Joint Solar and Energy Storage Member Steering Group Meeting

The Joint Solar and Energy Storage Member Steering Group Meeting held on 12th June 2020 focused on decarbonizing the economy. Discussions included key policy updates, capacity market changes, clean growth fund consultations, impact of coronavirus on the industry, and the future of energy storage. Various presentations and discussions highlighted important aspects of the energy sector and emphasized the pivotal role of solar and storage technologies in the transition to a sustainable future.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Joint Solar and Energy Storage Member & Steering Group Meeting 12thJune 2020 Decarbonising the economy

Housekeeping In the GoToWebinar format, and to prevent background interruptions, microphones will be automatically muted at the start of the meeting. If you would like to make a contribution in the meeting, please raise your hand if you would like to be unmuted to share something. To do this: In the control panel on the right of your screen, in the left-hand bar, there is a small hand-shaped icon, click on this to raise your hand. Steering group members are attending as panellists and will be able to unmute themselves. When you have finished speaking, please remember to mute yourself again. You can also make comments via the chat box, or ask questions to the presenters via the question box. This information is also in the update sent out to you this morning.

Agenda Time Energy Storage and Solar Steering Groups and Members 14.30 16.00 Welcome Vijay Shinde to Chair meeting Capacity Market Changes Double Charging for Storage Definition of Storage Clean Growth Fund 14.30 c.15.0 0 Consultations REA outline of proposals and discussion Half-Hourly Settlement Consultation (closing date TBC) Network Options Assessment Methodology (closing date 26 June) CMP 345 CUSC Consultation to Defer Covid-19 related BSUoS (Balancing Service Use of System) Charges into 2021 (NB. Final consultation closed 3pm today) Grid Securities Talk from Mark Hollands and Tim Humpage at British Solar Renewables c.15.00 c.15.10 Impact of Coronavirus on the Solar and Energy storage industries & Green Recovery REA overview Business Rates Presentations and Discussion Presentations from Thomas Kinsey at Gerald Eve, and representatives from the Solar and Energy Storage Steering Groups c.15.15- 15.30 c.15.30 16.00 The Future of Energy Storage Discussion, presentation from Hannah Clapham, Head of Energy Storage at BEIS, (3.40pm) and Q&A Close

Welcome and Key Policy Updates Capacity Market Changes Emissions limits introduced (REA long standing ask) Fossil fuel utilising plants, exemption under 1MW DSR 15 year contracts possible, increased credit cover to 10k Standalone Storage projects cannot bid as DSR (now enshrined in legislation) Multi-year DSR CMUs that contain a storage component will be de-rated as storage and must undergo extended performance testing for the duration of their agreement Secondary trading of projects possible from1MW size (previously 2MW) Covid 19 Business Continuity - Long-stop Date for New Build CMUs awarded T-1 agreements for the Delivery Year 2020/21 extended by 12 months, Also 12 month extension for Refurbishing CMUs with multi-year agreements which start in Delivery Year 2020/21 and New Build CMUs awarded T-4 agreements which started in Delivery Year 2019/20

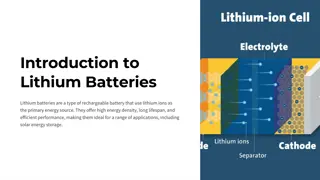

Key Policy Updates End to Double Charging for Storage Introduced SSFP and REA Ask: CMP281 Removal of BSUoS Charges From Energy Taken From the National Grid System by Storage Facilities for implementation on 1 April 2021 Will prevent Balancing Service Use of System (BSUoS) charges being levied on electricity volumes imported by storage facilities operating under a generation licence Other generation and non-licensed storage would still be liable for BSUoS charges on imports. Ofgem views the change as a stepping stone to an enduring solution that may follow the conclusions of the second Balancing Services Charges Task Force. Definition of storage Generation approach as flagged in past few years Primary Legislation definition sought Clean Growth Fund 40m of funding announced for innovative projects, match funding could increase this to 100m

Consultations Half-hourly Settlement Consultation (closing date TBC) Network Options Assessment Methodology (closing date 26 June) CMP 345 CUSC Consultation to defer Covid-19 related BSUoS (Balancing Service Use of System) Charges into 2021 (closed 3pm Friday 12 June)

CMP 345 CUSC Modification On 1 June the NG ESO published a workgroup consultation on proposals brought forward to delay payment of additional Covid-19 related BSUoS (Balancing Service Use of System) charges to the next Charging Year. The consultation closed on 3 June. The REA supports moves to facilitate flexibility at this very difficult time for all participants in the energy market. However, we have raised concerns with the NG ESO that the proposal as it stands will lead to a permanent loss of value to embedded generators, should proposal CMP 333 to remove embedded benefits in the next Charging Year be approved this summer. We have also raised concerns about the backdating of CMP 345 to 1st May, which could see CMP 345 apply to payments already made to embedded generators. This would see a situation where suppliers had to ask for that money to be returned. These proposals could also penalise new transmission-connected generation that comes online later in 2019 or early 2020, as they would be paying increased BSUoS charges for a period in which they were not operational. The NG ESO shares many of these concerns and has proposed an alternative option which would keep the charges within this financial year. On 9 June, a final consultation was published, which closed at 3pm today. The consultation report revealed a finely balanced split within the workgroup. The modification will now go to Ofgem for a decision, expected on or around 23 June.

Grid Securities British Solar Renewables verbal presentation and discussion, from Mark Hollands, Energy Strategy Director, and Tim Humpage, CEO.

Green Recovery & Impact of Coronavirus on Solar and Energy Storage Affect of pandemic and lockdowns on Solar and Energy Storage sectors REA initial view (Isobel Morris, Policy Analyst, REA) Green Recovery Overview (Amy MacConnachie, Head of External Affairs, REA)

REA JOINT SOLAR & ENERGY STORAGE MEETING 12 June 2020 Tom Kinsey Partner tkinsey@geraldeve.com 07944 583953 geraldeve.com

2017 RATING LIST WHERE ARE WE? Background to the 2017 List Update on appeals Solar Wind Batteries Covid-19 rate mitigation measures geraldeve.com

2021 REVALUATION POSTPONEMENT WHATS NEXT? Why was this postponed? The importance of the valuation date What are the implications for renewables? Solar & Wind Batteries Government s Fundamental Review geraldeve.com

Next phase of smart energy policy Flexibility is essential for achieving net zero, savings of up to 40bn. The 2017 Smart Plan and 2018 Progress Update were the first step in creating a flexible energy system, we have made good progress against the actions set out in the plan. Govt and Ofgem now need to consider the next phase of Smart Energy policy taking into account our net zero ambitions. This engagement is a key part of this. In this slide-pack we are focusing on policy and regulatory barriers to electricity storage. Not opening up markets and how markets value flexibility, which is being covered separately (workshop 7th February and webinar 27th March, further engagement to follow) DRAFT: NOT GOVERNMENT DRAFT: NOT GOVERNMENT POLICY POLICY

We have identified key themes to explore Flexibility Analysis Updated analysis showing how much flexibility may be needed in a net zero system, and from what sources & technologies Buildings Consumers Infrastructure Identification of specific regulatory barriers to smart technologies, including large-scale long-duration storage and domestic batteries. Set a vision for smart buildings. Identify barriers for the technical aspects of DSR, and ensure a holistic multi-vector approach is taken to building decarbonisation across heat, energy efficiency, transport and other sectors. Framework for driving participation and protecting consumers, through perspective of domestic, fuel poor, SME, I&C, local and public consumers. Cyber security and appropriate regulatory approach for aggregators. Data & Digitalisation Set out a strategic approach to digitalisation and opening up data across energy sector, including development of key products, data architecture and best practice guidance. Innovation Markets Ensure flexibility is fairly rewarded. Improve co-ordination & assess the value of carbon across markets. Consider new markets & ensure existing markets are right for net zero. Set out approach to innovation for both technologies and business models across each of the above smart systems themes Flexibility Monitoring Set out how we will monitor how much flexibility is coming forward, assess whether this is in line with estimated system needs, and propose the indicators we ll use to know whether/how to adapt our approach. DRAFT: NOT GOVERNMENT POLICY

What have Govt/Ofgem done so far? July 2017 SSFP focused on creating a best in class regulatory framework by removing regulatory barriers and reforming markets so that storage is rewarded fairly for the value it provides to the system Modifications to change use of system charges for storage progressed through industry governance, with some being approved by Ofgem. Ofgem consulted on modified generation licence for storage; when finalised this will enable avoidance of final consumption levies, definition of storage included for regulatory clarity, clarification of expectations for facilities below 50MW. Govt clarified under what conditions storage facilities can avoid payment of Climate Change Levy (CCL) Govt launched two consultations on reforming the planning system; facilitating the deployment of large scale storage. Govt. launched H&S governance group; funding gap analysis of standards framework. Ofgem introduced licence change to state DNOs cannot operate storage. Ofgem/Govt. guidance on co-location of storage with RO/FIT/CfD accredited plant. Govt launched Smart Export Guarantee (SEG). ENA consultations on queue management; clarity from DNOs on fast track process for storage. Govt launched several innovation projects; 20m to support deployment of large scale, long duration storage, 274m Faraday Battery Challenge, 9m cost reduction competition. - - - - - - - - - - DRAFT: NOT GOVERNMENT POLICY POLICY DRAFT: NOT GOVERNMENT

Future storage landscape Revenu es e.g. access to markets, valuing flexibility, transparen cy. Industry estimates by 2050 Landscape of barriers Standar ds, codes, guidanc e e.g. Health and safety framework, metering arrangement s Costs e.g. tax, policy costs, network charging, connection s Regulat ory clarity e.g. licensing, planning framework, network access arrangeme nts National Grid FES 2019 predicts 20-25 GW by 2050.2 Storage deploym ent Aurora predicts the need for 30GW of intraday storage capacity by 2050.1 Innovati on spend e.g. cost reduction, developing supply chain National Infrastructure Commission suggests between 15-20GW in 20503 Incentiv es e.g. smart export guarantee DRAFT: NOT GOVERNMENT POLICY POLICY 1 Aurora: The Road to 2050, 2019 2 National Grid: Future Energy Scenarios 2019, figures for community renewables and two degree scenarios 3 NIC: Net Zero: Opportunities for the power sector, 2020 DRAFT: NOT GOVERNMENT

Outcomes We have provided a certain level of regulatory clarity (noting we need to do primary legislation) Several regulatory barriers have been removed and we have seen storage (particularly batteries) deploy Storage is participating in a wide range of markets Are existing reforms to the policy and regulatory framework alongside the reforms to flexibility markets likely to result in sufficient deployment of storage for net zero? Is electricity storage able to deploy at every scale (domestic, behind the meter, grid scale) and for every type of consumer? Once all the actions in the original plan are implemented we will have removed several key policy and regulatory barriers to the deployment of grid-scale storage, (although we recognise there is more to do on flexibility markets). In our next phase of work, as well as driving forward outstanding actions we think we need to address policy and regulatory barriers for storage at different scales, for example domestic/small scale storage and large-scale, long-duration storage. DRAFT: NOT GOVERNMENT POLICY POLICY DRAFT: NOT GOVERNMENT

Areas identified for further investigation Facilitating the deployment of large-scale, longer-duration storage Stakeholders have identified that large- scale, longer duration storage may struggle to deploy due to high upfront costs. We want to better understand the role this type of storage will play in the energy system as well as the barriers they face and how best we can address these. Delivering existing actions and identifying additional barriers Some of the actions we set out in the original SSFP have not yet been fully implemented, we want to understand from stakeholders whether they are on track, how best these can be driven towards implementation and whether there are follow on actions? Facilitating the deployment of domestic/small scale storage We have identified some further barriers to the deployment of storage at a domestic/small scale level. We want to understand from stakeholders whether there are any further barriers, whether the business case for storage in this setting stacks up and what could be done to improve this further. Areas identified: Planning guidance Definition of storage Connections Innovation Business Rates Areas identified: Quantified system benefits of this type of storage How challenges should be addressed in policy/regulatory frameworks Facilitating a level playing field Innovation needs for this type of storage Areas identified: Health and Safety and asset registration Smart Export Guarantee Removal of final consumption levies VAT DRAFT: NOT GOVERNMENT POLICY POLICY DRAFT: NOT GOVERNMENT

Forthcoming EV Events