Microstructure of the Brazilian Corporate Bond Market: Insights from Research Workshop

Explore the microstructure and evolution of the Brazilian bond market through the research workshop conducted by Antonio Gledson de Carvalho and Felipe Tumenas Marques. The study provides a preliminary evaluation of the market, including detailed information on credit to non-financial corporations and institutional descriptions related to bond issuances. Additionally, learn about the different types of bonds available, such as CVM 400 and CVM 476, as well as institutional infrastructure bonds linked to infrastructure projects.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

The Microstructure of the Brazilian Market for Corporate Bonds Antonio Gledson de Carvalho With Felipe Tumenas Marques (UFBa) Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

Goal Exploratory work To describe the microstructure of the Brazilian bond market and its evolution Provide a preliminary evaluation Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

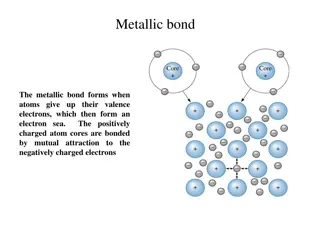

Credit to Non-Financial Corporations (as percentage of GDP) Table 1 Source: Bank of International Settlements (http://stats.bis.org). n.a.: not available. Emerging Markets n.a. n.a. n.a. 56.3 73.5 72.1 69.8 78.0 84.7 88.7 99.0 101.7 104.6 G20 Brazil Russia India China Countries n.a. n.a. n.a. 78.1 86.9 83.3 79.9 84.0 86.2 84.5 91.0 91.6 96.2 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 37.6 40.1 35.1 41.6 42.2 42.4 42.2 44.0 46.4 47.5 49.2 45.9 43.9 31.0 31.7 39.0 42.8 47.2 41.9 41.3 39.8 43.1 53.8 57.9 51.5 49.3 n.a. n.a. 42.3 46.2 47.3 50.3 50.4 51.9 52.2 50.3 50.3 46.3 44.7 n.a. 106.5 96.8 96.3 119.9 120.7 119.9 130.6 140.7 149.9 162.7 166.4 160.3 Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

Institutional description CVM 400 bonds traditional issuance (public corporations, fill in a detailed prospectus at CVM) Can be distributed to any investor There are no restrictions on trade CVM 476 bonds (2009) Non-public companies also can issue bonds No need to fill in a prospect at CVM Placement restricted to professional investors (PI, investments > BRL $10 mi) Prospectus distributed to at most 75 PIs Placement restricted to 50 PIs Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

Institutional Infrastructure Bonds (Law 12.431, 2011) Linked to infrastructure projects Need government approval Maturity cannot be less than 4 years No restrictions on trade Cupon payment frequency: at most semiannual Call provisions not allowed Issuer cannot trade on the bond for 2 years Can be issued under either CVM 400 or CVM 476 Individuals and foreign investors are tax-exempt Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

Corporate Bond Issuance over Time (proceeds and number of issues) Table 2 Year total amount issued in BRL billions, year total number of issues (in parentheses), percentage of year total BRL value and percentage of year total issues (in parentheses Total BRL Bi (# issues) 14 (46) 22 (42) 13 (49) 9 (37) 29 (113) 55 (197) 52 (210) 92 (321) 71 (346) 123 (354) 66 (270) 60 (243) 95 (354) percent of Regular bonds (%) Infra-bonds (%) Year Market is traditionally small GDP CNFC CVM-400 CVM-476 CVM-400 CVM-476 100 (100) 100 (100) 100 (100) 100 (100) 45 (35) 29 (17) 6 (7) 16 (10) 11 (7) 2 (2) 11 (2) 0 (1) 3 (1) 2005 0.66 6.69 It has be increasing in the recent years 2006 0.92 8.51 2007 0.49 3.90 CVM 476 bonds became predominant 2008 0.29 1.90 55 (65) 71 (83) 94 (93) 79 (87) 81 (87) 94 (90) 79 (88) 92 (88) 88 (85) Infra-bonds are a small portion of the market 2009 0.88 6.04 2010 1.41 9.88 2011 1.20 8.01 1 (1) 5 (3) 2 (3) 5 (4) 3 (2) 4 (5) 4 (2) 4 (3) 2 (5) 4 (6) 5 (9) 6 (9) 2012 1.90 12.96 2013 1.33 9.30 2014 2.12 15.46 2015 1.10 7.92 2016 0.96 8.07 2017 1.46 13.02 Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

Bond Issuance by Maturity (sample period 2009-2017): short maturity bonds predominate Table 3 Total in BRL billions, total number of issues (in parentheses), percentage of total BRL value and percentage of the total number of issues (in parentheses). Regular bonds CVM-400 CVM-476 5.9 (15) (549) 18.5 (32) (471) 33.9 (96) (890) 8.5 (23) (170) Total (100%) (# issues) (166) (2,088) Infra-bonds Maturity Overall CVM-400 CVM-476 86.4 14% (22%) 22% (20%) 53% (46%) 12% (11%) 643.6 (2,408) < 3 years - - 127.6 0.27 (3) 8.7 (39) 10.3 (64) 19.3 (106) 3 to 5 years - 276.1 11.1 (39) 4.2 (17) 15.5 (56) 5 to 10 years 51.8 > 10 years 66.8 542 BRL Bi Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

Types of Yields (sample period 2009-2017): mostly linked to interbank-offered rate (DI) Table 4 Total in BRL billions, total number of issues (in parentheses), percentage of total BRL value and percentage of the total number of issues (in parentheses). Regular bonds CVM-400 CVM-476 2.3% (1.8%) (0.4%) 64.1% (57.8%) (87.1%) Inflation index (anyone) (36.7%) (9.2%) Government- arbitrated (2.4%) (2.5%) 7.6% (0.4%) 1.9% (1.2%) (0.4%) BRL bi (# issues) (166) (2,088) Infra-bonds Overall (%) 2.3% (0.8%) 77.5% (79.2%) 11.1% (16.9%) 1.3% (2.3%) 6.4% (0.3%) 1.3% (0.4%) 643.6 (2,408) Index CVM-400 CVM-476 28.1% (7.5%) 1.4% Fixed rate - 84.1% Interest rate (DI) - - 28.5% 4.4% 100% (100%) 69.7% (91.5%) 2.2% (0.9%) 3.1% 1.1% - Dollar - - - 1.3% Other - - 66.8 542 15.5 (56) 19.3 (106) Total Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

Issues Size (sample period: 2009-2017): tend to be small Table 5 Total in BRL billions, total number of issues (in parentheses), percentage of total BRL value and percentage of the total number of issues (in parentheses). Regular bonds CVM-400 CVM-476 2.6% (16.3%) (40.1%) 11.2% (27.7%) (31.2%) 25.6% (29.5%) (15.8%) 60.5% (26.5%) (12.9%) BRL Bi (# issues) (166) (2,088) Infra-bonds Overall BRL mi CVM-400 4.5% (19.6%) 21.8% (35.7%) 34.1% (28.6%) 39.6% (16.1%) 15.5 (56) CVM-476 12.2% (41.5%) 31.9% (38.7%) 28.3% (15.1%) 27.7% (4.7%) 19.3 (106) 6.9% 6.5% (38.0%) 17.8% (31.4%) 21.5% (17.0%) 54.2% (13.5%) 643.6 (2,408) < 100 18.0% 100 to 250 20.4% 250 to 500 54.8% > 500 66.8 542 Total Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

Underwriting (sample period: 2009-2017): concentrated in two domestic universal banks Table 6 Total in BRL billions, total number of issues (in parentheses), percentage of total BRL value and percentage of the total number of issues (in parentheses). Regular bonds CVM-400 CVM-476 0.8% (0.6%) (0.4%) 53.5% (46.4%) (50.0%) 44.8% (51.8%) (44.8%) 1.73% (1.8%) (5.1%) BRL Bi (# issues) (166) (2,088) Infra-bonds Overall Bank CVM-400 CVM-476 0.8% 0.8% (0.4%) 53.3% (49.6%) 43.5% (45.5%) 3.27% (4.9%) 643.6 (2,408) Banco do Brasil 0 0 53.7% 59.4% (62.5%) 40.6% (37.5%) 33.7% (38.7%) 59.5% (53.8%) 6.8% (7.5%) 19.3 (106) Bradesco 42.8% Ita 3.43% Others 0 66.8 542 15.5 (56) Total Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

Rating (sample period 2009-2017): majority of non-rated bonds (CVM 476) Table 7 Total in BRL billions, total number of issues (in parentheses), percentage of total BRL value and percentage of the total number of issues (in parentheses). Regular-bonds Infra-bonds Percent Overall (%) CVM-400 CVM-476 CVM-400 CVM-476 97.6% (98.2%) 0.9% (1.2%) 1.5% (0.6%) 66.8 (166) 33.6% (28.2%) 0.5% (1.3%) 66.0% (70.5%) 542 (2,088) 94.2% (91.5%) 43.6% (37.5%) 0.5% (1.2%) 55.9% (61.3%) 643.6 (2,408) Investment grade 100% Non-investment grade - - 5.8% (8.5%) 19.3 (106) Not rated - 15.5 (56) BRL bi (# issues) Total Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

Ex-ante Credit Event (EACE, renegotiation and default): high numbers Table 8 Total in BRL billions, total number of issues (in parentheses), percentage of total BRL value and percentage of the total number of issues (in parentheses). Panel A: Sample period 2009-2013 Regular bonds CVM-400 CVM-476 21.1% (20.4%) (24.4%) 78.9% (79.6%) (75.6%) BRL Bi (# issues) (147) (1,009) Panel B: Sample period: 2014-2017 Regular bonds CVM-400 CVM-476 17.6% (26.3%) (33.4%) 82.4% (73.7%) (66.6%) BRL bi (# issues) (19) (1,071) Infra-bonds Overall CVM-400 CVM-476 8.4% (16.7%) 91.6% (83.3%) 6.4 (18) 27.8% 25.8% (23.5%) 74.2% (76.5%) 299.2 (1,187) EACE - 72.2% 100% No EACE 54.4 234.4 3.9 (13) Total Infra-bonds Overall CVM-400 6.3% (7.0%) 93.7% (93.0%) 11.6 (43) CVM-476 11.7% (9.1%) 88.3% (90.9%) 13.0 (88) 26.8% 25.2% (30.6%) 74.8% (69.4%) 344.4 (1,221) EACE 73.2% No EACE 12.3 307.6 Total Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

Ex-ante Credit Event (sample period: 2014-2017): mostly renegotiation, but default is high Table 9 Total in BRL billions, total number of issues (in parentheses), percentage of total BRL value and percentage of the total number of issues (in parentheses). Panel A: Renegotiation Regular bonds CVM-400 CVM-476 17.6% (26.3%) (31.7%) No renegotiation (73.7%) (68.3%) BRL Bi (# issues) (19) (1,071) Panel B: Strict Default Regular bonds CVM-400 CVM-476 - (2.6%) No default 100% (97.4%) BRL bi (# issues) (19) (1,071) Infra-bonds Overall CVM-400 2.3% (4.7%) 97.7% (95.3%) 11.6 (43) CVM-476 11.7% (9.1%) 88.3% (90.9%) 13.0 (88) 24.9% 23.4% (29.0%) 76.6% (71.0%) 344.4 (1,221) Renegotiation 82.4% 75.1% 12.3 307.6 Total Infra-bonds Overall CVM-400 4.0% (2.3%) 96.0% (97.7%) 11.6 (43) CVM-476 - 2.9% 2.7% (2.4%) 97.3% (97.6%) 344.4 (1,221) Strict default 97.1% 100% 13.0 (88) 12.3 307.6 Total Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

Bond Rating versus Ex-ante Credit Event (EACE) (sample period 2014-2017) Table 10 Number of issues and the percentage of the total number of issues (in parentheses). Investment grade: bonds with credit rating equal to or higher than BBB-, in the Brazilian local scale. Non-investment grade: bonds with credit rating lower than BBB-. Not rated: bonds issued without credit rating. EACE Number of issues No EACE EACE RenegotiationStrict Default 60 (19.0%) 5 (55.5%) 289 (32.2%) 252 (80%) 4 (45.5%) 591 (65.9%) 63 3 Investment grade (20.0%) 5 (55.5%) 306 (34.1%) (0.9%) 2 (22.2%) 24 (2.6) Non-investment grade Not rated Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

Ex-post Credit Event (EPCE, default and renegotiation): high numbers Table 11 Total in BRL billions, total number of issues (in parentheses), percentage of total BRL value and percentage of the total number of issues (in parentheses). Panel A: Sample period 2009-2013 Infra-bonds Regular-bonds CVM-400 9.8% (8.8%) 90.2% (91.2%) 54.4 (147) Overall CVM-476 20.3% (22.4%) 79.7% (77.6%) 234.4 (1,009) CVM-400 34.8% (38.5%) 65.2% (61.5%) 3.9 (13) CVM-476 45.9% (33.3%) 54.1% (66.7%) 6.4 (18) 19.1% (21.1%) 80.9% (78.9%) 299.2 (1,187) EPCE No EPCE BRL bi (# issues) Total Panel B: Sample period 2014-2017 Infra-bonds Regular-bonds CVM-400 2.2% (5.3%) 97.8% (94.7%) 12.3 (19) Overall CVM-476 23.0% (25.0%) 77.0% (75.0%) 307.6 (1,071) CVM-400 2.6% (2.3%) 97.4% (97.7%) 11.6 (43) CVM-476 2.5% (2.3%) 97.5% (97.7%) 13.0 (88) 20.8% (22.3%) 79.2% (77.7%) 344.4 (1,221) EPCE No EPCE BRL bi (# issues) Total Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

Ex-post Credit Event (EPCE): mostly renegotiation, but default is high Table 12 (2009-2013) Total in BRL billions, total number of issues (in parentheses), percentage of total BRL value and percentage of the total number of issues (in parentheses). Panel A: Renegotiation Regular-bonds CVM-400 8.8% (7.5%) 91.2% (92.5%) 54.4 (147) Infra-bonds Overall CVM-476 18.3% (18.5%) 81.7% (81.5%) 234.4 (1,009) CVM-400 32.9% (30.8%) 67.1% (69.2%) 3.9 (13) CVM-476 1.6% (11.1%) 98.4% (88.9%) 6.4 (18) 16.4% (17.2%) 83.6% (82.8%) 299.2 (1,187) Renegotiation No-renegotiation BRL Bi (# issues) Total Panel B: Strict Default Infra-bonds Regular-bonds CVM-400 1.7% (2.0%) 93.8% (98.0%) 54.4 (147) Overall CVM-476 5.7% (8.8%) 94.3% (91.2%) 234.4 (1,009) CVM-400 34.8% (38.5%) 65.2% (61.5%) 3.9 (13) CVM-476 45.9% (33.3%) 54.1% (66.7%) 6.4 (18) 6.2% (8.7%) 93.8% (91.3%) 299.2 (1,187) Strict Default No-Default BRL Bi (# issues) Total Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

Bond Rating versus Ex-post Credit Event (EPCE): surprising Table 13 sample period 2009-2013 EPCE Number of issues No-EPCE EPCE Renegotiation 50 (8.5%) 15 (68.2%) 139 (24.0%) Strict Default 23 (3.9%) 4 (18.2%) 76 (13.1) 520 (88.8%) 5 (22.8%) 412 (71.2%) 66 S&P Global rate: 0,26% Investment grade (11.2%) 17 (77.2%) 167 (28.8%) Non-investment grade Not Rated Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

Liquidity (sample period 2009-2013): low liquidity Table 14 Number of days with trading over the number of days since issuance. Total in BRL billions, total number of issues (in parentheses), percentage of total BRL value and percentage of the total number of issues (in parentheses). Panel A: sample period 2009-2013 Regular-bonds CVM-400 7.2% (8.8%) 27.3% (43.5%) 31.0% (24.5%) 21.7% (15.0%) 12.8% (8.2%) 54.4 (147) Infra-bonds Overall 38.2% (51.7%) 44.2% (38.6%) 8.8% (5.6%) 5.4% (2.6%) 3.4% (1.5%) 299.2 (1,187) CVM-476 45.4% (58.8%) 49.3% (38.4%) 3.5% (2.2%) 1.5% (0.6%) 0.3% (0.1%) 234.4 (1,009) CVM-400 CVM-476 62.2% (44.4%) 23.3% (33.3%) 9.8% (16.7%) 4.7% (5.6%) x = 0% - 7.7% (7.7%) 11.3% (38.5%) 13.1% (15.4%) 67.9% (38.5%) 3.9 (13) 0% < x 5% 5% < x 10% 10% < x 20% x > 20% - 6.4 (18) BRL Bi (# issues) Total Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

Bond Allocation (sample period, 2015-2017) : mostly to underwriters related parties Table 16 Source: www.debentures.com.br and www.cvm.gov.br Sample 2015-2017 (restri o dos an ncios de encerramento na p gina da CVM) Investors CVM-400 Regular-bonds Infra-bonds Overall CVM-476 CVM-400 CVM-476 Non Related Parts Investment clubs Mutual funds Insurance Companies Other financial institutions Other legal entities Pension funds Foreign investors Legal persons Sub-Total 0.00% 58.68% 0.46% 9.43% 0.09% 1.73% 0.00% 0.09% 70.5% 0.00% 41.24% 0.49% 1.65% 0.13% 0.87% 0.75% 0.09% 45.2% 0.06% 6.59% 0.06% 12.69% 0.03% 0.96% 0.00% 62.46% 82.8% 0.11% 23.09% 0.00% 14.65% 0.08% 0.15% 0.00% 20.04% 58.1% 0.01% 39.37% 0.44% 2.96% 0.12% 0.85% 0.66% 3.76% 48.2% Related Parts Financial institutions Intermediate institutions Mutual funds Other legal entities Legal persons Sub-total 14.78% 12.93% 1.82% 0.00% 0.00% 29.5% 35.74% 15.37% 2.98% 0.65% 0.04% 54.8% 106.1 6.43% 9.47% 0.77% 0.00% 0.48% 17.2% 29.04% 10.52% 0.36% 1.38% 0.61% 41.9% 33.76% 14.81% 2.49% 0.65% 0.09% 51.8% Total (BRL Bi) 2.4 4.9 6.7 120.0 Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

Questions To what extent we have a corporate bond market? Is CVM 476 a mechanism for commercial banks to overcome bank regulation and provide assets to their related parties? Do we need a Glass-Steagall regulation? What are the meaning of ratings in Brazil? Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019

THANK YOU! gledson.carvalho@fgv.br Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Antonio Gledson de Carvalho Funda o Getulio Vargas EAESP e Instituto de Finan as (IFin) Workshop CVM-Insper, 2019