Implications for Fiscal Transparency Standards and Code Revision

Explore the weaknesses in current fiscal transparency standards and the recommended changes to enhance fiscal reporting practices. Discover the objectives of the Fiscal Transparency Code 2014 and the architectural framework proposed for improved practices in fiscal reporting.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

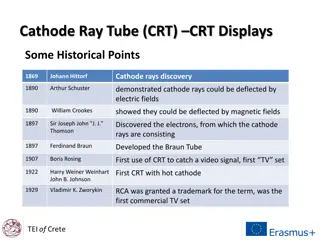

I. Lessons from the crisis Implications for Fiscal Transparency Standards Recommendation Weakness in Current Standards Problem Monthly operational fiscal reports Infrequent fiscal reporting Revisions to Deficits Publication of fiscal data for public sector Exclusive focus on general government Quasi-fiscal Activity by SoEs Recognition of doubtful debts in summary aggregates Losses on asset & liability holdings not recognized Unreported Flows Alternative macro- fiscal scenario analysis Bias in Macroeconomic Shocks macroeconomic forecasting Recognition of quantifiable contingent liabilities Exposure to Financial Sector No recognition of contingent liabilities

II. Fiscal Transparency Code 2014 Objectives of the Revised Code 1. Comprehensive consultation of code and piloting the new framework 2. Emphasize the quality and reliability of published information rather than clarity of reporting procedures 3. Update the principles and practices to reflect the lessons of the recent crisis 4. Align the principles and practices with relevant international standards (GFSM 2001, IPSAS, OECD Principles, PEFA) 5. Provide countries with a set of achievable milestones on the way towards full compliance with international standards 3

III. Fiscal Transparency Code Architecture of the New Code 4

III. Fiscal Transparency Code More Graduated Set of Practices PRACTICES GOOD # DIMENSION PRINCIPLE BASIC ADVANCED FISCAL REPORTING Fiscal reports should provide a comprehensive, relevant, timely, and reliable overview of the government s financial position and performance 1 Fiscal reports should provide a comprehensive overview of the fiscal activities of the public sector 1.1 Coverage Fiscal reports cover all entities engaged in public activity that are delineated according to international standards. Fiscal reports consolidate all central government entities. Fiscal reports consolidate all general government entities. Coverage of Institutions Fiscal reports consolidate all public sector entities. 1.1.1 Fiscal reports cover cash flows and all accrued revenues and expenditures and other economic flows. Fiscal reports cover all government revenues, expenditures, and financing. Fiscal reports cover cash flows and all accrued revenues and expenditures. Fiscal reports cover all cash revenues and expenditures. Coverage of Flows 1.1.2 Fiscal reports include a balance sheet of government assets, liabilities, and net worth. Fiscal reports cover all financial and non-financial assets and liabilities, and net worth. Fiscal reports cover all financial assets and liabilities. Coverage of Stocks Fiscal reports cover cash and all debt 1.1.3 5

IV. New Fiscal Transparency Evaluation: a. Summary Heatmap Costa Rica: Assessment Against Fiscal Transparency Practices 2. Fiscal Forecasting & Budgets 3. Fiscal Risk Analysis & Management 1. Fiscal Reporting Coverage of Institutions Unity Macroeconomic Risks Practices Advanced Good Basic Not Met Coverage of Flows Gross Budgeting Specific Fiscal Risks Coverage of Stocks Macroeconomic Forecasts Contingency Reserves Medium-term Budget Framework Asset and Liability Management Tax Expenditures Frequency of In-year Fiscal Reports Timeliness of Annual Financial Statements Fiscal Strategy Report Guarantees Budget Submission Financial Sector Exposure Classification Budget Approval Long-Term Contracts Internal Consistency Fiscal Policy Objectives Financial Derivatives Separation of Existing and New Policies Historical Consistency Sub-National Governments Comparability of Forecasts & Outturns Performance Information Public Corporations Statistical Independence Distributional Analysis External Audit Fiscal Sustainability Analysis Reliability Independent Evaluation Supplementary Budget Forecast Reconciliation 6

III. New Fiscal Transparency Evaluation: b. Fiscal Transparency Indicators: Fiscal Reporting Ireland: Fiscal Transparency Indicators Coverage of Public Sector Entities (percent of expenditure) Reporting of Assets and Liabilities (percent of GDP) Public corporations remain outside fiscal reporting Only a quarter of public sector liabilities reported General Government Reported Non-Fin Public Corp Unreported Financial Public Corp Liabilities Assets Central Bank Consolidation Public Sector Net Worth -400 -300 -200 -100 0 100 200 300 400

III. New Fiscal Transparency Evaluation: c. Fiscal Transparency Indicators: Fiscal Forecasting and Budgeting Bolivia: Source of Budget Forecast Errors Revenue Forecast Errors (Percentage point Contribution) Expenditure Forecast Errors (Percentage point Contribution) 50 50 45 Percent forecast error Means budgeted expenditure bears little relation to actual outcomes 99% 41% 111% 40 40 Percent forecast error 35 30 30 32% 23% 17% 25 120% 20 20 30% 15 Massive underestimation of revenue in the budget 31% 10 10 10% 5 0 0 Tax Revenue Operating Revenue Other Revenue Capital Revenue Total Error Wages and Salaries Goods and Services Misc Current Capex Total Error

III. New Fiscal Transparency Evaluation: d. Targeted Recommendations: Ireland Principle Advanced: Budget is presented on a gross basis and budget documentation includes all general government entities. Assessment Importance Rec. Low: Own source revenue accounts for 2.6 percent of total revenue which are presented gross in an annex. Medium: Real GDP growth forecasts have an overestimating forecast error of 1.0 percent of GDP in year t+2) and an absolute volatility-adjusted forecast error of 0.45 percent of GDP. High: Spending limits cover only 80 percent of the budget, tax expenditures and extrabudgetary funds are not included. 2.1.1 Budget Unity Advanced: The government publishes four comprehensive macroeconomic forecasts per year with explanations of all key variables and their composition and underlying assumptions. Macroeconomic Forecasts 2.1.2 Advanced: Budget documentation includes medium-term spending limits and revenue by ministry and economic category. Good: All major investment projects are subject to open and competitive tender and medium-term obligations are disclosed, but not all cost-benefit analyses are published before approval. Good: The Legal Budget Framework is comprehensive, but does not include a provision restricting legislature s power to amend the executive s budget proposal. Good: Budget proposals are released 3-4 months before the start of the financial year but approved by Parliament only in December. Advanced: The government has several precise and time-bound national and supranational fiscal rules, some of them in place for more than 3 years, NAO and not MoF reports on compliance. MT Budget Framework 2.1. 2.1.3 Medium: Public investment is relatively low at 2.6 percent of GDP. 2.2. 2.1.4 Investment Projects Low: Upward revisions by Parliament are low with 0.3 percent of total expenditures on average. 2.2.1 Fiscal Legislation Low: Budgets are routinely approved before the start of the financial year. Parliamentary amendments are limited. High: Not all national fiscal policy objectives are consistently observed. CG gross debt is not on a declining path but will grow from 41 percent in 2010 to 49 percent in 2015. Timeliness of Budget Documents 2.2.2 Fiscal Policy Objectives 2.1. 2.3.1 9

III. New Fiscal Transparency Evaluation: e. Sequenced Action Plan Ireland Fiscal Transparency Action Plan Action 2013 2014 2015 2016 2017 1. Expand Institutional Coverage of Budgets, Statistics, and Accounts a.Present all gross revenues and expenditures of central government entities in budget documentation Incorporate Non- Commercial Semi- State Bodies into budget documentation Incorporate all central government entities in budget documentation Integrate non- commercial semi- state bodies into departmental votes Incorporate NPRF into budget documentation Combine Finance and Appropriation Accounts into a partial Central Government Financial Statement based on existing accounting policies Combine the information in the notes to the Appropriation Accounts to produce a summary report Incorporate Non- Commercial Semi- State Bodies into consolidated provisional Central Government Financial Statement Prepare comprehensive consolidated Central Government Financial Statement for audit by C&AG b. Combine Finance and Appropriation Accounts into a consolidated Central Government Financial Statement Incorporate SIF and NPRF into partial Central Government Financial Statement Reconcile gross revenues and expenditures of Exchequer and general government in budget Publish quarterly statistics on gross revenues and expenditures of central, local, and general government sectors Publish monthly statistics on gross revenues and expenditures of central, local, and general government sectors Provide summary of gross revenues and expenditures of central, local, and general government in budget c. Provide an overview of the gross revenues and expenditures of the general government and its subsectors Provide summary of gross revenues and expenditures of central government in budget 10

IV. Fiscal Transparency Evaluation: Potential benefits for users Country Authorities A clearer picture of where they stand relative to international standards A better prioritized and sequenced action plan for addressing reporting gaps A wealth of data to use in starting to address those gaps Citizens, Markets, and the International Community A stronger evidence-base for the need for action to improve transparency Facilitates cross-country comparisons of fiscal transparency practices Identifying unknown unknowns provides a stronger basis for risk assessment 11