National Transfer Accounts in Economic Analysis

Explore the complexities of National Transfer Accounts with insights on longitudinal vs. cross-sectional analysis, difficulties of storage, the circular flow of goods and services, ways of saving for retirement, and the impact of various institutions on resource allocation across different societies.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

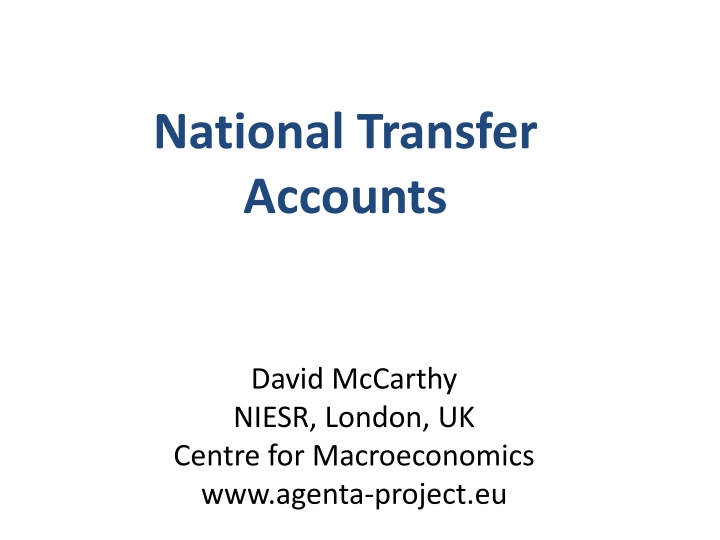

National Transfer Accounts David McCarthy NIESR, London, UK Centre for Macroeconomics www.agenta-project.eu

Outline National Transfer Accounts (+ extensions) Thorny questions Longitudinal vs cross-sectional The question of incidence

The difficulties of storage (On a generational timescale, storage is very difficult) Picture shows Pripyat, nr Chernobyl, Ukraine

The circular flow Goods and services Goods and services markets Goods and services Spending Revenue Firms Households Rent, wages, interest and dividends Income Land, labour, capital Land, labour, capital Factors markets (land, labour, capital) Real flows Financial flows So what the old and the young consume, others must produce

Ways of saving for retirement Storing up consumption goods in advance Income-producing capital, or shares in it Stores of value Having babies Owner-occupied real-estate. Non-owner-occupied real estate. Intra-household transfers, (e.g. multi- generational households). Gold coins. Bank notes. Durable goods (e.g. cars, domestic appliances). Businesses. Jewellery. Land & improvements. Antiques. Inter-household transfers (e.g. remittances). Fine art. Infrastructure. Bank deposits. Other collectibles. Shares. Public transfers (e.g. PAYG pension systems, public medical care). Other financial assets. And there are only four ways of saving for retirement (Different societies use different mix of the four)

National Transfer Accounts Individual (not HH) based Consumption (not income) based Aims to quantify the relative importance of different institutions in shifting resources across the lifecycle in different societies: Private transfers (family or extended family support) Capital markets (stocks, shares, pension funds) Public transfers (state old age pensions, public health care, public education, infrastructure, law and order, etc)

Results for US & Thailand There are now ~40 countries participating in the project Barro (transfers to elderly are saved and bequeathed) vs Feldstein (transfers to the elderly are spent)

Results for the UK (2007) 40,000 30,000 Pounds per person year 20,000 10,000 0 0 10 20 30 40 50 60 70 80 90 - 10,000 - 20,000 Age Asset-based Reallocations Bequests Public Transfers Private Transfers

Disaggregation of ABRs Saving is a balancing item Shows some dissaving at older ages (not too surprising, given the reliance of the UK aged on funded pensions)

Wealth across the lifecycle Quantifies the relative importance of transfer wealth across the world (e.g. Kotlikoff & Summers) Classical LC-PIH NTA (rich country, here UK) 140% 120% 100% Proportion of total wealth 80% 60% 40% 20% 0% 0 10 20 30 40 50 60 70 80 -20% -40% Age Public transfers Private transfers Human capital Financial wealth

Cross-sectional vs longitudinal NTA profiles are cross-sectional One-year snapshot of age-related transfers in a particular economy and the institutions that mediate them How to turn this into a longitudinal forward- looking picture of the lifetime of a particular cohort? Policy, factor price stability Discount rates Impact of changing demography

The thorny question of incidence NTA makes the same assumptions about incidence as generational accounting Broadly, incidence is on those that pay the tax or receive the benefit But this is highly problematic (Buiter, 1996) In effect, we are ignoring all changes in factor prices associated with public and private transfer systems, at least those that differ systematically across the life cycle

Distributional impact of transfers NTA says nothing about distributional impacts of transfer mechanisms within a particular cohort Challenge is that individuals move through the wealth distribution in systematic ways as they age v. hard to know how to move from cross-sectional analysis to longitudinal analysis in a way that does not simply reflect our assumptions Holy grail is joint age and wealth-driven picture of transfers

Current UK NTA projects AGENTA Historical NTA; integrating time-use surveys; DSGE & NTA With colleagues from Imperial we are using NTA to investigate: Which generation bore the brunt of the financial crisis in 2007-2008 The history of inter-generational transfers in the UK, by constructing past estimates of NTA s The implications of these results for how shocks are transmitted through the economy Traditional models of asset pricing assume that ALL shocks are transmitted through financial markets, assumption is wrong and may lead to problems in getting models to fit data well