Microeconomic and Organisational Context of Business

This chapter delves into the microeconomic aspects of business economics, focusing on stakeholders, shareholder wealth, organizational objectives, and conflicts. Learn the distinctions between different types of organizations, stakeholder interests, and the impact on organizational performance. Explore the dynamics of wealth creation, strategic decision-making, and stakeholder relationships in the business realm for better understanding and application in professional qualifications.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

CERTIFICATE LEVEL BA1 Fundamentals of Business Economics Chapter 4: Microeconomic And Organisational Context of Business Part 1 (C) Personal Use only. Any un-authorized use, copying or reproducing full or partial content is contravention of intellectual property act and unlawful. Failure to comply will be subjected to legal recourse. Transforming Students to Professionals

C Topics 3 Introduction 4 6 Organization 7 Mutual Organizations 8 Organizations based on ownership 9 11 Shareholders and their wealth 12 15 Financial Performance Measurement Short Term and Long Term 16 20 Stakeholders 21 22 Stakeholders Conflicts 23 Corporate Governance 24 25 UK Corporate Governance Code 2019 26 Transaction Costs 27 28 Module Questions & Keys 2

Introduction The first two chapters of this subject BA1 Fundamentals of Business Economics dealt with the Macroeconomic part of the business economics covering topics such as Demand and Supply side of an economy, followed by various approaches in an economy like fiscal and monetary policies. These policies took on dealing with inflation, unemployment, stagflation and the ways of dealing with it. The third chapter dealt with the indexation of any sales or purchases in a country using base year and rebasing the year. This chapter is totally opposite of the earlier two chapters i.e. it would be dealing with microeconomics part of the business economics. To begin with we will deal with various types of stakeholders of a business and their objective or agenda to put colloquially. It forays into distinguishing normal organization, which functions for making profits out of their products and services, not for profit organizations and Government organizations. In this chapter we will also be discussing about shareholder s wealth, the challenges faced for increasing that wealth and its role in management s strategic decisions. The other learning outcome expected out of this chapter is to learn the distinction between objectives of the shareholders and other stakeholders and identify any conflict that could impact the performance of the organization. Some of the relationships, their interests in the micromanagement of the organization, their roles and finally conflicts what you learn here will be put to good use at the advanced levels in this professional qualifications. 3

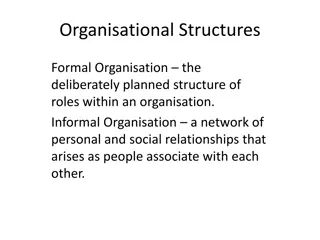

Organization Before we progress further in to this chapter, first let us understand the definition of an organization. There are hordes of them if one happens search for them in the internet. What is Organization? Organization refers to a collection of people, who are involved in pursuing defined objectives. Cambridge Dictionary terms them as, a group of people who work together in an organized way, for a shared purpose . Organizations are social arrangements for the controlled performance of collective goals (Buchanan and Huczynski). So an organization, going by its definitions mentioned above, is work together as social arrangements and controlled performance in a an organized way and collective goals are pursuing common agenda or objective. Let us dig deeper into these three classifications of an organization 1. Social Arrangements Organizations has several employees with different social background, education, experience yet they all come together to work for common goal of an organization. An individual run business might not meet this criteria but organizations with more than two people work, share and coach others to achieve the company s objective. 2. Controlled Performance Most organizations have multiple tasks to perform, and they can perform well only when there are instructions or guidelines which can control or direct or advise how each tasks can be performed. Simply, a controlled performance. 3. Collective Goals Each organization differ in their goal to achieve. Some may be for profit while others for service.

Organization Let us take an example of a Cricket Team. Say a team was selected for participating in the T20 World Cup. The team is like organization which would do the following: a) The common objective for the team is to win the World Cup for its country; Therefore, it has to win most of the matches it is required to play; - Collective Goal b) The players are chosen based on their skills some as specialized batsmen, some as bowlers and a wicket keeper. Each of them are expected to deliver effectively tasks allocated to them; - Controlled performance c) Each of the players are expected to participate in the team rigors without fail and all the social activities that are organized for their team bonding Social Arrangements; d) As part of the winning strategy, the team members must meet every day before the tournament starts along with their Manager and posse of coaches - Head Coach, Batting, Bowling, Fielding Coaches, Physiotherapists, Physical Trainers and Dietician for their organizing their efforts. The same set of rules or guidelines are applicable to all types of organizations and the industry within which they operate. So the purpose of organization, apart from producing goods and services, is to a) mobilize resources, b) specialize in what they do, and c) share their skills, knowledge and lend their experience to others within the organization. So, the organization as a whole gains as well as offers more than each individual possess or could offer. As the organizations grow larger so does its gains and offer to the society at large.

Organization Now that we have understood the definition of the organization, let us discuss about the types of organization - Business for Profit Business organisations engage in commercial activities, with the purpose of making a profit. NFP businesses focuses more on service and therefore do not have financial objectives. One of the main objective of these organisation is to maximize the wealth for its 75 % 95 % owners. 40 % 27 % They get invested by the owners to sustain in business and continue to generate profits. They focus on a particular community or society to serve and for them to obtain some benefit. A B They also focus on development and growth of business within or outside the boundaries. These are mostly Government organization catering to its state or province. Not for Profit Business Those organizations which does not focus on profit but only service.

Mutual Organizations This is one type of Not-for-Profit Organisations, and these are mostly Trade Unions, Housing Residents Associations, Co-operative societies etc. The purpose of these mutual organizations and their very purpose of existence to cater to its members. Farmer s Cooperative caters to the farmers of that province or across country towards supply of seeds, fertilizers and farming equipments and the spares for those equipments and lastly loans to meet their operating costs and facilitate them to market their produces. These cooperatives are owned and managed by the farmers only. These cooperative societies sell all the requirements of the farmer members at a very subsidized rates and procure final products at a very fair market prices. Trade Unions are organized and managed by the staff members of the organization itself. Their main function is to protect the interest of the members who are the staffs of the organization. Their objective is to get a fair share of the profit by way of pay rise, better bonus and ensure staffs gets at least minimum bonus, better working conditions and healthy work environment to its staffs overall, Housing associations are convened mainly by the owners of the residents within the residential condominiums. They administer day to day functioning within the apartment complex ensuring clean, healthy and harmonious living conditions. Ensures all amenities are sustained always. All these are meted out by the annual or monthly maintenance contributions made by the residents or owners of the complex. Main function of this association to the residents is to provide uninterrupted water and power apply. While the housing association addresses these functions without any whimper it should also be open to criticism, suggestions on equal footing. The office bearers of the association would be selected once a year through the annual general meeting.

Organizations based on Ownership Public Sector Organizations Private Sector Organizations Co-operative Organizations These are mostly if not all are owned by the Government. These are organizations which provide services like primary healthcare, schools, police & army services. There is no profit making motive for these organizations. Government spends for these services through revenues generated from taxes. These organization s objective is to make profit and maximize the owner s wealth. These organizations are prevalent in all industry sectors including some of the industries in which Government entities are in play such as primary schools, healthcare. They are not allowed to own military or any other essential services like national roadways, raiilways. These organizations are owned by group of individuals with common objective . These organizations are set up to pass on benefits to its owner members. These organizations are not floated to obtain investments from general public but only from members with same background like farmers, employees of an organizations, Trade unions.

Shareholders & Their Wealth Shareholders are the ones who own a stock in a company who had offered to public for investments. These shareholders can be a person, institution or a company. In order to reward them for their investments, these shareholders are paid dividends out of the profits earned by the invested company. These dividends and the appreciation of the invested stock s value are considered as wealth of the shareholders. The dividends paid to the shareholders are very high compared to other investments made into the company because they stand last in getting their money back if and when the company goes down bankrupt and ceases to be a going concern. They are paid finally from the residual proceeds after paying secured creditors, lenders, bond holders and preferential shareholders. Since return of their investment is disproportionate to what they had originally invested and for this risk alone they are rewarded highly. So, there are three key elements in valuing a shareholder s wealth. a) Return on Investment: Any investment in stocks of a company is analysed, prior to investment, the return the investment would fetch. For example, if an investor is anticipating a return for his investment at the rate of 12% p.a. then the company which is offering the stocks for investment should be able to provide that return 12%. If the company can only afford to pay 10% as dividend and 2% increase in the stock value, it is still acceptable to the potential investor. b) Cash Wealth: Dividends are cash wealth for the shareholders of a company. It is tangible and an annual income for the shareholders. They would prefer this than any other mode of return on investments, include increase in share price which is realised only when the shareholders chooses to sell their stake. c) Increase in Share Value: If the investor looks at the long-term perspective, then they should be monitoring the share price movement in the market. Even in case, the company is valued they are measured by current market price and its potential growth.

Profit and Cash Most often non- financial people tend to consider both profit and cash are the same. They think once a sales is made it is cash received. This is not true. Profit and Cash are two different components in a company s cash flow. Sales less all expenses is PROFIT and all cash receipts less all cash payments is NET CASHFLOW. For example for ease of understanding, if a company sells a products for $100,000 and it had incurred cost of $ 75,000. They have sold 80% of the products on credit. Therefore, Profit and Cash flow are as follows: PROFIT in $ Sales 100,000 Sales in $ Less Expenses (75,000) Less: Credit sales at 80% Profit 25,000 Cash received on cash sales CASHFLOW in $ 100,000 (80,000) 20,000 It should be understood from the shareholder s perspective that cash matters most for them than the profit. If dividend is paid to them it is cash flow for them for today and increase in the stock price in the market is an increase in cashflow for them tomorrow when they decide to sell their stakes in the market. But let us understand that all profit generated by the company may not be adequate enough to meet the shareholders expectations of dividend. Sometimes, the value of the stocks may get reduced despite company making a profit as they would not have earned to cover their cost of equity. Nevertheless, both profit and cash earned by the company belongs to the owners, i.e. shareholders. They may not get to have all the profits for themselves and some portion of profit may be reinvested in the company for development of business and there by to make more profits for the organization. This further increases the shareholder value in future.

Example - 1 Let us understand the topic with an example below: A company made a profit before Interest and Taxes of $ 20M for the year. It has a borrowing of $50M @ 6% p.a. The tax payable by the firm is 30%. The Equity of the company is $100M and the shareholders expect a return on their investment of 15%. Has the company met this requirement? Working $M Profit Before Interest & Tax 20 Less: Interest ($50M @ 6%) (3) Profit before Tax 17 Tax @ 30% 5.1 Profit After Tax 11.9 Profit required to achieve 15% ROI = 100 x 15% = $ 15M. It is evident that the company though had made profit after interest and tax of $11.9M, it has not earned enough to fulfill the shareholders expectation of 15% return on investment which is otherwise known as cost of equity (Ke). This would adversely affect the share price of the company.

Financial Performance Measurement Short Term It is very well known a company s performance can be different in two separate periods and are therefore needs to be measured according to the time frame Long Term and Short Term. Short Term is measured by Return on Equity and Earnings Per Share (EPS). It also measures as Return on Net Assets (RONA). Return on Net Assets Profit before Interest & Tax Total Assets Current Liabilities Return on Capital Employed The most important measurement tool for short term financial performance. Very easy to compare the performance with its competitors. How much returns i.e. profits is generated for the given amount of capital invested. Return on Capital Employed Profit Before Interest & Tax Capital Employed X 100 Earnings Per Share (EPS) Profit After Tax Number of ordinary shares Earnings Per Share: Used mostly by ordinary shareholders and are therefore most sought-after measurement. Based on the EPS the market movement of stock price takes place and helps Directors to decide on the dividend payout for the ordinary shareholders. Return on Net Assets This is one way of measuring return on capital employed. How well the capital invested the company is used for development of the company.

Example - 2 Let us understand the short-term financial performance using the following details for illustration. Profit Before Interest & Tax is $ 1,500,000, Tax is at 30%. Share capital, all ordinary shares, 1,000,000 @ $1 each and Debts are $ 2,000,000 @ 8% per annum. Calculate Return on Capital Employed (ROCE) and Earnings per Share (EPS). Calculations: $ Return on Capital Employed (ROCE) Profit Before Interest & Tax 1,500,000 Profit Before Interest & Tax / Capital Employed x 100 Interest ($2,000,000 x 8%) ( 160,000) $ 1,500,000 / ($ 1,000,000 + $ 2,000,000) x 100 = 50% Profit before Tax 1,340,000 Tax @ 30% ( 402,000) Earnings Per Share Profit After Tax 938,000 Profit After Tax / Number of Ordinary Shares. $ 938,000 / 1,000,000 shares = 0.94 cents per share.

Financial Performance Measurement Long Term Apart from the short-term financial performance assessment, companies should be able to measure long term performance. They cannot remain complacent if their short-term performance are acceptable. Any organization will have to perform well with future earnings in mind. How is future performances are measured and ensured that the investor s returns are sustained in the long run? There are several factors that ensures the shareholder s interest is retained and sustained but has challenges such as - valuing the income that needs to continuously flow, estimating such income or cashflow continues all through the life of the investment, and the correct cost of capital that is required to be maintained to finance the investment. The best way to solve the above-mentioned challenges is to discount all future cash flows of the company using the cost of capital that closely correlates with Return on investment expected by the potential investors as well as the existing shareholders. If a company is embarking on an investment in a new project and assuming the entire market and shareholders are keenly watching the outcome, it would help to provide the Discounted Cashflow of the project to them. The Net Present Value (NPV) that is derived out of Discounted Cash Flow (DCF) should, if the result is positive, help to enhance the market value of the company s share. Otherwise, any investment with the company would be considered adversely/ negatively. The investors will shy away from investing further in the company. Apart from the above, there are certain factors, internal and external, would affect the mood of the investors. Significant rise in cost or production, decline in sales revenue, decline in sales volume are some of the internal reasons while increase in interest rates, recession, change in tax rates are some of the external reasons.

Real Life Case Study - Converse There are several companies that survived several causes both internal and external before they bounced back. One such company is Converse. The popular footwear brand and in fashion world everything old is new again. The company was founded in 1908 as the Converse Rubber Company, but it found massive success 9 years later with the release of its canvas All-Star sneaker. With some marketing help by basketball star Charles Chuck Taylor, Converse became the original best-selling basketball shoe. The company fell into bankruptcy when the Great Depression hit in 1929, at which point former president of Hodgman Rubber Company Mitchell Kaufman took over. Converse changed hands many more times over the decades before being bought by Allied Corporation in 1979, after which it achieved unprecedented sales and profits. But by the 1990s, Converse s simple canvas shoe was facing stiff competition from high-performing athletic shoes like Nike and Adidas. By end of 1995, the company fell into huge pile of debt following the failed acquisition of apparel company and an aggressive but ill-timed expansion program that occurred when the sneaker market was going downwards. Converse filed for bankruptcy yet again in 2001, Converse was purchased by private equity firm Perseus, which returned the company to solid ground by replacing its management team, closing its US and Mexico factories, and deepening its relationships with retailers to increase shelf space. Then, in July 2003, it was purchased by Nike. There is no looking back after that as Nike went on a sales overdrive for Converse s sales with a huge marketing blitzkrieg with phenomenal advert spend. The company also refreshed its brand image and look and pitched their shoes as the in thing for younger population. Nike s infrastructure combined with the rebranding took Converse to new heights. Converse netted $2B in sales in 2017, up from $205M in 2002, the year before Nike bought the company. Sales dropped 11% to $1.9B in 2018, but with Converse s long history of rebounding it would rise sharply. The sales as on 2020 is $ 1.85Bn (source. Statista.com)

Stakeholders Stakeholders are generally those individuals or organizations that have material interest in the company. There are stakeholders all around the organization, both internally and externally and these stakeholders have close relationship with an organization. While Customers, Government, Regulators are all external parties who can affect the company, Staffs, Shareholders, Suppliers and Board & Senior Management are internal parties. The best definition of stakeholder was given by Freeman, in 1984, as Any group or individual who can affect or [be] affected by the achievement of an organisation s objectives . This definition is bi-directional about the stakeholders meaning they can be affected by the performance of an organization and also can affect the performance of an organisation. Ideally, Stakeholders can affect the organization depending on their interest and the position of influence they hold. While some of the stakeholders can get affected because they have invested in the company, therefore the revenue generated out of it makes matters most for them while some may exert influence over the company because of sheet power and position they hold with them. The stakeholders are categorized in to three External, Internal and Connected. Perhaps the easiest and most straightforward distinction is between stakeholders inside the organisation and those outside. There are other types of stakeholder who are little difficult to categorize Narrow and Wide stakeholders : Narrow stakeholders are those that are the most affected by the organisation s policies and will usually include shareholders, management, employees, suppliers, and customers , Wider stakeholders are those less affected and may typically include government, wider community and other peripheral groups. Primary and Secondary stakeholders : A primary stakeholder group is one without whose continuing participation the corporation cannot survive as a going concern . Those that do influence an organisation directly are primary and those that do not are secondary stakeholders.

Stakeholders Internal Stakeholders Expectations and Needs Employees Good working conditions, fair employment, Salary, Bonus, job security and career growth Managers / Directors Career position, delegation of authority, job security, pay and bonus, fringe benefits, empowerment. Shareholders Regular dividend, capital growth, continuation of business, Good appreciation to their investment. External Stakeholders Expectations and Needs Suppliers Prompt payment to their supply, continuous purchase / orders, be supplier of first choice. Banks and Financial Institutions Prompt repayment of debt, regular servicing of interests, no delay or postponement of debt commitments, good security to loans. Good return on debt. Government / Regulators Payment of taxes without delay, compliance to all local regulations, contribute to the growth of the economy. Local community & Environmental Groups Contribute to the development of local community, ensure environment safety, ensure community safety and overall health and safety. Trade Unions / Employees Association Involvement in decision making, protect employees and ensure their safety.

Stakeholders We have always known fully well about internal and external stakeholders. However, there is a third category of shareholders who are known as CONNECTED SHAREHOLDERS . This category of shareholders are partially internally as well as partially external. Suppliers, Guests or customers of a hotel fall in this category. Though they are not part of the organization, therefore not internal stakeholders per se, they cannot be totally done away with as without them an organization cannot sustain its existence. For example, if a hotel does not take care of the needs of its customer as they are only floating into their business once a while, it would soon go out of business. Their demand needs to be nurtured so that they make even walk in customers as repeat customers. Likewise, for suppliers, though they only supply to the organization, if they are not given due care and support, suppliers may fail in their delivery or compromise in their quality. Every manufacturing company must identify , after due diligence is done, its suitable supplier. But care should be taken that the organization does not rely only one supplier and must have more than one supplier for a particular material. Organization must ensure they keep themselves in supplier s good books by paying them on time, does not frequently ask for more credit days, review prices at the least once in two years if not early.

Stakeholder It is obvious that if there are more than one stakeholder, then there is enough meat for conflicts. The reason being each one of them would have their needs or expectations which are contradictory with others. Each of the conflict would require compromise to address their demands. Let us identify some of the conflicts of the stakeholders in the table below: Stakeholders Conflicts Managers v Directors Increase in Sales Revenue, Net earnings versus Budget for sales growth, development. Managers v Employees High productivity, reduction of process cost versus increase in salary, wages and benefits. Managers v Customers Sales promotion, high revenue, high customer base versus low price, high quality, better product features and product durability. Managers v Shareholders High Profit, High Sales revenue versus better dividend, capital growth of their stockholding. Government v Management Team Regulatory Compliance, Corporate Governance, Prompt tax payment versus volatile economic development, ever changing tax structure, stringent regulations. Society / Community v Management Team Environment safety, Community Safety, pollution, CSR versus new products introduced, constant pressure by NGO groups and legal interference. Suppliers v Management Team Prompt settlement of bills, good rapport, steady stream of business versus good quality products, lesser defects, competitive price for the supplies.

Stakeholder In the previous slide we did identify few conflicts between few prominent stakeholders and the company represented by either managers or management team overall. Mendelow Matrix had rightfully plotted stakeholders into four quadrant matrix split as people with Power and Influence and people with degree of interest. Not all of stakeholders carry same amount of interest and power. It varies according to the role they play and company can accord their response appropriately. Students are formally inducted into Mendelow Matrix here and they will get apply this tactics more when they pursue the professional qualification at a higher level. Nevertheless, let us get an heads up to it. LOW MINIMAL EFFORT At a very low level of interest and power. They can be easily swayed to accept what has been told. HIGH KEEP INFORMED These stakeholders are high on interest but wield less power to influence the strategy,they will try to influence lest will join with people high on power. LOW POWER The primary objective of the company is to increase the shareholder s wealth, though other stakeholders are equally important too. Key player quadrant gets priority over the ones in minimal effort quadrant. KEEP SATISFIED Any strategy developed will be advised to them as they can influence the decision on strategy considerably KEY PLAYERS Most influential players in the strategy decision making. They have both interest and power to decide on the strategy and their participation is vital. HIGH This concerns does not arise in the case of Not-For-Profit organizations as they do not have profit generation or increasing owner s wealth as primary motive. They satisfy or at least do not trigger any conflicts between stakeholders. But NFP is fraught with its own problems mostly raised by the local communities or social groups who are ready to up their ante. Most occasions these NFP which are mostly Government or public sector undertakings which would weight cost benefit to the society before they commence any initiatives. This helps in addressing the concerns raised by the affected parties. LEVEL OF INTEREST

Stakeholder Conflicts Management of an organization are always at the receiving end on both sides. They are always caught between devil and the deep sea. They need to trudge the land safely so they neither upset shareholders nor the customer, nor employees. Their decisions should be shaped in such a way that they increase the shareholders wealth. Their aim should be to ensure that return on investment must exceed the cost of capital. However, there are occasions when their decisions can go horribly wrong. In the earlier slide, we had mentioned conflict between Managers and Shareholders & Directors. This conflict is known as THE PRINCIPAL AGENT CONFLICT. The principals are investors, shareholders and they are huge in numbers in large companies. So all cannot manage the company. Therefore, they choose Managers to be their representatives also known as Agents. These professional managers run the company on behalf of the shareholders cum owners. The tacit agreement here is that the shareholders will not interfere in the day-to-day operations of the company. They have no role to play in the company s performance and the onus is on the managers. To manage the managers, Board Directors are installed. The members of the Board are mostly chosen from within shareholders and some from outside who are mostly industry experts with vast experience. The Principals always ensure that the Agents act according to their whim. But the Agents with a sole agenda to improve profits (which increases the potential for higher bonus and benefits to them, should be read between lines) and increasing the wealth of the owners may tend to drift most time which causes the conflict to arise. Management normally has to balance between interests of other stakeholders too. Since these interests are different from profit maximization management have to be neutral in their decisions without foregoing other s interests. This would include their own objective earning more salary, perks and bonuses. Management also are required to develop or grow the business by revenue maximization, exploring new locations, satisfying the owners with low growth with minimal increase in profits. There are other reasons for Management Shareholders conflicts and they are discussed in the next slide.

Stake holders Conflict Some more conflicts of the managers that may not be in the best interests of the shareholders are and they are classified in the boxed below. These conflicts are addressed and resolved through Corporate Governance guidelines (please see next slice for more details), establish with the directors the goal congruence with the organization s goal, pay and remuneration policy to be revised and made relevant so that the conflicts are kept at check, Short Termism Most of the time the conflicts take place when mangers take decisions that are short term in nature and do not plan for long term vision. Everything they want to achieve in a hurry. Mergers & Acquisitions Inefficient Controls Poor decisions and inept controls made WorldCom and ENRON to go bust. That fiasco had now paved ways for several legislations on internal and external control of business. Most of the M&As have only left shareholders wealth erode instead of increase. Most M&As are done to safeguard few jobs and positions not shareholders wealth.

Corporate Governance Corporate Governance is a system used to direct, manage and monitor an organization with relevance to its external environment. Effective implementation this will resolve the principal agent conflict effectively. Corporate Governance is a good to have guideline and not a legal document to be implemented in true letter and spirit. The ultimate objective of this guideline is to achieve the following: a) Increased amount of reporting and disclosures within that report; b) Increased disclosures to all stakeholders; c) Increased transparency in company s activities and instil confidence to all stakeholders; d) Ensure that the company is involved in legal activity and is ethical in its operations; e) Ensure control across the organization and is cascaded down the organization; And how are the above objectives are adopted in the organization: i) Frequent meeting amongst board members and the tasks shared amongst all board members so that no one individual or coterie of individuals control the affairs of the Board; ii) Directors are members for a limited period only and their emoluments like sitting fees are disclosed in the financial statements; iii) Audit, Nomination and Remuneration Committees are formed which are headed by Non-Executive Directors; iv) Auditors confirm in writing, counter signed by Chairman and Director Finance about the financial performance by the company at least once a year; and v) Non-Executive Directors with skills, experience and knowledge with different backgrounds should be inducted as Board members to add experience and diversity into the company.

UK Corporate Governance Code 2018 UK Corporate Governance Code was first published in 1992 and that was the first version. After several iterations the current version was published in 2018. Over the years the Code has been revised and expanded to take into account of the increasing demands on the UK s corporate governance framework. This code operates on a comply or explain basis which means it is not to be adhered compulsorily and non- compliance is not penalized or punished. At the same time, if the companies chooses to comply it should not be a tick box approach. All companies which are listed in the London Stock Exchange, whether incorporated in UK or elsewhere, are expected to adhere to the framework from 1st January 2019. Some of the important features of the Code are listed below: Features of the Code Explanations 1. Board Leadership & Company Purpose Board is led by effective and entrepreneurial members. The Board must establish the purpose, value and strategy of the company. Board must ensure effective participation and engagement by all stakeholders. 2.Division of Responsibilities The Board should have appropriate combinations of executive and non-executive directors so that no one individual or group control the board esp. their decision making. NEDs must allocate sufficient time for attending the board proceedings, The Chair leads the Board for its overall effectiveness in directing the company. 3. Composition, Succession & Evaluation Appointments to the board should be subject to a formal, rigorous and transparent procedure, and an effective succession plan should be in place for both board and Management. The Board must have right combination of skills, experience and knowledge. Annual evaluation of the performance of the Board is a must to ascertain how cohesively the Board members function.

UK Corporate Governance Code 2018 Features of the Code Explanations 4. Audit, Risk and Internal Control The board should present a fair, balanced and understandable assessment of the company s financial positions, assurance of internal audit and control independence, should ensure formal and transparent policies and procedures. Board should formulate procedures to manage risk and oversee internal control framework. 5. Remuneration Designing the remuneration policies to support strategy and promote long-term sustainable success. Formulating strategy for executive remunerations, and no director must be involved in deciding their own remuneration.

Transaction Costs Transaction Costs arises when a company decides between performing an activity in house or outsource it to third party in the market and the costs that are incurred in performing the activity such as outsourcing costs, shared costs of the service rendered by third party. Cost per transaction is the deciding factor in outsourcing to third party. Unlike, direct costs like material or labour, transaction cost is hard to determine easily. However, some of the costs which are relevant are taken into considering the transaction cost such as - Costs incurred in a) Selecting a suitable third-party service provider, b) all legal and other expenditures incurred in getting the agreement between both parties signed and registered and c) Quality Control costs incurred to maintain set standards and the quality of service rendered. The Transaction Costs are permanent and will vary according to the volume it processes, how unique is the requirement for the company that outsources and specific to it and uncertainty in continuity of the contract, whether it is only a short term or stop gap arrangement or will it be continued for more than a year. Shorter the term higher the transaction costs and vice versa. If companies chooses to consolidate certain operations into one shared service centres it is less likely they will go for outsourcing. In the early years of the new 21st Century, many MNC banks like HSBC, CitiBank, BNY Mello, JP Morgan, Standard Chartered, Bank of America and even World Bank moved their back-office operations to India, China and Malaysia to take advantage of low cost on operations. The above decision was possible due to relaxation in IT and ITeS regulations in these countries which facilitated ease of doing business and generation of thousands of jobs.

Module Test Questions Q. No 1: What is Corporate Governance ? Q. No 2: Meeting financial targets is not constraint to perform for Not-for-Profit Organization, because a) They do not have a flow of revenues, b) They cater to people who are economically backward, c) Their primary objective is not profit making d) They have no profits to reinvest. Q. No 3: The current EPS of a company is 15c and it is planning to commence a project that will increase profit by another $30,000 but that needed to be funded by issue of additional shares of 500,000 at $1 each. Currently they have shares on issue at 1,000,000 shares of $1 each. Calculate the new EPS? Q. No 4: Which one of the following falls under Low on Power and Low on Interest so that management take minimal effort in dealing with them at times of crucial situations? a) Individual Employees b) Local Communities c) Government d) Shareholders. Q. No 5: One of the following is not the principles of UK Corporate Governance Code 2019 (the Code). find the wrong one? a) Remuneration b) Concentration of Responsibility c) Audit, Risk and Internal Control d) Board Leadership. Q. No 6: Cash is less important than profit for investors. True / False. Q. No 7: Andrew is an angel investor who has invested in many start up companies. He has invested in Company A USD 1M and the company is now ready to go for further investment. Should they approach Andrew again for further funding? Which quadrant of Mendelow matrix does Andrew is classified?

Module Questions - Keys Q. No 1: Corporate Governance is a system through which companies are controlled and monitored for better management in the interest of its shareholders. Q. No 2: c) Making profit is not their objective hence it is not their constraint. Q. No 3: Profit earned already 1,000,000 shares @$1 each x EPS 0.15 per share = Revised Profit - $ 150,000 + $ 30,000 Revised Shares on Issue with new issue 1,000,000 + 500,000 shares Revised EPS cents. The EPS has reduced to 12 cents from 15 cents despite increase in the net earnings. $ 150,000 = = 1,050,000 = $ 180,000 $ 180,000 / 1,500,000 shares 0.12 or 12 Q. No 4: a) Individual employees. Q. No 5: b) Concentration of Responsibility it is actually Division of Responsibility. Q. No 6: False. Cash is more important than profit for investors, because the returns they receive, either as dividend every year or the capital gain from the rise of share prices, are all cash revenues for them. Q. No 7: Since Andrew s interest and power are high he comes under KEY PLAYER category as per Mendelow Matrix.

Next Chapter: Next Chapter: Chapter 5: Microeconomic And Organisational Context of Business Part 2 Contact: reachout@akontz.com Phone: 9384013393 (C) Personal Use only. Any un-authorized use, copying or reproducing full or partial content is contravention of intellectual property act and unlawful. Failure to comply will be subjected to legal recourse. Transforming Students to Professionals