85 90 95 00 05 10 15 20 Source of data: ABSA; FNB; BER

Capitalisation rates for grade-A office buildings, regional malls and industrial leasebacks (1989 to 2004) Downswing phases of business cycle are hatched National capitalisation rates 14 Regional shopping centres Decentralised office Industrial leasebacks 13 12 Capitalisation rate (%) 11 10 9 8 7 90 92 94 96 98 00 02 04 06 08 10 12 14 16 18 20 22 24 Source of data: Rode Publications & Media

Real total returns of institutional properties year by year (1962 to 2024) Downswing phases of business cycle are hatched Real total returns on directly held property 28 24 Nominal total returns deflated by CPI 20 16 12 Total return (%) 8 4 0 -4 -8 -12 65 70 75 80 85 90 95 00 05 10 15 20 Source of data: Rode Publications & Media (1962-1994) and MSCI (1995-2023)

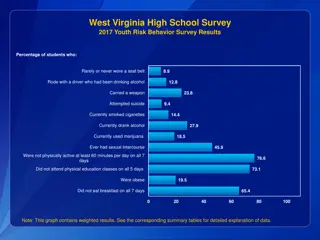

Total property returns in SA by supercycle Table 10.1 Historical property performance of standing portfolios, assuming directly held, even if listed 62-77 (16 yrs) 77-96 (20 yrs) 96-23 (28 yrs) Mean nominal total return % 9,5 17,0 12,6 SD of mean* return 2,4 5,5 6,9 Mean CPI 4,6 12,7 5,4 Real total return Geometric mean *Arithmetic mean This cycle may still be incomplete (the eventual trough may be lower than the current level). From Johannesburg office rentals we know the cycle started in 1960; thus, the cycle s length should be 18 years. Source of data: Rode Publications & Media (1962-1994) and MSCI (1995-2023) 4,9 4,3 7,2

Geopolitics Africa = commodity exporter Pros and cons of global war for Africa and S.A. Evidence from two world wars is ambiguous On balance: (world) wars are not good for wealth creation South Africa s anti-American stance cannot be beneficial

Demographic shifts Population growth = more mouths to feed But: Higher unemployment puts strain on fiscus Thus: the benefit of population growth depends on employability E.g. the 1960s baby-boomers in the West, incl. SA Semigration to Western Cape is a plus for its economy

Summary The RE supercycle in S.A. will continue its downswing House prices are affected by the business cycle (and interest rates) The office rents are rarely affected by the business cycle (long cycle) Industrial properties rents are often affected by the business cycle Capitalization rates are rarely affected by the business cycle Real total returns of RE funds will continue to be below par this year As a rule of thumb, the LT total return on RE is about 4 5% p.a. The WC RE trough will be shallower than in the rest of S.A. A global war would probably not benefit Africa.