Influence of Public Transport Systems on Spatial Change in South Africa

Explore the impact of public transport systems on spatial transformation in South Africa at a session presented during the South African Transport Conference. Delve into the theory of change, challenges in city governance, and the role of public transport in addressing urban spatial issues. Discover insights on population density, urban density, and the manifestation of problems through public transport data.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

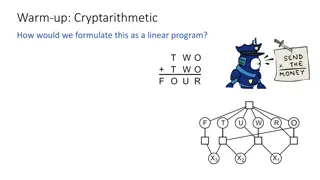

Presentation Transcript

Are public transport systems influencing spatial change? PRESENTATION AT SESSION: PUBLIC TRANSPORT AND SPATIAL TRANSFORMATION SOUTH AFRICAN TRANSPORT CONFERENCE 08 JULY 2019

Background Yet another piece of the puzzle - are public transport systems influencing spatial change in South Africa? Work in progress paper chronicles my experiences in a 5 year program of leading the public transport pillar in a program of explicit spatial transformation at the Cities Support Program. Transport was one of a number of pieces of the puzzle within the program aimed at changing urban space.

Structure 1. Then Theory of Change for the CSP 2. Engaging the Sector 3. Some important conclusions

Theory of Change Absence of the urban dividend from SA city growth Challenges in city governance, service delivery and spatial form deepen economic challenges in cities, and result in growing risks Targeted interventions on: governance, fiscal and financial reform and policy: lead to compaction, equitable urban growth and poverty alleviation.

Public transport manifests the problem powerfully Population Density for Different Cities (Thousand inhabitants per sq km) Atlanta 0.2 Tshwane 0.5 Phoenix 1.1 Ethekwini 1.5 Cape Town 1.5 Detroit 2.0 Johannesburg 2.7 Lima 3.5 Curitiba 4.1 Jakarta 4.4 London 5.4 Rio de Janeiro 5.4 Madrid 5.4 Singapur 7.6 Ahmedabad 12.0 0 2 4 6 8 10 12 Raskin (2017)

Public transport manifests the problem powerfully POPULATION (Million Inhabitants) URBAN DENSITY (Thousand inhabitans per Km2) 25 14.0 12.0 20 10.0 15 8.0 6.0 10 4.0 5 2.0 - 0.0 Raskin (2017)

Public transport manifests the problem powerfully AVERAGE BRT TRIP LENGTH (Km) FARE BOX RECOVERY/ BUS OPERATING COST* 160% 30 140% 25 120% 100% 20 80% 15 60% 10 40% 5 20% - 0% Raskin (2017)

Public transport manifests the problem powerfully TRANSMILENIO (BOGOTA, COLOMBIA) 180 1200 160 1000 Passengers (Thousands) 140 Trunk Bus departures 2.8 120 800 2.3 100 REA VAYA (JOHANNESBURG, SA)- Data 2014 600 80 60 400 40 200 7,000 250 20 0 0 6,000 10:00 11:00 12:00 13:00 14:00 15:00 16:00 17:00 18:00 19:00 20:00 21:00 22:00 23:00 4:00 5:00 6:00 7:00 8:00 9:00 200 Resources required only 1 hour per day 5,000 Time of day 2.7 150 Trunk Buses Passengers 4,000 8.9 METROLINEA (BUCARAMANGA, COLOMBIA) 3,000 100 2,000 14,000 25 50 1,000 12,000 20 Trunk Bus Departures 10,000 0 0 2.1 1.8 Passengers 15 10:00 11:00 12:00 13:00 14:00 15:00 16:00 17:00 18:00 19:00 20:00 21:00 22:00 23:00 4:00 5:00 6:00 7:00 8:00 9:00 8,000 6,000 10 Time of day 4,000 5 2,000 0 0 10:00 11:00 12:00 13:00 14:00 15:00 16:00 17:00 18:00 19:00 20:00 21:00 22:00 23:00 4:00 5:00 6:00 7:00 8:00 9:00 Raskin (2017) Time of day

1. Then Theory of Change for the CSP 2. Engaging the Sector 3. Some important conclusions

1. First things first: immediate challenges PTNG framework changes with requirement of fiscally and financially sustainable IPTNs Municipalities demonstrate sufficient local capacity to implement and operate revealed patterns of expenditure on inappropriate and fiscally unsustainable transport systems Formula allocation based on demand - disincentivise going large Incentive scheme for allocation Broaden range of transport services to be supported by the funding beyond BRT systems

Intense work with cities and national department on planning and budget process Created a guideline for IPTN formulation Requiring multiyear financial plan formulation (MYFIN) A series of toolkits for plan and budget analysis and grant allocation Subject Matter Expert appointment

Example of multiyear plan template # Main categories # Sub categories Presentation of revised 2018/19 PTNG template 2016/17 2017/18 2018/19 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 2026/27 2027/28 2028/29 2029/30 2030/31 2031/32 EXPENDITURE I 1.1 1.2 1.3 1.4 1.5 1.6 Project Management Operations Plan (including UDAP) Business Plan Marketing & Communications Plan Prelim + Detailed Infrastr Design Other (list items in notes below) 1 Planning TOTAL PLANNING Fare system equipment APTMS/ITS equipment Other (list items in notes below) 2.1 2.2 2.3 2 Equipment - excluding vehicles TOTAL EQUIPMENT CAPITAL EXPENDITURE Roadway civil works Top structures for stations / stops Depots Control centre Land and property acquisition Infrastructure renewal Other (list items in notes below) 3.1 3.2 3.3 3.4 3.5 3.6 3.7 Complete the Appendix 2 Multi-year Financial Plan in detail in the supplied spreadsheet. Infrastructure and other fixed assets 3 TOTAL INFRASTRUCTURE 1+2+3 TOTAL Combined capital exp on Planning, Equipment and Infrastructure Purchase costs (excl 4.2 costs) Other capitaised costs (list in notes) 4.1 4.2 4 Capital cost of vehicles TOTAL COST OF VEHICLES Compensation to licence holders Industry transition support 5.1 5.2 5.3 DO NOT alter the spreadsheet in any way by reformatting cells, adding / subtracting rows or changing/over-writing formulas. If the template is altered in any way, it will be returned and will have to be re-submitted. 5 Transition costs Other (list items in notes below) TOTAL TRANSITION 6 Other capital costs (list items in notes below) A: TOTAL CAPITAL EXPENDITURE 7 Direct vehicle operating costs 8 Capital charges for loan for vehicles (interest + redemption of capital) 9 Capital charges on loans for Planning, Equipment and Infrastructure (i+r) Fare system ops/maint Station services APTMS ops/maint Network authority institution System marketing Infrastructure maintenance Law enforcement Insurance Facilities rental Depot maintenance and security Other (list items in notes below) 10.1 10.2 10.3 10.4 10.5 10.6 10.7 10.8 10.9 10.10 10.11 TOTAL INDIRECT OPERATING EXP OPERATING EXPENDITURE Indirect operating expenditure for Phase/project 10 Please insert a pdf version of the final spreadsheet in the following pages of this report. This will serve as a hard copy record of the numbers in case the spreadsheet becomes corrupted. B: TOTAL OPERATING EXPENDITURE A+B: COMBINED CAPITAL & OPERATING EXPENDITURE SOURCES OF FUNDS II 2016/17 2017/18 2018/19 2019/20 2020/21 2021/22 2022/23 2023/24 2024/25 2025/26 2026/27 2027/28 2028/29 2029/30 2030/31 2031/32 11.1 11.2 11.3 11.4 Loans for purchase of vehicles Loans for purchase of equipment Loans for provision of infrastructure Loans for other (list below) 11 Total loans TOTAL LOANS SOURCES OF CAPITAL 12 13 14 15 16 17 Capital contributions from city Development charges Private capital contributions Other national capital grants (list items in notes below) Capital contributions from province Other (list items in notes) 18.1 18.2 PTNG for purchase of vehicles PTNG for Planning, Equip, Infrastr PTNG for transition/compensation 18 PTNG for capital 18.3 TOTAL C: TOTAL SOURCES OF CAPITAL 19 Total fare revenue 20.1 20.2 Advertising and merchandising Other (specify items in notes below) 20 Total other system revenue TOTAL 21.1 21.2 PTNG for capital charges on vehicles PTNG for indirect costs OPERATING REVENUE 21 PTNG for operating TOTAL 22 23 PTOG Other grants (specify items in notes below) 24.1 24.2 24.3 Rates Parking levy Other (specify items in notes below) 24 Rates and other local tax revenue TOTAL 25 Other local operating revenue (specify items in notes below) D: TOTAL OPERATING REVENUE C+D: TOTAL SOURCES OF FUNDS D - B: TOTAL OPERATING SURPLUS (DEFICIT) (C+D)-(A+B): TOTAL OVERALL SURPLUS (DEFICIT)

Example of assessment toolkits for performance STATISTICS III 2016/17 2017/18 2018/19 2019/20 2020/21 2021/22 2022/23 2023/24 PERFORMANCE MEASURES Acceptable Range A Annual Revenue km Revenue KM/Total Fleet Vehicle 42 000 - 78 000 B1 Annual passenger boardings B2 Annual passenger trips Spare Vehicle Percentage C.1 18 m 5% - 12% C.2 12 m Peak Vehicle Requirements during fiscal year C Direct vehicle operating costs/Revenue KM R 25 - R 42 C.3 9 m STATISTICS TOTAL - - - - - - - - Indirect vehicle operating costs/Revenue KM R 20 - R 30 D.1 18 m Total (direct + indirect) vehicle operating costs/Revenue KM R 45 - R 70 D.2 12 m Total Fleet Vehicles at fiscal year end D D.3 9 m Vehicle Capital Cost per Vehicle purchased R 2.5 m - R 5 m TOTAL - - - - - - - - E.1 18 m Average Compensation paid per operating licence R400K to R 1 m E.2 12 m Number of Vehicles Purchased during fiscal year E E.3 9 m Ratio of Boarding Passengers/Passenger trips 1.1 - 1.5 TOTAL - - - - - - - - Annual passenger trips/Revenue KM 1.00 - 1.40 F Number of Vehicle Operating Licences Compensated in FY G Number of staffed stations Average Fare per Passenger (total fare revenue/passenger trips) R8.50 - R12.50 Number of drivers employed H Fare Revenue/Direct Vehicle Operating Cost 30% - 65% Fare Revenue/Total Vehicle Operating Cost 15% - 35% (Fare Revenue + PTOG + Other local Revenue)/Total Dir Vehicle Operating Cost 100% - 150% PTNG for Indirect Operating Expenditure/Total Indirect Operating Expenditure <50% or <70% Station management costs/number of staffed stations R1m - R2.5m Rates + other local tax revenue contribution as percent of Total Rates 3% - 9% Driver Ratio - Drivers/peak buses 1.60 - 2.20 No of kilometres per driver per annum 25 000 - 35 000 Annual passenger trips/Peak bus 60 000 - 100 000 MTEF PTNG allocated in DORA as a % of PTNG required 80% - 100% Total overall surplus > R0

Example of city assessments Summary of Key Performance Indicators Indirect PTNG allocation / Indirect Operating Expenditure Station management costs / number of staffed stations Rates + other local tax revenue as percent of total rates MTEF Planning spend as a % of Infrastructure and Operational spend Annual passenger journeys / Revenue km City Driver Ratio - Drivers / peak buses Total overall surplus or (-deficit) City Revenue km / Total fleet vehicle Direct vehicle operating costs / Revenue km Average fare per passenger journey Fare revenue / Direct vehicle operating cost Passenger trips per bus per day (2019/20 unless otherwise indicated) (2019/20 unless otherwise indicated) Acceptable Range <50% or <70% R1m - R2.6m 3% - 9% 1.60 - 2.30 >= R0 4%-8% Acceptable Range 40 000 - 80 000 R 25 - R 42 1.00 - 3.00 0 R8.00 - R13.00 30% - 70% Buffalo City 70% NA 1% 2.4 R 10.2 M 3.1% Buffalo City 56 763 R13 0.12 37 R13.00 12% Cape Town 65% R 2.8 M 6% 2.1 - R 0.0 M 5.4% Cape Town 45 395 R38 1.22 439 R12.81 41% Ekhuruleni 168% R 3.2 M 0% 2.1 R 0.0 M 11.2% Ekhuruleni 42 593 R43 1.17 185 R8.28 22% eThekwini 50% R 2.6 M 1% 1.7 - R 111.3 M 7.9% eThekwini 40 472 R27 1.44 240 R10.00 53% George 75% R 7.2 M 1% 2.3 R 0.0 M 3.7% George 48 378 R27 1.39 272 R12.86 66% Johannesburg 74% R 1.2 M 4% 1.6 R 0.0 M 0.3% Johannesburg 42 311 R34 1.44 394 R11.44 49% Mangaung 70% R 1.3 M 0% 2.1 - R 9.6 M 25.9% Mangaung 42 784 R35 2.90 457 R7.00 58% Mbombela 183% R 1.3 M 3% 2.2 - R 162.0 M 14.0% Mbombela 42 998 R26 0.30 60 R13.58 16% Msunduzi 103% R 0.6 M 3% 1.8 - R 50.0 M 5.4% Msunduzi 25 098 R35 1.03 96 R14.00 41% Nelson Mandela Bay 70% R 0.0 M 4% 1.9 R 0.0 M 5.5% Nelson Mandela Bay 17 740 R38 1.59 262 R12.41 52% Polokwane 97% R 1.1 M 2% 2.1 R 15.3 M 10.4% Polokwane 42 117 R31 2.61 401 R9.51 81% Rustenburg 70% R 2.8 M 0% 1.8 - R 6.7 M 9.7% Rustenburg 12 960 R42 4.71 224 R9.00 100% Tshwane 70% R 2.6 M 2% 2.0 - R 9.5 M 7.3% Tshwane 36 818 R38 1.48 361 R13.49 53%

Additional areas of expenditure inefficiency work High costs in various areas of implementation work with cities on station management, ITS, bus operations Inefficient fiscal allocation - modal/governmental spheres - (PTOG, PTNG, PRASA, TRP & roads): resulted in now ongoing public transport finance policy process being driven by the NDoT Stalled devolution process efforts towards practical integration of various transport through IPTN Failing rail system.

2. Spatial targeting through the BEPP The Built Environment Performance Plan (BEPP) Targeting and prioritising catalytic infrastructure investment Fiscal alignment & integration with other key sectors (housing, economic development, transport) Harnessing private sector funding through project preparation Explicitly measuring it.

IPTNs largely aligned with other catalytic investment Comprehensive Assessment of 13 city IPTNS & Spatial Strategies IPTN city analysis showed a broad alignment with the catalytic projects Modelling was aligned to the SDF IPTNs use the long-range spatial scenario, as embedded in the SDF, to very broadly drive public transport action

Challenge of project preparation for the catalytic projects Intergovernmental project alignment and capital funding for projects was getting better Identifying projects to be delivered within the space by other government institutions Alignment of funding streams Main challenge was obtaining private sector funding To achieve real scale required funding outside government Well prepared bankeable projects were always a challenge despite availability of project preparation funding

Assessing outcomes was a challenge Influences of transport investment not tested & spatial effects not measured Impact Cities reporting on 2572 Indicators Integrated Outcomes Functional Outcomes Reporting Reform Project Exceptions: Cape Town sophisticated modelling - various land use end states for public transport Functional Outputs Functional Activities Functional Inputs Costs Developed a series of simple outcome indicators Current Emphasis at bottom

1. Then Theory of Change for the CSP 2. Engaging the Sector 3. Some important conclusions

Important conclusions Sectoral implementation issues trump spatial change both at national and city level It is currently ultimately about rewarding delivery Capacitated cities that control transport (and built environment functions) are best placed Devolution & city subsidiarity levers and instruments to create change Using the full spectrum of public transport investment is the big challenge Potential of PRASA

Important conclusions We do not have enough experience in understanding influences of transport investment in space Interesting and emerging work SACN, CSIR etc Influences of fiscal system big question of the car and road building Current public transport finance policy process at NDOT? No one is dedicated to holding the center in terms of long term spatial change New IUDF CoGTA focus Achieving scale how do we get greater buy in from private sector

Michael Kihato michael.kihato@planninghub.org