Investing Basics

This content explores different sociological perspectives of the mass media, such as the Functionalist View, Conflict View, Dominant Ideology, Feminist View, and Interactionist View. It delves into how the media functions as an agent of socialization, enforcer of social norms, conferral of status, surveillance of the social environment, gatekeeping, and construction of reality. The content also examines issues like cultural domination, underrepresentation of women, and the normalization of stereotypes in media portrayals.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Investing Basics A lot of this presentation was taken from https://youtu.be/6B6UkD3inaA Diagnostic Imaging

High Interest savings Bank account Non- registered investment RRSP TFSA

Bank account For day to day banking It is not earning any significant interest for you

High Interest savings accounts Accounts are safe Interest is still kind of low Accessible Short term savings goals like for a vacation or car

Non- registered investment RRSP TFSA

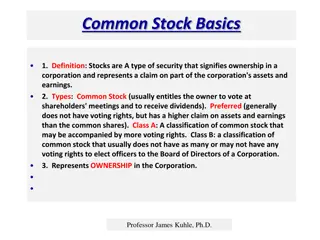

Stock Cash Ca$h Fund Bond Investment Account Bank Account

Non registered account This is an account you open at a bank, online brokerage or investment firm You transfer money from a bank account into this basket The money sits there until it is invested You invest in a stock/bond/fund It hopefully makes money over time You are taxed on that money

RRSP Very popular Great deal for Canadian investors You put money in an RRSP and you get a tax deduction, If you earn $60,0000 this year and put $10,000 of that in an RRSP You only pay tax on $50,000 That is a difference in taxes of several thousand dollars You receive a tax refund The investments in here grow TAX FREE while in the RRSP basket You can reinvest that money in more stocks BUT once you take money out you get taxed on it

RRSP There is an upper limit on what you can contribute per year You are forced to start taking money out at age 71

TFSA You put money in your TFSA now The money you put in is AFTER tax money no tax refunds here! You don t pay tax on any money in the account or when you withdraw There is again a cap on what you can contribute per year

What to use? Better to try at least something!

Financial Advisor/Planner Ask them their certification and how long it took Ask them their fiduciary obligations Ask them their T-REX score

You Invest: $100 Annual Rate of Return: 8% Annual Fee: 2%

References and links https://youtu.be/6B6UkD3inaA https://larrybates.ca/t-rex-score/ https://larrybates.ca/what-does-my-t-rex-score-mean/ https://larrybates.ca/t-rex-math/