Level 3 Diploma in Accounting: Advance Your Career

This Level 3 Diploma in Accounting prepares you with professional skills in accounts preparation, management accounts, professional ethics, and indirect tax. Gain increased earning potential, industry recognition, and the opportunity to progress in chartered accountancy.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

AAT Level 3 Diploma in Accounting Mrs Ruston

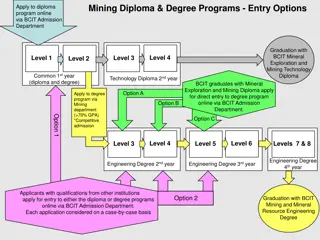

Year 13 The Advanced Diploma Once you have gained the Level 2 Certificate, you can then progress onto the Level 3 Diploma. This Diploma will give you professional status in the industry and immediately increase your earning capacity once you have qualified.

Where could Level 3 AAT take me? Advance your career and boost your salary Earn up to 67% more fully qualified Become an AAT full member (MAAT) Increased professional status, keep skills fresh and gain the letters MAAT after your name Progress to Chartered Accountancy Gain exemptions from ACCA, CIPFA, ICAEW, CIMA and ICAS. Be your own boss Set up your own practice offering financial services

Level 3 Diploma in Accounting Units Accounts preparation Prepare final accounts for sole traders and partnerships Management accounts Indirect tax Professional ethics Spreadsheet software The Professional Ethics and Spreadsheet elements of the course will be assessed in a final Synoptic Exam.

Accounts preparation You will review double-entry bookkeeping and the trial balance Financial statements and the extended trial balance Accruals and prepayments Depreciation of fixed assets Irrecoverable debts and doubtful debts The rules of accounting Accounting for capital transactions Control accounts and the correction of errors

Final accounts for sole traders and partnerships Preparing financial statements Incomplete records Sole trader financial statements Partnership financial statements Changes in partnerships

Management accounts Review basic cost accounting Material and labour costs Expenses Costing overheads Methods of costing Marginal and absorption costing Aspects of budgeting Short and long-term decisions

Indirect tax Introduction to VAT VAT and business documents Inputs and outputs and special schemes The VAT return VAT communications

Professional ethics Principles of professional ethics Objectivity and professional competence Confidentiality and taxation services Ethics and the employed accountant Ethics and the member in practice Taking on a new client Legal considerations Regulations of the accounting profession

Working with spreadsheets Spreadsheet basics Formatting the spreadsheet data Advanced formatting Spreadsheet functions Sorting, checking and importing data Statistical functions and charts Pivot tables and workbook management

How will AAT support me? MyAAT Your personalised online account which includes a log of all your assessment results. Study support e-learning and sample assessments for every AAT unit Career support Online CV builders, interview simulators and job search AAT Additions Exclusive benefits package includes discounted cinema tickets and gym membership AAT Weekly Your one-stop email with everything you need to know to qualify Events Free branch events and online webinars

Progression Gain UCAS points to help secure a place at university Gain an apprenticeship and continue to study Level 4 to work towards becoming an AAT full membership with letters after your name:(MAAT) Progress to Chartered Accountancy Gain exemptions from ACCA, CIPFA, ICAEW, CIMA and ICA. Be your own boss and set up your own practice offering financial services On successful completion of level 3 you can apply to become a fully qualified bookkeeping which will help you earn a much better salary

Any questions about this qualification? If you have any questions regarding the AAT qualification, you can contact Mrs Ruston at the King John 6th Form.