Mediterranean Hyper-Cluster Insights

Explore the project development and prevailing business models, segments, and strengths in the Mediterranean Hyper-Cluster. Key areas of CBC initiatives and value chains are highlighted, offering a glimpse into the competitive landscape of the industry.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

The Mediterranean Hyper-Cluster: Inputs for the CBC Initiatives Francesco Pellizzari Technical Assistance Manager CBC Cluster Conference Tunis, 17th Oct. 2014 1

Our Final Goal: Strengthen inside to Compete outside Russia Northern Europe China East Asia USA The Gulf Latin America Africa Tunis, 17th Oct. 2014

Project development OUTPUT: THE TEX-MED HYPER-CLUSTER OUTPUTS FOR EACH CLUSTER CURRENT ACHIEVEMENT INPUTS Data Collection Profile (size, products, value chains, ) Identification of 14 Areas of potential CBC Initiatives for Cluster Institutions (Innovation) Diversities and Complementarities 3 On site visits Survey (270 companies) Value Chains Business Models Segments and Markets Characterization (competences, business models) SWOT Analysis Needs/Offers SWOT Analysis Tunis, 17th Oct. 2014

The Eight value chains Fiber Prep Add Value Wet/Finish CMT Conf. Final mkt Retail Yarns Fabrics PRATO SABADELL THESSALON. CO T/C CETTEX TECH/MFCPOLE ALEXANDRIA BETHLEHEM AMMAN 4 Tunis, 17th Oct. 2014

Prevailing Business Models Foreign Owned Sub-contr. For Outside Sub-contr. For Inside Internat. Co- contr. Brands Own Prod. Hybrids PRATO SABADELL THESSALON. T/C CETTEX TECH/MFCPOLE ALEXANDRIA BETHLEHEM AMMAN 5 Tunis, 17th Oct. 2014

Prevailing Segments Functional Niches Technical. Textiles. Fashion Brands Standard Wear Casual Pr. Labels Home PRATO SABADELL THESSALON. T/C CETTEX TECH/MFCPOLE ALEXANDRIA BETHLEHEM AMMAN 6 Tunis, 17th Oct. 2014

The Med Hyper-Cluster SW Analysis Strengths Full coverage of the whole T/C value chain. Weaknesses Conflicting interests Weaker knowledge (compared to North EU and other advanced countries) on Technical Textiles. Many and diversified excellences: Cotton production Unbalanced and overall low effort for R&D in the scientific and technical fields. Fashion Manufacturing Average small size of enterprises (with exceptions) Widespread Entrepreneurship Widespread subcontracting (SMEs trapped ) Brand Positioning (partial) Retail (partial) 7 Tunis, 17th Oct. 2014

The Med Hyper-Cluster OT analisys Opportunities A global re-balancing of cost- competitiveness among countries Threats Political Instability of the Middle East and stabilization in North Africa (MENA) The economic development of nearby countries (Africa) The asymmetric position of Turkey Economic depression and adverse financial constrains in the Med EU countries (austerity, fiscal compact) Emergence of a fashion alternative to the western one. The enhancement of cooperation and integration among Mediterranean partners. Likely difficulties to keep pace technical innovation in comparison with other EU or Asian competitors. 8 Tunis, 17th Oct. 2014

The Mediterranean Hyper-Cluster Take advantage of diversification for fortification. Work hard to enhance a modern T/C Med Cluster 9 Tunis, 17th Oct. 2014

The Diamonds for CBC Initiatives CBC Initiatives aiming at: 1. Implement common assets/operations/methodologies for: product R&D, energy, environment, training . 2. Strengthen/share new process (management/organization) 3. Develop and sell new products (co-developed) 4. Set up new (renewed) marketing assets (such as: exhibition, common brands). In order to increase the individual as well as overall competitiveness of the Mediterranean T/C Clusters in the Global market. Penetrate new markets. 10 Tunis, 17th Oct. 2014

Areas of CBC Initiatives Market Development Technology and Product development B5. Access the USA/Canada Markets B6. International development A2. Finishing/Water Treatment and Recycling D11. (Inform for) Co-contracting A3. Technical textiles D12. E-commerce A4. Cotton Improvement. Techno-cotton- Organic-Recycled Management Style & Design Innovation E15 Young Entrepreneurs C8. Islamic Fashion E 16 HR Development C9. Style and product performance B7. Buffer Warehouse in Strategic Markets C10. Development/Support of Local Brands F16. Stock (leftovers) Management 11 Tunis, 17th Oct. 2014

Good Luck & Keep Going 12 Tunis, 17th Oct. 2014

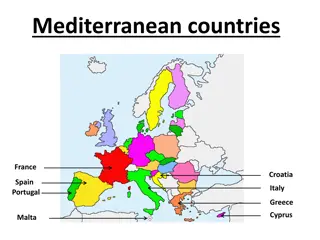

Disclaimer The 2007-2013 ENPI CBC Mediterranean Sea Basin Programme is a multilateral Cross-Border Cooperation initiative funded by the European Neighbourhood and Partnership Instrument (ENPI). The Programme objective is to promote the sustainable and harmonious cooperation process at the Mediterranean Basin level by dealing with the common challenges and enhancing its endogenous potential. It finances cooperation projects as a contribution to the economic, social, environmental and cultural development of the Mediterranean region. The following 14 countries participate in the Programme: Cyprus, Egypt, France, Greece, Israel, Italy, Jordan, Lebanon, Malta, Palestine, Portugal, Spain, Syria (participation currently suspended), Tunisia. The Joint Managing Authority (JMA) is the Autonomous Region of Sardinia (Italy). Official Programme languages are Arabic, English and French (www.enpicbcmed.eu). This presentation has been produced with the financial assistance of the European Union under the ENPI CBC Mediterranean Sea Basin Programme. The content of this document are the sole responsibility of UIP and can under no circumstances be regarded as reflecting the position of the European Union or of the Programme s management structures. 13 Tunis, 17th Oct. 2014