Managing Debt and Building Wealth: Essential Financial Steps

Learn essential steps for managing debt and building wealth for a secure financial future. Explore how to become debt-free, build a cash reserve, and secure your retirement through smart money management strategies. Discover the keys to financial freedom and peace of mind.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

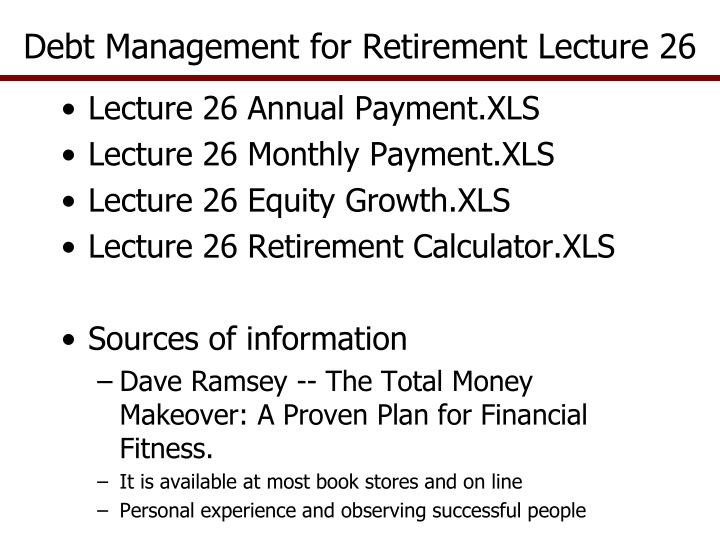

Debt Management for Retirement Lecture 26 Lecture 26 Annual Payment.XLS Lecture 26 Monthly Payment.XLS Lecture 26 Equity Growth.XLS Lecture 26 Retirement Calculator.XLS Sources of information Dave Ramsey -- The Total Money Makeover: A Proven Plan for Financial Fitness. It is available at most book stores and on line Personal experience and observing successful people

Do You Want to Manage Debt or Wealth? This lecture is not about business management It is about your personal money management The question is: Do you want to spend your life managing debt or wealth? People work for 2 reasons: Cover costs for necessities Increase net worth (so we can retire) To achieve this goal we must manage wealth

To Manage Wealth First step is to become debt free Second step is to build wealth Reasons to build wealth Retirement Security Have Fun Money is Not the Root of all Evil Desire of Money is the Root of all Evil

Steps to Becoming Debt Free Cut expenses so you live within your means and SAVE Stop using credit cards pay cash or postpone purchases Buy used cars 1-2 years old, keep them a few years and trade again After you have built wealth then you can afford to buy new cars NEVER lease a vehicle With a lease you are paying for the car plus interest PLUS someone else s profits Companies do not lease cars to lose money

Build a Cash Reserve Yes, before you start paying off debt build a cash reserve your personal VaR fund Why a cash reserve? How much? Where do to invest it? Cash reserve pay for an emergency: as job loss Not to go on a vacation, for a wedding, or fun Cash reserve should equal 3 times your after- tax Monthly Salary (Take Home Pay) Invest it in a Money Market account, interest is low but MMs usually require a min check size of $250 so it discourages using it on little items

How to Build a Cash Reserve Sell something Garage sale Extra vehicle Move to cheaper house, etc. Get a part time job Start a business doing something other people do not want to do for themselves This is not permanent just to get a reserve

Develop a Plan to Pay Off Debts Sort debts from low to high: D1, D2, .., Dn Pay maximum extra you can afford on the smallest debt (D1) until it is paid off Use money you had been paying on D1 and add it to the payment on D2 until it is paid Continue this until all debts are paid off Euphoria from paying off a debt is great so get the feeling early by attacking the lowest debt (D1) first, then move to D2 .. Low hanging fruit is easiest to pick

Do Not Get Back Into Debt Use Cash or Debit Cards Can I ever use a Credit Card again? Yes if your job reimburses your travel expenses Have a separate card for ONLY travel that will be reimbursed Avoid all kinds of debt Save money to buy a car Do not take vacations until you can pay cash Save money for a house

Years and Cost to Finance a Car The total cost of a $40,000 car Financed 72 months =$46,382 to $49,101 Shorter the loan, the lower total cost Monthly Total Cost/ Amount Borrowed 40,000 40,000 40,000 40,000 40,000 No. of Months for Loan Life Interest Rate Payment Interest Total Cost Initial Cost 72 0.05 644 60 0.05 755 48 0.05 921 36 0.05 1,199 24 0.05 1,755 Annual 6,382 5,291 4,216 3,158 2,117 46,382 45,291 44,216 43,158 42,117 1.160 1.132 1.105 1.079 1.053 72 60 48 36 24 0.07 0.07 0.07 0.07 0.07 682 792 958 9,101 7,523 5,977 4,463 2,982 49,101 47,523 45,977 44,463 42,982 1.228 1.188 1.149 1.112 1.075 40,000 40,000 40,000 40,000 40,000 1,235 1,791

Housing: Buy or Rent Renting Provides no income tax deductions But do you have sufficient income to itemize deductions? Probably not when just starting out Does not build equity Ownership Builds equity (slowly) Often get over extended with large payments Small income tax deductions on the whole Do not acquire debt to reduce income taxes! Save for a house; make a large down payment

Years and Cost to Finance a Home Examine total cost of a $100,000 home Financing for 15 vs. 30 years is $32,876 Finance for as short a period as possible Make large down payment to avoid added charges when making 10% down payment Amount No. Year for Annual Borrowed Loan Life Interest Rate Payment 100,000 5 0.035 100,000 10 0.035 100,000 15 0.035 100,000 20 0.035 100,000 25 0.035 100,000 30 0.035 Total Interest Total Cost 10,741 20,241 30,238 40,722 51,685 63,114 22,148 12,024 8,683 7,036 6,067 5,437 110,741 120,241 130,238 140,722 151,685 163,114

Once You Are Debt Free, Whats Next? Do not change standard of living -- SAVE Save for what? Retirement and fun Children s educ #529 College Savings Plan Where do you invest your savings? Low load mutual funds lots to choose from Every investment house has several Make sure you can move money among the Funds in the Family without a cost Get a broker, but do not let them make trades for you can lead to account churning

Retirement Savings When do I start? How much should I save? Is it to late? What about Social Security for your retirement? Can you live on 23.7% of your gross income?

Retirement Savings, Will Employer Look Out for US? In the future, businesses will not provide matching retirement accounts You will be on your own to save through an IRA Few businesses will provide matching funds Some will offer managed IRAs with limited options

Retirement Savings When to Start Start saving the day you graduate or today Save as much as you can but at least save 15% of your gross salary annually Save 50% of each raise Keep working and paying into Social Security so I can collect it! Do not depend on Social Security to cover your retirement needs Today Social Security will pay me 15% of my current salary; after paying in for 50 years

Social Security and Medicare/Medicaid Social Security has no store of money Congress will CUT these entitlements Debt ceiling, sequestration, budget reductions Presently prescriptions have a means test Probable changes in Social Security Extending retirement age to 75 Means testing based on wealth or income to receive social security payments There will be reduced payment rates for everyone

IRS and Retirement Savings Tax DEFERRED savings Traditional IRA - $5,000/year per person unless over 60 then can save $6,000/year If you are in a company retirement plan you can still use the max Traditional IRA If you are self employed you can have a SEP IRA 25% of business income up to $50,000 tax deferred or KEOGH plan 25% of self-employed income up to $49,000 tax deferred None tax deferred savings You can save as MUCH as you want

Retirement Saving is Risky Variables to consider Current age and amount you have saved Current salary and expected raises Age you want to retire Consumption expenditures after you retire Annual rate of inflation pre & post retirement Returns you expect on savings until retirement Returns on savings after you retire How long do you & spouse expect to live Which of these variables are stochastic? Nearly all of them!

Retirement Calculator I made a Monte Carlo simulation model to calculate retirement savings With lots of stochastic & input variables

Open the Retirement Calculator Enter your own values Simulate using the KOV table starting in row 183 What age do you have a zero wealth? How much do you have to save to give yourself a 95% chance of having wealth when you are 90 or 95 or even 100? Did you marry the right person ($ s)? Remember divorce cuts your wealth in half so it takes twice as longer to save for retirement

Summary of AGEC 622 Linear programming what ought to be . Probabilistic forecasting capabilities of forecasting with multiple regression, exponential smoothing, seasonal analysis, and time series analysis Monte Carlo simulation what could be . Frame your problem in a systems framework Model design and development Parameter estimation for stochastic variables and deterministic component of a forecast Validate simulated variables Univariate and MV distributions Apply these tools for business and personal decision making using stochastic efficiency

What can you take to the job? Improved Excel skills Refresher in applied econometrics Ability to organize & build a business model Make any business model a risk analysis tool Rank risky alternatives Deterministic and probabilistic forecasting Simetar Available as long as you are a fulltime student After you graduate, buy it at www.simetar.com If you do not have Simetar, you can use @Risk =NORM() same as =RISKNORMAL() =UNIFORM() same as =RISKUNIFORM()

What to Expect on Lab Exam Starts today at 2:00pm Ends at 4:00pm April 27. NO EXCEPTIONS Exam and data will be posted at 2:00 Open book, notes, and computer programs You must email me the Excel workbooks you develop You must print reports requested to my office AGLS 351 Two parts to the exam Part A is short, do it first DO NOT talk to current or past students, no texting, tweeting, face booking or other social interaction during the exam The type of problem for Parts A & B will be familiar You may use any computer you want. I will assign an F for a letter grade to cheaters!

What to Expect on Final Exam May 4th 3:00-5:00 Questions on all aspects of the material covered in class since I started teaching Short answer essay questions You should not need more space than what is provided for a complete answer DO NOT repeat the question as part of your answer It wastes time for you and ME A few calculator questions NO Cheat Sheet is permitted Study for this, do not give up like the students did last year their grades were even lower then the Mid Term exam!