Insights into Investment Demand and Economic Trends in Q1-Q2 2020

Explore discussions on investment demand theories, the impact of COVID-19 on economic indicators like retail sales and GDP growth in Q1, and projections for Q2 2020 regarding labor productivity and hours worked. Delve into the analysis of company project viability through Internal Rates of Return (IRR) and Net Present Value (NPV) calculations.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

A Theory of Investment Demand, A Theory of Investment Demand, An Expanded Loanable Funds Model An Expanded Loanable Funds Model 4/15/20

Cumulative Deaths: A Clear Flattening, Beginning in Late March (100,000 extrapolation vs 20,000 reality)

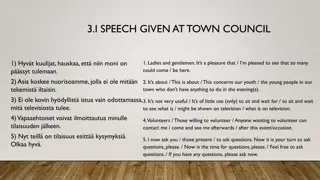

Deconstructing the Flattening:The Five hot spots were virulent. The Rest of the Country? Very Little Infection Introduction So how do we, even partially, re So how do we, even partially, re- -open the Nation for business? (as of 04/12/20) open the Nation for business? REPORTED DEATHS/MILLION ACTUAL = 1.5 X REP. IMPLIED INFECTION IMPLIED INFECTION DEATHS/MILLION RATE, W/1% MORT. RATE, W/.3% MORT. 100 1.0% 722 7.2% 410 4.1% 233 2.3% 274 2.7% 223 2.2% 39 0.4% POP (millions) 332 19.5 8.6 3.6 4.6 10 285.7 DEATHS USA NY NJ CONN. LOUIS. MICH. USA EX 5 22,115 9,385 2,350 554 840 1,487 7,499 67 481 273 155 183 149 26 3.3% 24.1% 13.7% 7.8% 9.1% 7.4% 1.3%

Total hours worked were flat, Q1 vs. Q4 real GDP??? oct 151,553 34.4 521 nov 151,814 34.4 522 dec 151,998 34.3 521 2019:Q4 151,788 34 522 NFP AWW Total hrs jan 152,212 34.3 522 feb 152,487 34.4 525 mar 151,786 34.2 519 2020:Q1 152,162 34 522 NFP AWW Total hrs

March retail sales suggest a big drop for Q1:PCEs. Suppose real GDP at a 3% annualized rate Growth in real GDP = Growth in labor hours + Growth in labor force -3% = 0 + Growth in labor force

For Q2:2020, we cannot use our shorthand approach: Suppose hours fall by 15% and labor productivity falls by 5% % Y = % labor productivity + % labor hours = -5% + -15% = -20% But the mathematically precise formula: 1.??% = (1-5%) (1-20%) = .76% = -24% AND THAT IS BEFORE ANNUALIZATION

We start by thinking about an individual company. We calculate the internal rates of return (IRR) of each potential project that the company is contemplating. Recall that the net present value (NPV) calculates the current value of a project s expected future cash flows for a given discount rate. The IRR calculates the discount rate that results in a value of ZERO for the project s NPV. Ergo, if the company s cost of capital their borrowing rate is below the project s IRR, the company will begin work on the project. . 10% 8% 6% 4% P1 P2 P3

THINK OF AN OIL SHALE DRILLER, REALITY AS OF 2/10/20 REALITY AS OF 4/15/20 AT 5% INTEREST RATE OIL PRICE: revenue 80 60 40 20 8000 3500 500 4000 6000 3500 500 2000 4000 3500 500 2000 3500 500 -2000 non-interest costs interest costs PROFITS 0 AT 15% INTEREST RATE OIL PRICE: revenue 80 60 40 20 8,000 3500 1,500 3,000 6,000 3500 1,500 1,000 4,000 3500 1,500 -1,000 2,000 3500 1,500 -3,000 non-interest costs interest costs PROFITS

WOULD YOU DRILL A WELL, THAT SPEWS OIL FOR THE NEXT 5 YEARS? FUTURES MARKET AS OF: TODAY SPRING 21 SPRING 22 SPRING 23 SPRING 24 AVERAGE OIL PRICE $20/BBL $36/BBL $39/BBL $41/BBL $43/BBL 35.8

Concho: a fracking based oil driller in Texas its share price, over the last 18 months:

Want to own an oil drilling company? What does the Q ratio tell you to do? . share total market cap $/share ($millions) ($billions) 10/18/2018 160 7/19/2019 100 4/15/2020 45 total change oil price market cap $/bbl % change 76 55 20 200 200 200 32,000 20,000 9,000 -38% -55% -72%

The Basic Loanable funds Model and Wicksell's The Basic Loanable funds Model and Wicksell's Natural Rate Natural Rate

The natural rate of interest: the borrowing rate that delivers a Goldilocks (not too hot, not too cold) economy So long as the money rate of interest persisted below the natural rate of return on capital, upward price pressures would continue. In Wicksell's theory price pressure could arise even if new credit were extended only against increases in production, that is, against "real bills". "Price stability would result only when the money rate of interest and the natural rate of return on capital-the marginal product of capital-were equal."

The loanable funds model, expanded to three The loanable funds model, expanded to three interest rates: interest rates: We create a model with three interest rates: rcthe real long term borrowing rate for corporations rg the real long-term borrowing rate for the government Fed monetary policy is tied to a third interest rate: rf the real short term interest rate: the real fed funds rate.

We net Fed actions, when figuring out houeholds need to finance government debt. Corporations demand funds in the corporate bond market: Dc demand of Corporations for funds in the corporate bond market Government demand for funds: TOTAL vs. PRIVATE Federal Reserve Buys and Sells Government Debt Government s Private Demand for funds: Net of Federal Reserve Transactions.

Four Actors: Households, Government, Federal Reserve, Corporations. Three Interest Rates : rfrg rc The Actions of Key Actors Federal Reserve sales or purchases of treasury bills, shifts net government demand for household funds in the treasury bill market: FRttb Federal Reserve t-bill transactions, add/subtract to net demand for household funds FRptb Federal Reserve purchases t-bills, reducing the net government demand for household funds FRstb Federal Reserve sells t-bills, adding to the net government demand for household loanable funds FRttb FRptbOR FRstb

In April the U.S. treasury will run a massive deficit, something like $500 billion, in just one month. That is roughly equal to the full year deficit of 2015 Reasons the deficit will soar: jobless benefit payments will soar payroll taxes collected will plunge food stamp payments will soar checks of $1,400 per person are going out ($100 billion) income taxes collected will plunge

How much of the debt will households, net need to buy? In April, the FRB, to stabilize illiquid markets, will likely buy $1.5 trillion in U.S. debt Dg = $500 billion Ft= $1,500 billion Shg = -$1,000 billion Hedge funds panic selling the most popular trade

The key to understanding the last slide? Stocks versus flows How much government debt is held by the public? $ 18 trillion How much is held by the Fed? $5 trillion How much is held by foreigners? $2 trillion

U.S. investors were panic selling some of the stock of outstanding debt

An example of Fed buying, removing the need for household funds, and lowering the equilibrium interest rate:

How monetary policy operates IN NORMAL TIMES Think of an individual investor. She has an opinion about how much risk to take: 2% risk-free bills, she commits 20% of her funds 3% risk-free bonds, she commits 30% of her funds 5% risky bonds, she commits 50% of her funds Now the rate on t-bills has been pushed down to 1%, via Fed open market operations. She will likely supply less in the t-bill market, given this lower rate of return. We see this as a movement along households supply curve for t-bills. Now money previously invested in t-bills shifts, and is invested in the t-bond and corporate bond market. Thus we have an outward shift for the bond market supply curves.

Monetary Policy Amid the Zero Bound, Monetary Policy Amid the Zero Bound, 2010 2010 in in How can the Fed get long term real rates lower, if it can t lower fed funds? Nominal Fed funds: 0% 10-year t-bond: 2% 2% Baa bond: 5% real -2% 0% 3% 2% 2%