Kissht - 4 Easy Ways to Improve your CIBIL Score Quickly in India

Kissht Reviews: A good CIBIL score is crucial for securing loans in India. It is an indicator of your creditworthiness and determines whether you will be approved for a personal loan, credit card, or other financial products. If you're looking to imp

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

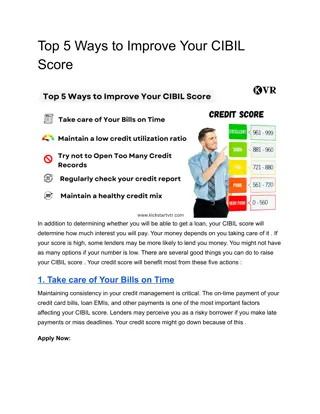

PAY YOUR BILLS ON TIME One of the most important factors in improving your CIBIL score is paying your bills on time. Timely payments of credit card bills, loan EMIs, and utility bills show your ability to manage debt responsibly. Lenders, when you apply for a loan online, will assess your payment history to gauge your reliability. Consistently paying bills on time is one of the fastest ways to improve your score.

MAINTAIN A LOW CREDIT UTILIZATION RATIO To maintain a low credit utilization ratio, you can opt for a personal loan from an online loan app to consolidate existing debts and reduce your credit card balances. By reducing outstanding credit, you will improve your CIBIL score, making it easier to qualify for low-interest loans and other financial products.

CHECK YOUR CREDIT REPORT REGULARLY Errors in your credit report can affect your CIBIL score. It s essential to review your credit report periodically to ensure that no errors or fraudulent activities are affecting your score. You can obtain a free copy of your credit report once a year from CIBIL. If you find any discrepancies, raise a dispute with CIBIL immediately. Keeping an eye on your credit score also helps you plan better when you decide to apply personal loan in the future.

USE A COMBINATION OF CREDIT PRODUCTS Having a mix of credit products, such as a cash loan app, instant small loans, or short-term loans, can improve your credit score. A diversified credit portfolio demonstrates to lenders that you can manage different types of debt responsibly. If you have never used a personal loan before, consider taking out a quick personal loan or instant personal loan for a small amount and repay it on time. This will not only add variety to your credit profile but will also show that you are capable of handling different types of credit.