Martin Brown & Graham Felstead

The bespoke mortgage proposition market segmentation, customer clusters, and future growth projections. Discover insights on luxury property customers, grey equity borrowers, stretching aspirers, youthful complexity profiles, and service devotees. Gain valuable perspective on the evolving specialist residential mortgage market set to triple by 2030.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Martin Brown & Graham Felstead Mortgage Senate September 2022 Information classification: Private (Amber) Classified as Private (Amber)

Bespoke Mortgage Proposition What have we seen so far? Is this market growing? In a changing market what more can be done to help customers? Classified as Private (Amber)

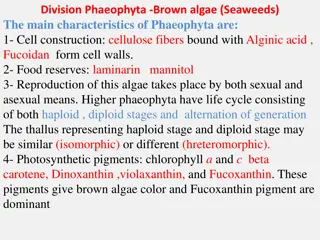

UK Mortgages Bespoke Customer Clusters Luxury Property Customers looking to purchase properties with an average value approaching c 1.5m. These customers typically earn 300k, live in London, with an average age of 40 Grey Equity A more mature customer with an average age of 52, looking to re-mortgage to release equity in their property to provide gifted deposits to their children or to purchase a holiday home, BTL property, etc. Stretching Aspirers Younger customers, in permanent company employment, with 90k average income, who are aspiring to trade up to a larger home. Youthful Complexity Customers with an average age 34, 95k average income and often with higher potential variable/performance based income. Service Devotee Customers living in London/South East and with larger incomes. They would meet the desired applicant profile but residency status wouldn't fit a standard approach. 3 Classified as Private (Amber)

UK Mortgages Bespoke Customer Clusters Cluster Rank Property Value LTV Annual Income Age 1 500k 70% 100k 34 Youthful Complexity 2 1.25m 55% 150k 52 Grey Equity 3 500k 85% 100k 34 Stretching Aspirers 4 750k 85% 175k 36 Service Devotee 5 1.5m 80% 300k 40 Luxury property 4 Classified as Private (Amber)

Specialist Residential Mortgage Market set to Triple by 2030: Market will double to 16bn by 2030 Gig economy Auto U/w vs Individual Non 13% didn t apply for a mortgage Standard property 12% Self employed/Contractor Non Nuclear Family 53% non standard Over 55 21% Non Standard income 22% Multiple incomes Cost of Living challenge Research by Opinium and Dr John Glen Cranfield School of Management 16/08/22 15/02/2025 5 Classified as Private (Amber)

Information classification: Sensitive (Purple) (Not for further distribution without prior consent from Information Owner) | Confidential (Red) | Private (Amber) | Public (Green) [Instruction: Delete all but one classification and this instruction each slide must include the classification which reflects the most confidential data within the entire document] Classified as Private (Amber)