Key Insights into Bridge Lending Market & Investment Strategies

Explore the dynamics of bridge lending, its benefits for investors, regulatory nuances, market size analysis, and real-world case studies. Gain valuable knowledge to enhance your investment decisions in this asset class.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

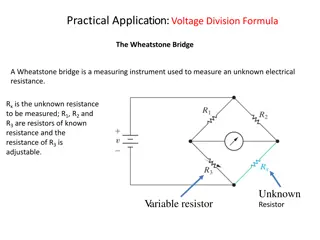

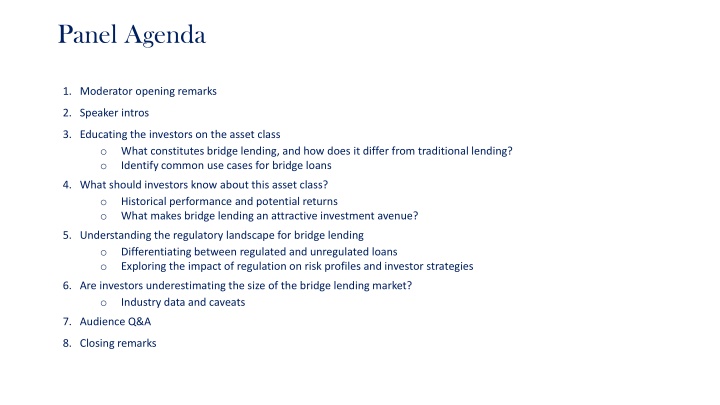

Panel Agenda 1. Moderator opening remarks 2. Speaker intros 3. Educating the investors on the asset class o What constitutes bridge lending, and how does it differ from traditional lending? o Identify common use cases for bridge loans 4. What should investors know about this asset class? o Historical performance and potential returns o What makes bridge lending an attractive investment avenue? 5. Understanding the regulatory landscape for bridge lending o Differentiating between regulated and unregulated loans o Exploring the impact of regulation on risk profiles and investor strategies 6. Are investors underestimating the size of the bridge lending market? o Industry data and caveats 7. Audience Q&A 8. Closing remarks

Case Study 1 Fast Acquisition Loan Purpose Bridge to Purchase Exit Strategy Refinance into long-term funding Property Location Regent s Park Gross Loan Size 2.1m 3.5m, but down valued to 3m by an over- cautious surveyor Purchase Price Timescale Time to completion 14 days 70% (previously 65%, Century increased by exception) LTV Property Size 2,230 sqft Number of Units 1 Borrower Overseas borrower with limited UK footprint

Case Study 2 Acquisition (below Market Value) Loan Purpose To purchase 61 units in a block at below market Sell for investment and retain remaining units once loan is repaid Exit Strategy Property Location Liverpool Gross Loan Size 3.3m Purchase Price 3.5m Market Value 5m Cost of Works - LTV 64% (using market value) Property Size [ ] sqft Number of Units 61 out of 92 total

Case Study 3 Purchase + Refurb To fund the purchase of a detached house with extension and refurbishment Loan Purpose Exit Strategy Sale of the completed house Property Location [ ] Gross Loan Size 815k Purchase Price 500k GDV 1.0m Cost of Works 200k Initial LTV 63% LTGDV 43% LTV 1,426 sqft (pre-work) 2,200 sqft (post-work) Property Size Number of Units 1 Additional Security An unencumbered house valued at 800k

Case Study 4 Acquisition (awaiting planning approval) Conversion of existing 1st and 2nd floors into 4x 2-bedroom flats permitted development and internal works only. Full planning required for additional storey to add 2x further flats. Loan Purpose Exit Strategy Retain and refinance as part of wider portfolio Property Location Benfleet Gross Loan Size 210k Purchase Price 545k Market Value 1.48m Cost of Works 545k LTV 50% Property Size 3,504 sqft (post development) Number of Units 6

Polling Questions 1. What is the true size of the Bridging market (p.a volume)? A. B. C. D. 6 8bn 8 10bn 10 12bn 12 14bn 2. Will small lenders exit the Bridging market in future? A. B. Yes No 3. Will there be more acquisitions of Bridge lenders? A. B. Yes No