Navigating the Stock Market World

Uncover the fundamentals of the stock market, including shares in public companies, stock market concepts, major indices, importance of stock markets, and the value for students now and in the future. Explore key insights to make informed investment decisions and understand the dynamic world of stocks.

Uploaded on | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

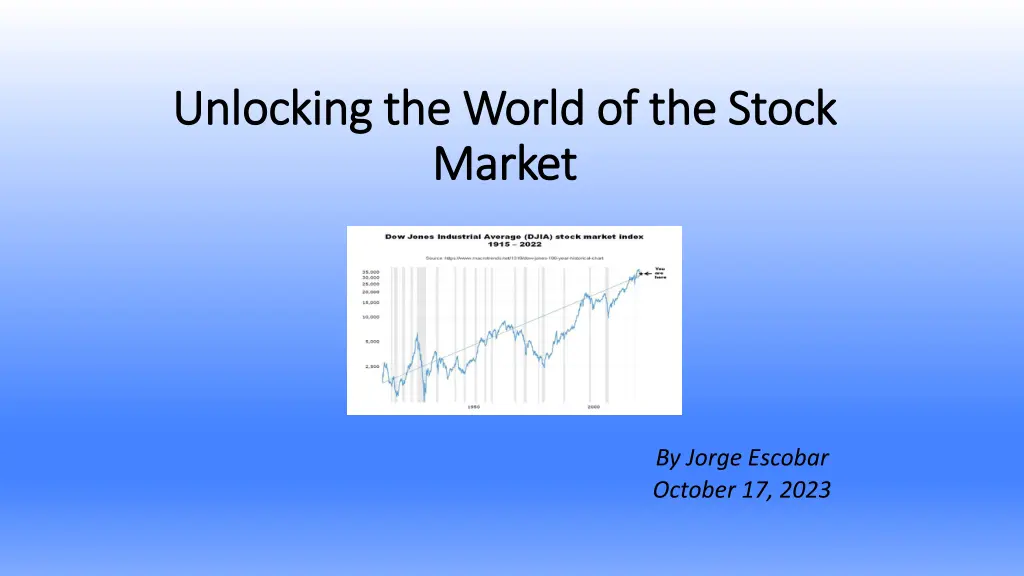

Unlocking the World of the Stock Unlocking the World of the Stock Market Market By Jorge Escobar October 17, 2023

Three Key Concepts What are shares in public companies? > Units issued by a corporation that represent ownership > A way for investors to build wealth and diversify their investments > Shares are sold by corporations to raise capital, grow and manage their businesses. > Public companies are classified as small, mid-size or large depending on their publicly owned capital. What are stock markets? > They are exchanges in which shares of publicly held companies are bought and sold under government and self-regulatory laws and regulations.

> In the U.S., the largest stock market in the world, the New York Exchange had a total of 2,385 listed domestic and international companies. The Nasdaq (National Association of Securities Dealers Automated Quotations) had 3,611. > A market index is a hypothetical portfolio of investment holdings that represents a segment of the financial market. Examples in the U.S.: Dow Jones Standard & Poor s 500, Nasdaq > Daily life examples: Apple, Microsoft, Google, Intel, Amazon, Costco, Chevron, CVS and thousands more in the U.S. and around the world. What do stock markets reflect? > They are linked to and reflect the behavior of individual businesses, industries, governments, business associations, national events and geopolitics.

> Examples to ask as an investor: - Are a company s products, management and profitability doing well? - What are the prospects for the oil industry with high gas prices? - Will the government raise, lower or leave corporate taxes alone? - What is the economic impact of hurricanes in the East Coast? - What is the outlook on the relationship between China and the U.S.?

Why is knowing about this topic valuable for students now and in the future? > During your lifetime, owning stocks helps you build savings, protect your money from inflation and taxes and maximize income from your investments. > Examples across ages: For the young like you 529 savings accounts for education and UTMA custodial accounts for minors. For adults, brokerage, managed accounts, mutual funds, etc. > Learning about this topic at a young age will be key whether you think of owning a business, working in the financial or other industry, manage your savings and select your financial advisors during your working and retirement years, as well as eventually educate your kids and grandkids.

What is your recommendation if students want to learn more about this topic? Suggest following this order: > Talk to a family member and an investment professional about the subject. > Visit websites of major investment firms, such as BlackRock, Vanguard, Merrill Lynch, Morgan Stanley, Charles Schwab. Look for their product offerings and financial markets views. > Read the business sections of national newspapers online, specialized press like The Wall Street Journal, Barron s, Bloomberg, Financial Times, etc. > Watch the financial segments of TV news and/or specialized channels like CNBC and Bloomberg.