Kentucky Tobacco Tax Facts 2014 and Public Health Implications

Explore Kentucky's tobacco tax landscape in 2014, including cigarette excise tax, sales data, and impacts on public health. Discover the rationale behind push for a $1.00 increase in cigarette prices. Delve into the costs of tobacco on healthcare, Medicaid, and productivity in Kentucky.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

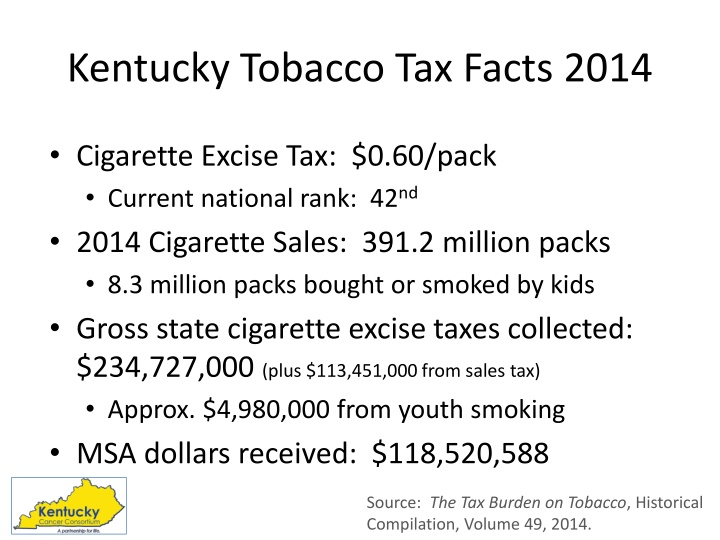

Kentucky Tobacco Tax Facts 2014 Cigarette Excise Tax: $0.60/pack Current national rank: 42nd 2014 Cigarette Sales: 391.2 million packs 8.3 million packs bought or smoked by kids Gross state cigarette excise taxes collected: $234,727,000 (plus $113,451,000 from sales tax) Approx. $4,980,000 from youth smoking MSA dollars received: $118,520,588 Source: The Tax Burden on Tobacco, Historical Compilation, Volume 49, 2014.

State Cigarette Tax Rates Average = $1.61 per pack As of 4/1/2016

Tobacco Taxes and Tobacco Use Federal, state, and local taxes that raise prices on tobacco products improve public health by reducing initiation, prevalence, and intensity of smoking among young people. Comprehensive reviews of the literature on the effect of price on tobacco consumption estimate a 3-5% reduction in overall cigarettes consumed as a result of a 10% increase in cigarette prices, and youth and young adults have proven to be even more responsive than adults to higher cigarette prices . --2012 U.S. Surgeon General s Report, Preventing Tobacco Use Among Youth and Young Adults, pg. 809-810

Why at least $1.00? If the average price of a pack of cigarettes in KY is $4.86, and a 10% price increase will reduce consumption by 3-5%, why push for at least a $1.00 when $0.50 will do the trick? it is possible that the observed reductions in smoking among youth would have been even larger had the price increases from state and federal taxes not been offset at least partially by discounting and other price- related promotions by cigarette companies. --2012 SGR, pg. 526

The Cost of Tobacco in KY Annual health care costs from smoking: $1.92 billion Medicaid costs: $589.8 million Residents state & federal tax burden from smoking-caused government expenditures: $1,185 per household Productivity losses: $2.79 billion Source: Campaign for Tobacco Free Kids

Tax Reform In the Kentucky s movement for tax reform, where does increasing the tobacco tax fit? Opportunities? Threats?