Key Milestones and Updates - May 2023 Newsletter

The May 2023 newsletter for York Way Estate contractors highlights key milestones, including the opening of a Resident's Respite Centre, upcoming ground source heat pump drilling, hoarding artwork completion, and community engagement efforts. Residents can also find information on site communication, contacts during working hours, and the commitment to safe operations. Stay informed about the development progress and community involvement opportunities.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

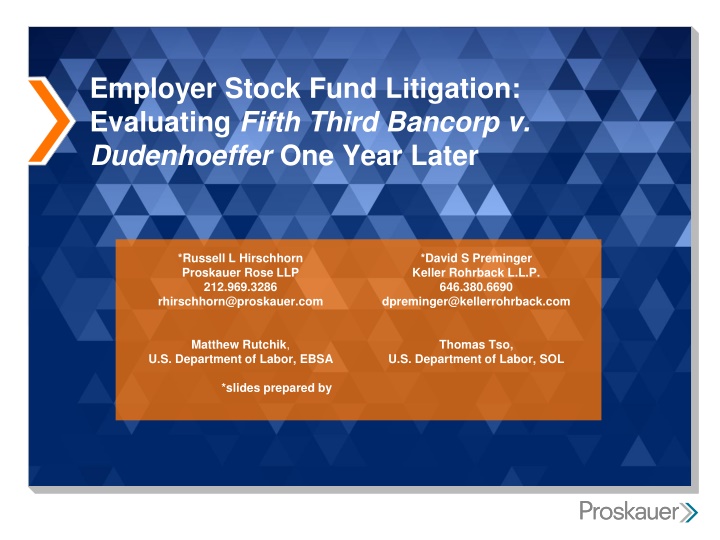

Employer Stock Fund Litigation: Evaluating Fifth Third Bancorp v. Dudenhoeffer One Year Later *Russell L Hirschhorn Proskauer Rose LLP 212.969.3286 rhirschhorn@proskauer.com *David S Preminger Keller Rohrback L.L.P. 646.380.6690 dpreminger@kellerrohrback.com Matthew Rutchik, U.S. Department of Labor, EBSA Thomas Tso, U.S. Department of Labor, SOL *slides prepared by

Agenda Plans with Publicly Traded Employer Stock - Background of the Presumption of Prudence - The Supreme Court decision in Fifth Third v. Dudenhoeffer - Post-Fifth Third Cases - Tatum v. RJ Reynolds 2

Types of Claims Asserted in Publicly Traded Employer Stock Litigation Prudence & Loyalty Claims Disclosure Claims Prohibited Transaction Claims Breach of Duty to Monitor Knowing Participation in Fiduciary Breaches or Prohibited Transactions Failure Correct Fiduciary Breaches 3

Categories of Publicly Traded Employer Stock Litigation Cases alleging inflation of stock price (usually related to material misrepresentations in securities lawsuit) Cases alleging that the stock had become too risky (but no allegations that the stock itself was inflated or mispriced) 4

The Rise of the Moench Presumption Moenchv. Robertson, 62 F.3d 553 (3d Cir. 1995) - Used the exemption from diversification to create a presumption that fiduciaries acted prudently in offering participants the option to invest in employer stock Most circuits adopted variations of the presumption, usually requiring the company to be in dire circumstances to sustain a claim of imprudence. Seven circuits applied the presumption on motions to dismiss. 5

The Sixth Circuits Pre-Dudenhoeffer View Kuper v. Iovenko, 66 F.3d 1447 (6th Cir. 1995) adopted a modified version of the presumption -- plaintiffs need only prove that a prudent fiduciary acting under similar circumstances would have made a different investment decision. Pfeil v. SSBT, 671 F.3d 585 (6th Cir. 2012) declined to apply the presumption at pleadings stage because it was an evidentiary presumption (not a pleading requirement). 6

Fifth Third Bancorp v. Dudenhoeffer Plan Design Participants could direct their 401(k) plan contributions to any one of 20 investment funds including a stock fund. Plan mandated in all events, the Fifth Third Stock Fund . . . shallbe an investment option. Fifth Third matched up to 4% of participants pre-tax contributions; the match was initially invested in the ESOP, but employees could then move these contributions to other funds. 7

Fifth Third Bancorp v. Dudenhoeffer Claims Alleged Fifth Third engaged in lending practices that were equivalent to participation in the subprime market. Fifth Third stock declined 74% in value. Prudence claim alleged Defendants were aware: (i) of risks of such investments and (ii) that mismanagement along with inaccurate and misleading statements by executives caused stock price to be artificially inflated. Disclosure claim alleged Defendants failed to provide complete and accurate information about stock: (i) change away from traditional conservative lending philosophy, (ii) deteriorating Tier 1 capital quality, and (iii) failure to set aside adequate reserves for nonperforming loans. 8

Fifth Third Bancorp v. Dudenhoeffer Procedural History District court dismissed (i) prudence claim for failure to rebut Moenchpresumption because Fifth Third is and was a viable, ongoing concern even though the complaint alleged the shift to the subprime market was perhaps disastrous and (ii) the disclosure claim because the statements and omissions incorporated in the SPD from the SEC filings were not made in a fiduciary capacity. Sixth Circuit reversed: (i) the presumption did not apply at pleading phase and could be rebutted by showing that a prudent fiduciary acting under similar circumstances would have made a different investment decision; (ii) incorporating SEC filings into a SPD was a fiduciary act. 9

Fifth Third Bancorp v. Dudenhoeffer Sup. Ct. THE ISSUE Whether the Sixth Circuit erred by holding that [Plaintiffs] were not required to plausibly allege in their complaint that the fiduciaries of an employee stock ownership plan ( ESOP ) abused their discretion by remaining invested in employer stock, in order to overcome the presumption that their decision to invest in employer stock was reasonable, as required by [ERISA] and every other circuit to address the issue? 10

Fifth Third Bancorp v. Dudenhoeffer Sup. Ct. THE ANSWER In our view, the law does not create a special presumption favoring ESOP fiduciaries. Rather, the same standard of prudence applies to all ERISA fiduciaries, including ESOP fiduciaries, except that an ESOP fiduciary is under no duty to diversify the ESOP s holdings. 11

Fifth Third Bancorp v. Dudenhoeffer Sup. Ct. (cont d) While courts may have to take account of competing congressional purposes, such as employees rights, with encouragement of the creation of employee benefit plans, the Court did not believe that the presumption at issue here [was] an appropriate way to weed out meritless lawsuits or to provide the requisite balancing. - The presumption does not readily divide the plausible sheep from the meritless goats. That important task can be better accomplished through careful, context-sensitive scrutiny of a complaint s allegations. 12

Fifth Third Bancorp v. Dudenhoeffer Sup. Ct. Reasons for Rejecting the Presumption - Presumption is beyond ERISA s express provisions - Section 404(a)(1)(B) imposes a prudent person standard - Section 404(a)(1)(C) requires ERISA fiduciaries to diversify - Section 404(a)(2) establishes the extent to which those duties are loosened for ESOPs - ERISA makes no reference to a special presumption - ERISA only modifies the duties imposed by Section 404(a)(1)(B) in a precisely delineated way: An ESOP fiduciary is exempt from the diversification requirement and also from the duty of prudence, but only to the extent that it requires diversification. 13

Fifth Third Bancorp v. Dudenhoeffer Sup. Ct. - Rejected arguments for creating a presumption: - Duty of prudence rooted in providing financial benefits, not non- pecuniary ones like employee ownership - Unlike common law, ERISA plan documents cannot excuse trustee from fiduciary duties - The presumption does not fit the goal of eliminating conflicts with the securities laws - The presumption does not readily divide the plausible sheep from meritless goats in weeding out meritless suits. 14

Fifth Third Bancorp v. Dudenhoeffer Sup. Ct. Mechanisms to Sort the Sheep & Goats - Because the content of the duty of prudence turns on the circumstances prevailing at the time the fiduciary acts, the appropriate inquiry will necessarily be context specific. - Apply the pleading standard as discussed in Twombly and Iqbal and provided guidance as to considerations. - Guidance divided between two categories of allegations: - Breaches based solely on publicly available information - Breaches based on non-public information 15

Fifth Third Bancorp v. Dudenhoeffer Sup. Ct. Allegations that a fiduciary should have recognized from publicly available informationalone that the market was overvaluing or undervaluing the stock are implausible as a general rule, at least in the absence of special circumstances. ERISA fiduciaries, like many investors, see little hope of outperforming the market based solely on publicly available information and thus may generally prudently rely on the market price. 16

Fifth Third Bancorp v. Dudenhoeffer Sup. Ct. To state a claim for breach of the duty of prudence on the basis of inside information, a plaintiff must plausibly allege: - An alternative action that the defendant could have taken that would have been consistent with the securities laws, and - A prudent fiduciary in the same circumstances would not have viewed as more likely to harm the fund than to help it. The lower courts should consider the following: - Duty of prudence does not require a fiduciary to break the law. - The extent to which a fiduciary s decision not to purchase stock or to publicly disclose inside information conflicts with federal securities laws or with the objectives of those laws. - Whether a prudent fiduciary could not have concluded that stopping purchases or publicly disclosing negative information would do more harm than good to the stock fund. 17

Discussion Points What are special circumstances? What, if any, types of claims are viable based on publicly available information? Does it matter whether the plan terms require an employer stock fund to be an investment option? What considerations are plan fiduciaries supposed to use in evaluating the prudence of the employer stock fund as an investment option? What is a plan fiduciary to do with inside information? 18

Post-Dudenhoeffer Decisions Harris v. Amgen (9th Cir. 2015) - Prudence claim for continuing to offer stock as investment - On appeal from a motion to dismiss - Removing the stock fund is a plausible option that would not cause undue harm to the plan - Removing the stock fund as an option would not violate the securities laws - No special pleading standard for ERISA cases 19

Post-Dudenhoeffer Decisions - Prudence & loyalty claim for failure to disclose - Incorporation of statements made in SEC filings is performed in a fiduciary capacity - Prohibited transaction claim - Exceptions to PT claims are affirmative defense - Unless the face of complaint shows affirmative defense applies, claim cannot be dismissed - Amgen s fiduciary status - Plan contains no exclusive delegation of authority to Committee (instead, acted on Company s behalf) - Nothing indicates Amgen appointed an investment manager - Blistering dissent 20

Post-Dudenhoeffer Decisions Gedek v. Perez (Kodak) (W.D.N.Y.) - Court deniedDefendants motion to dismiss. - The complaint recites a history not just of Kodak s inexorable slide toward bankruptcy, but of publicly available information contemporaneously documenting that slide, step by painful step, and accurately forecasting Kodak s bleak future. - A reasonable factfinder could conclude that at some point . . . the ESOP fiduciary should have stepped in and, rather than blindly following the plan directive to invest primarily in Kodak stock, shifted the plan s assets into more stable investments, as permitted by the plan document, and as consistent with the plan s and ERISA s purposes. 21

Post-Dudenhoeffer Decisions In re BP p.l.c. ERISA Litig., (S.D. Tex.) - Court denied Plaintiffs leave to amend their complaint to add a prudence claim based on public information. - Plaintiffs did not allege a theory as to why the market s valuation of BP based on public information was unreliable. - Plaintiffs claim that BP stock was excessively risky failed because the stock was widely traded in a public market place and the market is not inefficient. - Even if Kodak could be reconciled with Dudenhoeffer, the alleged riskiness of BP s stock simply does not conjure the inevitability of default, bankruptcy, or worse present in [Kodak]. 22

Post-Dudenhoeffer Decisions In re BP p.l.c. ERISA Litig., (S.D. Tex.) - Plaintiffs moved to amend their prudence claim based on nonpublic information, based on the following allegations: - Certain individual Defendants, including members of investment committee, had knowledge that BP had failed to implement a new safety system at sites such as Deepwater Horizon despite public assurances to the contrary. - One individual Defendant was accused of violating the securities laws; thus, there were adequate allegations that he possessed the type of inside information that could implicate the ERISA duty of prudence. 23

Post-Dudenhoeffer Decisions In re BP p.l.c. ERISA Litig., (S.D. Tex.) (cont d) - Plaintiffs identified alternatives to inaction that were consistent with securities laws and ERISA freezing, limiting or restricting stock purchases, and disclosure. - Defendants position: Dudenhoeffer created a presumption that alternatives to inaction would cause more harm than good, and plaintiffs must plausibly allege otherwise to avoid dismissal. - Plaintiffs position: Need only plausibly allege that a prudent fiduciary in the same circumstances would have viewed the alternative as more likely to help the fund than hurt it. 24

Post-Dudenhoeffer Decisions In re BP p.l.c. ERISA Litig., (S.D. Tex.) (cont d) - Court found both positions untenable: - Defendants construction would result in a virtually insurmountable standard for all future plaintiffs; - Plaintiffs construction equally problematic, because freezing the stock fund or disclosing inside information would be available in almost any case. - Court resorted to general pleading guidance of Twombly and Iqbal. - Granted leave to amend. - 1292(b) petition granted 25

Post-Dudenhoeffer Decisions In Re UBS ERISA Litig., 2014 WL 4812387 (S.D.N.Y. Sept. 29, 2014) - District court dismissed the case (again) finding that plaintiffs lacked Article III standing for failure to allege individual harm. - Observed in dicta that arguably the Supreme Court's decision in Dudenhoeffer has, if anything, raised the bar for plaintiffs seeking to bring a claim based on a breach of the duty of prudence. 26

Additional Post-Dudenhoeffer Discussion Topics Developing split on disclosure claims based on incorporation by reference of SEC filings into plan documents Whether to hard-wire employer stock fund into plan document Potential increased role of independent fiduciaries in monitoring employer stock funds Whether to discontinue the stock fund entirely: 27

Other Cases to Watch: Previously filed cases In re American International Group, SDNY Geroulo v. Citigroup Inc., SDNY Rinehart v. Akers (Lehman Brothers), SDNY Lipman v. Terex, D. Conn. Borboa v. Chandler (Land America), E.D. Va. Kopp v. Klein (Idearc), N.D. Texas Laffen v. Hewlett-Packard Co., N.D. Cal. Ramirez v. J.C. Penney Corp., E.D. Texas In re RadioShack, N.D. Texas 28