Managing Financial Stress for Veterans: Strategies and Resources

Learn about the financial challenges veterans face, including economic disparities, financial well-being, and the link between financial stress and suicide. Discover strategies and resources to help manage financial stress effectively in this comprehensive guide.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Managing Financial Stress Dr. Susan Black VBA National Suicide Prevention Officer Outreach, Transition, and Economic Development December 10, 2021

Overview Veterans Financial Well-being Financial Stress and Stress Response Strategies for Managing Financial Stress Resources 2

Veterans Economic Disparities Veterans enrolled in VHA care are less likely to be employed and more likely to have lower income levels than Veterans not receiving VHA care. Some Veterans report difficulty in transitioning to civilian positions and difficulty translating military-related skills to higher-paying civilian jobs. Unemployed & poverty are correlated with homelessness among Veterans Veteran Unemployment rate increased from 2.3% to 11.7% from April 2019 to April 2020 2020 National Veteran Suicide Prevention Annual Report 3

Veterans Financial Well-Being Many military service members become financially independent much later than civilian counterparts. Predatory lenders target military and Veteran populations(DOD, 2006; Oron, 2006; Tanik, 2005). Service members three times more likely than civilians to take out payday loans(Institute of Medicine, 2010). National Financial Capability Study showed that military service members were more likely to incur credit card debt than civilians (Financial Industry Regulatory Authority, 2013; Skimmyhorn, 2016) Military veterans were more likely to suffer through credit problems, underwater mortgages and late house payments than the civilian population (Skimmyhorn, 2014). 4

Financial Stress and Suicide Economic and financial uncertainty is associated with higher suicide rates (Chang et al., 2013; Frasquilho et al, 2016; Reeves et al., 2012) Veterans lacking money to cover basic needs (food, clothes, shelter, transportation, medical care) were three times more likely to endorse suicidal ideation one year later compared to Veterans with money to cover basic needs (22% versus 7%) (Elbogen et al., 2020a). 5

Financial Stress Financial stress is emotional tension that is specifically related to money; creates anxiety, worry, or a sense scarcity and accompanied by physiological stress response Financial Stress is one of the most common stressors An American Psychological Association study found 61% of Americans feel stressed about money Financial stress connected to military service is cited more than any other military-family issue by veteran spouses (54 percent) and military spouses (49 percent), as well as by veterans (44 percent). Among active-duty members, 6

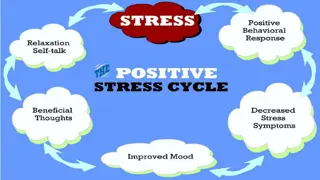

Stress Response Financial stress like any source of stress can trigger an inherent physiologic response: fight-flight-or-freeze response (acute stress response) Autonomic Nervous System (ANS): fires up and gives energy needed to deal with a threat or stressor Speeds up breathing and heart rate, raises blood pressure, tense muscles, pupils dilate Ready for action Takes 20 to 60 minutes for the body to return to its pre-arousal level (relaxation response) Chronic stress occurs when the body experiences stressors with such frequency or intensity that the autonomic nervous system does not have an adequate chance to activate the relaxation response on a regular basis. This means that the body remains in a constant state of physiological arousal. 7

Common Stress Reactions Irritability or anger Trouble falling asleep or staying asleep Feelings of hopelessness Lack of appetite or, the opposite, eating all the time Trouble concentrating or feeling confused Headaches, stomachaches or other body pains Chronic anxiety and nervousness Social isolation, shutting down or withdrawing from people and activities A lack of energy or feeling exhausted all the time Depression, sadness Misusing alcohol, tobacco, drugs or prescription medications to cope Having no feelings at all or feeling numb 8

Strategies for Coping with Stress Stay connected with friends, family, neighbors and colleagues to give and receive support. Staying in touch can help reduce stress Avoid using alcohol, tobacco and other drugs to manage distressing emotions; these substances often make things harder in the long-run and can cause problems. Focus on what you can control and practice acceptance Eat well, with a healthy, balanced variety of foods; taking care of your body reduces the negative effects of stress Get enough sleep; keep a regular sleep schedule Exercise; be physically active Find healthy ways to relax, such as breathing exercises, meditation, mindfulness, calming self-talk, practicing self-compassion, soothing music Engage in fun and restoring activities, including hobbies and social activities. 9

Improving Financial Well-Being Encourage Financial Literacy Veterans Benefits Administration - Financial Literacy website: https://benefits.va.gov/BENEFITS/financial-literacy.asp Direct Veterans to MyMoney.gov for helpful financial education tools and resources. Financial Wellness Center: www.prudential.com/vbaoted For financial resources for Veterans, service members, and military families, visit the Consumer Financial Protection Bureau s Office of Servicemember Affairs website at: www.consumerfinance.gov/practitioner- resources/servicemembers. Mental Health America: Managing your Money: www.mhanational.org/managing-your-money

Resources Don t Wait. Reach Out: Encourage Veterans to seek help before they re in crisis. If you or a Veteran you know needs support, you can find resources at: VA.gov/REACH VA Mental Health:VA s repository of mental health resources, information, and data materials. Website: www.mentalhealth.va.gov/MENTALHEALTH/suicide_prevention/index.asp Make the Connection: VA s premier mental health literacy and anti- stigma website, which highlights Veterans real, inspiring stories of recovery and connects Veterans and their family members and friends with local resources. Website: maketheconnection.net Lethal Means Safety: firearm suicide prevention & lethal means safety www.va.gov/reach/lethal-means Coaching Into Care: Through this program, a licensed psychologist or social worker can provide guidance to Veterans friends and family, including assistance with tools to motivate a loved one to seek support. Website:mirecc.va.gov/coaching 11

Apps for Managing Stress: mobile.va.gov/appstore/mental-health

Contact Information Dr. Susan L. Black, DSW, LCSW-C, BCD VBA National Suicide Prevention Officer Outreach, Transition and Economic Development Veterans Benefits Administration Email: VSPP.VBACO@VA.GOV 14