Local Public Service Demand: Citizen Behavior Insights

The demand for local public services in this lecture, delving into citizen behavior, individual demand, determinants of demand, and the concept of tax price. Understand how demand for services like police, fire, and education mirrors private good demand, influenced by income, price, related goods, and preferences, with the demand curve reflecting quality and marginal benefit.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

State and Local Public Finance State and Local Public Finance Professor Yinger Professor Yinger Spring 2021 Spring 2021 LECTURE 3 THE DEMAND FOR LOCAL PUBLIC SERVICES

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Section Outline: The Demand for Local Public Services This section consists of three classes are about the behavior of citizen/voters o 1. Individual Demand o 2. Demand Expression o 3. Case: Determinants of Demand for Local Public Services

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Class Outline The Determinants of Demand for Public Services o The Key New Concept: Tax Price How Demand is Revealed Through the Choice of a Community

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Class Outline The Determinants of Demand for Public Services o The Key New Concept: Tax Price How Demand is Revealed Through the Choice of a Community

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services The Demand for Local Public Services The demand for local public services (police, fire, education, and so on) is similar to the demand for a private good. LetSmeasure the quality of a local public service. S is a function of income, price, the prices of related goods, and preferences. The demand curve for Scan be drawn as follows, where MBstands for marginal benefit:

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services The Demand Curve for Local Public Services S = Local public service quality D = Demand MB = Marginal benefit from S

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Features of Public Demand Three twists arise in studying the demand for local public services: First, the output must be defined. o Ultimately, we want to measure the quality of local public services. o For today, we will define output as spending per household. Second, the price must be defined. o Public services are not usually sold directly to individuals. o The price arises through the tax system. Third, the salience of the price must be determined. o People do not respond to price differences they cannot observe.

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Tax Price Because it operates through the tax system, the price for a local public service is called a tax price. A tax price varies with the tax used; we examine a tax price with a property tax, which is the main local tax in the U.S. A tax price is defined as the amount a taxpayer would have to pay for another unit of services if the property tax rate were raised to pay for it.

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Property Taxes A property tax payment equals a tax ratemultiplied by a property s assessed value. o The tax rate is selected by elected officials. o The assessed value is determined by an assessor, who may be elected or appointed. In symbols, homeowner i s property tax payment (Ti) equals the property tax rate (t) multiplied by the assessed value of her house (Vi): T = tV i i

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services The Community Budget Constraint The community must set spending = revenue. Define: o S = spending per household o N= number of households o = average assessed value V t V i = = = Then: ( )( ) S N or i N t V S tV i i S V = or t

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Solving for Tax Price Put these 2 equations together: V V S V = = = i T tV V S i i i Note that Ti/S equals taxes paid per unit of S the price of S. T S V V = = "Price" i i So for every unit of S, homeowner i pays ( ); that is, ( ) is her tax price. / / iV V iV V

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Examples of Tax Price (= ) / iV V A house with the average V in its community has a tax price of 1.0. A house worth twice the average in its community has a tax price of 2.0. A house worth half the average in its community has a tax price of 0.5.

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Tax Price and Demand V Compare 2 owners of $100,000 houses, one in a city where is $50,000 V and the other in a city where is $200,000. oThe first owner has a tax price of 2.0; the second a tax price of 0.5. oAll else equal, the second owner faces a lower tax price and demands more public services as a result!

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services The Salience of Tax Price Differences Homeowners are not trained in public finance, so how do they figure out about tax price? o They observe what happens to their property taxes when a large shopping center in their town goes out of business, lowering and raising their tax price. V o Owners of relatively small houses may recognize that any property tax increase will be largely born by people with much more expensive houses. o These and other sources of information are not exact, but as we will see they are sufficient to cause significant behavioral responses but perhaps smaller responses than those to private market prices.

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Questions What are the determinants of the demand for public services? What is a tax price? How is it defined? What makes a tax price salient to a voter?

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Class Outline The Determinants of Demand for Public Services o The Key New Concept: Tax Price How Demand is Revealed Through the Choice of a Community

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services How is Demand Revealed? The demand for local public services is revealed in three ways: o Voting. o Choice of a community in which to live. o The purchase of related private goods (such as private schools or private security). The next class examines voting. This class ends with a brief analysis of community choice; for more see Yinger, Housing and Commuting, Chapter 13, Bidding and Sorting (World Scientific, 2018).

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services The Tiebout Hypothesis A famous 1956 article by an economist named Tiebout made two points: oPeople consider the public service-tax package when they decide where to live (a positive statement). oThe choice of a community is like the choice of a private good, so this process allocates resources in an efficient manner (a normative statement).

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Developments Since Tiebout The literature since Tiebout has identified two key implications of his positive analysis: First, better public services or lower property taxes lead to higher house values, all else equal. oThis phenomenon is known as capitalization. oWe study property tax capitalization in a later class.

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Public Service Capitalization Dozens of studies establish that, all else equal, the price of housing is higher in a community with better schools or better police protection. A recent review finds, for example, that all 50 studies of school quality capitalization published since 1999 find evidence of capitalization (Nguyen- Hoang and Yinger, Journal of Housing Economics, 2011). Several studies also find that lower crime leads to significantly higher house values, controlling for other things. If a policy changes the distribution of local public services, it will alter house values and therefore affect current homeowners!

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Income Sorting Second, people compete for entry into communities with desirable service tax packages. oHigh-income people win this competition. oThis leads to sorting: high- and low-income people tend to live in different places, with richer people in places with better public services and, often, lower property tax rates. oIncome sorting is a key feature of the U.S. federal system and a key cause of continuing inequality. This inequality is passed from one generation to the next.

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Sorting in Cleveland My recent research (Journal of Urban Economics, 2015), based on all house sales in the Cleveland area in 2000, focuses on these two points. oI find that housing prices are up to 30% higher in school districts where more entering 12th graders pass state tests. oI find (with a new method) that higher-income people do, indeed, sort into school districts with higher-quality schools a key source of inequality. A one standard deviation increase in homeowner income leads, purely because of income sorting, to a 1.30 standard deviation increase in the rate at which entering 12th graders pass state tests.

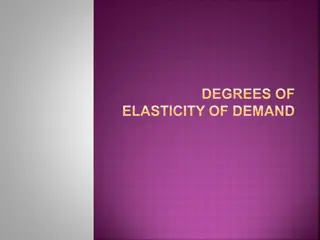

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Sorting in Cleveland, 2 It is also possible to estimate the overall value in the housing market of a house s neighborhood traits, including school quality and safety and other traits that cannot be observed. This value can be called neighborhood quality or neighborhood housing value. The following figure shows the relationship between neighborhood quality and income in the Cleveland area. The horizontal axis is the median income of a homeowner in a neighborhood (in log form); the vertical axis is neighborhood quality (also in log form); on average, a one percent increase in homeowner income leads to a 0.524 percent increase in neighborhood quality. This income sorting is a central cause of inequality in local public service outcomes.

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Sorting and Inequality This income sorting is a central cause of inequality in local public service outcomes. Households who win the competition for housing in high-service communities receive have access to better educations, better police protection, and so on. Better services lead to better outcomes, including higher incomes. The advantages of better public services are passed down to the next generation, thereby reinforcing and perhaps magnifying inequality. See the famous scholarship of Raj Chetty and co-authors: http://www.equality-of-opportunity.org/neighborhoods/

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Income Sorting in the Cleveland Area, 2000 13 12.5 12 11.5 11 10.5 9.5 10 10.5 11 11.5 12 log of median owner income log of neighborhood housing value Fitted values

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Sorting Over Time The inequality created by sorting is also influenced by three other factors. o1. Sorting is not fixed; economic or demographic changes can alter the type of household moving into a community. oOne important example is gentrification, which is said to occur when higher-income people move into a poor area, upgrade existing housing, and raise housing prices. oLow-income renters clearly lose from these changes, but low- income homeowners have gains (more valuable homes) and losses (fewer social ties).

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Zoning 2. In the US local governments also control zoning, that is, the rules determining what types of property can be build in different areas. oSome communities use large-lot zoning or some other restriction to prevent lower-income households from moving in. oBut because of competition for entry into nice neighborhoods with good schools, sorting would exist even without zoning. oWe do not yet know whether zoning causes sorting or competition-based sorting is reinforced by zoning or some of both. oSee https://www.nytimes.com/2019/06/20/us/single-family- zoning-los-angeles.html?searchResultPosition=1

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Housing Discrimination 3. Sorting, including who gets access to good public services, also is influenced by housing discrimination against certain racial or ethnic groups. You may think that housing discrimination is a thing of the past. The evidence says otherwise. A 2019 investigation by Newsday found an astonishing amount of discrimination on Long Island. This discrimination mainly consists of steering different racial and ethnic groups into different neighborhoods which is a type of sorting! See https://projects.newsday.com/long-island/real-estate-agents-investigation/ Academic research also finds discrimination, both in the form of steering and in the form of showing fewer housing units to black, Hispanic, and Asian than to white home seekers. See Oh, Sun Jung, and John Yinger. 2015. What Have We Learned from Paired Testing in Housing Markets? Cityscape 17 (3): 15-60. https://www.huduser.gov/portal/periodicals/cityscpe/vol17num3/article1.html

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Sorting and Allocative Efficiency On Tiebout s normative point, most scholars believe that having many local governments is more efficient than having just one. But, they disagree about: o whether the current federal system could be made more efficient; o whether the efficiency advantages of choice outweigh the equity costs of sorting. These are key issues in the design of any federal system in the U.S. and elsewhere.

State and Local Public Finance State and Local Public Finance Lecture 3: The Demand for Local Public Services Lecture 3: The Demand for Local Public Services Questions How is the demand for local public services revealed? What is the Tiebout hypothesis? What is public service capitalization? How does public service capitalization reinforce inequality?