Multiple Cash Flows in Investments

Scenarios involving multiple cash flows in investment decisions, such as calculating future and present values, determining worth of inheritances, and evaluating investment opportunities with different discount rates. Understand annuities and perpetuities through practical examples.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

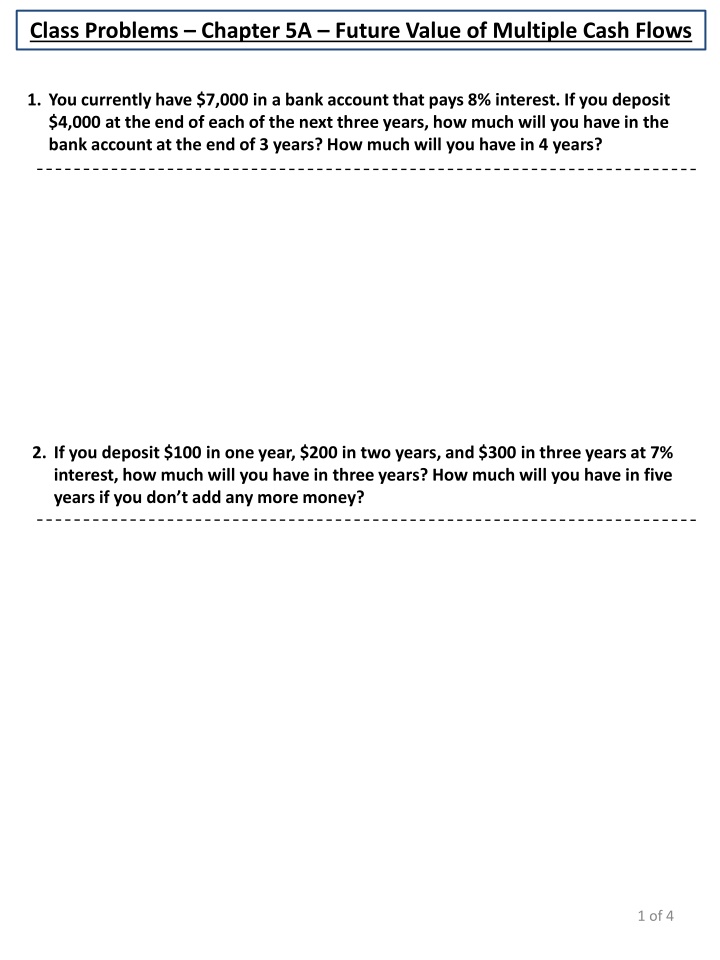

Class Problems Chapter 5A Future Value of Multiple Cash Flows 1. You currently have $7,000 in a bank account that pays 8% interest. If you deposit $4,000 at the end of each of the next three years, how much will you have in the bank account at the end of 3 years? How much will you have in 4 years? 2. If you deposit $100 in one year, $200 in two years, and $300 in three years at 7% interest, how much will you have in three years? How much will you have in five years if you don t add any more money? 1 of 4

3. If you invest $500 in a mutual fund today and $600 in one year, how much will you have in two years if the fund pays 9% annually? How much will you have in five years if you make no further deposits? 4. The Blue Hen Brewery, Inc. has identified an investment opportunity that will deliver the following cash flows: Year 1: $985; Year 2; $1,160; Year 3: $1,325; Year 4: $1,495. What is the future value of these cash flows in year 4 assuming an 8% discount rate? 2 of 4

Class Problems Chapter 5A Present Value of Multiple Cash Flows 1. You are considering an investment that will pay you $1,000 in one year, $2,000 in two years and $3,000 in three years. If you want to earn 10% on your money, how much would you be willing to pay? 2. Your grandmother has left you an inheritance that will give you $5,000 today and then $10,000 for each of the next two years. What is this inheritance worth today assuming a 6% discount rate? 3 of 4

3. A first-round draft quarterback has been signed to a three-year $10 million contract. The details provide for an immediate cash bonus of $1 million. The player then receives $2 million in salary at the end of the first year, $3 million the next, and $4 million at the end of the last year. Assuming a 10% discount rate, how much is the package worth? 4. The Blue Hen Brewery, Inc. has identified an investment opportunity that will deliver the following cash flows: Year 1: $680; Year 2: $490; Year 3: $975; Year 4: $1,160. What is the present vale of these cash flows assuming a 18% discount rate? 4 of 4

Class Problems Chapter 5B Annuities and Perpetuities 1. What is the future value of annual payments of $6,000 for 40 years at a 9% interest rate? Formula Solution Mathematical Table Solution 2. What is the present value of annual payments of $2,100 for 7 years at a 5% interest rate? Formula Solution Mathematical Table Solution 5 of 4

3. What is the future value of annual payments of $2,950 for 9 years at a 6% interest rate? Formula Solution Mathematical Table Solution 4. What is the present value of annual payments of $11,000 for 18 years at an 8% interest rate? Formula Solution Mathematical Table Solution 6 of 4

5. Investment X offers to pay you $3,400 per year for nine years (total cash of $30,600), whereas Investment Y offers to pay you $5,200 per year for five years (total cash of $26,000). Which of these cash flow streams has the higher present value if the discount rate is 6%? What if the discount rate is 22%? Mathematical Table Solution at 6% Investment X Investment Y Formula Solution at 22% Investment X Investment Y 6. A life insurance company wants to sell you an investment policy that will pay you and your heirs $30,000 per year forever. If the required return on this investment is 6%, how much will you pay for this policy? 7 of 4

Future Value for Annuities - Formula (1+r)t - 1 r FV = C * Present Value for Annuities - Formula (1+r)t 1 r 1 - PV = C * 8 of 4