Indian Fellowship Seminar on Interest Rates and Guarantees

Delve into the intricate world of interest rates and guarantees at the 26th Indian Fellowship Seminar conducted by the Institute of Actuaries of India. Explore the trajectory of interest rates, strategies to manage guarantees, and the impact of factors like demonetization. Gain insights from expert presenters and stay informed about the future landscape of the financial domain.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

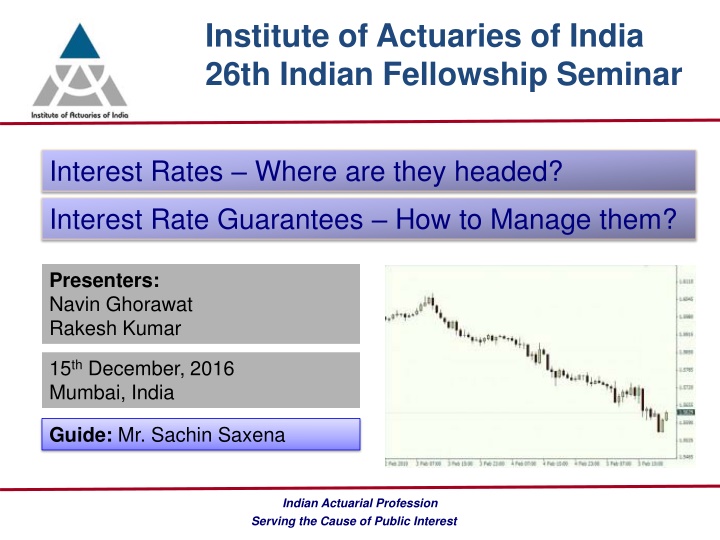

Institute of Actuaries of India 26th Indian Fellowship Seminar Interest Rates Where are they headed? Interest Rate Guarantees How to Manage them? Presenters: Navin Ghorawat Rakesh Kumar 15th December, 2016 Mumbai, India Guide: Mr. Sachin Saxena Indian Actuarial Profession Serving the Cause of Public Interest

Agenda 1. Where are the Interest Rates Headed? Historical Interest Rates Range and Spread Future of Interest Rates Best Estimate and Alternatives Impact of Demonetization 2. Interest Rate Guarantees and How to Manage them? Why and how guarantees arise? Impact of Guarantees on different Products Management of Interest Rate Guarantees Case Study: Japanese Life Insurance Industry www.actuariesindia.org 2

Historical Interest Rates - Range Historical 10 years G-Sec rates in India www.actuariesindia.org 3

Historical Interest Rates - Spread Comparative 10 years Bond Yield (India, UK,US, Japan and Brazil) www.actuariesindia.org 4

Future Interest Rates Best Estimate Reasons for Interest Rates falling to 4.5-5.5% Modi Govt. View: Target Inflation of 4% and Target Real Yields of 1.25-2% RBI Stance: Change of Governor, Supporting Govt. view Weather (Monsoons): Good Monsoons have lowered CPI Fiscal Deficit and Govt. Budget Higher tax revenues, Income Disclosure Scheme, Disinvestment Proceeds Sluggish Growth (as the IIP suggests) Stable Currency India attracting capital flows as a safe haven www.actuariesindia.org 5

Future Interest Rates - Alternative Reasons for Deviation from Best Estimate Weather: Bad Monsoons can have an adverse impact on Inflation and hence rates. Indian Govt.: Recent moves have not been as successful as hoped. Rajya Sabha minority still an issue. US/UK Quantitative Easing: If the developed economies raise rates and the spread between Indian and US/UK yields narrows, capital will flow out from India. Price of Crude Oil: Major drop in inflation and interest rates was due to sharp fall in Crude Oil prices. This trend has started to reverse. Global Political Environment: Syria, Brexit, Trump, Immigrants in Europe www.actuariesindia.org 6

Impact of Demonetization www.actuariesindia.org 7

Why interest rate guarantee arises? Non-life Business Relatively very less interest rate guarantee Life Business Pension To make the saving products attractive and competitive Immediate annuity products with guaranteed rates To improve the persistency and increase the NB volume Mostly Short term protection business with yearly renewal premium Deferred Pension plans have similar guarantee requirements as in saving products of life business To comply the regulatory requirements - Guaranteed surrender benefit/Minimum DB/Guaranteed minimum MB In case of sudden fall of interest rate the smoothing in interest rate declaration on fund based group products may lead to guarantee - Positive return under saving product at 4% p.a. interest rates Scenario Major contribution of Saving products under Life business www.actuariesindia.org 8

How interest rate guarantee arises? How interest rate guarantee arises under life business Pricing and other reasons Assets Implicit interest rate guarantee as assumed in pricing basis Limited investment avenues available and allowed to insurers Explicit Interest rate guarantee (which may be 0% p.a.) Higher reinvestment risk as large changes have been observed in G-sec returns Non-reviewable premium Under-developed Corporate Bond and Derivative Markets Guaranteed annuity rates under Immediate annuity products Volatile return on invested funds Without profits single premium products priced at higher interest rates www.actuariesindia.org 9

Impact on Different Type of Products Non-Participating Participating Significant impact Maturity and/or surrender may burden ALM mismatch Reinvestment risk Increase in Capital requirement Reduction in projected profits Bonus rate may not sustain Reinvestment risk Reduction in projected profits Withdrawal rate may increase Non- Participating Participating Others (ULIPs, Term, Health etc.) Annuities Annuities Others ( ULIPs, Term, Health.) Minor impact on all Impact on ULIPs: if guarantee is given ,withdrawal rate may increase, marketability may reduced 30 to 40 years term assurance have higher sensitivity of interest rates Long term care product may be impacted Significant impact Revision of rates and marketability issues ALM mismatch Reinvestment risk Reduction in projected profits www.actuariesindia.org 10

Management of Interest Rate Guarantees: Reasons and Strategy Reasons for Management Strategy for Management To reduce the volatility in profits Reduce dependency on non-par sales Capital Management Remove the products with heavy guarantee in current scenario To maintain the solvency position Sell more protection and shorter term products To meet PRE of par policyholders Introduce income benefit products rather than endowments Re-price the products to reduce guarantees Keep appropriate mathematical reserve Hedge the risk through derivatives Continuous monitoring and reporting to the top management www.actuariesindia.org 11

Management of Interest Rate Guarantee: Possible Actions, Implications and Challenges Possible Actions Revise the premium for without profits product Implications Challenges Reduce or eliminate the guarantee from new business Regulatory restrictions, marketability and competition Revise the Immediate annuity rates on continuous basis Reduce or eliminate the guarantee from new business Regulatory restrictions of maximum 10% changes, marketability and competition Bonus cut (RB and/or TB), additional interest rate cut Reduction in guarantee and hence value of liability. PRE and TCF, breaching of regulatory conditions, Persistency and NB volume. Due to change in interest rate the duration of liability gets change and hence duration of asset needs to be adjusted May reduce the impact of change in interest rate Matching assets may not be available and transactions cost Matching Asset and Liability Use of derivatives or immunization technique Cost and complexity, increase in credit risk and regulatory restrictions. www.actuariesindia.org 12

Management of Interest Rate Guarantee: Regulations and Professional Guidance Regulations GNs APS IRDAI Circular on ALM and Stress Testing, 2012 GN6: Management of Participating life assurance business with reference to distribution of surplus APS1: Appointed Actuary and Life Insurance Business APS2: Additional Guidance for Appointed Actuaries and Other Actuaries involved in Life Insurance IRDAI Investment Regulations, 2013 GN22: Reserving of Guarantees in Life Assurance Business APS3: Financial Condition Report IRDAI Guidelines on Interest Rate Derivatives, 2014 GN29: Valuation of Interest Rate Guarantees on Exempted Provident Funds APS5: Appointed Actuary and Principles of Life Insurance Policy Illustrations Other regulations such as ALSM, Product Regulations, 2013, Investment in Credit Default Swaps(CDS), 2012 etc. APS7: Appointed Actuary and Principles for determining Margins for Adverse Deviation (MAD) in Life Insurance Liabilities www.actuariesindia.org 13

Solvency II: Management of Interest rate guarantees 2. The impact of fall in interest rate is higher on value of liabilities as the duration of liabilities is much longer than assets and so matching is important aspect 1. The capital requirements under solvency II are designed to promote the insurers to match the duration of assets and liabilities 4. Use of derivatives: Derivatives can be used for hedging interest rate risk 3. Stress testing exercise consider the several low interest rate scenarios www.actuariesindia.org 14

A Case Study: Japanese Life Insurance Industry The impact of sudden decrease in interest rate and stay at low level for longer period of time Rapid decline in the interest rate in1980s, led to heavy sales of insurance product with high guarantees Insures invest their assets stock market and shock in equity market leads to large loss 8 out of 27 Japanese life insurance companies had defaulted from 1997 to 2008 due to Negative Yield Spread Insurers lost the policyholders confidence and leads to large surrenders Steps taken by Japanese LI companies after sharp decline of Interest rate: Stop selling high-yield saving products Reduce guarantee interest rate and commission of saving products Increase the policy reserves Purchase the longer term bonds to improve yields and reduce duration gap Use of interest rate swaps to hedge the interest rate guarantee under annuity portfolio www.actuariesindia.org 15

Summary Interest rate guarantee management is mainly for Capital management , profitability and solvency Management through proper product mix, matching of asset and liability and use of derivatives Follow the Regulatory provisions and Profession guidance Take lesson from the countries have already faced the burden of interest rate guarantees www.actuariesindia.org 16

26th Indian Fellowship Seminar THANK YOU! Contact us: nvghorawat@gmail.com rakesh.k@licindia.com www.actuariesindia.org 17