Miles of Snowmobile Trails and Market Insights

Snowmobiling offers a unique isolated activity that has seen steady sales despite the challenges of the pandemic. Discover how major manufacturers adapted, the significance of maintained snowmobile trails, and insights into the demographics and preferences of snowmobilers.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

The Advantages of an Isolated Activity Unlike many activities, much of snowmobiling occurs in isolated locations and among small groups of people, mostly families. Plus, recreational snowmobiling is primarily a local-club-based activity, so it s easier to agree on and follow safety measures during the pandemic. The market wasn t immune to the effects of the pandemic, but the 6.9% decrease in global snowmobile unit sales and 7.2% decrease in US sales during the 2019 2020 sales period (5/1/19 4/30/20) were much smaller than almost all other industries and markets. The global sales decrease was approximately the same as the previous year s gain, although some major markets increased unit sales. Plus, as with many industries and markets, snowmobile factories closed during the early- pandemic period, reducing available inventory.

The Big Four Manufacturers Arctic Cat (Textron), Polaris, Yamaha and BRP closed their plants during March 2020 and, although this obviously resulted in financial hits, it also allowed dealers to clear their inventories of new, but older models. Traditionally, fewer snowmobiles are sold during Q2. BRP revenues decreased 15.5% to $226.2 million for the fiscal quarter ending 7/31/20, but North American powersports retail sales increased 40%. Overall, net sales for Yamaha decreased 19.9% for the first half of 2020, including declining snowmobile sales. Polaris reported a 9.1% decrease in its snowmobile and off-road-vehicle segments; however, PG&A (parts, garments and accessories) sales increased 17%. Q2 2020 sales for Textron s specialized vehicles segment, which includes Arctic Cat, had a $126 million loss.

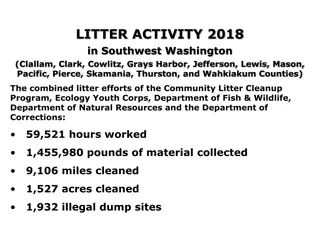

Ready to Ride According to the International Snowmobile Manufacturers Association s 2020 Fact Book, there were 136,853 miles of signed and maintained snowmobile trails in North America, and where 80% 90% of all riding occurs. Not only do many club members volunteer to maintain these trails, but also fund their development and maintenance via vehicle registration fees, snowmobile gas taxes, trail permits and snowmobile user permits. The majority of snowmobiles are purchased and used for recreational purposes; however, the remainder is vital for transportation in remote US and Canadian locations as well as for search- and-rescue, ranch work and environmental and wildlife scientists.

On the Trail of Snowmobilers With 45 still the average age of snowmobilers, insightful data from various sources will help to reveal more about them, including income levels, since the average snowmobiler spends $2,000 $3,000 annually for recreational snowmobiling, and 50% purchase a trailer. For example, the survey for Kampgrounds of America s 2020 North American Camping Special Report found 33% of campers were interested in an overlanding experience. Snowmobiles are the perfect vehicles to reach these isolated destinations. Since many snowmobilers have vacation residences, more of them are likely to choose a glamping experience. According to Kampgrounds of America s 2020 North American Glamping Report, 42% of those surveyed preferred a cabin, and 48% were Millennials.

Let It Snow! The Farmer s Almanac advanced forecast for winter 2020 2021 is filled with good news for the snowmobile market and snowmobilers as all of New England will be cold and snowy as well as the inland areas of the Southwest and California. The forecast for the Plains states (Kansas, Missouri, Iowa and Nebraska), eastern Mountain states (Colorado, Wyoming and Montana) and the northern tier of states (North Dakota, South Dakota and Minnesota) is cold and above-normal snowfall. The National Weather Service s forecast for December 2020 through January February 2021 is similar, with above-normal snowfall from Washington State across the northern tier of states and into the Great Lakes region.

Advertising Strategies Because there is a pent-up urge to spend more time outdoors, and safely, snowmobile dealers may want to promote a maintenance bundle at a special price to help snowmobile owners be ready to enjoy the season from the very first sufficient snowfall. With an increasing interest in glamping, dealers could receive exposure to a different and upscale audience by partnering with local/nearby glamping locations, especially those specializing in providing an overlanding experience to remote destinations. Pitch one or more local snowmobile dealer to place ads on the station s weather page of the Website, especially when there is forecast for abundant snowfall.

New Media Strategies Many snowmobile retailers already partner with local clubs, but with so many people experiencing isolation stress, consider developing a social media campaign, New Family Snowmobile Day, to attract families looking for a different outdoor activity. Dealers may also want to work with local clubs, including a sponsorship, to help promote and communicate their pandemic health and safety protocols based on local conditions. Have branded face masks made and distribute them free to participating clubs. Use the new models for 2020 in the table at the bottom of page 2 as topics of separate short videos for stores selling them, with each video hosted by a store employee and explaining the major features/improvements.