Measuring Customer Empowerment in Financial Services Sector

Explore the initiatives of a working group led by Anton Simanowitz to measure customer empowerment within the financial services sector. Discover the objectives, agenda, and strategies discussed in the group to enhance customer empowerment effectively and ethically.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Customer Empowerment Working Group Facilitator: Anton Simanowitz 23rd April, 2019

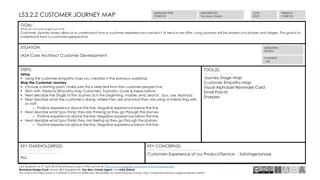

Objectives of Working Group USSPM customer empowerment lens (provider focus) Develop guidance and additional practices Test guidance & practices with FSPs. Measuring customer empowerment Integrate indicators into customer & market surveys Use survey data to analyse patterns of customer empowerment Action-research(what empowers customers?) Audience: Providers & wider market (regulators, associations etc) Time frame by October 2019 (6 months)

Agenda 25 mins 1. What to measure? Input from CGAP Outcomes Framework 25 mins 2. How to measure Capability, experience, outcomes? Practical and meaningful? 10 mins 3. Integrating measurement into planned work 10 mins 4. Action-research 5. Next steps

What do we want to measure? What would signal change in empowerment (in relation to choice, respect, voice, control)? Capacity/capability/knowledge? Attitude/confidence/intentionality? Behaviour/experience? Input from Antonique Koning (CGAP) Discussion What are key elements to capture? How do we deal with impact of variance in self-perception e.g. India research? Can we develop simple measurement that FSPs and others can use?

How to measure? What experience do you have of measuring customer empowerment? Likert-scale/self perception vs. objective measures? E.g. are you aware of the providers in the market? or name the providers that you know in the market .

Developing questions Capability/capacity E.g. knowledge about products & services on offer E.g. understanding consumer rights E.g. confident in selecting/using financial services Experience/outcomes E.g. Feel that treated with respect E.g. Ease/difficulty of choosing between providers or products E.g. Able to access desired products & services E.g. Effective use of financial services

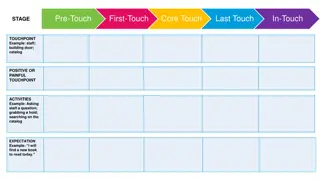

Choice Capacity to make effective choice When I need more information about financial services, I know how to get it. I can compare prices and terms offered by different FSPs. I am confident that I can select the products or services that are right for me. Experience I am able to access all of the products and services available from FSPs. Choosing between a provider or between products and experience is a stressful experience.

Respect Knowledge of what to expect from providers I understand my rights as a consumer and what I should expect from FSPs. Experience I am treated with respect and am not discriminated against. All customers receive the same respect and dignity regardless of their status or transaction size

Voice Capacity to engage with FSPs I know my rights and responsibilities as a financial services consumer, how to exercise them, and where to complain when problems arise. Experience I have access to staff who have time and an interest to hear and understand my needs and experience. I am able to discuss my financial needs with my provider and choose products and terms that suit me.

Control Capacity to effectively use financial services The products and services on offer to me help me better manage my financial life. I am aware of the consequences of poor financial decisions and motivated to try to avoid them. Experience I know how to budget, follow a financial plan and monitor progress towards my goals. I use financial services to achieve future goals. I know my financial limits and how to stay within them. I have confidence that if I make a mistake using my financial services my provider will help me to sort this out and I will not be penalised.

Integrating measurement into plans Customer research or market surveys Looking at market to understand characteristics of segments by levels of customer empowerment E.g. FINCA

Integrate customer empowerment focus into customer satisfaction, feedback or complaints Segmenting based on customer empowerment indicators Who complains or not, why, when Who is more satisfied or not (Note, more empowered may be less satisfied) Follow up qualitative what empowers them to complain or not Relationship with understanding, confidence, respect, voice etc

Action-research Building on existing work E.g. MFO Bangladesh Developing new concept focus on testing actions independent of providers Actions to build financial capability Connecting customers & sharing information through digital platforms Building collective voice, action and customer representation

Next steps 1) Collaboration on developing indicators/ questionnaire 2) Plans to integrate customer empowerment into customer surveys or research? 3) Developing action-research concept 4) In-person meeting June 25th, 5.15pm, Nairobi