Iowa Corn and Soybean Price Trends

In this collection of images, Chad Hart, a Crop Marketing Specialist, provides insights into Iowa corn and soybean prices compared to costs over the years. The visuals also show crop price seasonal patterns and the importance of having a marketing plan to navigate market fluctuations and avoid common pitfalls like fear, greed, and ego. Learn about different marketing methods such as cash sales, forward contracts, futures contracts, and options contracts, along with their advantages and disadvantages.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Marketing Exercise Ag Credit School Ankeny, Iowa June 6, 2024 Chad Hart Professor/Crop Marketing Specialist chart@iastate.edu 515-294-9911

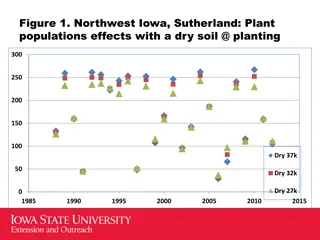

Crop Price Seasonal Patterns Source: USDA, NASS, Monthly Price Data 1981-2023

Why Should You Have a Marketing Plan? Detached from the decision Proper perspective Introduces discipline and consistency Check your logic What if

Fear, Greed, and Ego Fear of making a bad decision -- Watching prices slip away as you wait -- Watching prices rise after you ve sold Greed of expecting even higher prices -- Not taking advantage of good price opportunities Ego of wanting to claim you caught the market high -- Lake Wobegon marketing

Ego 8 7 $ per bushel 6 5 4 3 1/3/2007 3/3/2007 5/3/2007 7/3/2007 9/3/2007 1/3/2008 3/3/2008 5/3/2008 7/3/2008 9/3/2008 1/3/2009 3/3/2009 11/3/2007 11/3/2008

Advantages and Disadvantages Method Advantages Disadvantages Cash sales Easy to transact Immediate payment No set quantity Minimize risk No price protection Less flexible Forward contract Easy to understand Flexible quantity Locked-in price Minimize risk Must deliver in full Opportunity loss if prices rise Futures contract Easy to enter/exit Minimize risk Often better prices than forward contracts Opportunity loss if prices rise Commission cost Performance bond calls Set quantities Options contract Price protection Minimize risk Benefit if prices rise Easy to enter/exit Premium cost Set quantities Commission cost

What Makes a Marketing Plan Work? Knowing your market positions Track all positions where do you stand on % sold and average price? Making the plan manageable Don t expect to achieve your highest targets Focus on only tools you feel comfortable using Set price targets that are realistic Use multiple sources of analysis

Goals for the Marketing Exercise Learn more about the use of futures hedges in pricing Explore the use of futures across a variety of marketing years

Set-up for the Marketing Exercise Central Iowa farm, with 1,000 acres being planted to corn Production costs match ISU s estimates, $4.55 for corn following soybeans Expected yield is 200 bushels per acres, so expected production is 200,000 bushels You have monthly opportunities to pre-harvest market via futures hedges (or hedge-to-arrive) from November before planting to just before harvest in September

Set-up for the Marketing Exercise Basis will be set at harvest During March, you can choose to purchase crop insurance or go without, with the premiums based on 2024 levels Futures prices, basis levels, and realized yields are based on actual market and yield data for Iowa for a year sometime between 1976 and 2023 We ll compare results at the end of the year, and then plug in different years to show how your plan would work under different conditions

During the Marketing Exercise Remember the idea to test out hedging within this simulation The marketing exercise spreadsheet and instructions will be made available to all after the simulation This is a friendly exercise Please no wagering or smacktalk during the exercise (unless the instructor started it)

Thank you for your time! Any questions? My web site: https://faculty.sites.iastate.edu/chart/ Ag Decision Maker: http://www.extension.iastate.edu/agdm/

Iowa State University is an equal opportunity provider. For the full non-discrimination statement or accommodation inquiries, go to www.extension.iastate.edu/diversity/ext. Iowa State University ofrece igualdad de oportunidades. Para ver la declaraci n completa de no discriminaci n o para consultas de acomodaci n, siga a este vinculo: www.extension.iastate.edu/diversity/ext.