Medicare Options and Enrollment Periods in 2025

Explore the latest updates on Medicare for October 2025, including coverage details for Parts A, B, C, and D. Learn about Original Medicare and Medicare Advantage with Prescription Drug Coverage options. Compare Medigap with PDP and discover Medicare enrollment periods such as the Initial Enrollment Period (IEP) for those turning 65.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

October 2025 MEDICARE 101 UPDATE Agent First & Last Name

MEDICARE BASICS Part B Part B Part C Part C Part A Part A Part D Part D Part A covers hospital stays and Inpatient care. For most, cost is $0 a month. First 60 days covered 100% Part B helps pay for doctor visits and outpatient care. Base premium for 2025 is $185 (Adjusted for those with a joint income over $206,000 and individual income of $103,000 in 2022, two year look back) Part D is the Prescription Drug Coverage. Can be a Stand-Alone Prescription Drug Plan or a Medicare Advantage Plan with Prescription Drug Coverage. Medicare Advantage Plan (Part C) combines Parts A & B and can also include Part D. First 20 days of skilled nursing covered 100% Part B deductible is $240 for 2024 $1,632 deductible per occurrence

MEDICARE OPTIONS Option 1 Original Medicare Original Medicare The Government Program Option 1 Option 2 Option 2 Medicare Advantage w/ Prescription Drug Medicare Advantage w/ Prescription Drug Coverage Coverage Private Insurance Program Part A Part A Hospital Insurance Part B Part B Medicare Insurance Includes the same hospital and medical coverage as Original Medicare; typically, also offers prescription drug insurance; and often provides extra benefits, such as dental, vision, wellness and more. For an extra fee, you can purchase two additional For an extra fee, you can purchase two additional plan to fill the gaps in Original Medicare: plan to fill the gaps in Original Medicare: Part A Part A Hospital Insurance Part B Part B Medicare Insurance Part D Part D Prescription Drug Coverage Medigap Medigap Medicare Supplement Insurance Part D Part D Stand-Along Prescription Drug Plan (PDP)

MEDICARE OPTIONS COMPARED Medigap W/ PDP Pros Pros Cons Cons Medigap W/ PDP Medicare Advantage Pros Pros Medicare Advantage Cons Cons Open network for providers Low cost to consumer when using plans Cost of Medigap plans continue to rise between 8-15% per year PDP (Stand-Along Prescription Drug Plans) also are increasing in cost PDP plans have removed many drugs from their formularies Limited worldwide coverage Low to no premium cost Care management for those in need Rich prescription coverage built into plan if needed Extras such as dental, vision, hearing, gym membership, OTC and much more built in Limited to network of providers Prior authorization needed depending on carrier

MEDICARE ENROLLMENT PERIODS Medicare Enrollment Periods Medicare Enrollment Periods IEP IEP 7 months 7 months Initial Enrollment Period (IEP) Initial Enrollment Period (IEP) You have 7 months to enroll in Medicare for the first time when you turn 65 3 Months Before The Month You Turn 65 3 Months After AEP AEP Oct 15 > Dec 7 Oct 15 > Dec 7 Annual Enrollment Period (AEP) Annual Enrollment Period (AEP) Make change to your Medicare Advantage or Stand-Alone Prescription Drug Plan OEP OEP Jan 1> Mar 31 Jan 1> Mar 31 Open Enrollment Period (OEP) Open Enrollment Period (OEP) Medicare Advantage enrollees can switch plans or return to Original Medicare SEP SEP A Qualifying A Qualifying Event Event Special Enrollment Period (SEP) Special Enrollment Period (SEP) You can change your coverage after a qualifying event such as loosing group coverage

2025 MEDICARE CHANGES

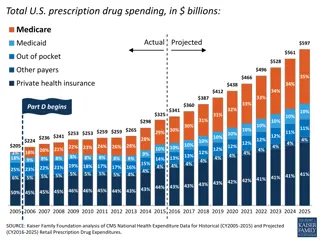

INFLATION REDUCTION ACT Passed in August of 2022 by President Biden to reduce cost of prescriptions. Well, that was the idea . 2023 2023 Part D Vaccine Coverage Expanded: No deductible or cost sharing may be charged for adult vaccines recommended by the Advisory Committee on Immunization Practices (ACIP) Insulin Savings Program: Out of pocket costs for insulin must be capped at $35.00 per month s supply of a covered insulin product 2024 2024 Once enrollee hits catastrophic the cost share for the remainder of the year is $0 with the plan picking up the 5% previously paid by the enrollee 2025 2025 Setting a $2,000 annual out of pocket maximum Elimination of the coverage gap (Donut Hole) Sunsetting the Coverage Gap Discount Program (manufacturer 70%) Establishment of a Discount Program that requires participating manufacturers to provide discounts on applicable drugs in the initial coverage and catastrophic phases Changes in the shared cost sharing among enrollees, plans, manufacturers, and CMS

2024 VS 2025 PART D Inflation Reduction Act of 2022 impacts on 2025. Below is the changes in total cost share for the beneficiary. Not all plans have deductibles. Does not include low-income subsidies. Cost is shifting from consumer for the Coverage Gap to the insurance carrier. In initial phase most pay either a copay or coinsurance. Copay- A fixed amount for the prescription such as $10 or $40 depending on tier Coinsurance- A fixed percentage of the drug such as 25% or 45% depending on tier Deductible Coverage Gap Initial Coverage 2024 $545 $1,121 $1,667 $3,333 $2,000 2025 $590 $1,460

PRESCRIPTION PAYMENT PLAN PROG. Beginning in 2025, all Medicare prescription drug plans, which include both standalone Medicare prescription drug plans (PDPs) and Medicare Advantage are required to offer Part D enrollees the option to pay out-of-pocket prescription drug costs in the form of monthly payments instead of all at once to the pharmacy under the Medicare Prescription Payment Plan. Client can opt in at any time and set up monthly payments to the insurance carrier. Payment will equal remaining balance of $2,000 Max out of pocket divided by number of months left in calendar year. Must opt in each year For those on low-cost drugs, probably will not make sense. For those knowing they will spend the $2,000, this is a great option to spread the cost out. Example: Joe picks up drug at pharmacy in January, pharmacy says that it will be $850, Joe can say no and still get prescription. Pharmacy notifies carrier, carrier divide that amount by the remaining months of the calendar year. Each month he picks up the prescription, it will be added to the months added.

IMPACT TO YOUR MEDICARE Higher Premiums on Stand-Alone Prescription Drug Plans Stricter Formularies on Drug Coverage Fewer Plan Choices Reduction in Medicare Advantage Benefits More Drug Utilization Reviews Medigap Rate Increases

If on Medicare, you should review *Examples below Medigap W/ PDP 2024 2024 2025 2025 Medigap W/ PDP Medicare Advantage 2024 2024 Medicare Advantage 2025 2025 2024 Plan G rate with carrier is $158.58 for Male with $240 Part B Deductible. 2024 PDP was a $0 Premium with drug cost averaging $354.96 a year. 2025 Plan G rate with same carrier is $177.21 for Male with $270 Part B Deductible. 2025 PDP is still $0, but drug cost is now $1,795.86 $0 Premium MAPD Drug cost equaled $64.20 in 2024 $0 Premium MAPD plan Drug cost for 2025 will be $850.08

Annual Notice of Change

ANOC Understanding Your Medicare Annual Notice of Change (ANOC) Letter Overview: Overview: Essential information for Medicare beneficiaries. Annual Notice of Change (ANOC) letter outlines modifications to coverage, costs, and benefits. Critical for managing healthcare coverage and ensuring the right plan. Key Takeaways: Key Takeaways: Annual Notice: Medicare beneficiaries receive an ANOC letter each year. Coverage Changes: Details on modifications to coverage, costs, and benefits. Review Importance: Ensure healthcare coverage aligns with needs. Support Available: We can assist with understanding the ANOC letter. Necessary Actions: Consider switching plans based on ANOC information.

ANOC Actions Based on the ANOC Letter: Actions Based on the ANOC Letter: Post-Review Actions: Compare plan changes with current coverage. Contact your insurance broker for clarification. Use Medicare Plan Finder tool on Medicare.gov. Consider switching plans during Open Enrollment if necessary. Special Note on Medicare Advantage & Part D: Pay attention to changes in prescription drug coverage and network providers. Adjust your plan to fit your needs during the Open Enrollment period.

NEXT STEPS Receive ANOC and Review Plan Documents Schedule an Appointment with Our Office Complete All Plan Changes by Dec. 7

THANK YOU Agent First & Last Name Agency Name Phone Email Website Address