Indian Mobile Manufacturing: Key Insights and Future Prospects

Discover the evolution of mobile manufacturing in India, from import figures to local value addition percentages. Explore the challenges and opportunities faced by the industry post-GST implementation. Learn about the Phase Manufacturing Plan aimed at transforming India into a mobile handset manufacturing hub.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

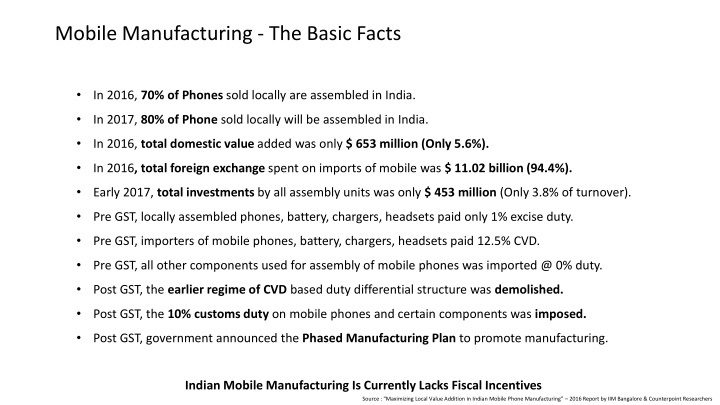

Mobile Manufacturing - The Basic Facts In 2016, 70% of Phones sold locally are assembled in India. In 2017, 80% of Phone sold locally will be assembled in India. In 2016, total domestic value added was only $ 653 million (Only 5.6%). In 2016, total foreign exchange spent on imports of mobile was $ 11.02 billion (94.4%). Early 2017, total investments by all assembly units was only $ 453 million (Only 3.8% of turnover). Pre GST, locally assembled phones, battery, chargers, headsets paid only 1% excise duty. Pre GST, importers of mobile phones, battery, chargers, headsets paid 12.5% CVD. Pre GST, all other components used for assembly of mobile phones was imported @ 0% duty. Post GST, the earlier regime of CVD based duty differential structure was demolished. Post GST, the 10% customs duty on mobile phones and certain components was imposed. Post GST, government announced the Phased Manufacturing Plan to promote manufacturing. Indian Mobile Manufacturing Is Currently Lacks Fiscal Incentives Source : Maximizing Local Value Addition in Indian Mobile Phone Manufacturing 2016 Report by IIM Bangalore & Counterpoint Researchers

Mobile Manufacturing - Imports vs Domestic 2014 2015 2016 2017* Total Market (Mn Units) 253 270 267 244 Mobile phone imports (Mn Units) 205 47 83 168 Local Assembling (Mn Units) 48 223 184 76 Total Market (Mn USD) 9113 13765 9722 11670 Mobile phone imports (Mn USD) 2566 4188 7382 6514 Import value of components( Mn USD) 6829 9894 2843 1405 Local Value addition (Mn USD) 1305 653 326 365 Local Value addition (%age) 9.5% 5.6% 3.6% 3.8% * Forecast Though Local Value Add Has Increased, But Sill Very Low Source : Maximizing Local Value Addition in Indian Mobile Phone Manufacturing 2016 Report by IIM Bangalore & Counterpoint Researchers

Mobile Manufacturing Mobile Manufacturing - - Facilities in India Facilities in India Total No. of Manufacturers in India Total Investment by Local Manufacturers ~ 50 US $ 453 Mn Almost 34% of manufacturing facilities in India are owned by individual OEM brands such as Micromax, Intex, Lava, Samsung, etc. Rise in contract manufacturers which own almost two-thirds of all facilities These Units Are Currently Are Focused on Semi Knock Down (SKD) Assembly Source : Maximizing Local Value Addition in Indian Mobile Phone Manufacturing 2016 Report by IIM Bangalore & Counterpoint Researchers

Mobile Manufacturing Mobile Manufacturing - - Phase Manufacturing Plan Phase Manufacturing Plan Value Add (%) 30% 25% 20% 33% 15% 25% 10% 17% 5% 10% 0% 2016-17 2017-18 2018-19 2019-20 Charger/Adapter, Battery Pack, Wired Headset Mechanics, Die-Cut Parts, Microphone & Receiver, Key Pad, USB Cable Display Assembly, Touch Panel/Cover Glass Assembly, Vibrator Motor/Ringer Printed Circuit Board Assembly (PCBA), Camera Module, Connectors To increase the intensity of manufacturing of mobile devices in India To promote enhanced value addition of mobile devices in India The Objective is to Convert India Into a Manufacturing Hub of Mobile Handsets

Mobile Manufacturing - Key Policy Incentives Import Local Manufacturing Type Barrier Countervailing Duty/GST Excise Duty/GST Custom Duty Imported Phones (CBU) 0% 12.5% NA 12.5% 11.5% Pre-GST 1.0% Manufactured Phones NA NA 1.0% Imported Phones (CBU) 0% 12.0% NA 12.0% Post-GST 0% Manufactured Phones NA NA 12.0% 12.0% Actions Taken Post GST, the barrier of 11.5% disappeared Post GST, India raised Customs Duty (to restore status quo) Potential Risks Potential Conflicts With ITA (International Telecommunication Agreement) Possibility of Retaliation from WTO members Possible Imports from FTA Nations - nullify impact of CD increase The Current Policy Incentives Have Potential Risk of International Retaliation

Global Best Practices: Indonesia & Brazil Indonesia Brazil Goal: Promote domestic manufacturing & development of mobile devices and improve mobile balance of trade Goals: a) Increase local R&D, and b) Increase local manufacturing industry Lever: In 2015, Indonesia announces quota of 30% local sourcing of LTE devices starting 2017 Policy: Made in Brazil Reduced Import Taxes for products produced in Brazil Reduced Value Added Taxes for products produced in Brazil Designed in Brazil Eliminate Value Added Taxes for products where Critical components are designed in Brazil Mechanics: Quotas for Local content - Defines as a combination of products and services for respective HW manufacturing and SW development. The domestic components includes the raw materials, processes, R&D, etc 4G LTE FDD: Minimum of 20% local content and increases to min. of 30% by Jan. 2017 4G LTE TDD: Minimum of 30% local content in 2018 and min. of 40% in 2019 Govt shall issue Certification for qualifying devices. Certificate is required to sell devices Mechanics: Increasing quotas on percent of content that must be sourced locally Indonesia and Brazil have Fiscal Incentives on Locally Designed & Manufactured Handsets

Global Best Practices: China & Vietnam China Vietnam Goals: Improve the balance of trade in ICs and increase self-sufficiency in semiconductors Goals: Increase indigenous mobile phone production Levers: Tax Incentives Policy: Semiconductor as top policy priority (IC design and manufacturing). Desire to move manufacturing to more advanced nodes 30-year tax holiday: 10% tax on mobile phone manufacturing which can be 100% exempted in the first four years and further reduced to 50% in the next nine years VAT Exemption on technology transfer Pre-tax treatment of science & technology development funds where the amount paid may not exceed 10% of the total taxable income for the assessable tax year Regional tax incentives Mechanics: Central government-led investment fund Total funds available: 120B RMB ($20B USD) Focus on 3-5 key regions of China Investment focus: IC manufacturing (main), IC design, test & packaging, equipment and materials General purpose, Project finance, M&A Types of Investment: Active investment, Passive investment, Interest subsidy, Tax credit China & Vietnam Has Comprehensive Incentive Programs To Promote Local Manufacturing

BIFs Proposal: E&Y Report, 12th Dec 2016 Incentive amount = (GST paid on Output supply - GST paid on import of goods and services) x N Benefits can be enhanced with multiplier ( N ) to match current benefits with similar value addition and higher benefits can be provided where value addition is more The Government may further consider deferring the payment of Customs Duty on import of goods and services till the time the goods are further supplied to customers. This would reduce upfront cash outflow for manufacturers Similar benefits can be extended to component manufacturers which in turn would help in building the eco-system for handset manufacturing BIF s Proposal Mitigate Risks & Incentivize Local Value Add to Promote Manufacturing

Strengthening IPR, R&D And Standards Contribute to Global Standards Bodies (3GPP, ETSI) to Ensure India Specific Requirements Will Ensure Economies of Scale Will Ensure Seamless Interworking Strengthen TSDSI for Enabling it to Contribute to Global Standard Settings Will Ensure Indian Requirements are not ignored Strengthen the IPR (SEP) regime to protect Innovation Will Reinforce the Collaborative Standard Setting Process Will Ensure Small Companies Make Investments in Risky R&D Will Ensure Small Companies Create Leverage Against Global Giants Will Ensure Small Companies get Adequately Compensated Will Prevent Global Giants From Too Much Leverage Will Promote Competition in Handset Manufacturing Will help Reduce Handset Prices Will Benefit Consumers Interests Will Incentivize Start Ups to Invest in R&D by to Create Leverage Against Established Companies

IEEE Policy Change Experience Require the use of the smallest saleable component as the royalty base Prohibit reference to existing licenses -- obtained under the explicit or implicit threat of injunction -- in determining a reasonable rate Exclude any value resulting from a patent s inclusion in the standard Prevent patent owners from seeking an injunction until after an affirmative appellate decision As per report authored by Ron Ron D. Katznelson, After more than 18 months in operation, the adverse impact of the IEEE patent policy adopted in March 2015 is clearly evident in my view, with an 83% decline in the average supply rate of non-duplicate LOAs to IEEE standard development activities . The IEEE controversial policy on Standard Essential Patents the empirical record since adoption. As per Keith Mallinson, IEEE decided to amend its IPR Policy deviating from the WTO principles and accepting amendments that are only pro-users. Since then, 73% of LOAs for the IEEE flagship 802.11 WiFi standard, accepted by IEEE and posted on its website in the 18-month period to June 2017, were negative IEEE IPR Policy Change Has Greatly Decreased The Start Ups Urge to Invest in R&D

Key Recommendations Provide Strong Fiscal Incentives to promote local value add Refunding GST back to the manufactures could be an option Ensure Phase Manufacturing Plan Executes as Planned Strengthen Collaborative Standard Development Process Strengthen IPR for startups to create leverageagainst established players Strengthen SEPs for startups to invest in Risky R&D Strengthen TSDSI to contribute to the standard setting process