Latest Updates on COVID-19 Financial Relief Measures

Stay informed about the latest updates on COVID-19 financial relief measures, including the Paycheck Protection Program (PPP) loan forgiveness criteria, repayment period extensions, FTE penalty exceptions, and payroll tax deferral options. Get insights on the changes and how they may impact your business. Visit now for crucial information.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

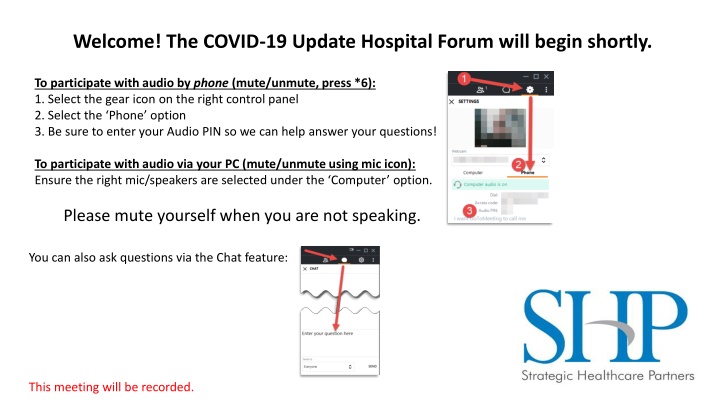

Welcome! The COVID-19 Update Hospital Forum will begin shortly. To participate with audio by phone (mute/unmute, press *6): 1. Select the gear icon on the right control panel 2. Select the Phone option 3. Be sure to enter your Audio PIN so we can help answer your questions! To participate with audio via your PC (mute/unmute using mic icon): Ensure the right mic/speakers are selected under the Computer option. Please mute yourself when you are not speaking. You can also ask questions via the Chat feature: This meeting will be recorded.

COVID-19 Financial Relief & Compliance shpllc.com | 912-691-5711

Paycheck Protection Program Loan Forgiveness & Audits Good Faith Certification SBA/Department of Treasury issued a safe harbor threshold of $2 million or less. All borrowers under this threshold are automatically deemed to meet the good faith certification and will not be audited against this provision. Forgiveness Application Initially published by the SBA on 5/15/2020: https://www.sba.gov/sites/default/files/2020-05/3245- 0407%20SBA%20Form%203508%20PPP%20Forgiveness%20Application.pdf Safe harbor of good faith certification does not override forgiveness application or any other audits/review by SBA or their lending partners. New PPP Forgiveness Rules Now Apply! shpllc.com | 912-691-5711

Paycheck Protection Program Loan New Rules HR 7010 Established New Forgiveness Criteria 8 vs. 24 week period: Added option to move eight-week period for spending the loan to 24 weeks or the end of the year; whichever comes first (obviously predicated on when your PPP loan was funded). Payroll %: Under the existing legislation; 75% of the loan had to be spent on payroll expenses; new rules lower that threshold to 60%. The 60% threshold is absolute though; if less than 60% is spent on payroll, there will be no forgiveness on the PPP loan (i.e. cliff vs. prorata penalty). This is a change from the reduced forgiveness allowances under the original guidance. Repayment Period: PPP borrowers would have five years; rather than two years, to repay any money owed on a loan. FTE Penalty Exceptions: PPP lenders cannot withhold forgiveness based on the employee count regulations if one of the two thresholds below are met: An employer is unable to rehire former employees and is unable to hire similarly qualified employees. An employer is unable to return to the same level of business activity due to compliance with federal regulations related to COVID-19. Payroll Tax Deferral- Employers will be able to defer paying the 6.2% payroll tax that employers are charged for employees for a period of two years, regardless of whether the borrower receives loan forgiveness under the PPP program. Prior law provided that no such deferral was available to PPP borrowers. SBA announced on June 8 that they will be issuing new forgiveness guidance/forms based on revised criteria. shpllc.com | 912-691-5711

Paycheck Protection Program Loan Application Payroll Costs Paid/Incurred- Language allows for costs paid during the 8-week or new 24-week period AND incurred but paid next payroll. For administrative convenience, borrowers with biweekly payroll may elect to calculate eligible payroll costs using the 8-week or new 24-week period that begins on the first day of their first pay period following disbursement of the loan ( alternate payroll covered period ); Non-cash compensation payroll costs are limited to employer contributions for employee health insurance and employee retirement plans, and employer state and local taxes assessed on employee compensation; Full time equivalents ( FTEs ) are considered on a 40 hour per week basis (vs. 30 hour FTEE previously); % of 40 hours based OR all part time= .5; borrower option. For the salary reduction calculation, borrowers must compare the average annual salary or hourly wage from January 1, 2020 to March 31, 2020 to the average annual salary or hourly wage during the 8 or 24 week period, and a specific calculation is provided for hourly workers; and For the headcount reduction calculation rehire safe harbor, FTEs are counted as of June 30, 2020 or end of 24 week period (no later than 12/31/2020). 24 weeks likely long enough for all $ s to be forgiven. Question is FTE count average for 24 weeks vs. baseline periods leaving % of $ s unforgiven regardless of allowable costs . shpllc.com | 912-691-5711

Paycheck Protection Program Loan PPP Forgiveness Loan Application Non-Payroll Costs Mortgage obligations include payments of interest on real or personal property, but the obligation must have been in place prior to February 15, 2020. Rent includes lease of personal and real property Personal Property Inclusions such as: Copiers, Servers, Autos Defines utilities to include: Electricity/Gas Water Internet Transportation Telephone Similar to payroll, must be paid during Covered Period OR incurred during Covered Period and paid during next billing cycle. shpllc.com | 912-691-5711

Paycheck Protection Program Loan PPP Forgiveness Loan Application Documentation Requirements Payroll Cost Support: Bank accounts or-third party payroll service reports documenting cash compensation. Tax Forms that overlap with covered period or the alternative payroll covered period. Payroll Tax Forms will be IRS 941 Forms & State Quarterly Wage and Unemployment Filings Payment receipts, cancelled checks or account statements documenting employer contributions to employee health insurance and retirement plans. Non-Payroll Cost Support: Rent or Lease Payments Copy of lease/rental agreement dated prior to February 2020. Copies of account statements from landlord/lessor showing payments or cancelled checks. Utilities Invoice from February 2020 to document service was in place prior to PPP funding. Account statements showing payments made, cancelled checks or bank account statements. shpllc.com | 912-691-5711

PPP Forgiveness-Best Practices Run forgiven payroll under all options. First paycheck and alternate period 8 vs. 24 weeks FTE baseline alternatives FTE safety net- 6/30 vs. end of 24 weeks vs. 12/31. Do NOT forget the next payroll or non-payroll billing cycle. Develop your budget for the covered period (8 week or 24 week). Wait until the eight week period clock starts Develop a loan forgiveness template or engage a third party Balancing the 60/40 rule of payroll vs. non-payroll eligible expenses Fix FTE count/pay cuts by deadline if possible. (6/30 or 12/31). Perform multiple what if scenarios that could increase your overall forgiveness: Timing of when your operations will be reopened/timing of staff returning to work; Permanent FTE adjustments projected for rest of the year. shpllc.com | 912-691-5711

HHS Allocations- Completed HHS $30B Medicare Allocation HHS $20B All Revenue Allocation HHS $12B Rural Hospital & RHC Allocation HHS $4.9 B SNF Allocation Attestations Agreeing to Terms & Conditions Must be Completed for Each Allocation Guidance on Internal Tracking PPP: records on how this money was spent in accordance with the legislation to maximize forgiveness (i.e. a minimum of 60% on payroll and up to 40% on mortgage/rent/utilities). HHS Distributions: records on how this money was utilized for non-PPP expenses; such as lost revenue offsets/ additional equipment required for PPE/office cleaning/etc. (this cannot overlap with the records on how you spent other HHS allocations) Annualizing COVID Impact-Potential Future Waves? shpllc.com | 912-691-5711

HHS Financial Relief Terms & Conditions HHS Quarterly Reporting HHS will require quarterly reports for any provider receiving over $150,000 in remuneration through direct financial relief. Reporting will begin in Q3.2020 Reporting shall detail: The total amount of funds received from HHS under the Direct Provider Relief grants The amount of funds received that were expended or obligated for reach project or activity A detailed list of all projects or activities for which large covered funds were expended or obligated, including: The name and description of the project or activity The estimated number of jobs created or retained by the project or activity, where applicable Detailed information on any level of sub-contracts or subgrants awarded by the covered recipient or its subcontractors Still pending HHS details on how this reporting will be operationalized. shpllc.com | 912-691-5711

HHS Financial Relief Terms & Conditions New FAQ Posted on 6/8/2020 Question: In order to accept a payment, must the provider have already incurred eligible expenses and losses higher than the Provider Relief Fund payment received? Answer: No. Providers do not need to be able to prove, at the time they accept a Provider Relief Fund payment, that prior and/or future lost revenues and increased expenses attributable to COVID-19 (excluding those covered by other sources of reimbursement) meet or exceed their Provider Relief Fund payment. Instead, HHS expects that providers will only use Provider Relief Fund payments for permissible purposes and if, at the conclusion of the pandemic, providers have leftover Provider Relief Fund money that they cannot expend on permissible expenses or losses, then they will return this money to HHS. HHS will provide directions in the future about how to return unused funds. HHS reserves the right to audit Provider Relief Fund recipients in the future and collect any Relief Fund amounts that were used inappropriately. shpllc.com | 912-691-5711

Pending & Ongoing Financial Relief Ongoing: HRSA COVID-19 Testing & Treatment for Uninsured HHS Announced as of 6/9/2020: $10 BILLION ALLOCATION FOR SAFETY NET HOSPITALS HHS is announcing the distribution of $10 billion in Provider Relief Funds to safety net hospitals that serve our most vulnerable citizens, recognizing the incredibly thin margins these hospitals operate on. This payment is being sent directly to these hospitals via direct deposit. This payment is going to hospitals that serve a disproportionate number of Medicaid patients or provide large amounts of uncompensated care. Qualifying hospitals will have: A Medicare Disproportionate Payment Percentage (DPP) of 20.2 percent or greater; Average Uncompensated Care per bed of $25,000 or more. For example, a hospital with 100 beds would need to provide $2,500,000 in Uncompensated Care in a year to meet this requirement; Profitability of 3 percent or less, as reported to CMS in its most recently filed Cost Report. Recipients will receive a minimum distribution of $5 million and a maximum distribution of $50 million. What is unclear from the announcement is whether this applies to Critical Access Hospitals; we are seeking confirmation on this question. COVID HIGH IMPACT DISTRIBUTION ROUND #2 HHS sent communications to all hospitals on June 8 asking them to update information on their COVID-19 positive-inpatient admissions for the period January 1, 2020, through June 10, 2020. This information will be used to determine a second round of funding to hospitals in COVID-19 hotspots. To determine their eligibility for funding under this $10 billion distribution, hospitals must submit their information by June 15, 2020 at 9:00 PM ET. shpllc.com | 912-691-5711

Pending & Ongoing Financial Relief HHS Announced as of 6/9/2020: MEDICAID RELIEF PORTAL HHS will launch an enhanced Provider Relief Fund Payment Portal on June 10 that will allow eligible Medicaid and CHIP providers to report their annual patient revenue, which will be used as a factor in determining their Provider Relief Fund payment. The payment to each provider will be at least 2 percent of reported gross revenue from patient care; but the final amount will be determined after the data is submitted, including information about the number of Medicaid patients providers serve. To be eligible for this funding, health care providers must not have received payments from the $50 billion Provider Relief Fund General Distribution and either have directly billed their state Medicaid/CHIP programs or Medicaid managed care plans for healthcare-related services between January 1, 2018, to May 31, 2020. This round of relief is focused on the 38% of Medicaid providers who have not yet received any financial relief; including for example pediatricians, obstetrician-gynecologists, dentists, opioid treatment and behavioral health providers, assisted living facilities and other home and community-based services providers. More information about eligibility and the application process will become available at https://www.hhs.gov/coronavirus/cares-act-provider-relief-fund/general-information/index.html. Department of Community Health Medicaid Waiver- Still on hold. shpllc.com | 912-691-5711

Proposed HEROES Act Per Senate; HEROES Act is DOA still pending Senate version PUBLIC HEALTH & SOCIAL SERVICES EMERGENCY FUND - $175 billion $100 billion under the Health Care Provider Relief Fund. Grants for hospitals and health care providers to be reimbursed health care related expenses or lost revenue directly attributable to the public health emergency resulting from coronavirus. The bill also establishes a program for distributing these funds to include an application for providers and specific formulas to determine "health care related expenses and lost revenue." Eligible expenses for reimbursement include medical supplies and PPE, retention of workforce, building or construction of temporary structures and more Lost revenues determined by net patient revenue from corresponding 2019 quarter minus net patient revenue in 2020 minus savings during the calendar quarter attributable to foregone wages, payroll taxes, etc. $75 billion for expenses necessary for testing, contact tracing, and other activities necessary to effectively monitor and suppress COVID-19. shpllc.com | 912-691-5711

Proposed HEROES Act MEDICAID Would increase federal Medicaid matching funds from 6% to 14%. Would prohibit HHS from finalizing the Medicaid Fiscal Accountability Rule. 2.5% increase in Medicaid DSH payments for 2020 and 2021. MEDICARE ACCELERATED & ADVANCED PAYMENT Lowers the interest rate for loans to Medicare providers made under the Accelerated and Advance Payment Program. Reduces the per-claim recoupment percentage. Extends the period before repayment begins. shpllc.com | 912-691-5711

Medicare Advanced Payment Program Medicare Advanced/Accelerated Payments Current Legislative Discussion Delayed repayment period? (Move recoupment period to start 1 year out) Partial Recoupment? Partial Forgiveness? Planning for Repayments: Monitor as time gets closer to 120 days from funding. Know your funding date/timeline. shpllc.com | 912-691-5711

Georgia State Budgetary Concerns GA Budget in shambles: Currently without a FY 2021 Budget for the fiscal year beginning on 7/1/2020; Facing a $3.5B shortfall; Currently, Governor asked all departments to submit 11% rate cut. Key points from DCH Budget: No proposed rate cuts at this time for traditional Medicaid!!! Medicaid: Low-Income Medicaid 93.2 Reduce funds for the Retro Rate Amendment and Risk Corridors for Care Management Organization (CMO) rates. State General Funds ($102,194,683) PeachCare 94.1 Increase funds for growth in PeachCare based on projected need. State General Funds $6,346,519 State Children's Insurance Program CFDA93.767 $25,134,230 shpllc.com | 912-691-5711

Georgia State Budgetary Concerns (Cont) Medicaid-Aged, Blind & Disabled 92.9 Replace state general funds with hospital provider payment funds. State General Funds ($2,042,672) Hospital Provider Fee $2,042,672 Medicaid-Low Income 93.10 Replace state general funds with hospital provider payment funds. State General Funds ($17,994,069) Hospital Provider Fee $17,994,069 shpllc.com | 912-691-5711

Market Shift-Tsunami State of Georgia unemployment February- 3.2% April- 11.7% May- 13.3% Short Term- Next 3-6 months Partially masked by Cobra/Unemployment Benefits. Potential for retroactive disenrollment? Longer Term- 6-12/24 months? Payer Mix- Several point shift from Commercial to Medicaid/CMO/Self Pay Less commercial equal bigger battle for reimbursement? shpllc.com | 912-691-5711

Department of Insurance Mandates Moratorium on Health Policy Cancellations ended on 5/31/2020 Retroactive Disenrollments Starting Effective 6/1/2020 Reduced Plan Administrative Burden Directive ended on 5/31/2020 Reinstatement of prior authorization procedures Medical Necessity Reviews Etc. Feedback from DOI Meeting- Outstanding Questions: Does retroactive disenrollment mandate removal now allow for patients to be dropped from rolls for March-May (i.e. for services already provided)? If policy change approval still in effect, then have rate changes been approved? shpllc.com | 912-691-5711

Guides & Tools Available at www.shpllc.com/covid SHP is available at walk through all available tools directly with you to walk through scenarios directly for your facility: COVID Funding Guide COVID Financial Projections Workbook HRSA COVID Uninsured Process Telehealth Guide HHS Portal Input shpllc.com | 912-691-5711

Wrap Up & Questions shpllc.com | 912-691-5711