Key Stages of MCC's Development for Sustainable Impact Investments

Key stages of MCC's development from 1952 to 2017, including its establishment, acquisition by Invitalia, and mission alignment with promoting economic development in Southern Italy through sustainable investments.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

7th Sustainable & Impact Investments International Conference MCC: a native candidate for pursuing social objective Elena De Gennaro

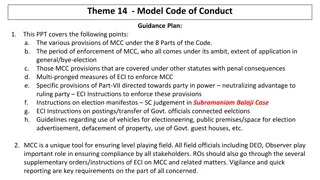

Key Stages of MCCs Development 1952 1994 1999 2007 2011 2017 Poste Italiane acquires 100% of MCC, pursuant to a MEF project for the setting up of Banca del Mezzogiorno with a view to contributing to the development of companiesin the South of Italy In shares of MCC sold by the Ministry of the Economy and Finance to Banca di Roma December 1999, 100% Establishment of MCC under Law no. 949 July 25, 1952 (Mea-sures for lopment of economy employment) entity the deve- and public as a Conversion from public entity to joint stock company. The new mission was to develop project & export activities,corporatefinance MCC becomes part of the UniCredit Group as its public sectordivision In August 2017 MCC is purchased by Invitalia(1), Developmentarm of the MEF the Economic finance (1) Invitalia, an operating entity of MEF whose mission is to promote the development and competitiveness of the national economic system, with a particular view to reducing the gap between the economy of the South of Italy and the rest of the Country 2

and Southern Financial District 12 Mar 2021 DL 142/ 2019 15 ott 2020 The Italian Ministry of Finance provides capital strengthening of Invitalia and MCC Group aimed at promoting developmentand investmentactivities End of Banca Popolare di Bari receivership and acquisition of controlby MCC. BPB owns 73.57% of Cassa di Risparmio di Orvieto economic On March 12, 2021 the Bank of Italy recognised Centrale as Banking Group with effect from 15 October2020 Mediocredito 3

MCC mission and the principle of prevalence (1/2) Under the provisions of article 2, paragraph 162, of the Law n.191, 23 December 2009 (Finance Law 2010), the Bank s operations must be aimed at achieving the following: expanding the capacity of products and services offeredby the banking and financial system in SouthernItaly; sustaining business initiatives which are the most creditworthy, impacting upon costs of procuring the financial resources necessary for investments; and channeling savings toward economic initiatives that lead to job creation in SouthernItaly. Mediocredito Centrale conducts its business exclusively in Italy and is required to operate mainly in the regions of Southern Italy (or South of Italy , or Mezzogiorno ), as provided under the relevant establishment law and its By-laws. The Bank must operate "by sustaining investment projects in Southern Italy and promoting, in particular, lending to small and medium-sized enterprises", with a special focus on growth in size and internationalization of such Italian enterprises, research and innovation, with a view to creating jobs". Accordingly, Mediocredito Centrale s commitment to sustainability is clearly reflected in the law, its By-laws, but also through strong internal policies that govern the principles and values of its overall activities, among which monitoring of prevalenceobjectives of supporting the economy of the South of Italy. 4

MCC mission and the principle of prevalence (2/2) With the establishment of the Mediocredito Centrale Banking Group (in March 2021), it was deemed appropriate to apply the principle of prevalence at the group level on a consolidated basis. Consequently, the Bank has developed the prevalence s indicators. The Lending Business indicators Clients in the South Compared to Total Clients (Numbers) This metric measures the number of clients (defined as entities with at least one active relationship) located in Southern regions (with legal headquarters for businesses and residence for private individuals) in relation to the total number of clients of the Group. This excludes banking and institutionalcustomers 80,1% Loans to the South as a Percentage of Total Loans (Amount) This metric represents the percentage share of the outstanding loan amount (short and medium/long term) classified as 'loans to the South' in the total outstanding loans to the Group's clientele (businesses, families). For classification purposes, the residence is considered for private individuals and either the legal headquarters or the funding destination for businesses 60,6% Savings and Investment Services in the Southern Italy as a Percentage of Total Savings and Investment Services This metric measures the proportion of direct/indirect deposits from clients in the South (based on legal headquarters for businesses and residence for private individuals) relative to the total direct/indirect deposits of the Group. This calculation excludes banking and institutional counterparts 76,2% The Actions for Development indicators Loans and grants to the South related to the activity of the Bank on behalf of the Public Administrations This measures the loans and grants destined for businesses in the South connected with the Bank s activity as Manager on behalf of the Public Administrations through instrument like the SME Guarantee Fund, the Sustainable Growth Fund or other National and Regional Funds. 5

Inaugural Social Bond EUR 300mln 1.500% Inaugural 5y Social Bond due 24thOctober 2024 Type: Senior Preferred Issuer: Banca del Mezzogiorno MedioCreditoCentrale S.p.A. ( MCC ) Format: RegS, Bearer / Social Bond Rating: Ba1 (Moody s, stab) / BBB- (S&P, neg) 17thOctober 2019 Launch Date: Notional: EUR 300mln 24thOctober 2024 Maturity: Coupon: 1.500% (annual) Bookrunners: Banca Akros, SocieteGenerale, UniCredit Financing / refinancing of loans to Italian enterprises which support positively the economic activities of the Deprived Areas of Italy, and in particular the South. USE OF PROCEEDS Eligible categories include: Support of Employment Contribution to Socioeconomic Advancement Social Bond Working Group (representatives from Finance, Credit, Market, Legal, Compliance, IT and Planning departments) to oversee the evaluation SELECTION & and selection process EVALUATION Commitment to reach at least 70% allocation and, on a best effort basis, full allocation within one year of issuance and until maturity of the bond MANAGEMENT Allocation determined on the basis of the level of utilization (outstanding amount) rather than on the committed amounts OF PROCEEDS Unallocated proceeds managed in line with normal liquidity management policy. 6

7th Sustainable & Impact Investments International Conference Thank you for your attention