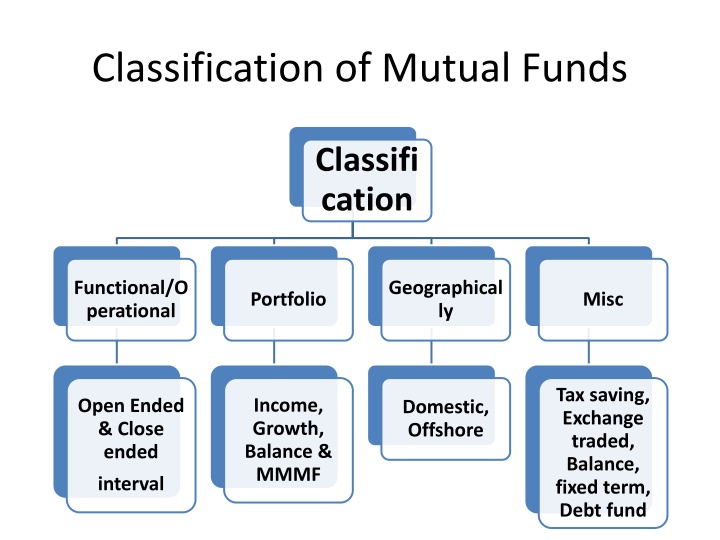

Mutual Fund Classification and Features

Explore the classification of mutual funds based on functionality, geography, portfolio, and more. Learn about open-ended and closed-ended funds, with insights into their features and objectives. Discover the differences between interval funds and their unique trading aspects. Delve into the domestic and offshore geographical aspects of mutual funds. Get an overview of mutual fund types and their distinguishing characteristics.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Classification of Mutual Funds Classifi cation Functional/O perational Geographical ly Portfolio Misc Tax saving, Exchange traded, Balance, fixed term, Debt fund Income, Growth, Balance & MMMF Open Ended & Close ended Domestic, Offshore interval

Open ended Meaning Features : Objective is income generation Not publically traded, the fund itself repurchases/ resells Instant liquidity Free entry & exit NAV Can be sold back to the Mutual Fund

Close ended scheme ABC co launched the scheme on 11thsept 2010 At BSE. 11th 25thSeptember 26thseptember

Closed-End Funds Issues a fixed number of shares at a given point in time Collect money from investors through IPO and use this money to invest in securities. maturity period of securities are fixed at the time of IPO.( 3-5 years Suited to specialized investing in small or illiquid Main objective is capital appreciation Publically traded Fund closes after stipulated period Lock in period * Assets are Net Assets, expressed in Millions, and exclude leveraged capital (preferred stock, debt, etc.).

Interval Funds Features of both open and close ended May be traded on stock exchange or may be open for sale or redemption during predetermined interval. Different from traditional close ended funds

Geographical Domestic : Off shore : UTI is the first institution to initiate off shore funds

Mutual Fund Investment Strategies MF Investment Strategies Systematic Investment Plan Systematic Withdrawal Plan Systematic Transfer Plan

Systematic Investment Plan Invest in funds regularly. Set apart a sum every month or quarter Save regularly and build up an investment Benefits / features: Power of compounding by investor now Cost averaging Convenience Disciplined investing

Advantages of SIP Inculcates discipline in investment Investing at pre defined intervals reduces risk Works in volatile market Helps in averaging Do not need large sum for investment We can stop, start or modify your SIP anytime

Systematic Transfer Plan An STP is a plan that allows investors to give consent to a mutual fund to periodically transfer a certain amount / switch (redeem) certain units from one scheme and invest in another scheme of the same mutual fund house.

Fund house : ABX Co. SCHEME : Equity & Debt Investor : has begun investing Equity After 6 months, wants to change his investment pattern Request ABX co. To switch to debt fund

Advantages of STP Higher returns STPs allows you to earn higher returns on your investments by shifting to a more profitable venture during market swings. Gaining market advantage in this method maximizes the profits through securities bought and sold in the capital sector. Stability During times of high degree of volatility in the stock market, investors can transfer their funds via an STP into relatively safer investment schemes such as debt funds and money market instruments. This allows an investor to ensure the safekeeping of his/her financial resources while earning stable returns at the same time. Rupee Cost Averaging This method is implemented while investing in Mutual Funds via STP, allowing investors to lower their average costs incurred on investments. Rupee Cost Averaging follows the technique of investing in funds when their average price is low and selling them when their market value increases, thereby realizing capital gains on the individual securities.

Systematic Withdrawal Plan SWP stands for systematic withdrawal plan. Under SWP, if you invest lump sum in a mutual fund, you can set an amount you ll withdraw regularly and the frequency at which you ll withdraw. For example, let s say you invested in HDFC Top 200 Fund an amount of 1 lakh for a year. Let s assume that you decided to withdraw an amount of 10000 per month. So every month, your investment in the fund will reduce by 10000. The amount left every month after withdrawal will continue to remain invested.

Features It is a facility to redeem units regularly You can choose the frequency of withdrawals You can either withdraw a fixed amount or only the capital appreciation It is ideal for investors seeking regular income from their investments

Benefits of SWP Easy Withdrawal Meeting financial Goals Protection from market fluctuation Enjoy average return Tax benefits Assurance of Return & Contingency withdrawal

NAV : NET ASSETS VALUE Gross investment in the mutual fund = R. 1000000 Admn & other liabilities : Rs. 200000 Balance = Rs. 800000 / 40000 NAV = ( Market Value of the fund investment + Receivable + Accrued Income) ( Liabilities + Accrued expenses) -------------------------------------------------------------- Number of outstanding Units of Mutual funds

Problem on NAV Scheme Name : XYZ Scheme size : Rs. 50,00,00,000 Face vale of unit : Rs. 10 Market value of shares : Rs. 75,00,00,000 Find out the NAV of XYZ scheme for today.

Answer NAV = market value of investment / No of units outstanding. = Rs. 75,00,00,000 / 5,00,00,000 = Rs. 15 / unit Rs. 50,00,00,000 / Rs. 10 = 5,00,00,000 crores units

A funds investment at market value total Rs. 700 crores. The total liabilities stand at Rs. 50 lacs and the number of units outstanding is 28 crore. What is the NAV? Answer : NAV= ( Market value of investment Liabilities) / Number of units outastanding = Rs. 700 Crore 0.5 Crore( Note : Rs. 50 lacs means 0.5 crore) / 28 crore = (700 0.5) / 28 699.5/28 =Rs. 24.98 / Unit

Problem 3 An open ended fund with 20000 units outstanding, had the following items in its balance sheet. Investment at market value : Rs. 2,00,000 Other assets : Rs. 40,000 Current Liabilities : Rs. 50,000 Calculate the fund s NAV per unit.

Problem 4 Suppose a scheme with 200 units has the following items in its Balance sheet. Unit Capital : Rs. 20,000 Investment at market value : Rs. 50,000 Other assets : Rs. 7,000; Other liabilities Rs 4,000 Issue expenses not written off Rs. 1,000 Reserves Rs. 34,000 Calculate NAV

Portfolio maturity What is maturity? Maturity of portfolio = applicable to Debt funds Why this concept?

Type of Investment Amount involved (rs.) Individual Proportion (%) Individual Maturity Weigtage Bond A 30000 50 2 yrs 1 year Bond B 10000 16.68 3 0.5004 Bond C 20000 33.33 5 1.665 100% 3.1654 Total 60,000

Entry Load & Exit load Load? Charge/ imposed on the investor Cost of distribution payment : income Entry load : Rs. 100 is invested by Mr. Ketan, reliance Entry Load @2.25% Rs. 97.50 Mutual fund investment Rs. 2.50 Company will collect charge from the customer Exit load