Insights into Finanzgruppe Sparkassenstiftung's Banking Activities

Explore the journey and operations of Finanzgruppe Sparkassenstiftung, focusing on their 200 years of banking in Germany, approach to financial inclusion, core figures, revenue sources, and interest rates for small loans. Understand their social mandate, objectives, and impact on local economies.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Finanzgruppe Sparkassenstiftung f r internationale Kooperation The Financial Inclusion Challenge A Bankers Perspective London, 5 December 2016 Finanzgruppe Sparkassenstiftung

Agenda 1. 200 years of Sparkassen in Germany 2. How Banks earn Money 3. Financial Inclusion or not 4. Project Example: Tanzania Finanzgruppe Sparkassenstiftung

1. 200 years of Sparkassen in Germany Sparkassen today: professional with a social mandate Sparkassen are Banks German Banking Act Supervision by ECB Full regulatory requirements for banks with a Social Mandate Defined in state laws and statutes Objectives: Provide financial services to all segments of the population, everywhere in the country ( account for everyone ) Provide SMEs with loans and other services Promote local entrepreneurial activity Promote social and cultural development Profitability is a necessary prerequisite for sustainable development Finanzgruppe Sparkassenstiftung

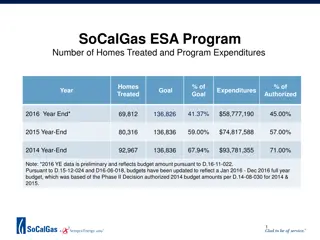

1. Sparkassen today Core figures (group of 403 local banks) Market share of in % Number of customers in million Savings deposits Loans to customers Principal bank account 38 52 5050 50 62 48 30 Number of in million 24 11 Savings accounts 55 Commerz- bank Deutsche Bank & Postbank Cooperative banks Credit / debit card 52 Current account 45 403 Sparkassen (savings banks) Others *Germany s total population: 81 million Finanzgruppe Sparkassenstiftung

2. How Banks Earn Money Sources of Income Sources of Income Fees and Commissions Return on Investments Interest Margin Retail Banking Investment Banking Finanzgruppe Sparkassenstiftung page 8

2. How Banks Earn Money Interest Rates for Small Loans - Components components typical range influenced by type of institution ( 2.6 %) Expected Profit ? Operating Expense (e.g. staff, equipment, rent, taxes) 10 - 30 % ( 14,0 %) efficiency 2 - 20 % ( 3.6 %) professionalism Loan Losses donors, Cost of Funds savings business, lending currency, inflation rate 5 - 20 % ( 7.8 %) (if in Forex: incl. exchange rate risk) Finanzgruppe Sparkassenstiftung Data for developing countries as of 2011: (CGAP 2013, Rosenberg et.al.)

3. Financial Inclusion or not Challenge 1: costs per loan Challenge: most operational costs are fixed (e.g. salaries, rent, IT) higher costs for small loans (as percentage of loan amount) Result: higher interest rates for smaller loans ! Solution: reduce costs esp. for smaller loans ! - efficient workflows and procedures - economies of scale (e.g. more loans per credit officer) - standardized products (amounts, terms etc.) - reduced transaction costs (technology e.g. POS terminals) - outsourcing (e.g. cooperation with agents, NGOs and others) Finanzgruppe Sparkassenstiftung

3. Financial Inclusion or not Challenge 2: non performing loans Challenge: non performing loans are extremely expensive: follow-up costs + loss of loan + loss of expected income general rule for small loans: total costs = 2 * loan amount Result: Solution: reduce risk of loan losses ! - standardized workflows and procedures - use of technology - training of staff - risk sharing agreements (e.g. with NGOs) Finanzgruppe Sparkassenstiftung

4. Project Example: Tanzania Training and Strengthening of MFIs, Financial Inclusion Partners: Tanzania Association of MFIs (TAMFI), Tanzania Postal Bank (TPB) and Karagwe Rural Development and Environmental Conservation Agency (KARUDECA) Objectives: Increase outreach of TPB, training of staff in MFIs and TPB, professionalize MFIs in Tanzania, savings mobilisation, business skills of micro-entrepreneurs - new TPB Training Center (for TPB and TAMFI) Results: - modernization/extension of TPB branches (incl. workflows) - savings mobilization campaign (World Savings Day etc.) - business simulation game for micro-entrepreneurs Finanzgruppe Sparkassenstiftung

If there are any further questions, do not hesitate to contact me. Niclaus Bergmann, Managing Director Phone: 0049-228-9703 6615 Email: Niclaus.Bergmann@SBFIC.de