Making Sense of Stock Prices Amid COVID-19 Economic Challenges

Explore how equity markets function in the context of the COVID-19 pandemic-induced economic challenges. Learn about the efficient market hypothesis, equity risk premium, and the value of equity in uncertain times. Understand the relationship between profits and economic growth for insightful investment decisions.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Corporate Equities, Investment Corporate Equities, Investment Trends and Capitalist Finance Trends and Capitalist Finance And how can we make sense of stock prices today, In the midst of the economy s COVID-19 medically induced coma? April 8th2020

We now need to add equity markets to our stylized model of finance. We build up from investing in a hard asset, to investing in equity shares: A company can choose to borrow to finance a project. As economic forecasters, we need to recognize that two drivers overwhelmingly determine business investment decisions: `estimated cash flows the discount rate. Both cash flow conjecture and discount rates are highly pro-cyclical.

If we embrace the efficient market hypothesis, shares reflect discounted present values of expected future earnings PV (A,r,n) = (A/r) [1-(1/(1+r))n] A annual net income r discount rate n number of years

The N.P.V. of a $50,000 truck? Depends on earnings and discount rates:

The equity risk premium: Equity discount rate = risk free rate + equity risk premium More generally, we define the value of equity as the discounted value of the stream of expected earnings, discounted by the equity cost of capital. Formulaically: Value of Equity = earnings (1) + earnings (2) earnings (XX) Where edr is the equity discount rate 3.75% 6.25% (1+edr )2 (1+edr) xx (1+edr)

Equity share prices, EMH says, reflect expected profits, discounted We can create the simplest of profit models: For the national economy we define margins as the ratio of Corporate Profits to Gross Domestic Product Profits = f(economic growth, corporate margins) Note: margins measure the share of top line revenues that accrue to earnings.

When forecasting profits, we acknowledge two truths about profits: Profits grow much faster than the economy for much of the business cycle, A forecast of long run margin expansion is nonsense. If the long run trend for profits has them rising as a share of income, over time all income accrues to capital, and the U.S. becomes ancient Egypt owners of Capital collect all income, the rest are slaves. but plunge during economic downturns (margins are violently pro-cyclical).

Equity Risk Premium Equity Risk Premium = (earnings yield) = (earnings yield) - - (risk free real yield) (risk free real yield) Why do we subtract inflation from the bond yield? The relevant comparison of cash flows would look at the perpetual stream of corporate earnings from the S&P 500 companies. These nominal streams will grow with time. Thus the earnings yield, a ratio of today s asset price to the expected earnings only one year forward understates the yield implied by the stream of growing corporate earnings. A useful short-hand for calculating the ERP is to simply subtract the real risk-free rate from the earnings yield.

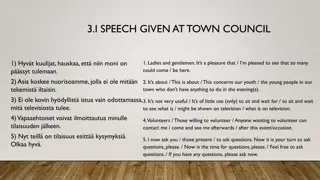

EARLY APRIL 2006 EARLY APRIL 2009 EARLY APRIL 2014 LATE MARCH 2017 OCT. 3RD 2018 MID JULY 2019 EARLY APRIL 2020 ESTIMATED EARNINGS PER SHARE (EPS) ESTIMATED EPS GROWTH (YOY) PRICE PER SHARE (PPS) $88/SHARE $78/SHARE $118/SHARE $129/SHARE $163/SHARE $166/SHARE $140/SHARE -16.1% 6.3% 9.3% 1310 800 1890 2369 18% 2925 3000 2660 EARNINGS YIELD (EPS/PPS) 6.72% 9.75% 6.24% 5.45% 5.57% 5.53% 5.3% EX-ANTE REAL 10-YEAR RISK FREE rate, r 2.35% 1.05% 0.51% 0.44% 1.03% 0.30% -0.40% EQUITY RISK PREMIUM (ERP) =EY-r 4.37% 8.70% 5.73% 5.01% 4.54% 5.23% 5.66% U.S. 10-year 5% 2.90% 2.70% 2.40% 3.18% 2.08% 0.75% Moody's Baa 6.60% 8.60% 4.90% 4.65% 4.98% 4.28% 4.54% Baa 10-year spread 1.60% 5.70% 2.20% 2.25% 1.80% 2.20% 3.79% Equity Premium vs. Moody's Baa 2.77% 3.00% 3.53% 2.76% 2.74% 3.03% 1.87%

Company priced at $100/share. Expected growth is 5% per year in perpetuity. Expected earnings are $10/share next year What is the earnings yield? Invoke EMH, the share price ($100) is the net present value of the earnings stream. The formula for the net present value of a growing perpetuity: PVG ( ) = ?? ? ? Where C1 flow in year 1; g the growth rate for C; r interest rate per period (the yield) Solving: 100 = ?? r-.05 = 0.1 ?? ? ? = ? .?? r = 0.15 = 15% Our simplified model, EY = E/P gives us an answer of 10%

In the long run, stocks outperform with an insane degree of regularity

Stocks, long run, always outperform, except when they don t .

Allocating Capital and Tobins Q Allocating Capital and Tobin s Q Tobin s Q is a measure of the market value compared to the Tobin s Q is a measure of the market value compared to the replacement cost of a company s assets replacement cost of a company s assets $1,000,000 of inherited money to form a small oil company. The company erects 1 oil rig, at a cost of $1,000,000. 10,000 shares at $100 per share. His equity exactly equals the value of the sole asset, the oil rig. Company sells oil at $50/bbl. osts are $30/bbl, netting him $20/bbl in profit. Costs are $30/bbl. Profits are $20/bbl In our super simplified example, the company has a Tobin s Q of 1. We assume the $100/share price correctly reflects the DPV of the stream of earnings that $50/bbl oil implies.

Now we have a shock. Chinese and Indian consumers begin to drive motor vehicles. Oil leaps to $100/bbl. The company now generates $70/bbl in profit. The DPV of this more than tripling of cash flow causes his share price to triple. What happens to the Q ratio of Ollie s company? The market value of Ollie s stock is now $3,000,000. The replacement cost to build another rig remains at $1,000,000. Thus the Q ratio is now 3. When the Q ratio is well above 1, it is in the shareholders interest to sell equity and invest in additional physical capital.

We can issue 3,333 additional shares at $300 per share, raising another $1,000,000, using proceeds to build a second oil rig, and doubling corporate earnings. Earnings double, but the original owner collects 2/3s of the earnings the tripling of the share price means only 1/3 of the number of shares were issued for $1,000,000 to drill.s. More generally, when the q ratio is well above 1, the equity cost of capital is low and investment climbs in said area. So a leap in oil prices drives share prices higher, inviting equity issuance to finance bricks and mortar or deep water oil rig investments What happens if share prices plunge? If you have company with a Q ratio well below 1, there is no incentive to expand productive capability. If a factory cost $1,000,000 to reproduce, and the market capitalization of the company is $600,000, and you have a hankering to be in that business, you can buy the factory, by buying the company for $600,000.

How does this relate to impact investing? What happens if we sell shares?