Making College Affordable: A Comprehensive Guide

Learn how to make college affordable with tips on understanding the average costs of attending college, various ways to pay for college including scholarships, grants, and federal loans, and strategies for managing loan repayment effectively. Discover how to navigate the financial aspects of higher education and make informed decisions to fund your college education efficiently.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

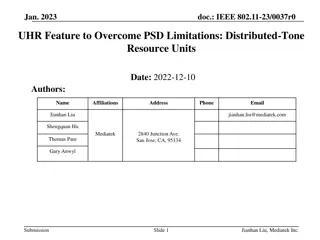

PAYING FOR COLLEGE 101 A GUIDE TO MAKING COLLEGE AFFORDABLE

INTRO & BACKGROUND Graduated from Penn State Worked in Omaha, NE with College Success and Access Programs and College Admission Offices Currently freelancing to spread how affordable college can be

ON AVERAGE, HOW MUCH DOES IT COST TO ATTEND COLLEGE? In 2021, the average cost is: Personal Experience: Private Colleges: $37,650 Out-Of-State was around $40,000 per year Public In-State: $10,560 Public Out-Of-State: $27,020 Costs Can Include: Tuition and Housing Parking, Student Activity Fees Travel and Books

WHAT ARE SOME WAYS TO PAY FOR COLLEGE? Savings Part-Time Work Loans Financial Aid Work-Study Grants Scholarships Federal Loans

SCHOLARSHIPS Money that is gifted and does not need to be paid back Can have requirements of having a certain GPA or participating in an organization on campus Can be based off of academic achievement, family income, hobbies, or co-curricular activities Typically, you are eligible through applying through FAFSA, through the school directly, or talking to financial aid offices

GRANTS Money that is gifted and does not need to be paid back Examples: - Federal Pell Grant: $6,500 Can be based off of financial need - Federal Supplemental Educational Opportunity Grants: $100 - $3,000 Typically, you are eligible through applying through FAFSA

FEDERAL LOANS Money that you do have to pay back however, federal loans are more manageable Two Types: Unsubsidized Gains interest while you are in school, do not have to be repaid until you leave school Subsidized Does not begin to gain interest until you leave school, do not have to be repaid until you leave school Ways of paying off loans: Monthly set amounts Based on income 10% of yearly income Repayment programs (typically for public servants i.e. teachers, lawyers, etc)

FEDERAL LOANS You must apply to the FAFSA in order to be eligible to receive this loan There are loan options where your parents hold the loan Parent Plus Loans Must start paying these as soon as you start school and have higher interest rates If you are ineligible for federal loans, schools will typically offer more aid through scholarships Subsidized: Unsubsidized: - Dependent Student: $3500 - Dependent Student: $2000 - Independent Student: $3500 - Independent Student: $6000

WORK-STUDY Money that is offered in a form of a campus job Work up to 15 hours a week on campus, flexible schedule, and you are paid bi-weekly Can assist with buying textbooks, food, clothing, etc Is included in your financial aid award letters

FAFSA: FREE APPLICATION FOR FEDERAL STUDENT AID Application that can determine need based scholarships, grants, and federal loan eligibility Application opens October 1st every year You would apply your senior year of high school Information it gathers Family size Parents Income Student Income If you are ineligible to apply for FAFSA due to various factors, financial aid offices have other resources EX. College of Saint Mary in Omaha, NE has a Misericordia Scholarship

PRIVATE BANK LOANS Money that you do have to pay back and typically will need a co-signer (your parents or guardian). Will need to be paid back starting immediately Have high interest rates Not many ways to repay