Long Term Care Insurance Rate Review Process

Explore the Long Term Care Insurance Rate Review Process, including historical regulations, rate increase standards, and key considerations for insurers. Learn about filing timelines, public comments, and insurer obligations for policyholders' protection.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

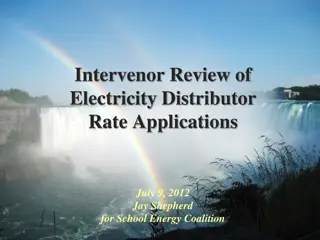

Long Term Care Insurance Rate Review Process March 10, 2016

Timeline Insurer files a rate change request with the Department The Department publishes the filing in the PA Bulletin and on our website A 30-day public comment period starts on the day of publication After the 30-day public comment period, the Department has 45 days to review the filing The Department almost always has questions about the filing. If we need extra review time because the company has not responded or outstanding issues remain, we can extend the review period.

History PA enacted its first Long Term Care regulation in 1995. It was based upon the National Association of Insurance Commissioners (NAIC) model and provided many consumer protections such as: Limits on pre-existing condition exclusions Requirements to offer inflation protection Unintended lapse protection by alerting a third party Standards for marketing and advertising

Rate Increase Review Standards Pre-2002 Policies A rate increase can be justified if a company can demonstrate that their expected claims over the life of the policy would exceed 60% of the expected premium. Post-2002 Policies PA adopted the updated NAIC Rate Stability model regulation in 2002 Encourages insurers to price conservatively. A company filing for a rate increase must demonstrate an expected 58% loss ratio for the initial premium and 85% loss ratio for additional premium collected due to the rate increase

Rate Increase Review Considerations Company projections Mortality how long a policyholder is expected to live Morbidity how healthy a policyholder is expected to be Lapse how likely policyholders will cancel their policy Company solvency Financial impact to consumers Past rate increases Availability and type of options to limit the rate increase by reducing benefits