Light-Duty ZEV Uptake in Government and Rental Segments

Explore the current landscape of light-duty vehicle (LDV) fleets in government and rental sectors, focusing on ZEV penetration, unique characteristics, and stock forecasting models. Discover the policies driving the push towards ZEVs and the high churn rate in rental fleets. Learn about the distribution of vehicle sectors by model year, ZEV penetration in government segments, and the prevalence of utility vehicles in government fleets.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

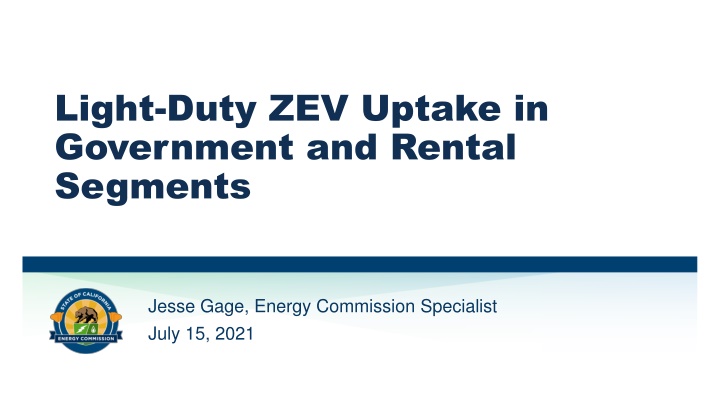

Light-Duty ZEV Uptake in Government and Rental Segments Jesse Gage, Energy Commission Specialist July 15, 2021

Overview Current makeup of LDV Government/Rental fleets What makes these sectors unique Government and Rental stock forecasting models Policies driving government/rental push towards ZEVs Questions for the group 2

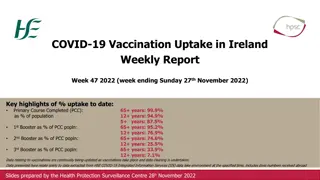

Govt/Rental sectors small, but have anomalous ZEV penetration LDV Fleet by Sector ZEV Penetration by Sector 6.0% 5.0% 4.0% Commercial 7% 3.0% Personal 91% Government 1% 2.0% Rental 1% 1.0% 0.0% Personal Commercial Government Rental Includes all light-duty vehicles model year 2000 and later. Source: Staff analysis of DMV Vehicle Registration Database. 3

Rental has very high churn rate Share of Vehicle Sectors by Model Year Share of Rental Vehicles by Model Year 12% 60% 10% 50% Percent of Fleet 8% Percent of Fleet 40% 6% 30% 4% 20% 2% 10% 0% 2019 2015 2010 2005 2000 0% Model Year 2020 2019 2018 2017 2016 Model Year Personal Commercial Government Data as of January 2020. Source: Staff analysis of DMV Vehicle Registration Database. 4

Most of the government fleet is local Government Fleet by Segment ZEV Penetration of Government Segments 10% 9% Other 25% 8% City 29% 7% 6% 5% State 7% 4% 3% Education 20% County 19% 2% 1% 0% City Education County State Other Includes government light-duty vehicles model year 2000 and later. Source: Staff analysis of DMV Vehicle Registration Database. 5

More utility vehicles in government Sector Fleets by Vehicle Class 100% Van, 6% Van, 11% Van, 15% 90% 80% SUV, 30% SUV, 23% SUV, 35% 70% 60% Pickup, 16% 50% Pickup, 9% Pickup, 36% 40% 30% Car, 49% Car, 45% 20% Car, 26% 10% 0% Government Rental All LDV Includes all light-duty vehicles model year 2000 and later. Source: Staff analysis of DMV Vehicle Registration Database. 6

Model Process Grow by Gross State Product Calculate Fleet Size Government: 10 Years Rent: 4 Years Gradually Retire Old Stock Class Share Remains Constant ZEV share determined exogenously Allocate New Vehicle Purchases 7

State-level directives Executive Order B-16-12: Directs California s state fleet to increase the purchase of ZEVs through the normal course of fleet replacement. It required that at least 10 percent of light-duty vehicle purchases be ZEVs by 2015. The requirement increased to 25 percent by 2020. 2016 ZEV Action Plan: Requires that 50 percent of all state agency light-duty vehicle procurements be ZEV by 2025. State Administrative Manual Sections 4121 4121.6: Instituted a ZEV and hybrid vehicle first purchasing policy and increased the ZEV purchasing mandate annually by 5 percent so that it will be 50 percent by 2025. Executive Order N-79-20: It shall be a goal of the State that 100 percent of in-state sales of new passenger cars and trucks will be zero-emission by 2035. Sources: Green Fleet Major Initiatives, EO N-79-20 8

State-level ZEV development strategy Source: Zero-Emission Vehicle Market Development Strategy 9

Local level California has 482 cities, 58 counties, 35 air districts, 18 metropolitan planning organizations, and 26 regional transportation agencies, each with different realities and constituencies. The objectives are high- level and directional their application will vary across the state. DGS to enable non-state public entities to leverage state contracts to purchase ZEVs and supporting equipment. Air districts take lead: Indirect Source Rules requiring ZEVs, incentives and creative market expansion programs; support ZEV Mobile Source Measures and Transportation Control Measures in updates to pollutant plans 10

Remaining questions Policies/metrics targeted at the city/county level? Would like input from cities and other stakeholders on what their action plans are, or if these have been compiled. Anything at all toward rentals, other than airport shuttles? Rental car companies sold half their fleet in 2020 in response to COVID-19 demand reduction. How might this sell-off affect ZEV uptake in the near term? What should the ZEV curves look like? When should we expect 100% ZEV purchases in the government (all segments) and rental fleets? 11