Improving Financial Management in Local Government through Budget Reform

Enhance financial management in local government through budget reform by aligning budgets with national priorities, improving service delivery outcomes, and preventing financial difficulties. Efforts include developing budgeting systems, grant monitoring, and LG reporting systems, to ensure credible budgeting processes and comparable information across municipalities.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

mSCOA / BUDGET ANALYSIS WORKSHOP National Treasury | Jan Hattingh 09 09 to 11 November 2016

Long-term objectives of LG budget reform agenda Quality local government information informing national policy debates Information comparable across all municipalities to aid resource allocation decisions Ensuring a credible budgeting process is a key ingredient to improving financial management Facilitate the alignment of the budget to national priorities with the aim of improving service delivery outcomes Over time, one should be able to draw a direct correlation between a credible budgeting and the audit outcomes Prevention of municipal financial difficulties before they occur by through the application of budget and Section 71 analysis - an early warning system Must form the basis of recovery plan where difficulties/challenges are experienced Strengthening the link between policy formulation, planning, budgeting, implementation, reporting and monitoring i.e. accountability and service delivery 2

Envisaged impact to the local government sphere All efforts must be the improvement between policy formulation, planning, budgeting, implementation, reporting and monitoring Prevention of municipal difficulties before they occur through the application of budget and section 71 analysis Ensuring a credible budgeting process as a key ingredient to improving financial management Information comparable across all municipalities to aid resource allocation decisions Quality local government information informing national policy debates 3

In summary: What have we done to date Development and implementation of a budgeting system for LG Development and implementation of a LG reporting system including the establishment of the LG Database which provides for a early warning system Development and implementation of a LG grant monitoring and management system Routine publication of municipal performance in various forms Issuing of key regulations Municipal Standard Chart of Accounts (April 2014) Municipal Budget and Reporting Regulations (April 2009) Research and development of a Uniform System Solution for LG Issued the Integrated Financial Management Transversal Tender on the 04 March 2016 Issued MFMA Circular No.80 on Municipal Financial Systems and Business Processes on the 08 March 2016 Announced the name of successful companies (seven) on 02 August 2016: Press Release as approved by DG and communications mSCOA Circular No. 6 Release of mSCOA Version 6 Research and development of LG revenue management initiatives to improve billing and revenue collection Research and development of financial modelling in municipalities by focusing on costing, tariff determination and cost benefit analyses for capital project Cross Cutting Activities Continuous stakeholder management with various stakeholders such as IMFO, NERSA, DWA etc. Continuous training, development and capacitating of all stakeholders such as municipalities, councillors, DWA, SALGA etc. 4

LGBA has been building a strong foundation for effective management of LG finances Initial focus on improving legal compliance with budgeting and reporting requirements among the 17 non-delegated municipalities (71% of LG expenditure) Timeliness, quality and comparability of fin info Now strengthening oversight provincial treasuries municipalities: Strategy to Address Performance Failures (TCF and BC in 09 & 14) Differentiated Approach to Support Provinces to Address LG Performance Failures (TCF & BC in July / Aug 14) BC resolution that NT and PTs will collectively focus their efforts on the game changers for next period (i.e. funded management, mSCOA, asset management and SCM) Research & Development Projects Frontline Team Support Team Financial Planning 9 X Directorates LG Database capacity delegated of Business Processes and Systems 17 Non-delegated municipalities for Grant Monitoring 9 provinces 261 delegated municipalities Local Government Costing and Tariff Setting Budget Reform and GIS Revenue Management Sector departments such as CoGTA Performance Management budgets, revenue mSCOA

. in a systematic way 2014 to 2017 2006 2008 2009 2010 2011 First publication of the S71 reports covered only 43 municipalities complied during the Q3 of the 2006/07 FY S71 compliance improved and by the Q4 2008/09 FY all 283 municipalities were compliant Introduction of mid-year budget and performance engagements for the 17 non- delegated municipalities (Section 72 of the MFMA) Introduction of the Budget and Benchmark Engagements for the 17 non- delegated municipalities (Section 18 of the MFMA) Promulgation of the Municipal Budget and Reporting Regulations (MBRR) Training and support for the implementation of the MBRR Significant improvement in the compilation and credibility of S71 reports Issued Regulations for mSCOA and implementation Implement mSCOA Phase 4 - change management and piloting These processes have improved the quality of municipal financial information reported and provided a platform whereby sector departments are able to constructively engage municipalities

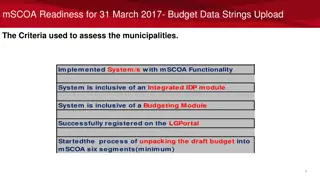

with extensive support to provincial treasuries in monitoring and oversight Training PT officials on the municipal budget formats and budget assessment methodology to ensure credible, funded and sustainable budgets number of funded budget have improved from 174 in 2013/14 to 189 in 2015/16 Supporting the PTs mid-year municipal visits and the annual budget assessment and benchmark engagements to ensure alignment to NTs processes Training PT officials on how to utilise NT s LG database for in-year monitoring and analysis of S71 reports Assist PTs to compile credible strategies to address LG financial performance failures that are aligned to the game changers Appoint advisors through MFIP II in NC, LP, EC and GP Treasuries (advisors for remaining provinces still to be appointed) with the implementation of their strategies. Advisors for NC and LP has resigned on 31 July and August respectively. In addition, appointed six mSCOA Advisors Appointed MFIPII advisors in selected municipalities to assist them to address / strengthen institutional and municipal finance management weaknesses Introduced municipal revenue value chain and integrated approach to PTs to provide insights into revenue management challenges. Established working group to design revenue management programme and identify pilot projects to be implemented Training for and guidance on mSCOA readiness and implementation

Outcome of the 2016/17 MTREF Budget Verification

Background and objectives October each year NT publishes a consolidated set of budget information for all municipalities Why do we do this? To compile a credible baseline for the monitoring of in-year performance through the S71 reporting process To inform the Medium Term Budget Policy Statement (MTBPS) To inform reporting to Parliament and key policy funding decisions To inform the analysis conducted by external stakeholders such as the Reserve Bank, credit rating companies, financial institutions, etc. Therefore the credibility of the information is of critical importance This means that the information in the following documents must reconcile 1 2 3 4 Budget return forms submitted to LG database Audited outcomes align to audited AFS Budget adopted by council with a resolution Electronic A1 schedules submitted to NT 2 2

Budget verification progress 02 November 2016 Description Northern Gauteng Mpu - Limpopo Kwazulu- Eastern North Free Western Total Cape malanga Natal Cape West State Cape Number of Municipalities Number of returns to be submitted to the LG database 31 905 11 305 20 575 27 735 54 39 22 635 23 665 30 900 257 7210 1420 1070 Number of actual returns submitted 905 305 575 735 1420 1050 630 665 900 7185 Number of input forms received which reconcile as follows: 905 305 428 605 1420 1025 630 659 630 6607 Returns reconcile for the three year audit outcomes 450 150 200 300 705 510 315 345 210 3185 Returns reconcile for the 2015/16 financial year 300 100 126 200 470 340 210 227 280 2253 Returns reconcile for the MTREF Period 155 55 102 105 270 175 105 112 140 1219 Number of Municipalities where all table A1-A7, A9 reconcile Verifications done by Directors / spot checks 31 31 11 11 8 8 21 21 54 54 35 35 21 21 22 22 28 28 231 231 % of returns received 100 100 100 100 100 98 99 100 100 100 % of returns reconcile % of all tables (A1-A7; A9) reconciling 100 100 100 100 74 40 82 78 100 100 96 90 99 95 99 96 70 93 92 90

mSCOA in the broader FM landscape Statistical reporting framework (GFS/SNA) BRF SCOA Segments Constitution Fund mSCOA Item SCOA Function Region Standard Classification Project MFMA AFS Financial reporting framework (accruals basis of accounting or GRAP) mSCOA represents the detailed, or posting-level, accounts which financial practitioners would use to capture transactions in the financial systems. The mSCOA data structure is then used to compile both budgets and financial statements. Budgets and actual financial transactions are captured in the municipality s financial system, across all of the segments of mSCOA; facilitating a direct comparison of budget versus actual spending. 12 12

What Segments are Required in mSCOA and where do they come from? Municipal Standard Classification: MSC is a non regulated segment and will probably still represent the MFMA vote. Project: DCOG This segment is to ensure that all projects in the IDP is aligned to budgets. Function: Here we align with the IMF, GFS, Constitution and Municipal Structures act to Departments and Votes Costing: Management Accountants / Tariff modelling . The PSD acknowledge a gradual approach I.E Administrative functions to Commercial services will suffice. Item: ASB / OAG This is the Accountants segment and is informed by GRAP, IFRS and accounting standards. All financial reporting and reconciliations happen in this segment. Fund: Budget Office National and Provincial Government are on Modified cash and Local government Item are on Accrual Here we align to Payments and receipts and in essence achieve cash flow here. Region: Communities need to feel and see delivery, Only through planning and physical delivery can this be communicated effectively. 13 13

Municipal Money and Financial Management Reforms

Municipal Money Website SALGA welcomed the Minister of Finance s announcement of the launch of the Municipal Money website. MPs asked several questions about the accessibility and accuracy of the data on the site 15 15

Background of Municipal Money In the 2016 Budget Speech the Minister of Finance said: This year brings our fourth fully democratic local government elections. In recognition of this, the National Treasury will launch a data portal to provide all stakeholders with comparable, verified information on municipal financial and non-financial performance. I hope this will further stimulate citizen involvement in local governance. www.municipalmoney.gov.za went live on 26 October 2016 Government budgets are a blueprint for how public resources are going to be spent and budget information should be transparent and accessible for people to understand how public funds will be used Broad Observations National Treasury is a founding member of the Open Government Partnership which strives for transparency and informed public participation in government processes 16

Content of Municipal Money Data accuracy Data is up to date and is based on the submissions of municipalities to the Local Government Database and Reporting System (Local Government Database and Reporting System). It is based on the quarterly Section 71 publications and the latest audit outcomes Municipal Money will be updated every quarter with the latest available finance data Accessibility Information is available 24/7 on internet and mobile devices It is educational and explains finances in citizen-speak It has links to the guidance on how to interpret the data It encourages and guides citizens on how they can get involved in the Budget and Planning cycle of the municipality It accommodates feedback mail for queries or general comments and collects statistics on the use of the open portal 17 17

Future refinements to Municipal Money National Treasury is committed to working with stakeholders to continuously improve the website 6125 people have already used the website Enhancements have already been requested: Better comparative measures on tariffs and household bills Tracking of capital projects of municipalities Ward based data The Project Steering Committee will meet at the end of this month to discuss new focus areas based on feedback from citizens 18 18

Local Government Accountability Cycle The IDP determines the strategy, objectives and service delivery targets for the municipality mSCOA, creates the environment to enable the execution of the accountability cycle, from IDP to Annual Report mSCOA , if well implemented and managed, after future phases have been completed, will provide direct evidence in dashboard format, of the achievement of IDP strategy, objectives and service delivery targets in the municipality Greatly limits greatly unauthorised expenditure. 5 Year Strategy IDP Spatial transformation plan & process BEPP 3 Year Budget Budget Annual Plan to Implement SDBIP Monitoring & Council Oversight IYR Oversight AFS Annual Report Standard Chart of Accounts Improved Service Delivery 19 19

THANK YOU 20 20