Insights on Corporate Affairs: Animesh Mukhopadhyay's Vision 2019-2024

Explore the vision and initiatives outlined by CA Animesh Mukhopadhyay for the Ministry of Corporate Affairs from 2019 to 2024, including themes like ease of doing business, AI integration, and regulatory enhancements. Dive into the future of corporate governance in India.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

May 19, 2024 CA (IP) ANIMESH MUKHOPADHYAY Contact Details: Email: animesh_fca@yahoo.co.in Mobile No: (+91) 9830107220 1

DISCLAIMER THIS PRESENTATION IS ACADEMIC IN NATURE AND IS NOT INTENDED TO BE USED AS LEGAL ADVICE. READERS/ USERS ARE REQUESTED TO TAKE APPROPRIATE LEGAL ADVICE RELATING TO THEIR SPECIFIC SITUATIONS. MCA AND/OR AUTHORITY/ OTHER COURTS IN INDIA MAY NOT INTEPRETATIONS REVEALED HERE. AGREE WITH THE CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 2

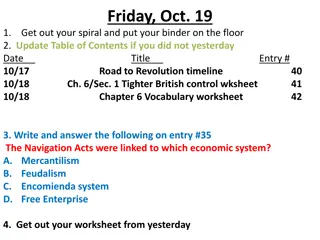

Can you identify this pic? CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 3

Chennai case ICLS officers from Chennai conducted search and seizure on 24.03.2023 at the registered office of Kanakkupillai CA firm involved in creation of more than 1500 cos where Co regn: 6141, GST Regn 999, TM -1999/- CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 4

Kolkata case Ticassa India Pvt Ltd Tax Audit Sign, UDIN and uploading -1500/-With JSON Creation- 2000/- Statutory Audit fee 800/- NW Certificate 800/- CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 5

VISION: 2019-2024 The Ministry of Corporate Affairs has identified the following six themes for its Vision 2019-2024, namely: Greater Ease of Doing Business. Overhaul of the existing Corporate Governance framework. To further Strengthen the Adjudicatory & Regulatory Institutions. AI and Analytics based MCA V3 Portal. Proposal of New Legislations. Single source of truth for key financial data. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 6

VISION 2019-2024 The Ministry operates the MCA21 System with the aim of providing stakeholders an easy, secure and speedy access to all registry related services with transparency and certainty. By leveraging Artificial Intelligence (AI) and analytics tools, the Ministry intends to deploy the next gen version 3.0 of the MCA21 system so as to meet the dynamically evolving needs of various stakeholders. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 7

VISION: 2019-2024 Growth of this new technology is not hindered and that innovation is not killed. These diametrically different approaches to regulate AI could pose difficult issues for the government, which is keen to harness the transformative technology s full potential through responsible regulation Balancing innovation and safety will be essential to create a sustainable and inclusive AI landscape that benefits the humanity as a whole. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 8

MCA Scrutiny e-Scrutiny: .S.O. 1257(E) dtd 18.03.2021 Under Sec 396 (1) and (2) of the Companies Act, 2013, the Central Government hereby establishes a Central Scrutiny Centre (CSC) for carrying out scrutiny of Straight Through Processes (STP) e-forms filed by the companies under the Act and the rules made thereunder. The CSC shall function under the administrative control of the e-governance Cell of the Ministry of Corporate Affairs. CSC shall carry out scrutiny and forward their findings to the concerned jurisdictional Registrar of Companies (RoC) CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 9

MCA Scrutiny Circular No: 5/ 2020 dated 22nd Apr 2020 SOP was issued to ROC Roc offices are directed to follow meticulously at the time of serving notices to the co and adequate care is provided to ensure that civil or criminal proceedings are not unnecessarily initiated against the Independent Directors (IDs) and Non-Executive Directors (NEDs) unless sufficient evidences come into existence. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 10

MCA Scrutiny Section 149 (12) is a non obstante clause - liability of an independent director (ID) or a non-executive director (NED) not being promoter or key managerial personnel would be only in respect of such acts of omission or commission by a co which had occurred with his knowledge, attributable through Board processes, and with his consent or connivance or where he had not acted diligently. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 11

MCA Scrutiny RoC office to examine Financial Statement, Form DIR 12 and Annual Returns to ascertain name of Directors and KMPs as on the date of default. RoC office may seek guidance of Director General of Corporate Affairs in case of any doubts on liability of any person or proceedings Gen Circular 01/2020 dated 02/03/2020 - Ordinarily, a WTD and a KMP are liable for defaults committed by a company. In absence of a KMP, such director or directors who have expressly given their consent for incurring liability in terms of the e-form GNL-3 filed with the Registrar would be liable. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 12

MCA Scrutiny Typically, apart from IDs, non-promoter and non-KMP, NEDs, would exist in the following cases: a) Directors nominated by the Government on the psu; b) Directors nominated by Public Sector Financial Institutions, Financial Institutions or Banks having participation in equity of a company, or otherwise; c) Directors appointed in pursuance to any statutory or regulatory requirement such as directors appointed by the NCLT. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 13

MCA Scrutiny 1. Form ADT-1- For Auditors 2. Form ADT-3- For Auditors 3. Form AOC-4- For Balance Sheet 4. Form AOC-5- For keeping the books of account at place other than Regd Office 5. Form CHG-1- For Charge related 6. Form CHG-4- For Charge related 7. Form DIR- 3- For Directors DIN CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 14

MCA Scrutiny 8. Form DIR -3 KYC For Directors details 9. Form DIR-12- For Directors appointment or cessation 10. Form INC-22- For Registered Office details 11. Form MGT-7- For Annual Return 12. Form MGT-15- For informing outcome of AGM by listed company 13. Form MSME-1-For outstanding to MSME 14. Form PAS-3 -For Return of Allotment CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 15

MCA Scrutiny The CSC shall carry out scrutiny of the aforesaid forms and forward findings thereon, wherever required, to the concerned jurisdictional Registrar of Companies for further necessary action under the provisions of the Act and the rules made E-adjudication: E-adjudication conceptualised to manage the increased volume of adjudication proceedings by Registrar of Companies (RoC) and Regional Directors (RD) and will facilitate end to end digitisation of the process of adjudication, for the ease of users. It will provide a platform for conducting online hearings with stakeholders and end to end adjudication electronically. thereunder. has module, been CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 16

Version 3.0 e-Consultation: To automate and enhance the current process of public consultation on proposed amendments and draft rules etc., e-consultation module of MCA21 v3 will provide an online platform amendments/draft legislations will be posted. Further, the system will also facilitate AI driven sentiment analysis, consolidation and categorization of stakeholders inputs and creation of reports on the basis thereof, for reference of MCA. wherein, proposed CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 17

Default and MCAs role If any e-form, document, application or return filed with RoC containing wrong/ false/misleading information/ omission of material fact or attachments by the person, the DSC shall be de-activated. Rule 10 gives power to RoC - if the e-Forms or documents identified as informative in nature and filed under STP may be examined at any time on suo-moto or on receipt of any information or complaint from any source at any time after its filing and RoC may call for further information or documents. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 18

Default and MCAs role If RoC finds any e-form or document filed under STP as defective or incomplete in any respect, at any time suo- moto or on receipt of information or compliant from any source at any time, he shall treat the e-form or document as defective and shall issue a notice. The called up person or company shall file the e-Form or document afresh along with fee and additional fee, as applicable at the time of actual re-filing, after rectifying the defects or incompleteness within a period of 30 days from the date of the notice. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 19

Default and MCAs role Any e-Form approved through STP , if within 8 years found as defective by CSC, then it will report to RoC and RoC will send Notice to file e-Form or document afresh along with the fees and additional fees in 30 days time. Please note there is no opportunity being given for resubmission or rectification of defect. 2. Whereas for any other e-Form other than STP , RoC will be sending notice and give opportunity to company to rectify and resubmit the form in 15 days time without any fees or additional fees. 3. RoC through CSC may open e-Forms filed earlier under STP (upto past 8 years) and Rule 10 (6) of these Rules provide that RoC may issue notice. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 20

Reflecting on the Amendments G.S.R. 298 (E) dated 17th April 2023 effective from 1st May 2023 : Effective from May 01, 2023 introducing the Companies (Removal of Names of Companies from the Register of Cos) Amendment Rules, 2023. Substitution of sub-rule (1) in Rule 4: An application for removal of name of a company under sub-section (2) of section 248 shall be made to the Registrar, Centre for Processing Accelerated Corporate Exit in Form No. STK-2 along with fee of INR 10000/- CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 21

Reflecting on the Amendments Insertion of Rule 3A :The Registrar, Centre for Processing Accelerated Corporate Exit established under sub-section (1) of section 396, shall be the Registrar of Companies for the purposes of exercising functional jurisdiction. Relevant forms introduced: STK 2, STK 6, STK 7, STK 8. Proof of surrender of PAN, GST, etc CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 22

Reflecting on the Amendments G.S.R. 354(E) dated 10th May 2023 Companies (Removal of Names of Cos from the Register of Cos) Second Amendment Rules, 2023. Rule 4(1) - co shall not file an application unless it has filed overdue financial statements under section 137 and overdue annual returns under section 92, up to the end of the financial year in which the company ceased to carry its business operations CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 23

Reflecting on the Amendments Provided further that in case a company intends to file the application after the action under sec 248 (1) has been initiated by the Registrar, it shall file all pending financial statements under section 137 and all pending annual returns under section 92, before filing the application. Provided once notice under Sec 248(5) has been issued by the Registrar for publication pursuant to the action initiated under section 248 (1), a company shall not be allowed to file the application under this sub-rule. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 24

Reflecting on the Amendments MCA Notification dated May 15, 2023: Companies (Compromises, Arrangements and Amalgamation) Rules, 2016. Substitution of sub-rule (5) and (6) of Rule 25: If no objection or suggestion is received from the ROC/OL, within a period of 30 (thirty) days from the date of submission of the scheme and the CG is of the opinion that the scheme is in public interest, a confirmation order shall be issued within 15 (fifteen) days after the expiry of 30 days. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 25

Reflecting on the Amendments MCA Notification dated May 15, 2023: Companies (Compromises, Arrangements and Amalgamation) Rules, 2016. Substitution of sub-rule (5) and (6) of Rule 25: If no objection or suggestion is received from the CG within a period of 60 (sixty) days, it is considered that the CG has no objection. Related Form: CAA 12 for issuance of scheme confirmation. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 26

Reflecting on the Amendments MCA Notification dated May 15, 2023: Companies (Compromises, Arrangements and Amalgamation) Rules, 2016. Substitution of sub-rule (5) and (6) of Rule 25: In case the CG deems fit for such objection by the ROC/OL as unsustainable, the confirmation order may be issued within 30 days, from the date of expiry of the initial thirty day period. Related Form: CAA 12 for issuance of scheme confirmation. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 27

Reflecting on the Amendments MCA Notification dated May 15, 2023: Companies (Compromises, Arrangements and Amalgamation) Rules, 2016. Substitution of sub-rule (5) and (6) of Rule 25: In case the CG deems such scheme to be violative of public interest, it may issue an application with the Tribunal, within 60 (sixty) days of the receipt of scheme. Related Form: CAA 13 for issuance of observations to the scheme. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 28

Reflecting on the Amendments MCA Notification dated October 27, 2023: Companies (Management and Administration) Second Amendment Rules, 2023. Insertion of sub-rules (4), (5) and (6) in Rule 9: Every Company is required to designate a person who shall be responsible for providing information to the ROC/Concerned Authority, w.r.t the beneficial interest in shares. Who can a Company Designate? A Company Secretary, if any. A key managerial personnel, other than the company secretary (iii) Every director, if there is no company secretary or key managerial personnel (i) (ii) CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 29

Reflecting on the Amendments MCA Notification dated October 27, 2023: Companies (Management and Administration) Second Amendment Rules, 2023. Insertion of sub-rules (4), (5) and (6) in Rule 9: Note that in case the Company, fails to designate, the following persons shall be responsible: Company secretary, if any (ii) Every Managing Director or Manager, in case a company secretary has not been appointed; or (iii) Every director, if there is no company secretary or a Managing Director or Manager. (i) MANDATORY DISCLOSURE in the Annual Return, from FY 2023- 24 onwards. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 30

Reflecting on the Amendments Related Form: In case of change of such designated person, the Registrar shall be intimated by E-Form GNL 2. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 31

Reflecting on the Amendments G.S.R. 802(E) dated 27th October 2023: Companies (Prospectus and Allotment of Securities) Second Amendment Rules, 2023. Insertion of Rule 9(2): Rule 9(2) - Every pub co which issued share warrants prior to commencement of the Co Act, 2013 and not converted into shares shall (a) within 3 months inform the ROC the details of share warrants though PAS -7 B) within 6 months of the commencement of this Rule shall surrender such warrants to the co and co shall place a notice for the bearers in PAS 8. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 32

Reflecting on the Amendments In case of any pending share warrants, the Company must inform the Registrar about the same within a period of 3 months from the date of commencement of the aforesaid rules. Relevant Form Introduced: PAS-7 Bearers of such share warrants are required to surrender them and get the shares dematerialized. March 18, 2025 CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 33

Reflecting on the Amendments The Company shall notify the bearers via Form PAS-8 on its website, and additionally, the same will be published in the newspaper (in English and Vernacular). What if the bearer fails to surrender the share warrant? A: In case of failing to surrender the warrants within the stipulated time, the Company is obligated to convert the same into dematerialized shares and transfer to the Investor Education and Protection Fund. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 34

Reflecting on the Amendments Companies (Prospectus and Allotment of Securities) Third Amendment Rules, 2018. Effective from 2nd October, 2018 Rule 9A - Every unlisted public company shall (a) issue the securities only in dematerialized form; and (b) facilitate dematerialization of all its existing securities Every holder of securities of an unlisted public company- (a) who intends to transfer such securities on or after 2nd October, 2018, shall get such securities dematerialized before the transfer; CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 35

Reflecting on the Amendments or (b) who subscribes to any securities of an unlisted public company (whether by way of private placement or bonus shares or rights offer) on or after 2nd October, 2018 shall ensure that all his existing securities are held in dematerialized form before such subscription. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 36

Reflecting on the Amendments What s in it for Private Companies? Insertion of Rule 9B: All Private Companies, other than Small Companies, are required to: (a) Issue securities ONLY in Dematerialized form, (b) Facilitate dematerialization of all its existing securities. Note that Companies are required to check the eligibility on the last day of the FY, on or after March 31, 2023. A time limit of 18 months have been prescribed to ensure compliance, i.e., on and from September 30, 2024. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 37

Reflecting on the Amendments Mandatory Dematerialization shall be required for which Transactions? (a) Issuance of securities by way of private placement (b) Buy-Back (c) Bonus Issue (d) Rights Issue. Exemptions: Government Company. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 38

Reflecting on the Amendments Private Companies are further required to ensure that the entire share holding of the Promoters, Directors and KMPs are in dematerialised form, prior to making any issuance or buyback of securities. Application with the dematerialization of existing securities and obtaining ISIN by coordinating with the RTA. Executing a Tripartite Agreement between the Issuer, RTA and Depository. Informing the existing dematerialisation. Depository for ensuring security holders about CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 39

Reflecting on the Amendments Filing of E-Form PAS-6 with the Registrar of Companies on a half yearly basis, within 60 days from the conclusion of each half-year. This move has been taken by the Ministry with a view to reduce the number of benami owners and to increase the transparency, especially in Private Limited Companies. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 40

Reflecting on the Amendments At present two Depositories viz. National Securities Depository Limited (NSDL) and Central Depository Services (India) Limited (CDSL) are registered with SEBI. Dematerialization is the process by which physical certificates of an investor are converted to an equivalent number of securities in electronic form and credited into the BO s account with his DP. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 41

Demat process How can one convert physical holding into electronic holding i.e. how can one dematerialise securities? In order to dematerialise physical securities, fill in a DRF (Demat Request Form) which is available with the DP and submit the same along with physical certificates that are to be dematerialised. Separate DRF has to be filled for each ISIN. The complete process of dematerialisation is outlined below: CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 42

Demat process 1. Surrender certificates for dematerialization to the DP. 2. DP intimates to the Depository regarding the request through the system. 3. DP submits the certificates to the registrar of the Issuer Company. 4. Registrar confirms the dematerialization request from depository. 5. After dematerializing the certificates, Registrar updates accounts and informs depository regarding completion of dematerialization. 6. Depository updates its accounts and informs the DP. 7. DP updates the demat account of the investor. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 43

Demat process ISIN (International Securities Identification Number) is a unique 12 digit alpha-numeric identification number allotted for a security (E.g.- INE383C01018). Equity-fully paid up, equity-partly paid up, equity with differential voting /dividend rights issued by the same issuer will have different ISINs. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 44

Demat process Can odd lot shares be dematerialized? Yes, odd lot share certificates can also be dematerialized. Do dematerialised shares have distinctive numbers? Dematerialised shares do not have any distinctive numbers. These shares are fungible, which means that all the holdings of a particular security will be identical and interchangeable. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 45

Demat process Can electronic holdings be converted back into physical certificates? Yes. The process is called rematerialisation. If one wishes to get back his securities in the physical form he has to fill in the RRF (Remat Request Form) and request his DP for rematerialisation. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 46

Demat process Shares in a physical format held by your grandparents or parents will come to you only when they have been converted into a dematerialised form. According to a circular issued by SEBI in April 2019, the request for transfer of shares will not be processed unless they are in dematerialised form. Exceptions: transmission and transposition of securities. Transmission is when the ownership title of the shares is being transferred via inheritance or succession. Transposition is when there is a re-arrangement or interchanging in the order of the shareholders. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 47

Demat process For conversion to a dematerialised form, file DRF. One DRF form will suffice for 4 share certificates. If there are more share certificates, submit separate sets of DRFs for different cos. The holder of the physical shares will have to submit the share certificates along with the DRFs and KYC documents to the broker. The broker will then send the transferable shares and documents to a registrar and transfer agent who then convert them into a non-manual form and gets reflected in the demat account. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 48

MCA Notifications MCA Notification dated January 24, 2024: Introduction of the Companies (Listing of equity shares in Permissible Jurisdictions) Rules, 2024 ( LEAPRules ). Permissible Jurisdictions Listing on the International Financial Services Centre ( Gift City ) India International Exchange and NSE International Exchange. For too long, Indian companies dreamed big but faced hurdles in accessing global capital. ADRs, GDRs, and foreign borrowings have their complexities. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 49

MCA Notifications MCA Notification dated January 24, 2024: Introduction of the Companies (Listing of equity shares in Permissible Jurisdictions) Rules, 2024( LEAPRules ). The pivotal moment wasn t spontaneous, it was followed by certain strategic actions: (a) In 2020, the Companies (Amendment) Act, enables direct listing on the Foreign Stock Exchange. (b) MCA and MOF took the baton thereby notifying the LEAP Rules, along with the FEMA Amendment Rules, easing overseas listing. (c) SEBI is yet to notify the Operational Guidelines in this regard. CA ANIMESH MUKHOPADHYAY animesh_fca@yahoo.co.in 50