Interest Rate Risk and Derivatives

Understanding interest rate risk, its impact on financial instruments, and strategies to hedge using interest rate derivatives. Explore concepts like price risk, reinvestment risk, yield to maturity, and bond valuation in changing interest rate environments.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Lecture 3 Interest rate risk and interest rate derivatives

Todays content Interest rate risk and term structure of interest rates Hedging using interest rate derivatives Interest rate futures Forward rate agreement Interest rate swaps Interest rate options Readings: oBuckley (2012) chapters 12 and 16 oBessis (2015) sections 5.1 and 6.2

Questions: Are floating-rate bonds subject to interest rate risk? Are fixed-rate bonds subject to interest rate risk?

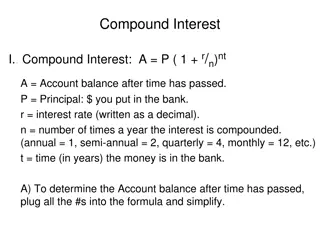

INTEREST RATE RISK Interest rate risk = probability of loss due to a change in interest rates Changing interest rates impact both the income statement (net interest margin) and the balance sheet (assets, liabilities and net worth) of firms Two types of interest rate risk: Price risk: when interest rates rise, the market value of the bond or asset falls Reinvestment risk: when interest rates fall, the coupon payments on the bond are reinvested at lower rates Interest rates are the price of credit: Demanded by lenders as compensation for the use of borrowed funds Expressed in percentage points and basis points (1/100 of a percentage point)

Interest rate and market price Yield to Maturity (YTM): discount rate that equalizes the current market value of a loan or security with the expected stream of future income payments that the loan or security will generate Reflects the current level of market interest rates

Example Bond with face value = 1,000 at a fixed rate (i) of 10% with maturity = 10 years For the issuer (company) = cost of 10% For the subscriber (investor) = interest (coupon) of 10% What is the present value of the bond for a market interest rate r = 10%? + 10 10 = 100 + 1000 + 1 1 ( ) 1000 + r = + = + 100 P ( ) ( ) 10 k 10 1 ( ) r r 1 1 r r 1 k

Questions: Now assume that just after the bond is issued, the market interest rate falls from 10 to 9%. What is the new value of the bond? Is it a gain/loss for the issuer? For the investor? What is the value of the bond if the interest rate rises to 11%?

+ 10 10 = 100 + 1000 + 1 1 ( ) 1000 + r = + = + 100 P ( ) ( ) 10 k 10 1 ( ) r r 1 1 r r 1 k If r = 10% P = 1,000 If r = 9% P = 1,064.18 If r = 11% P = 941.11

Termstructure of interestrates Effect of time on interest rates UK benchmark yields (Source: http://markets.ft.com/data/bonds) 1-month Treasury notes = 0.15% 6-month rate = 0.26% 1-year rate = 0.08% 5-year rate = 0.40% 10-year rate = 1.20% 30-year rate = 1.92% Different term structures = yield curves

Flat structure Interest rate 6% Maturity 6m 10y

Upward sloping structure Interest rate 6% 5% Maturity 6m 10y

Downward sloping structure Interest rate 6% 5% Maturity 6m 10y

Example: UK yield curve http://markets.ft.com/data/bonds 2005 2012

Other countries: www.bloomberg.com/markets/rates-bonds/government-bonds/us www.bloomberg.com/markets/rates-bonds/government-bonds/japan www.bloomberg.com/markets/rates-bonds/government-bonds/germany

Termstructure theory Why different maturities have different yields? 3 explanations: Liquidity preference Investors prefer short-term assets to long-term assets Speculation + precaution Need a liquidity premium for long-term investment upward sloping structure

Segmented markets Strong preferences for certain maturities Insensitive to interest rate differentials between preferred maturities and others (strong risk aversion) Ex. of insurance companies: Need to balance assets & liabilities maturities Pure expectations Long-term interest rate = geometric average of current short-term rate and expected future short-term rates (1+r0,2) = (1+r0,1)(1+r1,2) Expectation of rising rates upward sloping Expectation of falling rates downward sloping

Interest rate risk management Derivatives Interest rate futures Forward rate agreement (FRA) Interest rate swaps Options Refinancing / Repricing next week Restructuring the loan agreement (change maturity, fixed/floating rate, etc.) Interest-sensitive gap management Duration gap management

Types of derivative contracts used by depository institutions to manage different types of risk exposure, 3rd quarter 2014 Derivative contracts by underlying risk exposure Interest rate Foreign exchange Equity Commodity Credit 190,894,367 37,993,284 2,317,269 1,327,011 10,408,372 78.6% 15.6% 1.0% 0.5% 4.3% Derivative contracts by transaction type Swaps Futures & Forwards Purchased options Written options 148,328,645 45,058,646 17,991,014 17,560,650 64.8% 19.7% 7.9% 7.7% Source: FDIC Quarterly, 2014, Volume 8, No. 4

Interest rate futures Most common financial futures contracts Long-term contracts: US Treasury bond futures US Treasury notes futures Short-term contracts: 3-month Eurodollar time deposit futures 30-day Federal funds futures 1-month LIBOR futures Tick = smallest increment by which the price varies = smallest possible price movement

Quoting interest rate futures Long-term futures contracts are quoted as % of par: In the US, tick = 1/32 of 1% E.g. US Treasury bond futures price = 96-12 = 9612/32 = 96.375 (% of notional principal) Contract value = 100,000*96.375/100 = $96,375 1 tick = 100,000*1/32*1/100 = $31.25 A quote of 96-31 increasing by 1/32 will give a new quote of 97-00 Short-term futures contracts are quoted as an index (same around the world): Index = 100 interest rate E.g. interest rate of 4.8% Quote of 95.20 Quote Price Actual price = 100 (rate/100)*( t/360) For 3-month Eurodollar futures, 1 tick = 1 basis point = 0.01% $1,000,000*0.01/100*3/12 = $25 For 3-month T-bill futures, 1 tick = 1/2 basis point = 0.005% $1,000,000*0.005/100*3/12 = $12.5

Example: Quotes on 10 April 2008 Source: http://markets.wsj.com/

Hedging with futures Interest rate risks that most firms face are: Protecting the market value of securities and loans from losses due to rising interest rates Avoiding a rise in borrowing costs Avoiding a fall in the interest returns expected from loans and security holdings Hedge is structured to create profits from futures transactions in order to offset losses experienced on the balance sheet

Long hedge vs. short hedge Hedge against drop in interest rates Buy futures contracts A buyer of a futures contract is said to be long futures Agrees to pay the underlying futures price or take delivery of the underlying asset Buyers gain when futures prices rise and lose when futures prices fall Hedge against rise in interest rates Sell futures contracts A seller of a futures contract is said to be short futures Agrees to receive the underlying futures price or to deliver the underlying asset Sellers gain when futures prices fall and lose when futures prices rise In both cases, gain/loss = purchasing price selling price In both cases, gain/loss is offset by loss/gain on the underlying asset

Example: Protecting the market value of securities from losses due to rising interest rates In January, a bank owns $5 million 10% US Treasury bonds maturing in 20 years Since the bank acquired the bonds 2 years ago, their price has decreased due to rising interest rates Current market price (C0) = 994/32 Market value of bonds = $5,000,000 * (994/32/100) = $4,956,250 The bank fears that interest rates will continue to rise over the next year and wants to hedge its position in US Treasury bonds Short hedge = Sell 50 US Treasury bond futures contracts (= 50*100,000 = $5,000,000) Price (F0) = 976/32 In October, the bank decides to sell the bonds it owns and close its position on the futures (i.e., buy 50 contracts).

1. If interest rates further increased between January and October: New bond price (Ct) = 862/32 New market value of bonds = $5,000,000 * (862/32/100) + ($5,000,000*10%*9/12) = $4,678,125 Loss on the fixed-income market = 4,956,250 4,678,125 = $278,125 $375,000 New futures price (Ft) = 844/32 Gain on the futures market = $100,000*50*(976/32 844/32)/100 = $653,125 Net result = +$375,000 Hedge is perfect

2. If interest rates decreased between January and October: New bond price (Ct) = 1098/32 New market value of bonds = $5,000,000 * (1098/32/100) + ($5,000,000*10%*9/12) = $5,837,500 Gain on the fixed-income market = 5,837,500 4,956,250 = $881,250 New futures price (Ft) = 10710/32 Loss on the futures market = $100,000*50*(976/32 10710/32)/100 = $506,250 Net result = +$375,000 Hedge is perfect

Forward Rate Agreement (FRA) One party guarantees the other party an interest rate for a given time period on a given notional amount of principal Lock in the effective rate of interest in advance of the intended date of borrowing/deposit Fix a future borrowing cost buy a FRA Fix a future return on deposit sell a FRA The 2 parties will exchange the difference between the reference rate (market rate) and the fixed rate (FRA rate)

Example Treasurer forecasts a need for 10m in 3 months that will last for 3 months Cannot borrow immediately because has no use for the funds now But wants to protect himself against a rise in interest rate Buy a FRA Today: 3-month interest rate: 7.875% (month 1,2,3: 7.875) 6-month interest rate: 8.125% (month 1,2,3,4,5,6: 8.125) FRA rate = 8.21% (month 3,4,5: 8.21)

On settlement date (after 3 months): Company borrows for 3 months on the market (at the current rate) If current market rate > contract rate counterparty pays the difference If 3-month interest rates = 8.375% bank borrows at 8.375% Counterparty pays (8.375% 8.21%) x 90/360 x 10m = 4,125 Effective cost of borrowing = 8.375% (8.375% - 8.21%) = 8.21% If current market rate < contract rate bank pays the difference If 3-month interest rates = 8% bank borrows at 8% Pays to the counterparty (8.21% 8%) x 90/360 x 10m = 5,250 Effective cost of borrowing = 8% + (8.21% - 8%) = 8.21%

INTEREST RATE SWAPS Manage interest rate risk over a longer time horizon Agreement between 2 parties to exchange a series of payments for a stated period of time, e.g. fixed vs floating OTC product The first interest rate swap occurred between IBM and the World Bank in 1981 In 1987: Swaps market had a total notional value of $865.6 billion (International Swaps and Derivatives Association) By end-2014: this figure exceeded $380 trillion (Bank for International Settlements) more than 15 times the size of the US public equities market

Example 1: Basic swap Firm X with fixed-rate debt (10%) Expects interest rates to fall Would like to enter into a pay floating/receive fixed interest rate swap Firm Y with floating-rate debt service payments (Libor + 1%) Expects interest rates to rise Would like to enter into a pay fixed/receive floating interest rate swap

Situation before the swap Situation after the swap 10% X Y Libor +1% 10% Libor +1% Fixed income market Interbank market

Example2: Quality swap See seminar slides

Interest-rate options Over-the-counter market (OTC) Custom-tailored options Any maturity Good liquidity, but counterparty risk remains Options on FRA Organized exchanges Standardized interest-rate option contracts Clearing House Options on futures: U.S. Treasury Bond Futures Options; Eurodollar Futures Option Caps, floors and collars

Options on FRA Borrower fears an increase in interest rates Buy a call on FRA Lender fears a decrease in interest rates Buy a put on FRA In both cases, pay the premium (%) Underlying = market rate (e.g. LIBOR) Strike price = FRA rate

Example Treasurer forecasts a need for 10m in 2 months that will last for 30 days Wants to protect himself against a rise in interest rates but wants to take advantage of a possible fall Buy a call with FRA rate = 4% Underlying = 1-month Libor Premium = 0.25% (for 2 months) What is the effective cost of borrowing in 2 months if: Libor = 5%? Libor = 3%?

If Libor= 5% Exercises the call and borrows at 4% (1 month) 30 = = 10 m 4 % 33 333 , Cost of borrowing: 360 60 = . 0 = 10 m 25 % , 4 167 Cost of the option (2 months): 360 30 ( ) = + . 0 = 10 m 4 % 2 25 % 37 500 , Total cost: 360 Effective rate = 4.5% If 1-month Libor > 4% in 2 months Effective cost = FRA rate + 0.5%

If Libor= 3% Let the call expire and borrows at 3% 30 = = 10 m 3 % 25 , 000 Cost of borrowing: 360 Cost of the option = 4,167 30 ( ) = + . 0 = 10 m 3 % 2 25 % 29 167 , Total cost: 360 Effective rate = 3.5% If 1-month Libor < 4% in 2 months Effective cost = Libor + 0.5%

Profit and Loss at maturity Gain 4% 0 Libor 1M 4.5% - 0.5%

Guaranteed rate and effective rate Interest rate Effective 4.5% 0.5% Guaranteed 4% 0 Libor 1M 4%

Next week: Asset Liability Management (ALM) Interest rate gap and duration